Highlights (Key Facts & Solutions)

Extractive Format

- Core Benefit: Connecting bank accounts to QuickBooks automates transaction downloading, replacing time-consuming manual data entry, and providing a real-time financial view.

- Linking Methods: Users can link accounts via the Banking section (the quickest method) or via the Chart of Accounts (to map a new feed to an existing account record).

- Transaction History Limit: The initial transaction download is typically limited to the last 90 days by most financial institutions, though some may offer up to 24 months. Older data requires manual download and CSV or QBO file upload.

- Manual Upload Solution: If a bank is not listed for a direct connection, transactions can be manually imported using industry-standard file formats: QBO, QFX, OFX, or CSV.

- Troubleshooting Connection: A status of “Action Required” usually means the bank requires re-authorization due to security updates or changed login credentials, which must be fixed by updating the sign-in information in QuickBooks.

- Reconciliation Necessity: Reconciliation remains mandatory even with an automated feed; it is the final internal control step used to formally match the QuickBooks cleared balance against the official bank statement to verify accuracy and track uncleared items.

Overview

Do you want to learn how to link bank account to QuickBooks? You’re lucky, then! Thanks to our extensive blog, the procedure will be simple, quick, and clear.

You may manage your finances more effectively when you link bank account to QuickBooks. You’ll be able to smoothly link bank account to QuickBooks in no time with our step-by-step instructions and useful advice. Say bye-bye to manual data entry and hello to automatic updates and streamlined financial management. Our blog will give you all the knowledge you need to effectively link bank account to QuickBooks, whether you’re a beginner or an experienced QuickBooks user. Get ready to simplify your financial life with QuickBooks!

Link Bank Account to QuickBooks – Significance

If you link bank account to QuickBooks, you create a bridge connecting your bank with the accounting program. This bridge eliminates the need for manual entry of your bank transactions because QuickBooks can automatically download them for you. By establishing this link, you save yourself the hassle and time-consuming task of entering each transaction manually.

QuickBooks becomes the intermediary that retrieves your bank transactions and seamlessly integrates them into your financial records. Say bye to the tedious manual data entry process and let QuickBooks do the work for you. When users link bank account to QuickBooks, you simplify and streamline your financial management, allowing you to focus on what matters most – running your business effectively.

After your bank account is connected, you may immediately classify and add those transactions into QuickBooks. The software does most of the work for you by automatically downloading and categorizing your transactions.

Imagine having a personal assistant that retrieves and organizes your bank data for you. All you need to do is examine and approve the transactions, and QuickBooks handle everything else.

The Benefits of Connecting a Bank Account to QuickBooks

Linking your bank account with QuickBooks offers the following benefits:

Automatic Transaction Download

When you link your bank account to QuickBooks, transactions are automatically imported, eliminating the need for manual entry. Your account activity will seamlessly appear in QuickBooks, saving you time and effort.

Simplified Bookkeeping and Reconciliation

With automatic bank transaction imports, categorizing and reconciling your finances becomes much easier. You can set up rules in QuickBooks to automatically tag transactions, streamlining your bookkeeping process.

Real-Time Financial Overview

Automatic transaction processing ensures you always have current financial information available when you log into QuickBooks. This helps you make informed decisions quickly based on accurate, up-to-date data. For more details on these benefits, visit Connecting Your Bank Accounts to QuickBooks (intuit.com).

How To Link Bank Account to QuickBooks?

There are two principal methods you can choose from when it comes to connecting your bank account or credit card to QuickBooks desktop.

The first method uses QuickBooks Online banking area. With this choice, you can use the software’s financial functions and immediately link your bank account to QuickBooks.

Follow these Steps to Connect your Bank or Credit Card Using the Banking Section

- Log into your Intuit QuickBooks desktop program.

- Go to ‘Add Account’ in the Banking section of the left menu, then search.

- Choose your financial institution from the list when syncing QuickBooks with your bank account.

- Enter your username and password for your institution’s website and click “Continue.”

