To fix the QuickBooks Payroll PSXXX series error such as PS033, PS036, PS058, PS101, and PS107, turn off User Account Control (UAC) settings in Windows, update QuickBooks and the Payroll Tax Table, and use QuickBooks Tool Hub tools.

The PSXXX series errors are configuration and setup-related issues that block payroll verification, subscription validation, and communication with Intuit’s servers.

PSXXX series errors are caused by corrupted payroll setup files, inactive or expired subscriptions, damaged program files, security restrictions, or outdated QuickBooks versions. These configuration issues stop tax table downloads, block payroll form submissions, and interrupt real-time data synchronization.

Understanding the technical causes — such as firewall interference, CPS folder corruption, or Windows User Account Control (UAC) limitations — is essential for diagnosing and fixing PS033, PS036, PS058, PS101, and PS107 errors.

This article provides a structured analysis of these configuration and setup issues along with verified technical methods to restore stable payroll operations.

QuickBooks Desktop Payroll configuration and setup errors include: Payroll subscription issues (inactive or expired); Damaged program files or network/security blocks (TLG and ND files) ; Firewall or antivirus interference; Corrupted payroll setup file in the CPS folder; Outdated QuickBooks versions; and Windows UAC restrictions (access, permissions, or credentials).

Payroll configuration and setup errors disrupt payroll verification, block tax table downloads, and interrupt communication with Intuit’s servers. When configuration settings or file structures are damaged, QuickBooks fails to authenticate payroll data, leading to incomplete updates and halted payroll processing.

Causes for QuickBooks Payroll Error PSXXX Series

The Payroll PSXXX series errors occur when QuickBooks Desktop fails to validate payroll files or subscription data due to corrupted setup components, damaged payroll folders, invalid subscription credentials, outdated program files, or restricted system permissions that interrupt payroll verification and update processes.

1. Payroll Subscription Issues (Inactive or Expired)

An inactive or expired payroll subscription prevents QuickBooks from verifying your account with Intuit. This occurs due to missed renewals, outdated billing credentials, or wrong service keys. The issue stops payroll updates and blocks employee pay calculations.

2. Damaged Program Files or Network/Security Blocks

If QuickBooks installation or Windows system files are corrupted, payroll components fail to load correctly. This includes damage to .ND (Network Data) and .TLG (Transaction Log) files — both critical for linking the company file to the network and maintaining real-time transaction logs.

When these files become damaged or unreadable, QuickBooks cannot establish communication with Intuit’s servers, leading to incomplete updates, failed payroll synchronization, and recurring payroll validation errors.

3. Firewall or Antivirus Interference

Security software may block essential QuickBooks processes like QBW32.exe or QBCFMonitorService.exe. When these processes are restricted, QuickBooks cannot connect to payroll servers, resulting in failed updates and broken subscription validation.

4. Corrupted Payroll Setup File (CPS Folder)

The CPS folder contains payroll setup data. If the folder becomes corrupted due to interrupted updates or abrupt shutdowns, QuickBooks cannot read its configuration files. This directly causes PS033 and related errors, disabling all payroll functions until the corruption is fixed.

5. Outdated QuickBooks Versions

Older QuickBooks versions may not support the latest Intuit payroll updates or tax tables. This leads to mismatched files, incomplete validation, and PS107/PS101 errors that stop payroll updates and employee processing.

6. Windows UAC Restrictions (Access, Permissions, or Credentials)

Windows User Account Control (UAC) may restrict QuickBooks from editing payroll-related files or accessing secure folders. Limited permissions or incorrect user credentials can trigger PS033 and PS036 errors, freezing payroll updates and blocking access to payroll setup.

Payroll Error Codes Triggered by Configuration and Setup Issues

1. QuickBooks Error PS033: CPS Folder or UAC Permission Issues

QuickBooks Desktop Payroll Error PS033 occurs when the software cannot read or validate files in the CPS (Common Payroll Setup) folder. This often happens due to corrupted payroll setup files or restricted Windows UAC (User Account Control) permissions.

The QuickBooks error PSO33 appears when downloading payroll updates or opening a company file with payroll enabled. QuickBooks may display: “QuickBooks can’t read your payroll setup files.”

Error PS033 stops payroll updates completely. Users cannot install payroll tax tables, run payroll, or file payroll forms until the CPS folder is repaired or UAC permissions are adjusted.

2. QuickBooks Error PS036: Payroll Subscription or EIN Issues

QuickBooks Desktop Payroll Error PS036 appears when the payroll subscription is inactive, expired, or contains invalid service details such as an incorrect EIN (Employer Identification Number) or service key.

