QuickBooks Payroll Error 15241 is a technical fault that prevents payroll updates from installing properly due to the malfunction of the File Copy Service (FCS). The FCS is a Windows-based background service that assists QuickBooks Desktop in managing and validating payroll update files. When it fails to operate correctly, the payroll update process stops, preventing users from downloading or applying the latest tax table updates.

Error 15241 primarily results from damaged QuickBooks installation files, incorrect Windows service configurations, restricted administrative permissions, or interference from third-party security software that blocks the File Copy Service. It can also occur when the FCS has been inadvertently turned off during system optimization or antivirus scans.

This article outlines the main causes, symptoms, and effective solutions for QuickBooks Error 15241, including step-by-step methods for different Windows operating systems and provides additional guidance on ensuring the File Copy Service runs correctly. By following these steps, users can reactivate the FCS, complete payroll updates, and maintain the overall stability of QuickBooks Desktop.

What is QuickBooks Payroll Error 15241?

QuickBooks payroll error 15241 is an update-related fault that occurs when the QuickBooks File Copy Service (FCS) is disabled, missing, or unable to start. This background service is essential for managing file transfers during payroll update installation. When it fails to operate, the QuickBooks Desktop application cannot verify or apply payroll data, causing the update process to stop abruptly.

Users typically encounter the following message on their screen:

“Error 15241: The payroll update did not complete successfully.

The QuickBooks FCS service is disabled.”

This message confirms that the payroll update cannot proceed because QuickBooks is unable to access the File Copy Service required for the process. The error reflects a configuration or permission issue rather than any damage to the company file. Restarting or re-enabling the FCS through Windows Services usually resolves the issue and allows the payroll update to complete successfully.

What is File Copy Service or FCS?

The QuickBooks File Copy Service (FCS) is a Windows background component that enables QuickBooks Desktop to manage, transfer, and install update files securely. It acts as a communication bridge between QuickBooks and the Windows operating system, ensuring that payroll updates, patches, and other data files are properly downloaded and installed.

This service coordinates file movement during updates, verifies data integrity, and prevents interruptions during the installation process. When the FCS is disabled, missing, or malfunctioning, QuickBooks cannot complete payroll or software updates because the system loses the ability to handle file transfers efficiently.

Note: The File Copy Service must remain active and properly configured to ensure the smooth operation and reliability of QuickBooks Desktop.

Why Does QuickBooks Error 15241 Occur?

QuickBooks payroll update error 15241 occurs when the QB Desktop File Copy Service (FCS) has problems that prevent it from starting or running properly. This service is responsible for a variety of tasks, including updating QuickBooks and its components. Error 15241 is usually associated with problems related to QuickBooks Desktop payroll updates.

