The process of importing an accountant’s adjustments into a live QuickBooks file is essential for maintaining accurate financial records while ensuring daily business operations continue uninterrupted. QuickBooks uses the “Accountant’s Copy” feature, which creates a file containing a dividing date, allowing the client and the accountant to work on the books simultaneously. This workflow maximizes efficiency, resulting in timely and precise financial reporting.

The changes, usually provided in a .QBY file, can be incorporated into the main company file via two methods: directly from the Intuit web server or by importing the file locally. Successfully applying these modifications requires attention to detail, specifically ensuring both the client and the accountant are using compatible QuickBooks versions to prevent common issues such as version mismatch errors or partial imports. Implementing these steps confirms the accountant’s necessary edits, like year-end journal entries, are correctly applied to the company data.

Highlights (Key Facts and Solutions)

- Core Feature: The content focuses on the Import Accountant’s Changes option in QuickBooks, which uses the Accountant’s Copy file format to merge professional adjustments with the client’s ongoing transactions without interruption.

- Data Exchange: The Accountant’s Copy is saved on the Intuit server, facilitating secure data exchange, and the client receives a file with the .QBY extension containing the revisions.

- Import Methods: Changes can be imported using one of two methods: Import Accountant Changes from the Web or Import Accountant’s Changes via File, with the latter often preferred for stability.

- Critical Compatibility: A key requirement for successful import is ensuring both the client and the accountant use the exact same version and release year of QuickBooks Desktop; version mismatch is a primary cause of import failure.

- Troubleshooting Solutions: Common issues and immediate fixes include:

- Locked File: Solution is to ensure all other users are logged out of the company file before starting the import process.

- Incompatibility: Solution is to confirm matching QuickBooks versions.

- Incorrect File Format: Solution is to ensure the file is the correct .QBY extension.

- Partial Import: Solution is to retry the import or request a fresh file due to potential corruption or connection issues.

Understanding Accountant’s Copy in QuickBooks

An accountant’s copy in QuickBooks is a file created by an accountant and then sent to the client after making any adjustments or edits for accounting purposes.

Now, the client imports this copy into a QuickBooks file and continues their regular business operations. The accountant’s copy is saved on the Intuit server, where a user can exchange data securely with accountants.

An accountant’s copy allows clients and accountants to work on the same set of books simultaneously. The importing process ensures accurate and timely financial reporting without losing any day-to-day transactions a user has entered in the meantime.

| Note: Accountants cannot update client company files into QuickBooks Desktop 2024. You have two options. First, use the older version of QuickBooks Desktop Accountant, and second, ask your client to update their file to QuickBooks Desktop 2024 and then send a new accountant’s copy. |