It is commonly seen while changing payroll settings, confirming subscription status, or attempting payroll updates. QuickBooks shows: “There is a problem verifying your payroll subscription.”

Error PS036 stops payroll updates, blocks subscription verification, and prevents payroll form submissions until the subscription issue is corrected.

3. QuickBooks Error PS058: Corrupted System Files or Incorrect File Locations (.ND and .TLG Files)

QuickBooks Desktop Payroll Error PS058 occurs when payroll updates fail to download or install due to corrupted system files, incorrect file locations, or blocked Windows components.

This includes damage to .ND (Network Data) files, which allow multi-user access to the company file, and .TLG (Transaction Log) files, which record all accounting transactions in real time. QuickBooks displays: “Payroll update cannot be completed.”

Error PS058 stops payroll updates, prevents new tax table downloads, and halts employee pay runs until the damaged files or locations are corrected.

4. QuickBooks Error PS101: Payroll Server Connection or Firewall/Antivirus Issues

QuickBooks Desktop Payroll Error PS101 appears when the software fails to connect to Intuit’s payroll servers because of firewall restrictions, antivirus blocks, or poor internet connectivity.

The error can also occur if payroll files are corrupted or the internet settings on your computer are misconfigured. QuickBooks displays: “Payroll didn’t complete successfully, try again.”

Error PS101 stops payroll downloads, blocks subscription validation, and freezes all payroll activity until connectivity or security issues are resolved.

5. QuickBooks Error PS107: Outdated Version or Damaged Update Files

QuickBooks Desktop Payroll Error PS107 occurs when the application cannot validate the payroll subscription or read update files due to an outdated QuickBooks version, corrupted company files, or blocked connections.

The error message is generally: “An internal file in QuickBooks has become unreadable [PS107].” It appears during manual or automatic payroll updates.

Error PS107 stops payroll updates, prevents employee pay processing, and blocks access to payroll tax tables until QuickBooks and subscription files are repaired or updated.

How to Resolve QuickBooks Payroll Configuration and Setup Errors

Resolving configuration and setup errors in QuickBooks Desktop Payroll involves addressing subscription issues, file corruption (CPS Folder), network log file configuration, firewall and antivirus security issues, and system permissions. All these solutions will help resolve QuickBooks Desktop Payroll PSXXX series errors, specifically PS033; PS036 ; PS058 ; PS101 ; and PS107.

The solution to resolve PSXXX series errors are:

- Solution 1: Turn Off User Account Control (UAC) Settings in Windows

- Solution 2: Fix the Outdated QB and Payroll Tax Table Issue

- Solution 3: Use QuickBooks Tool Hub Tools

Solution 1: Turn Off User Account Control (UAC) Settings in Windows

User Account Control (UAC) is a Windows operating system security feature, not a QuickBooks setting. Windows’s User Account Control (UAC) settings are important for security, but it must be turned off to resolve common QuickBooks Payroll errors.

The steps involved in turning off UAC are mentioned below:

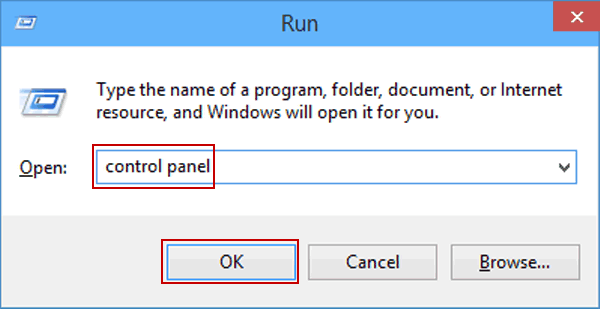

Step 1: Open the Control Panel

The first step in this solution is to open the Control Panel using the Windows key + R on your keyboard. Press the key, type ‘Control Panel,’ and select it from the search results.

Step 2: Change the Control Panel view (if necessary)

Make sure the Control Panel is set to either ‘Category’ or ‘Large icons’ view. If it’s on ‘Small icons,’ click the ‘View by’ drop-down menu and select ‘Category’ or ‘Large icons’ to adjust them according to your requirements.

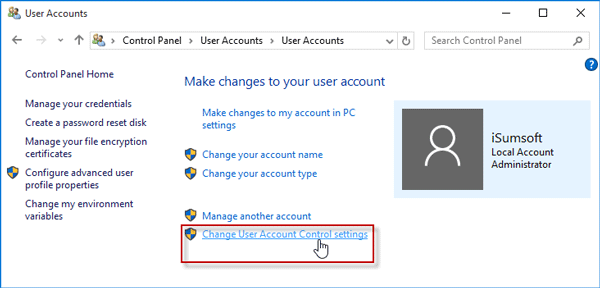

Step 3: Open User Accounts

When you access the Control Panel, go to the “User Accounts” option and move forward with it.

