To resolve QuickBooks Desktop Enterprise Payroll errors from large or oversized files, verify the subscription status, reduce the company file size, disable multi-user mode, create a new company file, run the QuickBooks File Doctor Tool, and install the latest payroll tax table updates.

These errors happen when your company file exceeds size limits, becomes damaged, contains excessive historical data, lacks proper admin privileges, has data integrity problems, or uses outdated software and tax tables.

Oversized files prevent payroll tax table updates, cause incorrect tax calculations, and result in incomplete paychecks. They also slow down system performance and tax report generation, increasing the risk of crashes, backup failures, missing data, file locking, and data conflicts.

Fixing the QuickBooks Desktop Payroll Error improves system performance, reduces processing delays, and ensures accurate payroll calculations.

Resolving file size issues reduces software crashes, improves user experience, and restores full access to payroll features such as direct deposit, tax filings, and reporting tools.

Reasons for Payroll Errors from Large Company Files in QuickBooks Desktop Enterprise

Large or oversized company files in QuickBooks Desktop Enterprise often trigger payroll errors by degrading system performance, increasing the risk of data corruption, and limiting efficient payroll processing. When the company file exceeds the 1.5 GB size limit, QuickBooks struggles to manage and update payroll data accurately.

Common issues caused by oversized files include:

- File Size Exceeding 1.5 GB Limit: QuickBooks Enterprise imposes a 1.5 GB limit, and surpassing this threshold impacts payroll functionality.

- Unresolved Data Integrity Issues: Large files prevent successful verification and repair of data inconsistencies.

- Corrupted or Damaged Company Files: File corruption leads to inaccurate payroll calculations and processing errors.

- Overloaded Historical Data: Excessive old data burdens the file, slowing down payroll operations.

- Insufficient User Access Rights: Limited permissions block necessary payroll updates.

- Outdated Software and Payroll Tax Tables: Running outdated versions causes synchronization failures and tax calculation errors.

- Data Conflicts and File Locking: Multiple conflicts and locked files disrupt payroll transactions.

Consequences of Large Company Files in QuickBooks Desktop on Payroll Accuracy

Oversized QuickBooks Desktop files disrupt payroll processing, reduce file stability, and degrade overall system performance.

QuickBooks may freeze or become unresponsive during paycheck calculations, direct deposit submissions, and payroll report generation.

Common error messages when updating payroll, paying taxes, or opening federal and state forms include:

- “The file you specified cannot be opened”

- “The file exists”

Additional issues include:

- Delays when opening or switching between payroll reports

- Backup and data verification failures

- Higher risk of data corruption due to file size

- Inability to access or update specific employee records

- Errors when running Verify and Rebuild Data utilities

Tips to Fix QuickBooks Desktop Enterprise Payroll Errors

If you’re facing payroll errors in QuickBooks Desktop Enterprise due to a large or damaged company file, follow these easy steps to fix the issue and avoid data loss:

- Create a company file backup immediately to avoid any sudden data loss.

- Condense your company file data.

- Run Verify and Rebuild Data to check for file integrity issues.

- Use the QuickBooks File Doctor Tool to remove the corruption and damage.

- Access QuickBooks as an administrator.

- Disable multi-user access.

- Make a new company file if you’re unable to save your data.

- Download the latest updates for your software and payroll tax table.

Verify Payroll Subscription Status Before Troubleshooting

Check your payroll subscription status to confirm compatibility with larger company files. The file size limit varies based on your active payroll plan in QuickBooks Desktop.

- Log in to QuickBooks Desktop company file as the Primary Admin or Payroll Admin.

- Go to Employees > Payroll Centre.

- In the Payroll tab, click Manage My Account under Subscription Status.

- In the Product Information window, review the active payroll service to ensure it supports large or oversized company files.

How to Resolve QuickBooks Desktop Enterprise Payroll Errors Caused by Large or Oversized Files?

QuickBooks Desktop Enterprise Payroll errors due to large or oversized files generally take place when your company files are too large to handle, and the payroll data they have is more than their file size limit.

Solution 1: Condense the Data

Before you condense your file, make sure to create a backup copy of your company file. A backup copy allows you to restore it to undo the changes in case any changes happen.

Keeping all transactions

Condense the data while keeping all the transactions:

- Navigate to the File menu > choose Utilities.