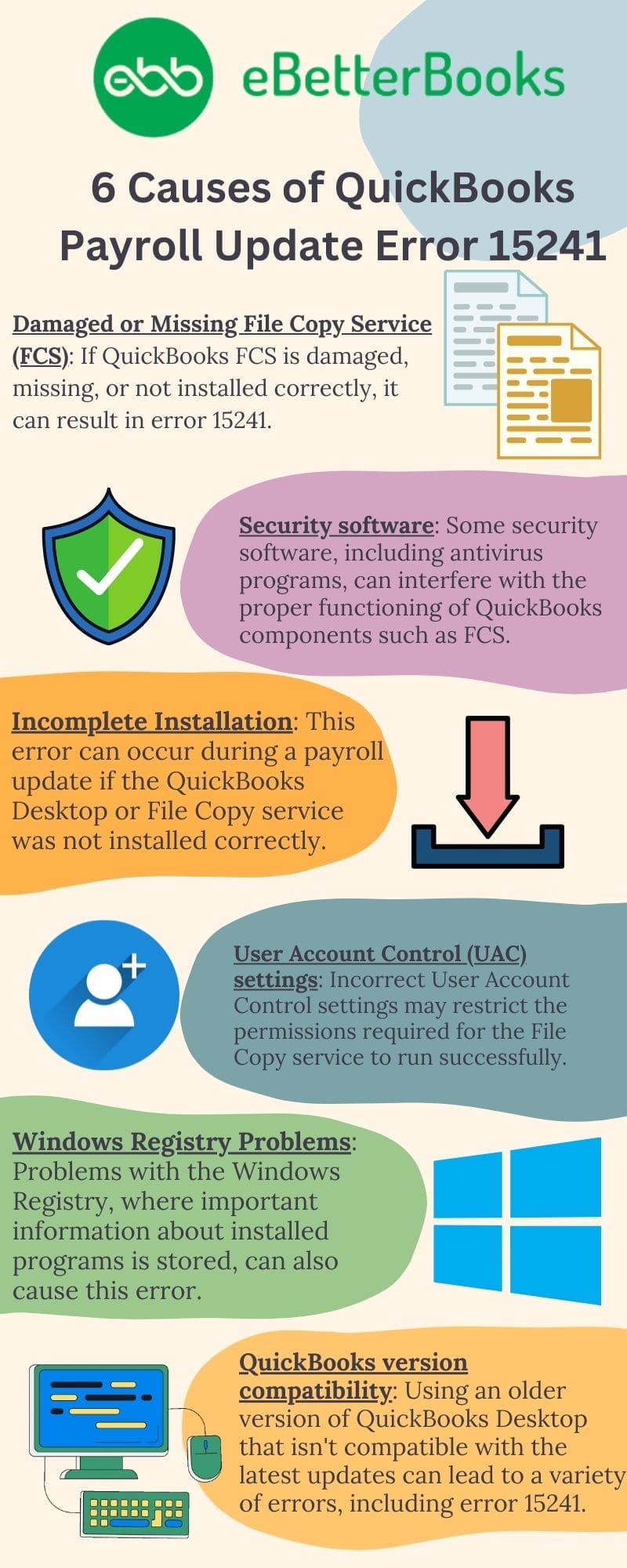

Several factors can lead to this error, including:

- Damaged or Missing File Copy Service (FCS):- If QuickBooks FCS is damaged, missing, or not installed correctly, it can result in error 15241.

- Security software:- Some security software, including antivirus programs, can interfere with the proper functioning of QuickBooks components such as FCS.

- Incomplete Installation:- This error can occur during a payroll update if the QuickBooks Desktop or File Copy service (FCS) was not installed correctly.

- User Account Control (UAC) settings:- Incorrect User Account Control settings may restrict the permissions required for the File Copy service to run successfully.

- Windows Registry Problems:- Problems with the Windows Registry, where important information about installed programs is stored, can also cause this error.

- QuickBooks version compatibility:- Using an older version of QuickBooks Desktop that isn’t compatible with the latest updates can lead to a variety of errors, including error 15241.

So now that you know what could be causing this frustrating error, keep calm and follow the steps to get over that feeling and get back to work.

Common Symptoms of the QuickBooks Payroll Error 15241

QuickBooks Payroll Error 15241 affects payroll updates, data accuracy, and overall software performance. Users may experience failed update downloads, disabled payroll functions, or delayed system response. Identifying these symptoms early helps in diagnosing the issue and reactivating the File Copy Service (FCS) to restore normal payroll operations in QuickBooks Desktop.

Inability to Download the Payroll Updates

QuickBooks displays an error message like:

- “Error 15241: This would imply “The payroll update did not complete successfully.”

- Whenever several aspects of payroll are changed, the updates never go through as planned and have to be attempted several times.

Disabled Payroll Features

- It would be rather strange, for example, if a module responsible for calculating taxes or checking paychecks did not work.

- Payroll forms or tax tables may remain the same.

Sharp QuickBooks Halting or Locking

- Automated processes during QuickBooks Desktop payroll procedures and when updating payroll taxes may lead to system crashes, freezes, or slow speed.

QuickBooks Error Messages

- You notice system messages informing that the File Copy Service (FCS) is not operative or has been turned off.

- They may also contain messages related to the remaining parts of an installation or an update process.

QuickBooks Desktop: Difficulties With Opening

- A QuickBooks file may not open or require an exceptionally long time to open.

Discrepancies in Payroll Data

- Incorrect or obsolete payroll information could be observed because the recalculations are not integrated properly.