Step 4: Change the User Account Control settings

Now, click the “Change User Account Control settings” link within the User Accounts window.

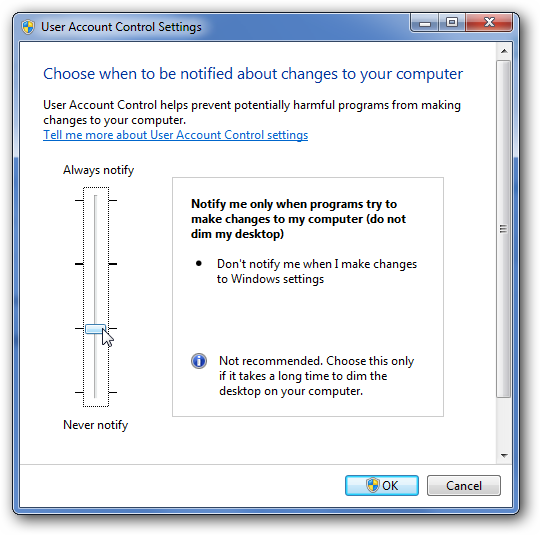

Step 5: Change the User Account Control settings

You will see a vertical slider with different levels of UAC settings for your requirements. By default, it is set to a level that notifies you when programs make changes to your computer. So to turn off UAC, move the slider down to “Never notify.”

Step 6: Confirm the changes

After moving the slider, you can confirm the changes by clicking the “OK” button.

Step 7: Restart your computer

To apply the changes, restart your computer by clicking the restart button. Make sure to save any open files and close all programs before restarting.

Solution 2: Fix the Outdated QB and Payroll Tax Table Issue

An outdated QuickBooks payroll and tax table issue can be rectified by downloading and installing their updates. Since an old version becomes incapable of dealing with several bugs and requires immediate fixes. Resolve these issues by taking the following steps:

Step 1: Launch QuickBooks

To start updating QuickBooks, open it on your computer by double-clicking its icon on the desktop or from All Programs.

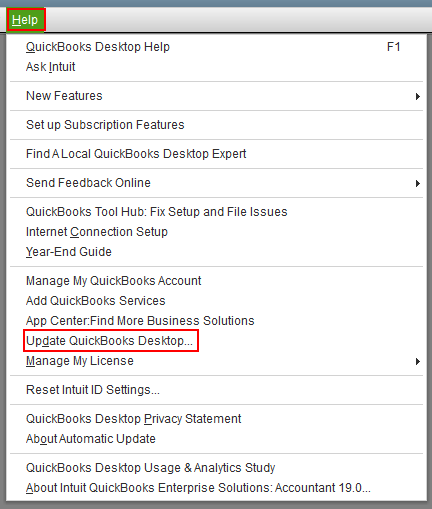

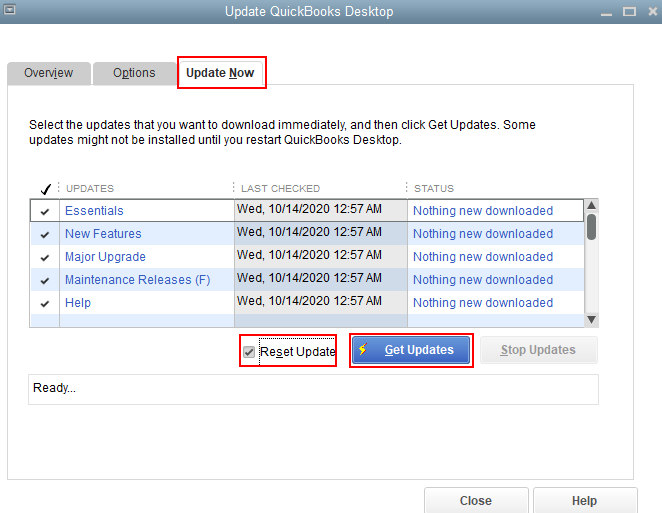

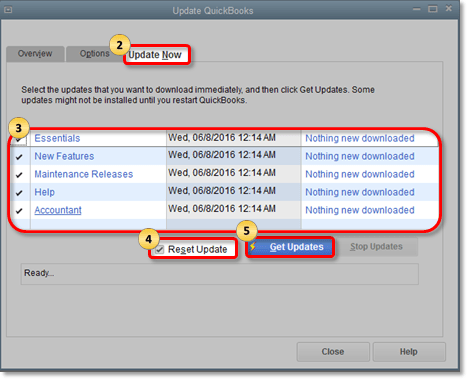

Step 2: Check for New QuickBooks updates

Next, check if any new updates are available by going to the “Help” menu at the top. Then click the “Update QuickBooks Desktop” button. If the latest version installs successfully, a message will appear saying, “You are up to date!” Otherwise, clicking the “Update Now” button will show the whole update process on your screen.

