Fix QuickBooks Error 3180 by correcting sales tax account mapping, repairing damaged payment items, closing modal dialog boxes during Web Connector operations, and switching to single-user mode before processing transactions.

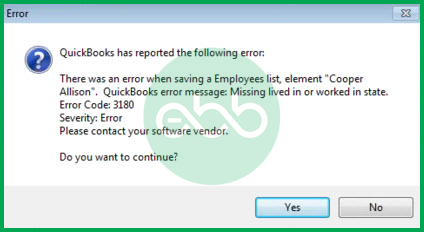

QuickBooks Error 3180 appears when the software cannot lock internal records during transaction processing-specifically when saving sales receipts or during financial exchanges between QuickBooks Desktop and QuickBooks Point of Sale.

Error 3180 blocks business operations by preventing users from saving sales receipts, processing invoices, or completing data synchronization through the Web Connector. The message “The internals could not be locked” indicates another process, user, or dialog box is holding the transaction data that QuickBooks needs exclusive access to.

Common Error 3180 messages: “Status code 3180: There was an error when saving a Sales Receipt” or “QuickBooks Error 3180: The internals could not be locked. They are in use by another user.”

This article provides a diagnostic framework, risk assessment, and complete solution guide. Internal lock failures require immediate attention because they prevent all transaction recording operations. Delayed repairs stop sales recording and halt business revenue tracking.

Error Classification: Which Series Does Error 3180 Belong To?

Error 3180 belongs to the 3000 series of QuickBooks errors handling financial exchange and transaction synchronization problems between QuickBooks Desktop and QuickBooks Point of Sale.

The 3000 series represents transaction-level access failures rather than company file corruption. QuickBooks generates code 3180 specifically when it cannot obtain an exclusive lock on transaction data that another process is currently using.

The 3000 series focuses on cross-application data exchange errors. Error 3180 indicates a record lock conflict during synchronization. Error 3140 points to missing vendors in tax items. Error 3120 signals invalid account mapping. Each error in this series targets a specific transaction processing failure between Desktop and POS applications.

QuickBooks organizes errors by series: C= series (internal processing), H series (multi-user hosting), 3000 series (Desktop-POS exchange), 6000 series (file access). Related errors include “Company File in Use” messages and “Transaction could not be locked” warnings. Error 3180 is unique because it targets active transaction locks, not file-level access.

Can QuickBooks Error 3180 Trigger Other Errors?

QuickBooks errors create additional failures when the transaction lock goes unresolved. One locked record generates multiple error codes across linked operations.

| Cause of Error 3180 | Possible Triggered Errors |

| Invalid sales tax account mapping | Error 3140 (missing vendor in sales tax item) |

| Damaged payment items | Financial exchange failure (POS cannot sync) |

| Open modal dialog boxes during sync | Web Connector timeout errors |

| Corrupted company file | File access failures (various codes) |

- Invalid sales tax account mapping causes Error 3180 by assigning the Sales Tax Payable account as the posting account for receipt items. QuickBooks locks this account during tax calculation.

Any sales receipt attempting to post to a locked tax account triggers Error 3180. Error 3140 then appears when the system cannot locate the vendor associated with the tax item.

- Damaged payment items stop financial exchanges between Desktop and POS. Error 3180 appears when POS tries to save a sales receipt using a corrupted payment method. The Desktop system cannot lock a damaged item record. The entire financial exchange fails. POS transactions cannot transfer to Desktop accounting records.

- Open modal dialog boxes during Web Connector operations create lock conflicts. A modal dialog (such as a QuickBooks confirmation box or preference window) holds transaction focus.

The Web Connector attempts to insert an invoice while the dialog holds internal locks. Error 3180 appears immediately because both processes compete for the same record.

- Corrupted company files compound transaction lock problems. File damage prevents QuickBooks from releasing locks cleanly after operations complete. Ghost locks remain active even after users close transactions. Every subsequent transaction attempt encounters Error 3180 because phantom locks block access.