Effective Solutions To Fix QuickBooks Payroll Update Error 15241

QuickBooks Payroll Error 15241 can be resolved by enabling the File Copy Service (FCS), running the QuickBooks reboot.bat file, and updating the payroll tax tables to the latest version. The troubleshooting process differs slightly across Windows versions, as each system manages background services differently. Following the appropriate method for your Windows version helps ensure that payroll updates install successfully and QuickBooks Desktop continues to operate without interruptions.

Solution 1: Run QuickBooks Reboot.bat File

The QuickBooks reboot.bat file can help fix errors 15241 in QuickBooks, Here’s how to use it:

- Find the reboot.bat file in the same folder as your QuickBooks installation.

- Double-click on the file to run it.

- After it finishes, close QuickBooks and restart your computer.

- Now, try opening QuickBooks again. The error should be resolved.

Solution 2: Restart QuickBooks File Copy Service

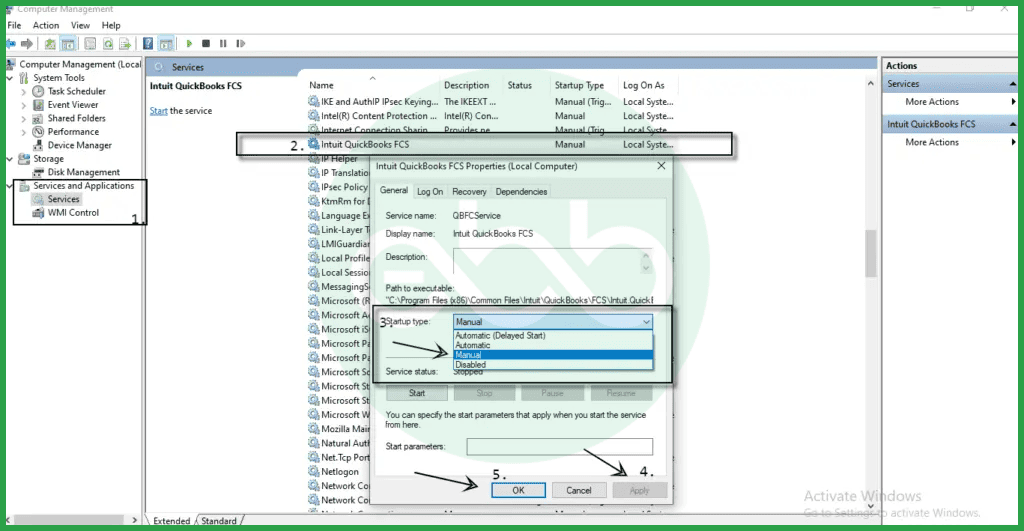

For Windows 11 | 10 | 8 | 7 | Vista Users:

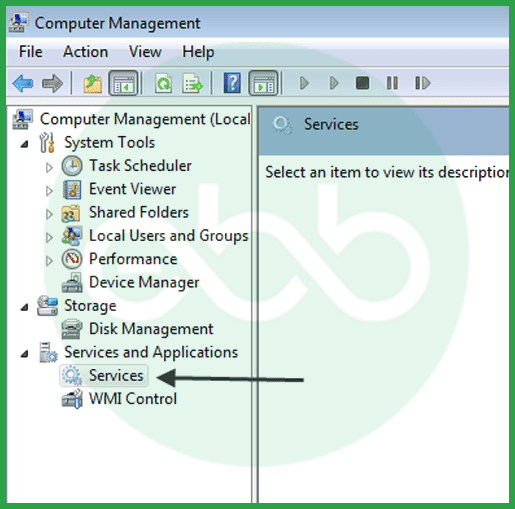

- Firstly, close the QuickBooks Desktop window.

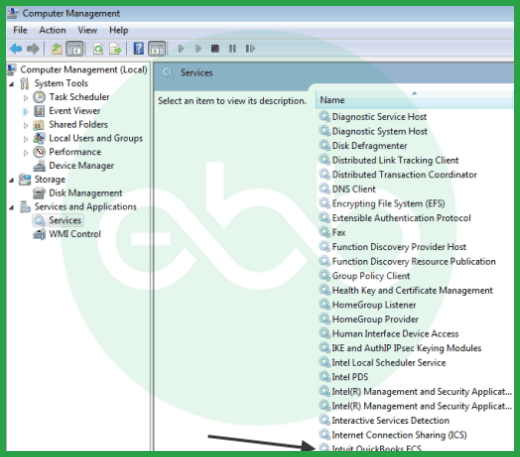

- Secondly, go to windows Start button, right-click on the computer, and click Manage. In case you are a Windows 10 user, then you need to go to search (taskbar), and then to the computer. Right-click on the This PC icon, and choose Manage.

