Bank Feed configuration for QuickBooks Desktop is thoroughly detailed in this guide, providing users with essential, step-by-step instructions for securely downloading bank and credit card transactions directly into their software using two primary methods: Direct Connect and Web Connect (.qbo files). It emphasizes critical preparatory steps, such as creating a backup of the company file and understanding file compatibility, noting that QuickBooks Desktop primarily requires the .qbo format and does not support QIF files, which often require a third-party conversion tool. The tutorial details the process for both Windows and Mac platforms, covering initial setup, managing login credentials (which requires deactivating and reactivating the feed), and troubleshooting common issues like limited historical data downloads (typically the last 90 days from the bank) and the prevention of duplicate entries. The content establishes expertise by clearly outlining the differences between the automatic Direct Connect and the manual Web Connect process, enabling users to choose the most efficient method for maintaining up-to-date, accurate financial records for reconciliation.

Highlights (Key Facts & Solutions)

- Backup is Mandatory: Users must create a backup of their QuickBooks company file before initiating any transaction download or import process to safeguard their data.

- File Type Restriction: QuickBooks Desktop’s Web Connect feature exclusively works with the .qbo file format. Other types like QFX and QIF files are not directly supported and require conversion, often via third-party applications.

- Two Download Methods: Transactions can be imported using either Direct Connect (automatic, two-way communication, potential bank fee) or Web Connect (manual import using a downloaded .qbo file, generally free).

- Historical Data Limit: Most financial institutions limit the initial download via Direct Connect to the last 90 days of historical transactions; users must manually import a .qbo file for older data.

- No Re-downloading: Once downloaded transactions are deleted from the Bank Feeds Center, they cannot be re-downloaded to prevent duplicate entries.

- Updating Credentials: To change a Direct Connect login PIN or user ID, users must first deactivate the online services for the account via the Chart of Accounts and then re-enable the Bank Feed with the new credentials.

- Account Mapping: When setting up Direct Connect, the QuickBooks account type (e.g., Bank, Credit Card) must correspond to the financial institution’s classification.

Points to be considered before downloading the Bank feed Transactions!

Below are certain things you need to keep in mind when downloading the bank feed transactions in QuickBooks Desktop, which include:

- It is recommended that you create a backup of your QuickBooks company file before you start downloading or importing. This will allow you to access it again later if required.

- You can’t download transactions into the same company file more than once. However, if your Bank is able to reopen the transactions on its end, then you can download them again. Contact your Bank in case you need any assistance.

- It is important to know that Web Connect files only work with .qbo files. Other file types like QFX and QIF Quicken files won’t work. There are a few third-party applications available on the Intuit Marketplace that can manage the QIF files.

Simple ways to download Bank Feed transactions in QuickBooks Desktop

There are two methods to download bank feed transactions, including Direct Connect or Web Connect, and you can select any one of them if you want to import transactions manually. Below, we have discussed how each method can be downloaded and used on a QuickBooks desktop.

You can download bank feed transactions in these scenarios; one is when you are using QuickBooks software, and the other is when you are outside of QuickBooks.

- When you are using QuickBooks software, then the solution is automatically built within the system, and we use Direct Connect or Web Connect services.

- When you are outside of QuickBooks, then you can download the .QBO file and upload manually into your QuickBooks software.

If You’re Using QuickBooks Desktop

Download Bank Feed Transactions Using Direct Connect

When you connect for the first time, QuickBooks automatically downloads the maximum limit of transactions available from your Bank. It totally depends on your Bank, and this can give you up to a year of historical transactions. However, most of the banks may only download 90 days of historical transactions.

Adhere to the following steps to download transactions using Direct Connect:

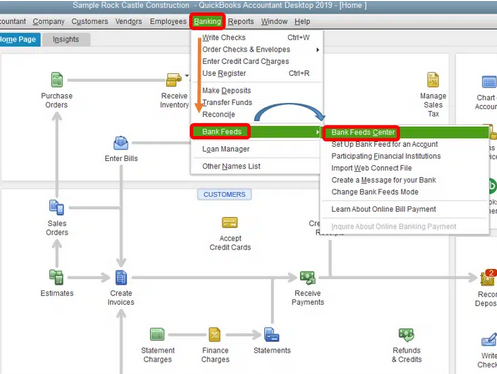

- Navigate to the Banking section.

