Highlights (Key Facts & Solutions)

- Forecasting Limit: The Cash Flow Planner is optimized for short-term financial management, projecting future cash flow up to 90 days .

- Data Sources: Predictions are calculated using two sources: historical data from connected bank accounts and future-dated open invoices (Money In) and bills (Money Out) entered into QuickBooks.

- Projections are Separate: Manually added items in the Planner are for scenario testing only and do not create actual transactions or impact the official company books (General Ledger).

- Alert System: Users can set a minimum Threshold via the gear icon settings; the Planner generates an alert if the projected cash balance falls below this limit.

- Accuracy is Data-Dependent: Accurate forecasting requires the user to fix common data issues, including uncategorized transactions, overdue invoices with unrealistic dates, and missing recurring items.

- Excluded Transactions: The forecast specifically excludes non-cash items (like Depreciation or Journal Entries), credit card transactions, and transactions from complex features (like Multicurrency files) to maintain its core focus on immediate cash flow.

- Sync Issues: Common causes for data sync failure include bank security changes, maintenance outages, or corrupted browser cache, all of which require user troubleshooting.

Overview

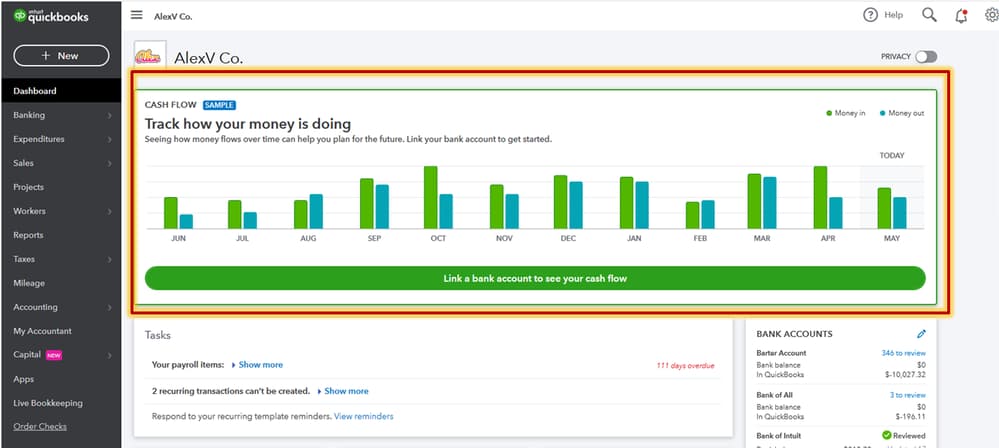

QuickBooks provides Cash Flow Planner as an inbuilt tool for cash flow forecasting. The Cash Flow Forecasting Tool in QuickBooks is a decisive element designed to assist businesses handle their finances by forecasting prospective cash flow based on income and expenses.

This tool delivers a precise sight of expected cash inflows and outflows, permitting business owners to design effectively for upcoming periods, make knowledgeable decisions, and evade the issue of potential cash shortages.

By using this tool, users can track upcoming bills, sales, and additional financial activities, assuring they preserve adequate cash reserves to protect expenses. Whether you’re a small enterprise owner or a financial manager, utilizing QuickBooks Cash Flow Forecasting Tool can significantly improve your capability to supervise liquidity and financial health.

QuickBooks Cash Flow Planner

Features of QuickBooks Cash Flow Planner

- Cash Flow Forecasting: Predicts future cash flow trends so that you can track your goals.

- Automatic Data Sync: Connects with bank accounts and transactions.

- Manage Bills: Pay multiple bills and vendors at once, track due dates, and set up recurring payments.

- Customizable Timeframes: Offers weekly, monthly, or custom views.

- Interactive Graphs: Visualizes cash flow for better understanding.

- Mobile Accessibility: Access cash flow data on the go.

- Create and Send Invoices: Send customized invoices anywhere, anytime.

- Track invoices: See when customers view and pay invoices and get an up-to-date picture of your cash flow.

- Real-Time Updates: Provides live cash flow insights.

- Expense and Income Tracking: Monitors all cash inflows and outflows.

- Alerts and Notifications: Warns of potential cash flow shortages.