The Root Cause For QuickBooks Error 3180

Read the complete error message. Identify whether the error appears during Web Connector sync, manual sales receipt saving, or Desktop-POS financial exchange. Each scenario requires a different first fix.

| Possible Causes and QuickFix for Error 3180 | ||

| Error Event | Likely Cause | Recommended Fix (When to Perform) |

| Error 3180 during Web Connector sync | Modal dialog box open during insert operation | Before running Web Connector again, close all QuickBooks windows and dialog boxes, then disable AutoRun in Web Connector settings |

| Error 3180 when saving sales receipt | Sales Tax Payable account used as posting account | Before saving another receipt, verify sales tax account mapping in Lists > Item List and ensure no receipt items post to Tax Payable account |

| Error 3180 during Desktop-POS exchange | Damaged POS payment item | Right after financial exchange fails, rename all POS payment items by adding “OLD” prefix, then run exchange to recreate items |

| Error 3180 on multiple transactions | Another user has transaction open | When error displays user name, ask that user to close and save their transaction, or switch to single-user mode before processing |

Data Safety Advisory Section For QuickBooks Error 3180

Understanding QuickBooks transaction locks prevents data loss during repairs.

- Transaction Locks Explained: QuickBooks places a temporary lock on every record while users edit it. This lock prevents two people from changing the same invoice, sales receipt, or payment simultaneously.

The lock releases automatically when the user saves or closes the record. Error 3180 appears when QuickBooks cannot place a lock because another process already holds one.

- Modal Dialog Impact: A modal dialog box is a QuickBooks window that requires user action before any other operation can continue. Common examples include error messages, confirmation prompts, and preference settings.

Modal dialogs hold internal transaction locks silently. The Web Connector attempting data insertion during a modal dialog triggers Error 3180.

- Sales Tax Account Mapping: Every item in QuickBooks links to a posting account that receives the transaction amount. Sales Tax items should never use the Sales Tax Payable account as their posting account.

This creates a circular reference where tax calculation locks the account that the item tries to post to. Correct mapping uses separate income or asset accounts.

- Payment Item Structure: QuickBooks POS creates payment items in Desktop during financial exchanges. These items record how customers paid-cash, credit card, check. Damaged payment items retain invalid data from failed exchanges. Renaming damaged items forces POS to recreate them cleanly during the next successful exchange.

Steps to Fix QuickBooks Error 3180

Solutions are organized by skill level, risk level, and success probability. Start with Level 1 solutions and move to higher tiers only if lower-tier solutions fail.

Level 1 – Beginner Safe Fixes

These solutions require no technical expertise. The risk of data loss is minimal. Anyone can perform these steps safely.

| Solution 1.1: Close All Modal Dialog Boxes and Retry | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Beginner | Low | Moderate to High | 5-10 minutes |

| Risk Explanation | Closing dialog boxes does not modify any data. This step clears temporary locks only. No financial records are changed. | Solution Explanation | Modal dialog boxes hold internal transaction locks that block other operations. Closing all open QuickBooks windows releases these locks. Retrying the operation after clearing locks allows QuickBooks to obtain the access it needs. |

Steps to Implement Solution 1.1

- Look at the QuickBooks screen for any open dialog boxes. Dialog boxes appear as small windows in front of the main QuickBooks window. Common examples include error messages, preferences windows, or “Are you sure?” confirmation prompts.

- Click OK, Cancel, or the X button on every dialog box to close it. Close every QuickBooks window except the main company file window. Do not close QuickBooks entirely-just close extra windows and tabs.

- Attempt the operation again. If saving a sales receipt, click Save & Close. If running Web Connector, click Update Selected. If performing financial exchange from POS, run the exchange operation. Test if Error 3180 still appears.

| Solution 1.2: Switch to Single-User Mode Before Processing | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Beginner | Low | High | 5-10 minutes |

| Risk Explanation | Switching modes disconnects other users temporarily. Company data is not modified. Users can reconnect after the operation completes. | Solution Explanation | Multi-user mode allows multiple people to edit different records simultaneously. Another user may have the transaction open without your knowledge. Single-user mode disconnects all other users and releases all transaction locks. This guarantees exclusive access for saving the problematic record. |

Steps to Implement Solution 1.2

- Ask all other users to save their work and close QuickBooks. Confirm no one else is actively using QuickBooks before proceeding. In QuickBooks on your computer, click the File menu. Select “Switch to Single-user Mode.”

- QuickBooks displays a confirmation message. Click Yes to confirm the switch. QuickBooks may prompt you to close and reopen the company file. Follow the prompts.