- Choose Bank Feeds and then select the Bank Feeds Center option.

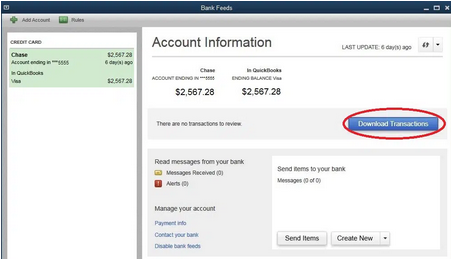

- Now, click on the account you want to connect from the Bank Account list. To edit or cancel a payment, hit the Online Checks link under the Send items to your bank section (It is optional, not mandatory).

- Once you’re ready to get your transactions, choose the Download Transactions option.

Note: If you’ve already downloaded the transactions but haven’t reviewed them yet, check for the Transaction List.

- Select the Synchronize icon.

- If you only want to download transactions for a particular account, click the Sync this account icon.

- Or, if you want to download transactions for all your accounts at the same Bank, mark the Sync all for this Bank option.

- Enter your PIN or password to connect to your Bank in the Access to window.

- Press the OK button.

- After downloading the transactions, you need to match or add any new ones.

Important: You can delete any remaining (previously matched/added) transactions or statements. Once you delete your downloaded transactions, you won’t be able to re-download them. This will avoid duplicate entries or data redundancy.

Download Bank Feed Transactions using Web Connect

Some banks allow you to set a date range for downloads, but if your Bank doesn’t have this option, you can automatically get the maximum number of transactions available when you download. The range may be from 30, 60, 90 days, or more days, depending on your Bank.

You can import transactions from Web Connect using two different ways, which are as follows:

If you’re using QuickBooks Desktop

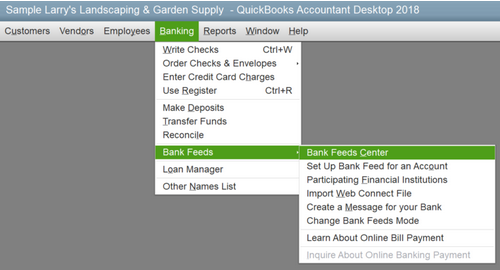

- Hover over the Banking menu.

- Go to the Bank Feeds and then choose Banking Center.

- Locate your Bank and select Download Transactions. This will open up a browser window to your Bank’s website.

- Finally, log in to your Bank’s website to download the Web Connect file.

Download Bank Feed Transactions if You’re Outside of QuickBooks Desktop

- Open a web browser and then navigate to your Bank’s website.

- Now, log into your bank account using the normal process.

- After this, download your transactions as a QuickBooks Web Connect (.qbo) file.

Note: Every Bank has different ways to download QuickBooks Web Connect files. If you’re not sure about how to do it, visit your Bank’s website and follow the on-screen instructions or reach out to the nearby branch for help.

- When you have the Web Connect file, try to import it into the QuickBooks Desktop application.

Download Bank Feed Transactions in QuickBooks Desktop for Mac

With online banking, QuickBooks connects to your bank in one of two ways:

- Direct Connect

- Web Connect

Here’s how to download and import your transactions in both ways.

Note: QuickBooks doesn’t control which transactions are downloaded from your bank. It only shows the info received from your bank.

Download Transactions with Web Connect

When you download transactions through Web Connect, QuickBooks opens them from a .qbo file. Let’s download and import this file into QuickBooks.

- Navigate to Banking

- Choose a Website. This opens a browser window to your bank’s website.

Note: You can also download transactions outside of QuickBooks. Just open a browser and go to your bank’s website.

- Log in to your online banking account.

- Hover over your transactions and then enter the time you want to display. If you’re not asked for a date range, you’ll see the maximum number of transactions your bank allows.

Note: Steps on how to download QuickBooks Web Connect files vary per bank. If you’re not sure how to download the .qbo file from their website, immediately contact your bank for help.

- In QuickBooks, move to Banking and then select Downloaded Transactions.

- Click on Import File, then search for the .qbo file you downloaded.

Download Transactions with Direct Connect

Direct Connect downloads transactions directly from your bank to QuickBooks. You don’t need to import your transactions as they’re made available in your register when you download.

- Head to the Banking menu and then select Downloaded Transactions.

- Choose the account you want to connect from the QuickBooks Account dropdown menu.

- Hit the Download icon.