Pros and Cons of QuickBooks Cash Flow Planner

| Pros of QuickBooks Cash Flow Planner | Cons of QuickBooks Cash Flow Planner |

| Accessible on mobile and desktop platforms.Easy cash flow tracking for small businesses. Integrates seamlessly with QuickBooks accounting software.User-friendly interface and visual forecasts. Real-time updates for accurate cash flow insights.Syncs with bank accounts for live tracking. | Predictive accuracy depends on entered data quality. May lack advanced reporting for in-depth analysis. Not ideal for large enterprises or unique industries. Limited customization for complex cash flow needs. Requires QuickBooks subscription to access features. Additional costs for certain integrations and tools. |

Using QuickBooks Cash Flow Planner for Cash Flow Forecasting Setting Up your Account

In order to begin with the setup of the cash flow planner in QuickBooks, you first need to connect your bank and your credit card accounts. By doing so, you can easily use the data from your cart off accounts ( COA).

Steps to connect your bank and your credit card accounts:

Step 1: Click on the Transactions, then choose Bank Transactions.

Step 2: Choose Link Account.

Step 3: Put the URL or name of your bank in the Search field, then choose the bank.

Note: If you can’t find your bank, you can manually upload transactions instead.

Step 4: Enter your Sign info in the Login and Password fields, then select Continue.

Step 5: Choose the account that you want to connect and date to pull transactions from the dropdown .

Step 6: Then, select Next.

Note: Some banks let you download the last 90 days of transactions, while others can go back as far as 24 months.

Step 7: Choose your account type on the Account type drop-down, then select Next.

Note: Select the account type that matches your QuickBooks account chart. If you don’t see the correct account type, select +Add new.

If there is a new bank account:

Step 1: In the Account Type drop-down, choose Bank.

Step 2: In Detail Type, choose Savings or Checking.

Step 3: Assign the account a name and then choose Save and Close.

If there is a new credit card accounts:

Step 1: In the Account Type drop-down, choose Credit Card.

Step 2: Give the account a name and then choose Save and Close.

Step 8: Map the bank account in the Existing accounts dropdown, then select Next.

Step 9: Click on Connect, then select Done.

Note: You can edit the account name in the New account name field or change it later.

Manage Items

In this step, the user can add, edit, or delete an item in the income and expense planner.

Note: The items in the Planner aren’t actual transactions. So they won’t appear in your books.

Case 1: When the User Wants to “Add an Item”

Step 1: Click on the Dashboards and choose the planner option.

Note: If it’s your first time, select Start planning, then select Let’s go.

Step 2: Click on “Add item”.

Step 3: Choose the “Money in” option on the screen ( if the item is an income) or choose the “Money out” option ( if the item is an expense ).

Step 4: Put the name under the “Description field” and then mention the amount under the ” Amount field”.

Note: If it’s a recurring item, select Repeating. Then select how often the item repeats.

Step 5: Select Save.

Note: To export your cash flow details, select the Download Report dropdown. You can export the report as a CSV, PDF, or XLS file.

Case 2: When the User Wants to “Edit an Item”

Step 1: Go to Dashboards and select Planner

Step 2: Select the item you want to edit.

Step 3: Edit the info.

Step 4: Select Update.

Case 3: When the User Wants to “Delete an Item”

Step 1: Go to Dashboards and select Planner.

Step 2: Select the item you want to delete.

Step 3: Choose Remove, then choose Confirm.

Note: To delete an entire series, choose an item in the series, turn off the Repeating switch, choose Remove, and then select Remove again.

Customize your Planner

Choose the data you would like to view in your planner.

Here’s how to do it:

Step 1: Click on the Dashboards, then choose Planner.

Step 2: On the planner page, choose the gear icon.

Step 3: Select your preference.

Step 4: In the Linked Accounts section, select the accounts that you want to show in the Cash flow planner.

Note: Select Link bank account to link to another bank account.

Step 5: In the Threshold section, set an amount you don’t want to go under.

Step 6: Click on Save.

Conclusion

In conclusion, the Cash Flow Forecasting Tool in QuickBooks is essential for businesses looking to manage their financial health. It offers real-time insights into cash inflows and outflows, enabling informed decision-making. The tool integrates effortlessly with QuickBooks, pulling data from bank accounts and transactions. Whether planning for growth or managing expenses, it helps keep your business financially on track.

FAQs:

1. How does the Cash Flow Planner calculate its future prediction, and how far out can it forecast?

The QuickBooks Cash Flow Planner forecasts your business’s future cash position by combining two primary data sources to provide actionable insights.

- Data Sources for Prediction:

- Historical Data: The tool analyzes transactions from your connected bank and credit card accounts to identify recurring income (e.g., subscription payments) and recurring expenses (e.g., rent, utilities).

- Future Transactions: It includes transactions you have already entered into QuickBooks that have a future due date, such as open invoices (Money In) and open bills (Money Out).