- After switching to single-user mode, attempt the transaction again. Save the sales receipt or run the Web Connector operation. After completing successfully, return to the File menu and select “Switch to Multi-user Mode” to restore network access.

| Solution 1.3: Restart QuickBooks and Web Connector | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Beginner | Low | Moderate | 10-15 minutes |

| Risk Explanation | Restarting releases all locks and clears cached processes. No data is modified. The worst outcome is that the error continues. | Solution Explanation | QuickBooks and Web Connector sometimes hold ghost locks after operations crash or close unexpectedly. These locks remain active in memory even though no visible window shows them. Fully restarting both applications clears all memory-resident locks. |

Steps to Implement Solution 1.3

- Close QuickBooks Web Connector completely. Right-click the Web Connector icon in the system tray (bottom-right corner near the clock). Select Exit or Close. Close QuickBooks Desktop through File > Exit.

- Press Ctrl+Alt+Delete. Select Task Manager. Click the Processes tab. Look for QBW32.exe or any process with QB in the name. If found, click the process and click End Task. This removes any background QuickBooks processes.

- Restart QuickBooks Desktop. Open the company file. Start Web Connector from the Windows Start menu. Load the service and attempt the sync operation. Test if Error 3180 appears.

Level 2 – Intermediate Fixes

These solutions modify account mapping and payment items. Basic QuickBooks knowledge is helpful. Always create backup before attempting Level 2 solutions.

| Solution 2.1: Verify Sales Tax Account Mapping | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Intermediate | Low to Moderate | High | 15-20 minutes |

| Risk Explanation | Changing account mapping affects how transactions are posted. Incorrect changes may post revenue to wrong accounts. Follow these steps exactly. Back up before starting. | Solution Explanation | Error 3180 appears when receipt items incorrectly use the Sales Tax Payable account as their posting account. This account should only receive sales tax amounts, never item sales. Changing items to post to appropriate income accounts resolves the lock conflict. |

Steps to Implement Solution 2.1

- Create a backup first. Go to File > Back Up Company > Create Local Backup. Choose location and wait for completion. Navigate to Lists menu. Select Item List.

- Click the Type column header to sort items by type. Locate all items showing “Sales Tax Item” or “Sales Tax Group” in the Type column. Double-click the first sales tax item to open the Edit window.

- Check the Tax Agency field. Note the vendor name. Click OK to close. Now check all receipt items (Service, Non-inventory, etc.). Double-click each receipt item. Look at the Account field showing where sales post.

- If any receipt item shows “Sales Tax Payable” in the Account field, change it. Click the Account dropdown. Select an appropriate income account matching the item type. Click OK to save. Repeat for every item posting to Sales Tax Payable.

- Navigate to Edit > Preferences > Sales Tax > Company Preferences. Verify the correct sales tax payable account displays. Click OK. Attempt to save a sales receipt. Test if Error 3180 appears.

| Solution 2.2: Rename and Recreate Damaged POS Payment Items | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Intermediate | Moderate | High | 20-30 minutes |

| Risk Explanation | Renaming payment items affects how POS records payments in Desktop. Items link to historical transactions. Renaming preserves history while allowing fresh items to be created. | Solution Explanation | QuickBooks POS creates payment method items in Desktop during financial exchanges. Corrupted payment items retain invalid data from failed exchanges. Renaming damaged items by adding “OLD” prefix deactivates them. The next successful exchange creates fresh replacement items automatically. |

Steps to Implement Solution 2.2

- Create a backup first. Navigate to Lists > Item List in QuickBooks Desktop. Click the Type column to sort. Locate all items beginning with “POS” such as “POS Cash”, “POS Visa”, “POS MasterCard”.

- Right-click the first POS payment item. Select Edit Item. In the Item Name field, add OLD at the beginning. Example: Change “POS Cash” to “OLD POS Cash”. Click OK to save.

- Repeat for every POS payment item in the list. Add an OLD prefix to each one. This deactivates them without deleting historical data. Close Item List after renaming all POS items.

- Open QuickBooks Point of Sale. Run a financial exchange from POS to Desktop. POS creates fresh payment items during this exchange. The new items use correct current data without corruption.

- After successful exchange, return to Desktop Item List. Find the newly created payment items without the OLD prefix. These are the clean replacement items. The OLD items can remain inactive for historical reference.

| Solution 2.3: Run QuickBooks File Doctor | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Intermediate | Low | Moderate | 30-45 minutes |

| Risk Explanation | File Doctor scans and repairs company file damage automatically. The tool does not modify financial data. Scan takes longer on large files. | Solution Explanation | Corrupted company files create ghost transaction locks that Error 3180 detects. File Doctor scans the company file structure and repairs damaged records preventing lock release. This resolves Error 3180 caused by file-level corruption rather than user actions. |

Steps to Implement Solution 2.3

- Close QuickBooks. Download QuickBooks Tool Hub from Intuit website. Search “QuickBooks Tool Hub” and select the official Intuit link. Save and install QuickBooksToolHub.exe.