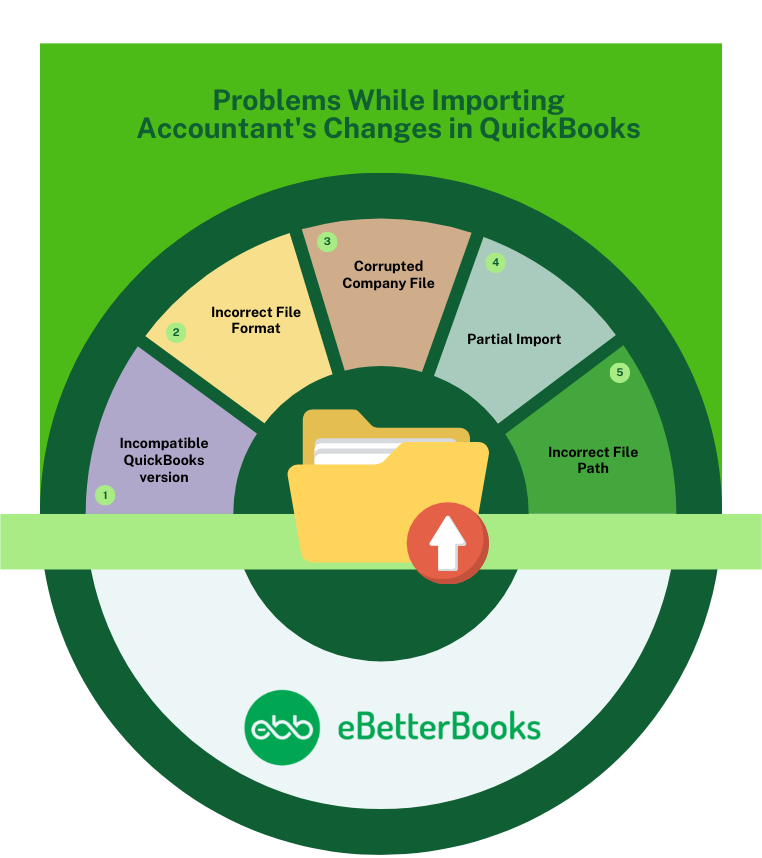

Key Takeaways:

Problems: Incompatibility between QuickBooks version.

Solution: Make sure both the client and accountant are using the same version of QuickBooks software.

Problems: Incorrect File Format

Solution: Get the correct accountant’s changes file with .QBY extension.

Problems: Corrupted Company File

Solution: Get a new file from your accountant and download it completely.

Problems: Partial Import

Solution: Try to re-import the file.

Problems: Incorrect File Path

Solution: Make sure the file is correctly located.

How to Import Accountant’s Changes in QuickBooks

Importing changes in the accountant’s copy comes in need when a business owner is required to provide their accountant with the necessary data to review and make adjustments without interrupting the daily work.

When the account is done with the adjustments that were requested, these changes can be imported back into the main QuickBooks file. Now, importing accountant changes in QuickBooks can be done in two ways: either by importing through the web or by importing through a company file.

Import Accountant Changes in QuickBooks From the Web

- Launch QuickBooks Online and login using your credentials.

- Go to the File menu and select Open or Restore Company.

- Click Open a Company File, then Next.

- Click Browse and then choose the business file you wish to open.

- Select Open, then enter your login information.

- Navigate to the File menu, then choose Accountant’s Copy.

- Choose Import Accountant Changes from the Web.

- Download the accountant’s copy and make modifications.

For Business or Premier Edition Users:

- Launch QuickBooks Online and login using your credentials.

- Follow steps 2–5 above.

- Navigate to Client Activities and choose Import Accountant Changes from the Web.

- Download the accountant’s copy to apply the modifications.

Import Accountant’s Changes into QuickBooks via File

- Launch QuickBooks and log in using your credentials.

- Go to the File menu and select Open or Restore Company.

- Click Open a Company File, then Next.

- Click Browse and then choose the business file you wish to open.

- Select Open, then enter your login information.

- Navigate to the File menu, then choose Accountant’s Copy.

- For Enterprise Users: File > Client Activities → Import Accountant Changes from File.

- Select a file with the .qby extension and click Open.

- Review the revisions done by the accountant.

- Use the “+” symbol next to each modification to get more comprehensive dispute resolution recommendations.

- Choose Print or Save as PDF to keep track of the changes.

- Click Incorporate Accountant’s Changes to apply the changes to your company’s filing.

- Confirm the adjustments and click OK to close QuickBooks.

- Create a backup file at your selected place.

Check the included changes for correctness, then click Close.

Problems While Importing Accountant’s Changes in QuickBooks

Consider the following issues which may arise during the process and affect the working:

- QuickBooks version does not match with the file shared by an accountant.

- The company file (.QBY) can be corrupted, which can hinder the import process.

- An unstable internet connection can disrupt the importing process in QuickBooks Online.

- The company file (.QBY) can be locked, which means changes cannot be imported.

- Only some of the changes are imported due to partial import.

Conclusion

An accountant’s copy allows a client and accountant to have clear communication and understanding to ensure that changes are properly imported and reflected in the system. Importing accountant’s changes in QuickBooks can be hampered if the internet connection is not stable, the company file is corrupted, or due to partial import.

After considering the problems, a user can import accountant’s changes in QuickBooks in two ways, either through company file or through the web.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “A Complete Guide: How to Import Accountant’s Changes in QuickBooks” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.