Recording an ACH payment in QuickBooks Desktop/Online is important to help businesses track their finances properly. Recording these payments well keeps the QuickBooks Desktop or Online records clean. This guide will lead you through the easy steps to include ACH payments in your documentation.

What Is an ACH Payment and How Does It Work?

An ACH payment or Automated Clearing House payment is an EFT that transfers cash between financial organizations through an intermediary system. They utilize it to pay employee wages and bills and transfer funds due to its affordability, and security is paramount.

It plays an important role in financial management by enabling businesses to collect payments from customers efficiently, pay vendors, and manage payroll. ACH payments enhance banking operations by reducing the dependence on paper checks and manual processes, leading to cost savings and increased operational efficiency. They integrate effortlessly with accounting systems, ensuring the accurate and timely recording of financial transactions, which is essential for maintaining precise and up-to-date financial records.

Here’s how it works:

- Initiation: The payer provides a release to transfer an agreed sum of money via a bank or other online payment provider.

- Processing: The transaction moves to the ACH network, where it is processed in batches to meet the one—and two-business-day settlement goal.

- Settlement: Payments are made between the payer’s and payee’s accounts, which usually take a day up to 3 business days.

Why use ACH payments?

You can get the advantages mentioned below by using the ACH payments:

- ACH payments offer several advantages that make them an essential choice for businesses and individuals:

- Cost-Effective: The cost of ACH payments is generally cheaper than that of credit card payments or wire transfers, making them cheaper for businesses.

- Convenient and Efficient: They make the regular fund transfer process more efficient and less time-consuming for frequent activities such as salary, utility bills, and subscription dues.

- Secure: The ACH network is governed and protects their fund transfers through encryptions to enhance security and reliability.

- Environmentally Friendly: ACH payments also help decrease paper checks, resulting in a higher sustainability of the payment method.

- Reliable Recordkeeping: Such transactions are easily traceable, thus improving financial management and clearing of accounts.

How to Record an ACH Payment in QuickBooks Desktop?

ACH payments can be entered in QuickBooks Desktop by categorizing customer payments, reviewing deposits, and verifying them to enter easily. Follow these steps to ensure accurate records:

First, you need to enable automatic matching so that QuickBooks can deposit and record customer payments for you:

Step 1. Enable Automatic Matching

To have QuickBooks automatically deposit and record client payments, activate automatic matching:

- Go to Banking and choose Record Merchant Service Deposits.

- Click Change the deposit parameters.

- Activate Auto Match & Record feature.

- Click the Save button.

Step 2. Analyze Payments on Your Bank Statement

When you get your bank statement, complete these steps to confirm ACH payments in QuickBooks Desktop:

- Go to the Banking menu and choose Record Merchant Service Deposits.

- Select the Recorded tab.

- Examine the first bank deposit on the list. Click the arrow symbol next to the deposit for more information, including individual client payments.

- Align each bank deposit in QuickBooks to the bank statement. Check it off if the date and amount are correct.

How to Record an ACH Payment in QuickBooks Online?

To record an ACH payment in QuickBooks Online, go to Expenses, select Vendors, choose the vendor, find the open bill, click Make Payment, select the bank option, uncheck Print later, enter ACH in Ref no., and Save and Close.

The process of recording an ACH payment in QuickBooks Online is relatively simple. Here’s how to do it:

Step 1. Enter ACH Payment info in QuickBooks Online

- On the left panel, click Expenses.

- Select the Vendors tab and choose the vendor’s name.

- Go to the Transaction List tab and find the open bill.

- Click Make Payment.

- Under Bank/Credit account, select the bank option.

- Uncheck the Print Later box.

- Enter “ACH” in the Ref no. field for easy identification.

- Fill in any mandatory details.

- Click Save and Close.

Step 2. Set up QuickBooks Online ACH Payment

QuickBooks online also allows you to pay bills online using Automated Clearing Houses. With this tool, you can:

- Check by ACH or by sending paper checks to pay bills.

- Automate recording of a payment transaction.

Step 3. Sign Up for Online Bill Pay

- Open QuickBooks and go to the Apps menu.

- Search for Bill Pay in the search bar.

- Select the Bill Pay for QuickBooks Online app card.

- Click Get Bill Pay.

- On the Learn More page, choose Get Started.

- Enter your company information and click Next.

- Follow the on-screen instructions to connect your bank account and click Next.

- Provide your personal information and click Next.

- Complete the identity verification process. If you face issues, contact Intuit’s Care Support.

Note: Although no monthly subscription fee is required for this service, you will get charged a transaction fee for every payment you process.