- After that, click the option of services and applications (on the left pane). Then choose Services (right pane).

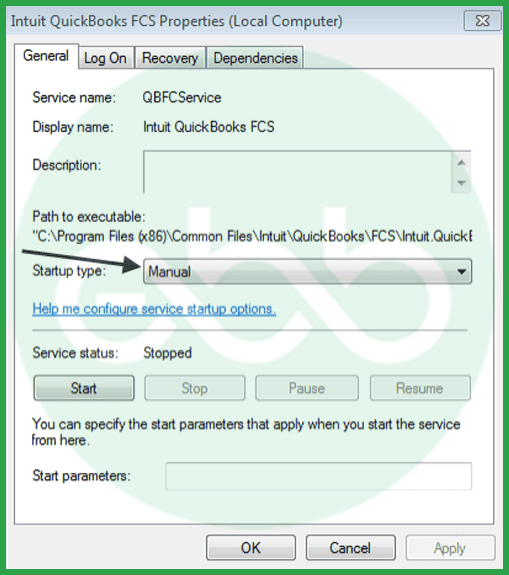

- Now the option of Intuit QuickBooks FCS will be visible. Double click on it, and when the Intuit QuickBooks FCS properties windows open, move the general tab and click startup type. It is a drop-down menu, where you have to choose the manual option.

- Click apply, then press OK.

- Click open QuickBooks software, download the updates, and update the payroll tax tables.

For Windows XP Users

- Firstly, close the QuickBooks desktop.

- Secondly, right-click on the My Computer icon, and select Manage. Now you will go to the Computer Management screen.

- Then go to services and applications, click the services option.

- Now, scroll down, double click the Intuit QuickBooks FCS service, which will lead you to properties.

- Go to the general tab, hover the mouse, and a drop-down list will open.

- Choose manual, click OK, and then open the QuickBooks desktop.

- At last, download QuickBooks desktop updates, and also update the payroll tax tables.

Solution 3: Update QuickBooks Payroll Tax Table

Be it any Windows OS, to completely resolve QuickBooks Update 15241, you have to update the payroll tax table by the end you troubleshoot the error. Therefore, we have mentioned the steps here:

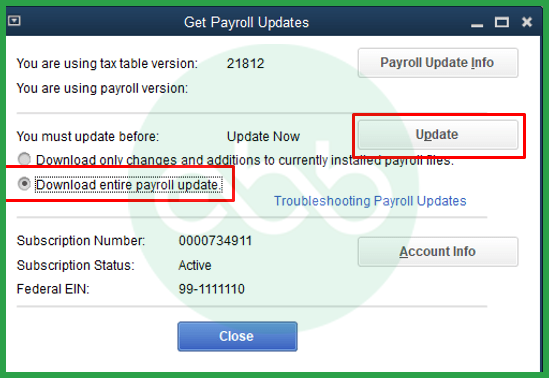

- Go to Employees Menu, choose Get Payroll Updates.

- Here, tick the download entire update option, and click the update button on the right side.

- At last, the option of download complete will pop up, indicating the completion of the process.

Solutions for Resolving QuickBooks Error 15241 (According to Windows Version)

There are different steps to fix QuickBooks Error 15241, depending on your operating system. The steps for Windows XP users are different from those for Windows 7, 8, 10, or Vista. We’ll look at each set of steps separately.

Steps for Windows XP users:

- Close QuickBooks Desktop temporarily.

- Then, go to “My Computer” on your desktop and right-click it. Then, select “Manage.” This will open the Computer Management system.

- In the Computer Management window, navigate to “Services and Applications” and click on “Services.” This will open the Services window.

- Scroll down and double-click on “Intuit QuickBooks FCS Service.” This action will open the Intuit QuickBooks FCS Properties window.

- Now, go to the “General” tab and click the drop-down list next to “Startup Type.” Choose “Manual” from the options.

- After making this selection, click the “OK” button to save the changes you’ve made.