- When completing your bank’s security verification, choose “Securely Connect.”

- Choose your bank or credit card from the “Account type” drop-down box after selecting the bank logo. To create one, click +Add new.

- You can get the last 90 days’ transactions from QuickBooks by choosing “Connect.” To connect a bank account to a QuickBooks desktop, follow these steps.

The second method entails connecting your bank account via the chart of accounts. You may reconcile transactions and maintain the consistency of your financial records by adding your bank account as an account in the chart. Both methods provide practical means of integrating your banking activity with QuickBooks Online.

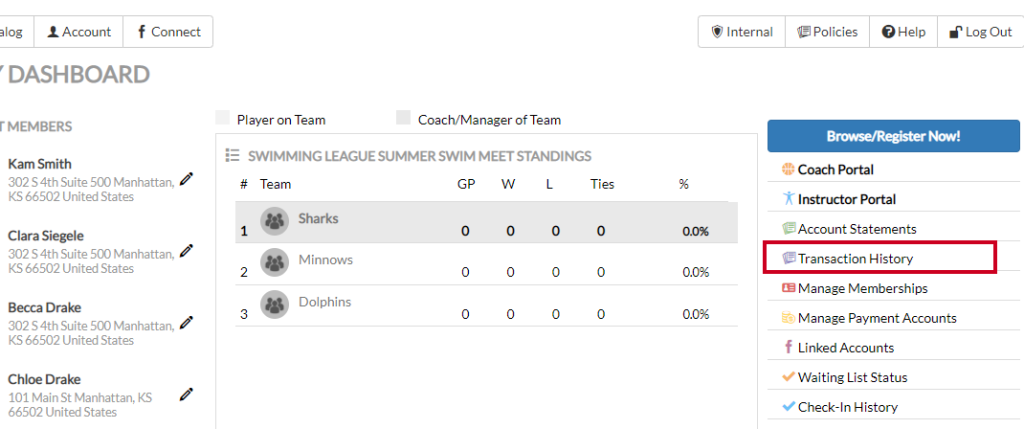

Follow these Steps to Link Existing Bank Accounts via the Chart of Account

- Open QuickBooks and click the gear button in the top right corner.

- Select the bank you want to connect to in the action column after clicking Chart of Accounts.

- From the Account History (or View Register) drop-down, click Connect Bank.

- Follow the steps to complete the bank linking process.

- You can update the transaction download any time after connecting to the bank.

Steps to Add a Bank Account/Credit Card in QuickBooks Online

After learning how to link bank accounts to QuickBooks Desktop, let’s move on to learning how to link bank accounts to QuickBooks Online.

Step 1: Connect Bank/ Credit Card Account

- Check out the Banking tab.

- Click the Connect account button on the landing page if this is your first time configuring a QuickBooks connection to a bank account. If the account has already been created, select Link account.

- Find your bank and establish connections with them and the smaller credit unions. You can manually upload the transactions if there isn’t a bank connection for QuickBooks.

- To log onto your banking website, select Continue and enter your username and password.

- Complete the remaining security tests and finish the connection process. It could take some time to connect your bank account to QuickBooks online.

- Select the savings, credit card, and other accounts you want to link. From the chart of accounts in QuickBooks, choose the appropriate account type.

- Now, download any previous day’s transactions that you like. Banks typically grant 90 days, but some may even offer 24 months.

- To link a bank account in QuickBooks Online, tap Connect.

Step 2: Download the Most Recent Transactions

The next step is downloading your transactions after connecting your bank account to QuickBooks Online. Once you connect your bank account and update your system, QuickBooks will automatically take care of this process.

Follow these easy steps to download your transactions:

- Visit QuickBooks Online’s Banking section.

- Find the Update option and select it.

You can effortlessly manage your money with the help of QuickBooks by having it obtain and update your most recent transactions with just a few clicks.

Step 3: Arrange the Downloads into Categories

Examining and categorizing your transactions after downloading them into QuickBooks is crucial to ensure they are classified correctly. Linking your bank account in QuickBooks Online requires you to complete this step.