Set Up or Edit your Bank Accounts for Bank Feeds in QuickBooks Desktop

In QuickBooks Desktop, you have the option to use Bank Feeds to connect your Bank or credit card accounts to online banking services. When you download your bank transactions, you don’t have to record them manually. There are two ways to set up an account, including Connect with Direct Connect or Web Connect. The way you connect depends on what is available at your Bank.

Connect with Direct Connect

Note: Make sure you have a PIN or password from your Bank’s end to use this method.

After setting up the account, you can download your online statements to your Bank Feeds. However, if you’re downloading transactions for the first time, QuickBooks will automatically set up an account for Bank Feeds.

Important: Check with your Bank if there’s a fee or if the service is free when you start setting up your account.

Bank-Provided Credentials

For online banking setup, your Bank offers a Customer ID and password (or PIN) to every customer.

You may also need the following things:

- Account Number: This is the number that your Financial Institution provides you when you create a new bank account. It appears on your banking statements. If you fail to find it, contact your Bank for help.

- Routing Number: Financial Institutions have a 9-digit number called a routing number. You can usually find it on a check for the account. Connect with your bank account if you aren’t able to find it.

- Account Type: For every account holder, it is important to know how your financial institution classifies your account, not how QuickBooks does.

| Account Type at Financial Institution | Account type in QuickBooks |

| Checking | Bank |

| Savings | Bank |

| Money Market | Bank |

| Line of Credit | Bank |

| Credit card | Credit card |

| Line of Credit | Other current liability |

- Head to the Bank Feeds from the Banking section.

- Now, choose the Set up Bank Feeds for an account option.

- Under the Enter your Bank’s name field, type and select your Bank.

If you’re a new user or enrolling for the first time, click on the Enrollment Site link and then apply for Direct Connect. However, if your Bank needs to approve your application, contact them or ask them if you need special sign-in credentials.

Once you log in successfully, do the following:

- Press Continue.

- Then, type in your Online Banking user ID and Password.

- Choose Connect to link your QuickBooks to your Bank’s server.

- After this, select the bank account you wish to connect to your account in QuickBooks.

- Hit the Finish tab when the connection process is completed.

Connect with Web Connect (.QBO) Files

To download your company’s transactions from your Bank or credit card, you can use a .QBO file in case your Bank doesn’t offer Direct Connect. Then, you need to import that file to QuickBooks and add such transactions to your accounts.

If your Bank offers Web Connect:

- Under the Banking menu, choose Bank Feeds and then Import Web Connect Files.

- Now, select the .QBO file you saved, then click Open.

- When you’re prompted to opt for your bank account:

- Select an existing QuickBooks account if the account you’re trying to import transactions into is already set up in QuickBooks.

- Create a new QuickBooks account in case the account you’re importing transactions into isn’t in QuickBooks yet.

- Press the Continue tab.

- After this, You’ll be directed to a dialog box letting you know that the data has been successfully read into QuickBooks. Later, hit the OK icon.

- At last, navigate to the Bank Feeds Center to check your transactions.

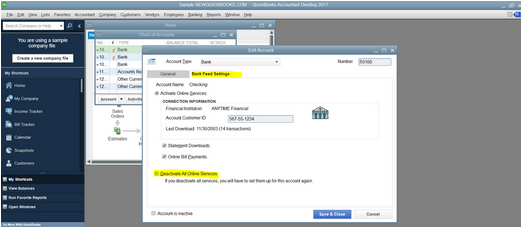

Edit your Bank Feed settings for Bank or Credit Card Accounts

To change or edit your login and other info related to the bank account you use with QuickBooks Desktop, you are required to turn off your Bank Feeds and then set it up again.

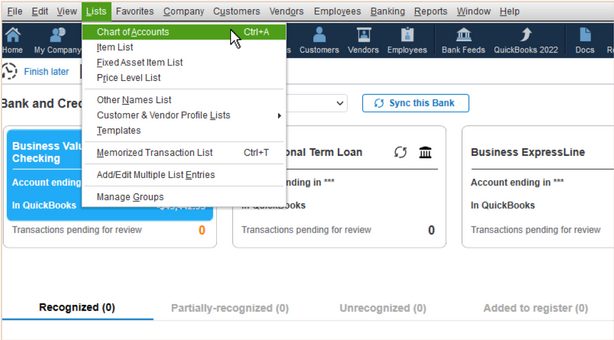

- Firstly, disconnect Bank Feeds for your account. Here’s how:

QuickBooks Desktop for Windows

- Hover over the Lists menu and then choose the Chart of Accounts.

