QuickBooks Error 3180 is a financial exchange error that occurs during synchronization between QuickBooks Desktop and QuickBooks Point of Sale (POS). The error prevents users from saving sales receipts or cash memos when the sales tax payable account or payment mapping is misconfigured. QuickBooks status code 3180 indicates that the transaction data could not be recorded accurately due to an invalid posting account or a corrupted company file.

This article explains what QuickBooks Error 3180 is, why it happens, and how to fix it. The error appears when saving a sales receipt or during data exchange between QuickBooks Desktop and Point of Sale (POS). Here, you will find simple steps to identify the cause, repair damaged payment or tax mapping issues, and adjust configuration settings to keep your QuickBooks system running smoothly and prevent the error from happening again.

What is QuickBooks Status Error Code 3180?

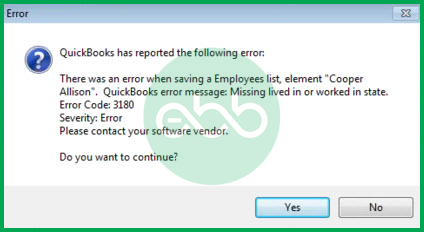

QuickBooks Status Error Code 3180 is part of the 3000-series errors that occur during data exchange between QuickBooks Desktop and QuickBooks Point of Sale (POS). This error typically appears while saving a sales receipt and is linked to incorrect account mapping or missing vendor information in sales tax items. When triggered, users may see error messages such as:

“Sales tax detail line must have a vendor,”

Or,

“There was an error when saving an Employee list, element ‘Employee, Name’”

QuickBooks Desktop Error 3180 is directly related to issues with saving sales receipts or cash memos. This error appears when QuickBooks encounters problems recording a sales transaction, often due to incorrect account mapping or data conflicts between QuickBooks Desktop and Point of Sale (POS).

What are the Symptoms of QuickBooks Error Code 3180?

When QuickBooks Error Code 3180 occurs, it affects the normal operation of QuickBooks Desktop and Point of Sale (POS). The issue prevents users from saving or processing sales receipts correctly and may slow down overall system performance. Common signs of this error include:

- A dialog box with the following message will pop up on your screen with the message “Status code 3180: There was an error when saving a Sales Receipt.“

- Difficulty saving or updating sales receipts in QuickBooks.

- Slow or unresponsive behavior when using the keyboard or mouse.

- Windows or QuickBooks running sluggishly, affecting other programs as well.

- Unexpected crashes or automatic closure of QuickBooks Desktop or Point of Sale (POS).

- Delayed system responses or freezing during transaction processing.

Why does QuickBooks Error Code 3180 Occur?

QuickBooks Error 3180 usually occurs due to issues in account mapping, configuration errors, or damaged company files. The most common causes include:

- A damaged or corrupted QuickBooks company file.

- Incorrect mapping of the Sales Tax Payable account in QuickBooks.

- The Sales Tax Payable account being used as the target account for receipt items.

- A “Paid-out” transaction made using the Sales Tax Payable account.

- Incorrect or incomplete linking of sales tax items with vendors.

- Damaged or misconfigured payment item types.

- Improper or incomplete installation of QuickBooks Desktop.

- Faults in the Windows registry affecting QuickBooks operations.

- Interference from antivirus software blocking QuickBooks functions.

- Misconfigured vendor expense or tax-related settings within QuickBooks.

How to Fix QuickBooks Status Error Code 3180?

QuickBooks Error 3180 can result from incorrect account mapping, damaged files, or configuration issues. The following solutions help you identify the cause, correct account settings, and restore proper data exchange between QuickBooks Desktop and Point of Sale (POS).

Solution 1: Ensuring that a Vendor is Assigned for Sales Tax Item

- Firstly, go to QB Desktop–> Lists–> Item List.

- After that, select the option of Include Inactive.

- Sort the list by choosing the Type header.

- Finally, ensure that every sales tax item has a tax agency attached to it.