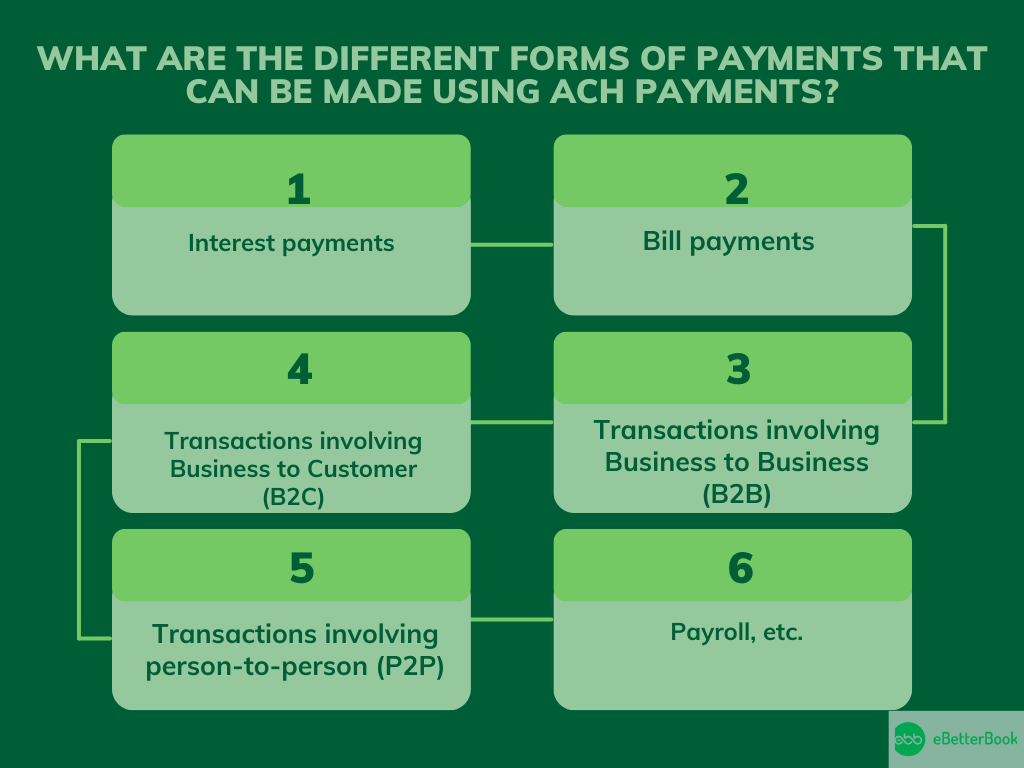

What are the different forms of payments that can be made using ACH payments?

ACH payments can be used for various transactions, including interest payments, bill payments, B2B, B2C, P2P transactions, and payroll. These forms offer a convenient and secure method for transferring funds.

The following table shows the types of transactions that are suitable for ACH payments:

| Type of Payment | Description |

| Interest Payments | Transfers of interest earnings directly to recipients’ bank accounts. |

| Bill Payments | Payments for recurring expenses like utilities, loans, and subscriptions. |

| Business-to-Business (B2B) | Transactions between businesses for goods or services. |

| Business-to-Customer (B2C) | Disbursal of refunds, rebates, or other payments to customers. |

| Person-to-Person (P2P) | Money transfers between individuals using ACH-supported apps or platforms. |

| Payroll | Direct deposits of employee salaries into their bank accounts. |

What Are the Best Practices for Recording Returned ACH Payments in QuickBooks?

To manage the money correctly, the ACH recording modified by the returned payment must be entered properly in the accounting books.

Here are some best practices to follow:

1. Keep Track of Returned ACH Payments

- Record and track returned ACH payments inside QuickBooks utilizing QuickBooks’ existing tools as well as features.

- It’s important to review and sort these transactions continuously in order to ensure that you keep clean books.

- It also provides much better control in tracking your finances and leaves no doubt as to your financial status.

2. Set Up Alerts for Returned ACH Payments

- Allow account monitoring within QuickBooks and banking levels so that you will be informed of cleared checks.

- These alerts help take action at the right time, decrease payouts, and maintain healthy relationships with clients.

- Through adopted monitoring, effective reconciliation and banking are attained.

3. Regularly Reconcile Bank Accounts

- Bank statements should be balanced more often to notice mistakes or inconsistencies.

- If returned, make sure that ACH payments are entered correctly and compared to your bank statement.

- Reconciliation promotes good financial accountability, the adoption of rules and regulations, and compliance with established reporting standards.

The Bottom Line:

Recording returned ACH payments in QuickBooks as promptly and properly as possible is crucial for maintaining clean books and operations.

Through a commitment to payment tracking, creating payment alerts, and performing account reconciliations, business people can minimize the chances of making the wrong payments, reduce financial losses, and improve organizational productivity.

Using these best practices not only enhances financial transparency but can also serve in the decision-making process of an organization for the betterment of the business.

ACH payments offer a convenient and quick way to process transactions through QuickBooks. Compared to traditional methods, they are simpler and have lower transaction fees.

Disclaimer: The information outlined above for “How to Record an ACH Payment in QuickBooks Desktop/Online – Learn the Process” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.