- Next, hit right-click the account you’d like to turn off and then select the Edit Account option.

- Go to the Bank Settings and choose Deactivate all online services, then press OK.

- In the end, click Save & Close.

QuickBooks Desktop for Mac

- Head to Lists, and then choose the Chart of Accounts.

- Now, highlight the account and click the pencil to edit.

- Select the Online Settings option and click Download Transactions.

- After this, choose Not enabled.

- Lastly, press OK to confirm.

- Once done, make your changes.

- Then, set up feeds for your account.

Bottom Line!

Bank feeds are a digital link that automatically downloads transactions from your bank account to your accounting software on a digital basis. You can then work with the data by creating new transactions as needed or match bank transactions to your financial institution. Once set up, the feed automatically sends transaction information from your bank account to your accounting software, helping provide you with an up-to-date view of your business finances in one place.

FAQs

Why can’t I see recent transactions after downloading Bank Feeds in QuickBooks?

If you can’t find recent transactions in QuickBooks, make sure that you’ve set the correct date range for before downloading the bank feeds. Adjust the date filter to include the time frame that you want to view in your transactions.

Or, follow the steps below:

- Head to Bookkeeping, click Transactions and then select Bank transactions.

- Choose the bank account or credit card tile that you want to search.

- Newly downloaded transactions will be under the For review tab.

- Recently categorised transactions will be under the Categorised tab.

- If you mark a transaction as personal or a duplicate, it goes to the Excluded tab. QuickBooks won’t add excluded transactions to your accounts. However, if you want to include it, click Undo from the Action column.

How do I turn on bank feeds log files in QuickBooks Desktop?

The Bank Feeds logs record what happens during an online connection with your bank. If the connection fails, or you get an error, the logs can help pinpoint the failure. There’s a preference to create log files. Make sure you enable this before you reproduce the bank feeds issue.

Here’s how:

- Click Edit, then choose Preferences.

- Hit the Checking tab and then click on Company Preferences.

- Select Turn on Bank feeds log files, then press OK.

- If you don’t see the option to turn on bank feeds logs, switch to Express mode.

How can I manually download bank transactions in QuickBooks?

You can manually upload transactions if you want to enter old transactions, can’t find your bank, or connect it to QuickBooks.

Here are the steps:

- Navigate to Transactions and then select Bank transactions.

- Click the blue tile for the account you want to upload the transactions into.

- Hit the Link account dropdown menu and then choose Upload from file.

Note: If your account is not connected yet to online banking, click Upload from file.

- Select Drag and drop or click files and then opt for the file you downloaded from your bank. Then, press Continue.

- Choose the account you want to upload the transactions into under the QuickBooks account dropdown menu. Then, hit the Continue button.

Note: If you’re new to QuickBooks, you may not have an account to upload the transactions into. If you don’t see one, click Add New from the drop-down to create a new bank account.

- Follow all the on-screen steps to match the columns on the file with the correct fields in QuickBooks and then click Continue.

- Go for the transactions you like to import and then press Continue again.

- Click Yes and hit the Done tab.

When can the transactions be downloaded from last in QuickBooks?

When you connect your bank to QuickBooks, the system downloads up to the last 90 days of transactions. If you need transactions that are more than 90 days old, you can import your bank statement or enter the transactions manually into your account before connecting to a bank feed.

Is there any way to download bank transactions in QuickBooks?

Yes, if you want a detailed list of all your transactions, you can export them into a CSV file.

Here are the steps to download the transactions:

- Navigate to the Transactions menu.

- Use the Type, Account, and Time period dropdowns to sort the transactions.

- Hit the Export icon.

Note: Receipts aren’t exported. You can download them from specific transactions. Or move to the Reports menu and then download all of your receipts for specific tax years.

Why am I unable to see more than 90 days of historical transactions when setting up Direct Connect for the first time?

The number of historical transactions downloaded is controlled by your financial institution, not by QuickBooks. Upon initial connection using Direct Connect, most banks default to providing only the last 90 days of transaction history. While QuickBooks has the technical capability to download up to a year of data, the bank’s policy limits this initial retrieval.