Solution 2: Verifying the Tax Preference to Fix QuickBooks Status Code 3180

- Firstly, go to QuickBooks POS–> File Menu–> Preferences.

- Choose Company.

- After that, go to financial–> Accounts.

- At last, check both the basic and advanced tabs. Ensure that the QuickBooks Sales Tax Payable is listed only in the sales tax row. If this is not the case, change the scenario and run the financial exchange.

- Finally, check whether the QuickBooks Status Code 3180 has been fixed.

Solution 3: Ensure that the Sales Tax Payable is not Used for Paying the Problem Receipt

- Go to POS Home page–> Sales History.

- Right-click any column to select the customize columns option.

- Ensure that QB status is selected.

- If there are incomplete receipts paid out for sales tax payable, then select them and choose the option of Reverse Receipt.

At last, use a non-sales tax payable account to re-create the paid-out process. Finally, run the financial exchange.

Solution 4: Repair Damaged Payment Item (When you are Facing an Error while Saving a Receipt)

- Firstly, go to QB Desktop–> Lists–> Item List–> Include Inactive.

- Here, to sort the list, click the Type header.

- After that, Rename the Point-of-Sale payment items. Right-click the items with POS and choose edit items. Add OLD at the beginning of the item, and select OK.

- From the Point of Sale, choose the run financial exchange option.

- At last, in QB Desktop, merge the duplicate items by right-clicking on the payment OLD and selecting Edit Item. After that, remove the OLD and follow the prompt for merging the files.

Solution 5: When “The Posting Account Is Invalid. 140108 Payment Item Lookup Error “Xxxxxxxx” message displays.

- Firstly, open QB Desktop –> Lists –> Item List.

- Ensure that every POS item in the list is using the correct account.

- At last, run the financial exchange and check whether the QuickBooks desktop status code 3180 has been resolved.

Solution 6: Open The POS

- Firstly, go to the File menu –> Preferences –> Company –> Financial –> Accounts.

- Check all basic/ advanced tabs. Ensure correct mapping of accounts, and click the save option to secure all changes.

- Finally, run financial exchange.

Hopefully, it will resolve the QuickBooks Error 3180.

Solution 7: Recreate/ Rename All Financial Methods

- Initially, go to QB Desktop –> Lists menu –> Customer & Vendor Profile Lists –> Payment Method List.

- Here, right-click on the Cash method option to select the Edit payment method button.

- In the payment method field, add the letter X at the start and save the changes.

- Again, right-click the cash method option to select new.

- Lastly, rename it as cash and run the financial exchange. If needed, rename and recreate all payment methods.

Best Practices to Prevent QuickBooks Error Code 3180

To avoid encountering QuickBooks Error 3180 in the future, it is important to maintain accurate account settings and perform regular system checks. Try these best practices to keep your QuickBooks Desktop and Point of Sale (POS) systems running smoothly:

- Verify Account Mapping: Ensure that all payment and sales tax accounts are correctly mapped in both QuickBooks Desktop and POS. The Sales Tax Payable account should never be used for “paid-out” transactions.

- Link Sales Tax Items: Always associate each sales tax item with a valid vendor or tax agency to prevent missing vendor references during transactions.

- Maintain Company File Integrity: Run the Verify Data and Rebuild Data utilities periodically to identify and repair potential file corruption issues before they cause errors.

- Keep QuickBooks Updated: Install the latest updates for QuickBooks Desktop and POS to ensure compatibility and prevent data exchange issues between versions.

- Use Reliable Security Software: Configure antivirus and firewall settings to allow QuickBooks operations. Avoid using overly restrictive settings that can block data synchronization.

- Regularly Back Up Your Data: Create scheduled backups of your QuickBooks company file at regular intervals to ensure data safety in case of errors or corruption.

- Check Vendor and Tax Preferences: Review vendor details, tax preferences, and financial account settings after major updates or changes to business operations.

Conclusion!