- Forecasting Horizon: The planner is optimized for short-term visibility, projecting future cash flow up to 90 days into the future. This short-term focus helps businesses manage immediate liquidity needs.

2. If the predictive accuracy of the planner depends on entered data quality, what types of data issues should a user look out for?

The accuracy of the cash flow forecast is directly proportional to the quality and consistency of the data in QuickBooks. Users must focus on data integrity to ensure reliable predictions.

- Key Data Quality Issues to Fix:

- Uncategorized Transactions: Transactions that are imported from the bank but have not been assigned a category or expense account will not be accurately factored into projections.

- Overdue Transactions: Overdue invoices or bills must be manually updated with a realistic expected payment or due date for them to be included in the future forecast.

- Missing Recurring Items: Future or potential income and expenses (like a large planned purchase or a new monthly subscription) must be manually added to the Planner as “items” to ensure they are considered in the model.

- Incorrect Bank Mapping: Ensure imported bank transactions are correctly linked to the corresponding Chart of Accounts in QuickBooks.

3. Why is a manually added item in the Cash Flow Planner not showing up as a transaction in my actual books?

The Cash Flow Planner is fundamentally a planning tool separate from the official accounting records (the General Ledger).

- Planner Items vs. Accounting Transactions: Items added manually to the planner (e.g., a “Money In” estimate for a new client) are strictly projections for scenario planning. They are meant to simulate “what if” scenarios.

- No Impact on Books: These items do not create journal entries, affect the Chart of Accounts, or impact financial statements like the Profit and Loss or Balance Sheet.

- Data Integrity: This separation is intentional, allowing users to experiment with various cash flow scenarios without risking the integrity or accuracy of the company’s official financial records.

4. What are the known limitations of the Cash Flow Planner for large enterprises or businesses with complex needs?

While powerful for small to medium-sized businesses, the Cash Flow Planner has limitations related to depth and complexity, making it less suitable for large enterprises.

- Forecasting Horizon: It is typically limited to a short-term 90-day forecast, which is insufficient for large-scale strategic or capital expenditure planning.

- Customization: The tool may lack the advanced reporting and customization options required for complex financial modeling often used by large organizations (e.g., departmental budgeting or specific industry cost analysis).

- Transaction Scope: The tool may not include transactions from advanced features, such as multi-currency files or certain manually entered journal entries, which are common in larger businesses.

5. What are the common reasons a connected bank account might stop syncing data to the Cash Flow Planner?

A connected bank account may stop providing real-time data due to several common issues that require troubleshooting both within QuickBooks and on the bank’s own platform.

- Primary Causes for Sync Failure:

- Bank Security Changes: The bank may have recently changed its security protocols, requiring a new password or a multi-factor authentication step that needs to be resolved by updating credentials in QuickBooks.

- Bank Maintenance/Outage: The bank may be undergoing scheduled or unscheduled maintenance, temporarily blocking the data feed.

- Account Status Change: The bank account may have been closed or become inactive, requiring the user to verify the status directly on the bank’s website.

- Browser Cache: In some cases, a corrupted or full browser cache can interfere with the connection; clearing the cache is a simple first step for resolution.

6. How can a user set up an alert to warn of potential cash flow shortages?

The Cash Flow Planner allows users to set a minimum threshold, which acts as a visual and alert mechanism for anticipating financial shortages.

- Setting the Threshold:

- Users access the planner’s settings via the gear icon on the Planner page.

- A specific amount is set in the Threshold section. This amount represents the minimum cash balance the user does not want their account to fall below.

- Alert Functionality: If the Cash Flow Planner’s projection dips below this defined threshold amount at any point in the forecast horizon, the user is alerted to the potential cash shortage. This feature enables proactive financial planning.

7. What specific types of transactions are not included in the Cash Flow Planner’s forecast?

While the planner uses most bank-connected data, it specifically excludes certain transaction types that do not represent true cash movement or are tied to advanced accounting features.

- Transactions Excluded from the Forecast:

- Credit card transactions (only the payment to the credit card is included as an outflow).

- Journal entries (these typically represent internal accounting adjustments, not cash flow).

- Transactions entered manually into the QuickBooks accounting system (only bank-imported or future-dated invoices/bills are reliably included).

- Transactions processed through files that have the Multicurrency feature enabled.

- Non-cash expenses such as Bad Debt Write-offs or Depreciation.

Disclaimer: The information outlined above for “What is the Cash Flow Forecasting Tool in QuickBooks & How to Use It?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.