- Open Tool Hub. Click Company File Issues. Select Run QuickBooks File Doctor. Choose the company file from the dropdown. If not listed, click Browse and navigate to .QBW file location.

- Select “Check your file and network” option. Click Continue. Enter QuickBooks administrator password. Click Next. File Doctor scans for 20-40 minutes.

- Review results for green checkmarks. Open QuickBooks. Attempt the transaction causing Error 3180. Test if an error appears.

Level 3 – Advanced / Professional Intervention

These solutions require technical knowledge and modify Web Connector and registry settings. Data backup is mandatory.

| Solution 3.1: Adjust Web Connector AutoRun Settings | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Advanced | Low | High | 10-15 minutes |

| Risk Explanation | Changing AutoRun settings affects sync frequency only. Company data is not modified. Too-frequent syncs may cause performance issues. | Solution Explanation | Web Connector AutoRun set to short intervals (10 minutes) starts new syncs before previous operations finish. This creates overlapping processes competing for the same transaction locks. Increasing AutoRun to 45-60 minutes gives each operation time to complete and release locks. |

Steps to Implement Solution 3.1

- Open QuickBooks Web Connector. Locate the AutoRun setting at the top of the window. Current value shows in minutes. Check if the value is set to 10 minutes or less.

- Click the AutoRun dropdown. Select 45 minutes or 60 minutes from the list. This ensures each sync completes before the next one starts. Click to save the new setting.

- Uncheck AutoRun entirely if sync operations fail repeatedly. Manual syncing prevents overlapping processes. Click the Update Selected button only when ready to sync.

- Close and reopen Web Connector for changes to take effect. Monitor sync operations for Error 3180.

| Solution 3.2: Rebuild Data to Release Ghost Locks | |||

| Skill Level | Risk Level | Success Probability | Approximate Time Required |

| Advanced | Moderate to High | High | 30-60 minutes |

| Risk Explanation | Rebuild Data rewrites company file internal structure. The process must complete without interruption. Always create backup before Rebuild. Interrupting Rebuild causes file damage. | Solution Explanation | Rebuild Data reorganizes company file records and clears ghost transaction locks that persist after crashes. The process releases all internal locks and rewrites lock management tables. This resolves Error 3180 when ghost locks from previous sessions block current operations. |

Steps to Implement Solution 3.2

- Create backup. Go to File > Back Up Company > Create Local Backup. Choose a location. Wait for completion. Close all other programs.

- Navigate to File > Utilities > Rebuild Data. Read the warning message. Click OK to proceed. QuickBooks creates automatic backup. Choose a backup location.

- The rebuilding process begins. Do not close QuickBooks. Do not restart the computer. Do not open other programs. The process takes 30 minutes to several hours depending on file size. Progress bar shows status.

- After the completion message appears, run Verify Data from File > Utilities > Verify Data. This confirms Rebuild succeeded. Open company file. Attempt transaction. Test if Error 3180 appears.

Scenarios Requiring Expert Support

Some situations require professional assistance. Stop attempting solutions if:

- Error 3180 appears for every sales receipt across all users and all items indicating deep file corruption beyond standard repairs.

- Rebuild Data fails with critical errors after backup.

- Web Connector cannot connect even after adjusting AutoRun settings and restarting.

- Desktop-POS financial exchange fails with multiple 3000-series errors simultaneously.

- Company file becomes unresponsive after attempting to Rebuild Data.

Prevention Strategy

Preventing Error 3180 requires disciplined transaction processing and Web Connector management.

- Web Connector Best Practices: Set AutoRun to 60 minutes minimum in Web Connector settings. Never close the Web Connector while sync is active. Allow each operation to display a completion message before starting the next sync. Monitor Web Connector window for operation status before closing QuickBooks.

- Sales Tax Configuration: Review sales tax account mapping quarterly. Navigate to Lists > Item List and verify no receipt items post to Sales Tax Payable account. Only tax items should link to Tax Payable. All other items post to income or asset accounts. Incorrect mapping is the leading Error 3180 cause.

- Modal Dialog Awareness: Close all QuickBooks dialog boxes before running Web Connector. Never leave preference windows or report customization dialogs open during automated operations. Modal dialogs block background processes silently. Clean window management prevents sync conflicts.

- Multi-User Coordination: Establish clear transaction ownership rules in multi-user environments. One person edits each invoice or receipt at a time. Communicate before processing to avoid simultaneous access. Switch to single-user mode for complex operations requiring exclusive access.