To obtain older transactions, you must typically:

- Log into your bank’s website.

- Manually download the required transaction file, usually the Web Connect (.qbo) format, for the specific date range needed.

- Import the file separately into QuickBooks Desktop.

My bank offers QIF files, but the article says Web Connect only works with .QBO files. How can I import my transactions?

QuickBooks Desktop does not natively support the import of Quicken Interchange Format (.qif) files. It primarily relies on the Web Connect (.qbo) file format for secure and reliable transaction import.

If your bank only provides QIF files, the supported solutions are:

- Conversion Tool: Use a specialized, third-party software utility, often found through the Intuit Marketplace or general web search, to convert the QIF file data into the QuickBooks-compatible .QBO format.

- Bank Request: Contact your bank’s support and specifically request the ability to download a QuickBooks Web Connect (.qbo) file, as this format is widely supported across financial institutions.

Can I undo or re-download transactions after I delete them from the Bank Feeds Center?

No, once transactions are deleted from the Bank Feeds Center (the list of downloaded items not yet added or matched to the register), they are permanently removed and cannot be re-downloaded by QuickBooks. This restriction is enforced to prevent data corruption and duplicate entries in your company file.

If transactions are deleted by mistake, your only recovery option is to:

- Restore your QuickBooks company file from a backup taken before the deletion.

- Manually download the transactions again from your bank’s website using a Web Connect (.qbo) file for the specific time period.

What are the correct account types to select when setting up a Direct Connect account?

When connecting via Direct Connect, you must match the account type as defined by your financial institution for correct mapping in your QuickBooks Chart of Accounts.

The necessary account type mapping is as follows:

- Bank Account Type at Financial Institution: Checking, Savings, or Money Market

- Corresponding Account Type in QuickBooks: Bank

- Bank Account Type at Financial Institution: Credit card

- Corresponding Account Type in QuickBooks: Credit card

- Bank Account Type at Financial Institution: Line of Credit

- Corresponding Account Type in QuickBooks: Other current liability (or Bank/Other current asset, depending on specific classification)

What steps should I take if I need to change the login PIN or user ID for my Direct Connect account?

You cannot directly edit the existing login credentials within the Bank Feeds settings. To securely update your User ID or PIN for an account connected via Direct Connect, you must disconnect the online service first and then reconnect it.

The steps are:

- Go to the Chart of Accounts (

Listsmenu). - Right-click the account and select Edit Account.

- Go to the Bank Settings tab.

- Choose the option to Deactivate all online services (or Not enabled for Mac).

- Click Save & Close (or OK).

- Return to the Bank Feeds Center and follow the original setup steps to reconnect the account using the new, updated credentials.

I downloaded transactions, but my Bank Feeds Center is empty. Where did they go?

When the Bank Feeds Center shows a zero or missing transaction count despite a successful connection, it could be due to a few common configuration issues, primarily pending alerts at the bank or a mapping error.

To resolve this, confirm the following:

- Check Bank Website: Log directly into your bank’s website and clear any security alerts, notifications, or messages. These alerts can block QuickBooks from retrieving the data.

- Check Account Mapping (Web Connect): If you used a Web Connect (.qbo) file, confirm that you selected the existing QuickBooks account during the import, not accidentally created a new one or mapped to an incorrect account.

- Check QuickBooks Status: Ensure your QuickBooks Desktop software is updated to the latest release and check if your firewall or antivirus is blocking the connection.

What is the fundamental difference between Direct Connect and Web Connect, and why should I choose one over the other?

The difference between Direct Connect and Web Connect lies in the connectivity and potential cost.

| Feature | Direct Connect | Web Connect (.QBO File) |

| Connectivity | Automatic, direct server-to-server connection via the internet. | Manual, single-use file downloaded from the bank’s website and imported. |

| Two-Way | Yes, allows downloading transactions and sending bill payments/transfers from within QuickBooks (if supported by the bank). | No, only allows one-way downloading of transactions. |

| Bank Fee | May incur a monthly fee from the bank, as it is often considered a premium, two-way service. | Generally free from the bank, as it is a manual file download. |

You should choose Direct Connect for automation and payment capability. Choose Web Connect if your bank does not support Direct Connect, to avoid potential bank fees, or when needing a specific historical date range.

Disclaimer: The information outlined above for “How to Download the Bank Feed Transactions in QuickBooks Desktop?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.