- Click Condense Data.

- Select Keep all transactions, but remove audit trail info to date.

- Choose the Next tab.

- Let the process complete and click Close.

Removing selected transactions

Condense the data while removing all the selected transactions:

- Go to the File menu > click Utilities.

- Select Condense Data.

- Choose Remove the transactions selected from your company file and click Next.

- Pick the transactions you’d like to remove and click the Next icon.

- Click how transactions would be summarized, and select Next.

- Select how inventory should be condensed and click Next.

- Choose the recommended transactions you want to remove and click Next.

- Opt for the List entries to be removed and choose Next.

- Click Begin Condense and wait for the process to be completed.

- Select Close when it’s done.

Solution 2: Verify and Rebuild Company Data

The verify tool finds the most common issues in a company file, and the rebuild tool fixes them.

Verify your company data

- Navigate to Windows > click Close All.

- Open the File menu > select Utilities.

- Choose Verify Data when you see:

- QuickBooks detected no problems with your data—your data is clean, and there’s nothing else to do with it.

- An error message—look for it on the QuickBooks Desktop support site for how to fix it.

- Your data has lost integrity—Data damage was found in the file. Rebuild your data to fix it.

Note: Contact the QuickBooks Support Team before you rebuild your data in case you use Assisted Payroll.

Rebuild your company file data

- Navigate to File > Utilities > select Rebuild Data.

- QuickBooks will ask to create a backup before it rebuilds your company file. Click OK. A backup is required before you rebuild.

- Choose where to save your backup and click OK. Don’t replace another backup file. Enter a new name in the File name and click Save.

- Click the OK tab when the message Rebuild has completed appears.

- Move to File > select Utilities > choose Verify Data again to check for additional damage.

- When the verify tool finds more damage, fix it manually. Look for the error(s) in the qbwin.log on the QuickBooks Desktop support site for how to fix them.

- When your error can’t be found, restore a recent backup. Go to File, then choose Open or Restore Company.

Note: Avoid replacing your existing company file and re-entering the info into your company file after the backup was created.

Solution 3: Run QuickBooks File Doctor From the Tool Hub

Before you start, create a backup copy of your company file then download and install QuickBooks Tools Hub. Run the Quick Fix My File and make use of QuickBooks File Doctor tool. This is a built-in tool that auto-detects and auto-fix data damage issues within QuickBooks.

Step 1: Run Quick Fix My File

- Download and install the most recent version (1.6. 0.8) of QuickBooks Tool Hub.

- Choose Company File Issues from the tool hub.

- Select Quick Fix My File.

- Click OK when it completes, and open your QuickBooks.

Step 2: Run QuickBooks File Doctor

- Choose Company File Issues from the tool hub.

- Select Run QuickBooks File Doctor. It may take up to one minute for the file doctor to be opened.

Note: Look for QuickBooks Desktop File Doc and open it manually in case the QuickBooks File Doctor doesn’t open.

- In QuickBooks File Doctor, choose your company file from the drop-down menu.

Note: Click Browse and search to find your file when you’re unable to see your file.

- Click on Check your file (middle option only) and select Continue.

- Enter your QuickBooks admin password and click the Next tab.

Scan time depends on the file size and usually takes 10–15 minutes. Even if the scan result shows as unsuccessful, it may still resolve underlying issues. After the scan completes, open QuickBooks and access your company file to verify the fix.

Solution 4: Create a New Company File

Creating a new company file from scratch in QuickBooks gives you full control over how your business is set up tailored exactly to your needs.

- Navigate to the File menu > choose New Company.

- Follow the wizard displayed on your screen.

- Open the original file and export your lists.

- Access the exported Intuit Interchange Files (IIF) and delete the unnecessary list entries.

- Import your clean files into the new one.

- Set up the opening balances.

Solution 5: Run QuickBooks as an Administrator

Running QuickBooks as an administrator grants the permissions to the program and allows it to work smoothly especially when managing company files, installing updates, or accessing payroll features.