- Open QuickBooks Desktop again.

- Proceed to download the latest QuickBooks Desktop product updates.

- Once you’ve updated the accounting software, also update the payroll tax tables.

These steps should help Windows XP users resolve QuickBooks Error Code 15241.

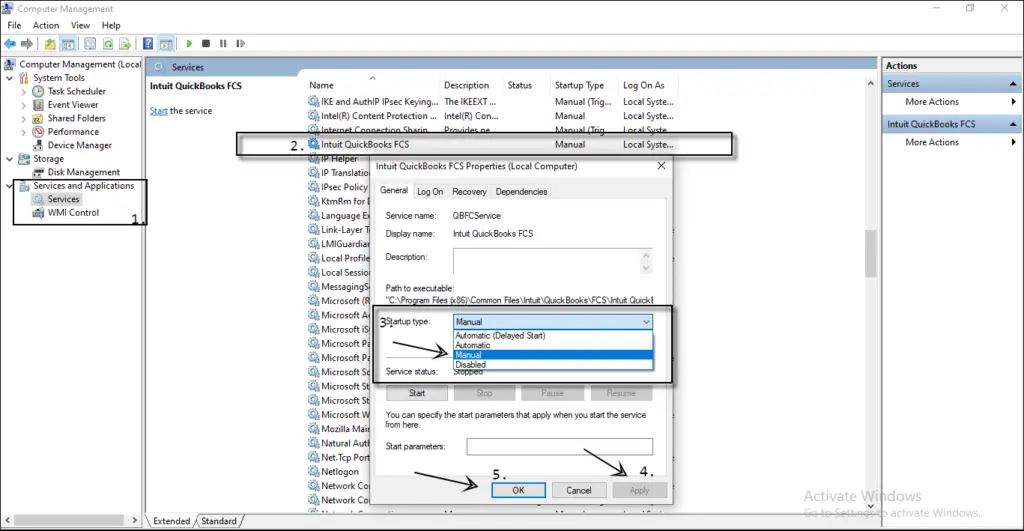

Instructions for users of Windows 11, 10, 7, 8, or Vista:

- Close QuickBooks Desktop.

- Then, click the Start button in Windows.

- For Windows 10 users, you can skip steps 2 and 3 and directly search for “Computer” in the taskbar’s search and select “This PC,” then choose “Manage.”

- Click on “Services and Applications” in the left pane.

- Double-click on “Services” in the right pane.

- Find and double-click “Intuit QuickBooks FCS.”

- In the QuickBooks FCS properties window, go to the “General” tab and select “Manual” from the drop-down menu next to “Startup Type.”

- Click “Apply,” then click “Start,” and finally, click “OK.”

- Open QuickBooks and download any available updates.

- Lastly, update your payroll tax tables, and you’re good to go.

Alternate Method To Fix QuickBooks Payroll Update Error 15241

You can keep your QuickBooks settings on automatic mode, which will update the application on its own, sparing you from doing it manually.

To activate automatic updates, follow these steps:

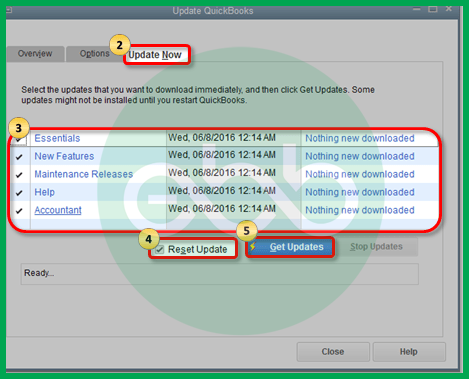

- Go to help, select update QuickBooks desktop

- Click options, choose YES for automatic updates. After that, close the app.

Update QuickBooks Payroll in Pro/Premier Versions

You can also use Payroll update CD to determine if the issue is with your system or the CD itself. Just install it in two different systems to find out the same.

- Insert the payroll update CD and open “Get Payroll Updates.”

- Click “Get Payroll Updates” under Employees.

- Select “update.dat” and “update3.dat” files from the CD, follow on-screen instructions.

- Choose “Browse,” pick the CD drive, and open the files.

- Click “OK” in the update window.

- Close QuickBooks.