- POS Financial Exchange Timing: Run Desktop-POS financial exchanges during low activity periods. Early morning or after business hours provides exclusive system access. Avoid exchanges during peak sales times when multiple users are saving receipts. Timing reduces lock conflict probability.

- Backup Before Major Operations: Create backup immediately before every Rebuild Data operation. Store backup in a separate location from the company file. Test backup restoration quarterly to verify integrity. Current backups make Error 3180 recoverable if repairs fail.

Conclusion

If QuickBooks Error 3180 continues after completing the tiered solutions above, do not attempt further repairs without professional assessment. Ghost transaction locks and corrupted payment items require specialized tools beyond standard troubleshooting. At this stage, structured professional diagnosis is the safest path forward.

Get expert assistance to analyze transaction lock states, repair account mapping, and restore Desktop-POS exchange functionality. Acting early protects both your records and your business continuity. Professional support resolves complex lock conflicts that standard solutions cannot address.

Frequently Asked Questions

Does Error 3180 affect my sales receipts or financial records?

Yes, the error can interrupt the saving of sales receipts, leading to incomplete or inaccurate financial data exchange between QuickBooks Desktop and POS.

How does QuickBooks Error 3180 affect integration with Point of Sale (POS) systems?

QuickBooks Error 3180 often affects integration with Point of Sale (POS) systems. This error usually happens when sales tax or payment items are not set up correctly. For instance, if the sales tax items are not linked properly or payment methods are misconfigured, you might encounter this error during POS transactions.

How does Error 3180 impact tax filing in QuickBooks?

Error 3180 can impact tax filing in QuickBooks by causing issues with sales tax items and payment records. When this error occurs, it can prevent you from saving sales receipts correctly, leading to incorrect or incomplete sales tax information. If sales tax items are incorrectly assigned or linked to accounts, Error 3180 can disrupt tax-related transactions. This can make it challenging to file your taxes accurately and on time.

Why is mapping the Sales Tax Item to a Vendor mandatory for saving receipts?

It’s a foundational accounting requirement. The sales tax you collect isn’t your money; it belongs to the government. In QuickBooks, the Vendor you assign to the Sales Tax Item is the designated Tax Agency (e.g., your state’s Department of Revenue). When you save a Sales Receipt, QuickBooks immediately needs to know who to credit that liability to. If the Tax Agency Vendor is missing or deleted, the transaction violates the system’s financial integrity checks, causing the 3180 error upon saving.

What’s the danger of linking a Payment Item directly to the Sales Tax Payable account?

This is a common setup mistake that guarantees the 3180 error. A Payment Item (like “Credit Card Payment”) should always be mapped to a bank account or Undeposited Funds. The Sales Tax Payable account is a Liability account used only for tracking the money owed to the tax agency. If you link a payment item directly to it, you incorrectly try to reduce a liability every time you get paid, breaking the fundamental rules of double-entry bookkeeping and blocking the transaction from saving.

Why does this error often happen right after importing a new set of Sales Items?

When you import new products or services into your Item List, you must ensure the correct Account Mapping is maintained for every single item. If the import process fails to map an item to a valid Income Account (or a Cost of Goods Sold account, if applicable), or if it accidentally maps an item to an A/R or A/P account, QuickBooks will halt the saving of any transaction containing that item, triggering the 3180 error. It’s a data integrity issue caused by incomplete item definitions.

Can using an Inactive Item or an Inactive Account cause Error 3180?

Definitely. Even if an item or account is marked as Inactive, QuickBooks still retains its transactional history and financial connections. If an item or payment method on your Sales Receipt is somehow linked to a system component that was later made inactive (especially if it’s the Sales Tax Item’s underlying liability account), QuickBooks struggles to process the financial movement, leading to the exchange failure and the 3180 error. You should check the Inactive lists when troubleshooting.

I use QuickBooks Point of Sale (POS). Why does the error keep coming back after every Financial Exchange?

This is a classic symptom of damaged or duplicated Payment Items that have been created and merged incorrectly between POS and Desktop. The sync process (Financial Exchange) forces the corrupted data mapping into Desktop repeatedly. The fix isn’t just correcting the item once; it requires a specific process of renaming and merging the duplicate POS-created payment items on the QuickBooks Desktop side to eliminate the bad link entirely, otherwise the next sync will just corrupt it again.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error 3180 While Saving A Sales Receipt?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.