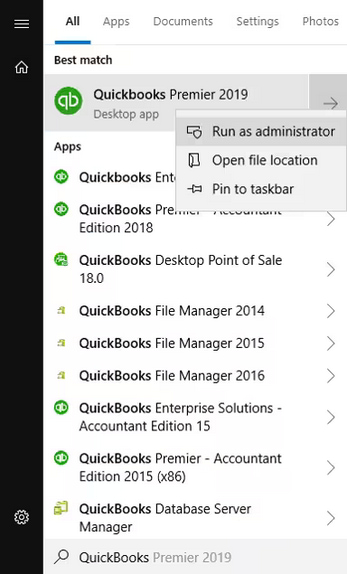

- Open the Windows Start menu.

- Enter “QuickBooks” into the search bar.

- You will see your results listed in the Search window.

- Right-click on the QuickBooks version and the year you want to open.

- Choose Run as administrator.

- Run the payroll update if required.

- Close and reopen the QuickBooks software.

Solution 6: Update QuickBooks and Payroll Tax Table

Regular updates ensure QuickBooks has the latest features, security patches, and accurate payroll tax rates so you can process payroll confidently and avoid costly mistakes. The following steps help you to download the most recent QuickBooks and payroll tax table updates.

Update QuickBooks to the latest version

To resolve this error, update your software to the latest release.

- Open QuickBooks Desktop and navigate to the Help menu.

- Choose Update QuickBooks Desktop.

- Hit the Update Now tab. Tip: Tickmark the Reset Update checkbox to clear all previous update downloads.

- Select Get Updates to start the download.

- Once done, close and reopen QuickBooks to install the update again.

Get the Payroll Tax Table Updates

To maintain compliance with the most recent tax regulations, download and install the latest Payroll Tax Table updates. These updates ensure that all payroll calculations reflect the newest federal, state, and local tax rates, deductions and benefits.

- Choose Update QuickBooks from the Help menu

- Click the Update Now tab.

- Select Get Updates.

- Go to File and click Exit.

- Restart QuickBooks Desktop.

Note: The 2024 payroll tax table updates are not available as a web patch. You must install them directly through the QuickBooks Desktop software.

Solution 7: Disable Multi-User Access

Multiple users accessing the company file at the same time causes data conflicts, file locking, and delays. QuickBooks fails to calculate paychecks, update tax tables, or process direct deposits. Switch to single-user mode to run payroll without errors and maintain file stability.

- Open your QuickBooks company file as an admin.

- Navigate to the File menu and choose Utilities.

- Move to the next workstation when the Host Multi-User Access option appears.

- Select Stop Hosting Multi-User Access instead.

Most Common QuickBooks Payroll Errors

QuickBooks Payroll errors are generally related to the tax table update or the QuickBooks company file. To know more, click here.

Best Practices to Prevent QuickBooks Desktop Enterprise Payroll Errors From Large or Oversized Files

Consider the following best practices to avoid QuickBooks Desktop Payroll-related errors due to large or oversized files.

- Keep your software and payroll tax tables up-to-date.

- Regularly back up your company file before processing payroll.

- Turn off auto-calculations for payroll items when editing transactions manually.

- Limit simultaneous multi-user access during payroll processing.

- Double-check employee records, especially tax information and payment methods.

- Review all the payroll summaries (like employer taxes, hours worked, deductions and contributions) before submitting.

Conclusion

Large or oversized company files in QuickBooks Desktop Enterprise can trigger serious payroll errors, system slowdowns, and data corruption. By reducing file size, verifying data, running tools like QuickBooks File Doctor, and keeping software updated, you can restore payroll accuracy and system performance. Following the right troubleshooting steps ensures smoother payroll processing and protects your business from costly mistakes.

Frequently Asked Questions

Why is my Payroll Not Working in QuickBooks Desktop Enterprise?

Your payroll may fail if your company file is too large (over 1.5 GB), corrupted, or outdated. QuickBooks struggles to calculate paychecks and process taxes accurately in oversized or damaged files.

How can I Fix Payroll Errors Caused by a Large Company File?

To fix these issues, condense the data, verify and rebuild the file, run the QuickBooks File Doctor Tool, update your payroll tax table, and always open QuickBooks as an administrator.

Can I Prevent Payroll Errors in the Future?

Yes! Regularly update QuickBooks and payroll tax tables, back up your data, limit multi-user access during payroll, and clean up unnecessary data to keep your file size manageable.

Disclaimer: The information outlined above for “Resolve QuickBooks Desktop Enterprise Payroll Errors from Large or Oversized Files” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.