Steps to Link Bank Account to your Chart of Accounts

- Navigate to Settings and then choose a Chart of accounts .

- Under the Action column, select the View register dropdown menu. Then, hit the Connect bank tab.

- Type the URL or name of your bank into the Search field, then click the bank.

Note: If you can’t locate your bank, you can manually upload transactions instead.

- Enter your login credentials in the Login and Password fields, then press Continue.

- Choose the account that you want to connect and date to pull transactions from the dropdown. Then, press Next.

Note: Some banks allow you to download the last 90 days of transactions. Others can go back as far as 24 months.

- Select your account type in the Account type dropdown and then hit Next.

Note: Opt for the account type that matches your chart of accounts in QuickBooks. If you don’t see the correct account type, click +Add new.

For New Bank Accounts:

- Choose Bank from the Account Type dropdown menu.

- Select Savings or Checking in Detail Type.

- Provide a name to the account and then press Save and Close.

For new credit card accounts:

- From the Account Type dropdown, choose Credit Card.

- Give a name to the account and then press Save and Close.

- Map the bank account in the Existing accounts dropdown menu, then click Next.

- Select Connect, then press Done.

Note: You can edit the account name in the New account name field or modify it later.

Steps to link another bank account if your bank is already connected

If you have already linked your bank account, you can easily add more bank or credit card accounts from the same institution.

Here’s how:

- Move to Transactions and then choose Bank transactions.

- Select Manage connections under the Link account dropdown menu. Then toggle on the Image of the switch for any additional account you want to connect.

Note: Manage connections displays all connections ever made via bank feeds. They can’t be removed.

- If you’re unable to see the account there, go back to Transactions and choose a Link account.

- Then, follow the steps to connect a new bank or credit card account.

For New Bank Accounts:

- In the Account Type dropdown menu, choose Bank.

- Select Savings or Checking from the Detail Type.

- Give a name to the account and then press Save and Close.

For New Credit Card Accounts:

- Select Credit Card from the Account Type dropdown menu.

- Provide a name to the account and then click Save and Close.

- Map the bank account in the Existing accounts dropdown, then press Next.

- Choose Connect, then hit the Done tab.

Note: You can edit the account name in the New account name field or change it later.

Connect and Manage your Bank Account in QuickBooks Online

Link your bank or credit card to QuickBooks Online is important to keep your books in check without any stress or mistakes.

Link a New Bank Account

Connect through Standard Bank Connection

To set up Standard bank connection, adhere the following steps:

- Navigate to Bookkeeping and select Transactions, then click on Bank transactions.

- Choose Connect Account if this is your first time connecting, or Link account if you’ve created one in the past.

- Look for your bank.

- Press Continue and then enter your banking user ID and password to log in to your bank.

- Follow all the on-screen steps to connect and go through any additional security checks required.

- Select any accounts you want to connect e.g. your savings, transaction, or credit card.

- Opt for the matching account type from your chart of accounts in QuickBooks.

- Decide how far back you want to download transactions. Some banks let you download the last 90 days of transactions while others can go back as far as 24 months.

- Click on Connect.

- Re-enter QuickBooks Online and refresh your window.

Connect through Direct Bank Connection

To set up a direct feed for your eligible bank account, follow these steps:

- Head to Transactions and then choose Bank transactions.

- Select Connect Account if this is your first time connecting, or Link account if you’ve created one in the past.

- Look for your bank.

- Choose to Get direct bank feeds.

- Read the steps on connecting the bank feeds, then click on Get direct feeds.

- Type your account details. It’s important that these fields match what the bank has on file for you.

Note: For Credit Card accounts, you need to enter your 9-digit Account Number, not your actual credit card number.

- Click on the bank account you want to connect to, press Connect and an authorisation form will be created.

- Hit the Preview form tab.

- Print the form and hand-sign it. If there are two signatories, both signatories will need to sign the form. However, if there are more than two, then all signatories need to sign the form.