QuickBooks Error 3180 usually occurs when there is an issue with account mapping, tax setup, or data exchange between QuickBooks Desktop and Point of Sale (POS). By reviewing account preferences, repairing damaged payment items, and ensuring proper vendor and tax configuration, you can simply resolve the error and prevent it from recurring.

Regularly check the company file integrity and keep QuickBooks updated to ensure stable and accurate financial operations. With proper configuration and routine maintenance, QuickBooks can process sales receipts and transactions efficiently without errors or interruptions. Contact eBetterBooks Error Support contact number +1-802-778-9005 for immediate support if the error continues after following these solutions.

Frequently Asked Questions

Does Error 3180 affect my sales receipts or financial records?

Yes, the error can interrupt the saving of sales receipts, leading to incomplete or inaccurate financial data exchange between QuickBooks Desktop and POS.

How does QuickBooks Error 3180 affect integration with Point of Sale (POS) systems?

QuickBooks Error 3180 often affects integration with Point of Sale (POS) systems. This error usually happens when sales tax or payment items are not set up correctly. For instance, if the sales tax items are not linked properly or payment methods are misconfigured, you might encounter this error during POS transactions.

How does Error 3180 impact tax filing in QuickBooks?

Error 3180 can impact tax filing in QuickBooks by causing issues with sales tax items and payment records. When this error occurs, it can prevent you from saving sales receipts correctly, leading to incorrect or incomplete sales tax information. If sales tax items are incorrectly assigned or linked to accounts, Error 3180 can disrupt tax-related transactions. This can make it challenging to file your taxes accurately and on time.

Why is mapping the Sales Tax Item to a Vendor mandatory for saving receipts?

It’s a foundational accounting requirement. The sales tax you collect isn’t your money; it belongs to the government. In QuickBooks, the Vendor you assign to the Sales Tax Item is the designated Tax Agency (e.g., your state’s Department of Revenue). When you save a Sales Receipt, QuickBooks immediately needs to know who to credit that liability to. If the Tax Agency Vendor is missing or deleted, the transaction violates the system’s financial integrity checks, causing the 3180 error upon saving.

What’s the danger of linking a Payment Item directly to the Sales Tax Payable account?

This is a common setup mistake that guarantees the 3180 error. A Payment Item (like “Credit Card Payment”) should always be mapped to a bank account or Undeposited Funds. The Sales Tax Payable account is a Liability account used only for tracking the money owed to the tax agency. If you link a payment item directly to it, you incorrectly try to reduce a liability every time you get paid, breaking the fundamental rules of double-entry bookkeeping and blocking the transaction from saving.

Why does this error often happen right after importing a new set of Sales Items?

When you import new products or services into your Item List, you must ensure the correct Account Mapping is maintained for every single item. If the import process fails to map an item to a valid Income Account (or a Cost of Goods Sold account, if applicable), or if it accidentally maps an item to an A/R or A/P account, QuickBooks will halt the saving of any transaction containing that item, triggering the 3180 error. It’s a data integrity issue caused by incomplete item definitions.

Can using an Inactive Item or an Inactive Account cause Error 3180?

Definitely. Even if an item or account is marked as Inactive, QuickBooks still retains its transactional history and financial connections. If an item or payment method on your Sales Receipt is somehow linked to a system component that was later made inactive (especially if it’s the Sales Tax Item’s underlying liability account), QuickBooks struggles to process the financial movement, leading to the exchange failure and the 3180 error. You should check the Inactive lists when troubleshooting.

I use QuickBooks Point of Sale (POS). Why does the error keep coming back after every Financial Exchange?

This is a classic symptom of damaged or duplicated Payment Items that have been created and merged incorrectly between POS and Desktop. The sync process (Financial Exchange) forces the corrupted data mapping into Desktop repeatedly. The fix isn’t just correcting the item once; it requires a specific process of renaming and merging the duplicate POS-created payment items on the QuickBooks Desktop side to eliminate the bad link entirely, otherwise the next sync will just corrupt it again.

Disclaimer: The information outlined above for “How to Fix QuickBooks Error 3180 While Saving A Sales Receipt?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.