- Check if CD files open on another PC.

- If they open, the issue may be with your system or CD drive.

- If not, get a new update CD from Intuit.

- Ensure reliable sources for updates and verify tax tables.

- Install QuickBooks Payroll and latest tax tables, then click “OK” to finish.

Ways to Establish Preferences in the QuickBooks Desktop?

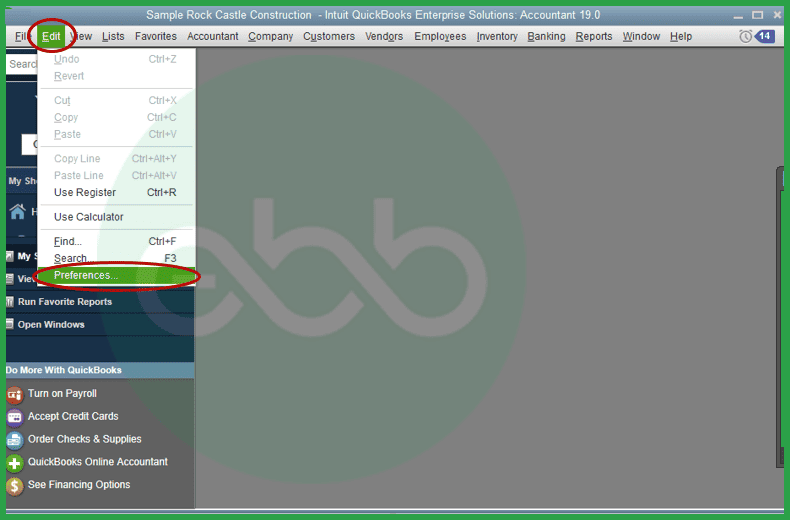

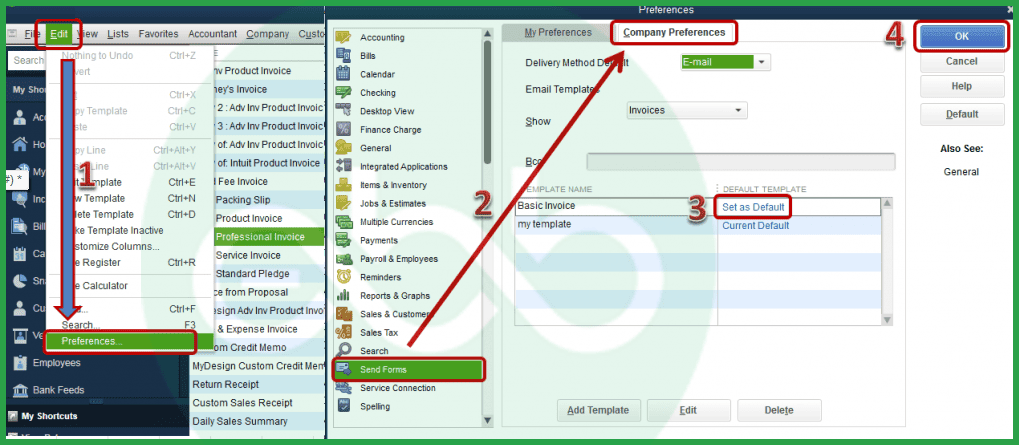

- Go to Edit Menu –> Preferences

- After clicking preferences, choose these options –> Reports and Graphs Located (Given on the left side)

- Choose either My Preferences or Company Preferences.

In case you are choosing My Preferences, then follow these steps:

- Make sure you choose the modify report button. Thereafter, double-check before opening the report.

- Whenever you create the report, modify report window will open simultaneously.

- After that, refresh the system, select the graph. After doing this, press report preferences to confirm the process. Here you will see two refresh options:

Automatic refresh: It is a hassle-free option. Whenever you make changes to your work, it will automatically refresh the software.

Ask me to refresh: It is more of a manual option. Whenever you make some changes and refresh the report, an error message pops up. It says that the graph needs to be refreshed.

Preventive Measures to Avoid QuickBooks Payroll Error 15241

Error 15241 occurs when the File Copy Service (FCS) is disabled or configured incorrectly. The following best practices help maintain QuickBooks stability, enable successful updates, and prevent service-related issues in the future.