- Email or post the form using the following details:

- Email: intuitforms@siss.com.au

- Subject: QuickBooks Bank Feed Request

- OR

- Mail: SISS Data Services Pty Ltd

- Locked Bag 3060

- Crows Nest, NSW, 1585

Note: Such copies aren’t accepted by the banks, so don’t deliver the form into your local branch. The entire process will take up to 10 business days from the time your form is received by SISS.

How to Add Another Bank Account to QuickBooks Online

Adding a bank account to QuickBooks Online is quick and easy. Follow these steps:

- Log into QuickBooks Online

- Go to Bookkeeping → Select Transactions

- Click on Bank Transactions

- Select “Connect Account”

- Choose Your Bank and log in

- Select the Account you want to connect

- Classify the Account Type

- Map the Account for proper tracking

- Sync Transactions

That’s it! Your bank account is now connected to QuickBooks Online, allowing for seamless transaction tracking.

How to Sync Your Bank Account with QuickBooks

Easily connect your bank account to QuickBooks by following these steps:

- Go to the Bookkeeping section.

- Select Transactions, then Bank Transactions.

- Click Connect Account (if it’s your first time).

- Search for your bank and select it from the list.

- Click Continue and sign in to your bank.

- Follow the prompts to connect your account.

- Choose the bank accounts you want to sync.

- Click Connect to complete the setup.

The Last Word

Hopefully, the information given above will be useful to you. But if you are still facing any kind of issues with your software and need professional assistance regarding accounting, bookkeeping & accounting software-related issues, then feel free to get technical support with us at +1-802-778-9005, or you can email us at support@ebetterbooks.com

How to Manually Add a Bank Account in QuickBooks?

If you need to add a bank account to QuickBooks Desktop or QuickBooks Online without connecting it to online banking, follow these simple steps:

For QuickBooks Online:

- Go to Chart of Accounts – Click Settings > Chart of Accounts.

- Add New Account – Select New, then choose the Account Type (Bank) and Detail Type (Checking, Savings, etc.).

- Enter Account Details – Name the account, add a description (optional), and enter the opening balance if needed.

- Save – Click Save and Close to finish.

For QuickBooks Desktop:

- Navigate to the Chart of Accounts – Select Lists > Chart of Accounts.

- Create a New Account – Click Account > New, then choose Bank Account.

- Enter Account Details – Provide the account name, type, and opening balance.

- Save – Click OK to complete the setup.

Why Add a Bank Account Manually?

- If your bank doesn’t support automatic connections.

- To track offline transactions and cash accounts.

- For businesses that prefer manual bookkeeping.

By following these steps, you can successfully manage bank accounts in QuickBooks without linking them to a bank feed.

How to Reconcile Bank Transactions in QuickBooks Online?

Reconciling your bank transactions in QuickBooks Online ensures that your records match your bank statements, helping you track finances accurately and identify discrepancies. Follow these simple steps to complete a reconciliation:

Step 1: Prepare for Reconciliation

- Ensure all transactions are entered and categorized in QuickBooks.

- Gather your bank statement for the period you’re reconciling.

Step 2: Start the Reconciliation Process

- Go to Reconciliation: In QuickBooks, navigate to Settings ⚙️ > Reconcile.

- Select Your Account: Choose the bank or credit card account you want to reconcile.

- Enter Statement Details: Input the statement ending balance and ending date from your bank statement.

Step 3: Match Transactions

- Compare transactions in QuickBooks with those on your bank statement.

- Mark transactions as cleared if they match.

- Investigate any discrepancies (e.g., duplicate entries or missing transactions).

Step 4: Finalize the Reconciliation

- If the difference is $0, click Finish Now to complete reconciliation.

- If there’s a discrepancy, review and adjust transactions as needed.

Step 5: Review & Maintain Accuracy

- Run the Reconciliation Report to keep records for future reference.

- Regularly reconcile to keep your books accurate.

Still have questions? Explore our detailed FAQs.

Disclaimer: The information outlined above for “How to Link a Bank Account to QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.