- Keep the File Copy Service (FCS) active: Regularly verify that the Intuit QuickBooks FCS service is active and set to “Manual” or “Automatic” startup in Windows Services.

- Run QuickBooks as an administrator: Always open QuickBooks Desktop with administrative privileges to ensure all background services function properly during updates.

- Update QuickBooks and Windows versions: Install the latest QuickBooks Desktop and Windows updates to ensure compatibility and fix known service-related bugs.

- Allow uninterrupted updates: Do not close QuickBooks or turn off the computer during payroll or software updates, as this may disrupt service configurations.

- Add QuickBooks to antivirus exceptions: Add QuickBooks and its components, including the File Copy Service, to your antivirus and firewall exclusion list to prevent interference.

- Perform regular system maintenance: Run system scans and disk cleanups periodically to remove corrupted files and optimize system performance for QuickBooks operations.

- Create frequent data backups: Create frequent backups of your company files before performing updates to protect data integrity in case of system errors.

- Verify service status after updates: After installing Windows or QuickBooks updates, recheck that the File Copy Service remains enabled and properly configured.

Conclusion!

QuickBooks Payroll Error 15241 is a common issue that disrupts payroll updates due to a disabled or malfunctioning File Copy Service (FCS). Re-enabling the FCS, running the QuickBooks reboot.bat file, and updating the payroll tax tables help restore seamless payroll operations. The File Copy Service (FCS) must remain active and properly configured to prevent future update errors.

Regular system maintenance and timely software updates ensure stable and efficient QuickBooks Desktop performance. Get in touch with us at +1-802-778-9005, or you can mail to us at: support@ebetterbooks.com if you’re still facing any kind of software-related issues and need professional assistance.

FAQs (Frequently Asked Questions)

Can I process payroll without downloading the latest tax table update?

Technically, yes, you can run payroll, but it is not recommended. Without the latest tax table update, QuickBooks will calculate paychecks using outdated tax rates, which can lead to incorrect withholdings, tax penalties, and compliance issues with the IRS or state agencies. It is safer to resolve the update error before issuing paychecks.

What is the File Copy Service (FCS) in QuickBooks?

The File Copy Service (FCS) is a Windows background process that manages file transfers and updates for QuickBooks Desktop. It ensures payroll and software updates are downloaded, verified, and installed correctly.

Why does the File Copy Service (FCS) keep disabling itself automatically?

If the FCS disables itself repeatedly after you fix it, the culprit is usually an aggressive third-party application. System optimization tools (like PC cleaners) or over-zealous antivirus software often flag the FCS as an unnecessary background process and shut it down to “save memory.” You may need to whitelist Intuit services in your security software settings to prevent this from happening again.

Yes, these errors are closely related. While Error 15241 indicates the update service (FCS) is disabled, Error 15270 usually means a specific file is missing or the update requires User Account Control (UAC) permissions to finish installing. If you see 15270 after fixing 15241, restarting QuickBooks as an Administrator usually resolves it.

Can I fix QuickBooks Error 15241 without technical help?

Yes, most users can resolve this error manually by following the correct steps for their Windows version. However, if the FCS service fails to start or QuickBooks remains unresponsive, contacting QuickBooks support is recommended.

Does running the reboot.bat file delete my QuickBooks company data?

No, running the reboot.bat file does not delete or damage your company data (.QBW files). This script simply re-registers the QuickBooks software components (DLL and OCX files) with Windows. It resets the program’s internal connections, not your financial records. However, it is always best practice to back up your data before performing any troubleshooting.

Does Error 15241 affect company data?

No, this error does not damage company files. It only affects the payroll update process by stopping the File Copy Service required for file transfers.

How do I enable the File Copy Service in Windows?

Open the Run window, type services.msc, locate Intuit QuickBooks FCS, right-click it, select Properties, set Startup type to Manual, and click Start followed by OK.

Do I need Windows Administrator rights to change the FCS startup type?

Yes. Modifying Windows Services (services.msc), such as the Intuit QuickBooks FCS, requires full Windows Administrator privileges. If you are logged into a standard user account or a guest profile, the options to change the startup type to “Manual” may be greyed out. You must log in as an Admin to apply this fix.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error 15241 When Downloading Payroll Updates?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.