Step 3: Choose updates to install

QuickBooks will show a list of available updates and their descriptions. Review them thoroughly and pick the ones you wish to install. However, experts recommend you opt for all available updates to ensure you have the latest features and bug fixes.

Step 4: Click on “Get Updates”

After selecting the updates of your choice, get these updates via the “Get Updates” button. This will start downloading and installing the updates. It may take longer if your internet is slow or the update is large.

Step 5: Restart QuickBooks

A successful installation message will appear to inform you the update has finished without any issues. Click the “Close” button, exiting QuickBooks, and rebooting QuickBooks to start the updates.

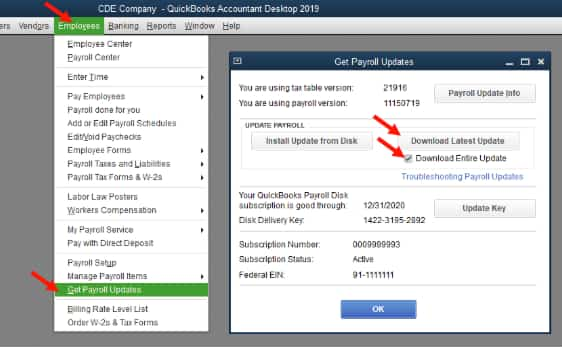

Step 6: Check for payroll tax table updates

Once your QuickBooks program is up-to-date, check the payroll tax tables. You can find payroll tax table updates in the “Employees” menu at the top. Then click “Get Payroll Updates.”

Step 7: Select the download method

When the payroll updates appear on the screen, and you know you need the latest version for your payroll calculations, choose the download method in the “Get Payroll Updates” window. If you have an internet connection, select “Download Entire Update” and click “Update” to start the process.

Step 8: Let the update finish

QuickBooks will download and install the latest payroll tax table update in its own time, containing the latest tax rates, forms, and calculations needed for accurate payroll processing.

Step 9: Confirm the update

After the QuickBooks payroll tax table update finishes, a message will appear showing that the update was installed successfully. Close the message by clicking the “OK” button.

Step 10: Do a test run

It’s recommended to do a test run of payroll to make sure the updated tax tables and calculations are working correctly and the installation is complete. You can create a sample paycheck and check the deductions, withholdings, and calculations to confirm everything is accurate.

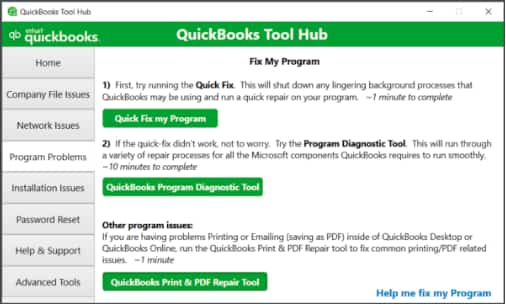

Solution 3: Use QuickBooks Tool Hub Tools

QuickBooks Tool Hub provides several utilities like Quick Fix My Program and QuickBooks Install Diagnostic Tool to fix problems with the program’s performance, installation files, and more. The following steps will help you scan and fix issues using these tools:

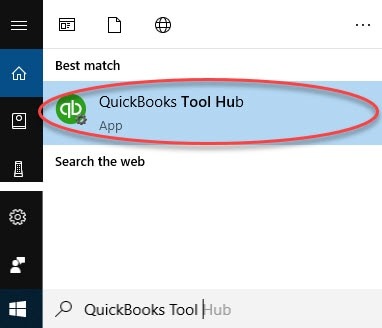

Step 1: Download and install QuickBooks Tool Hub

Start by downloading and installing the QuickBooks Tool Hub. Go to the official QuickBooks website and find the “QuickBooks Tool Hub” section. Download the latest installer and follow all the instructions to install it on your computer.

Step 2: Open the QuickBooks Tool Hub

After the QuickBooks Tool Hub installation, locate the Tool Hub icon or file where you saved it on your computer system and double-click it to open the tool.

Step 3: Choose the appropriate tool

After opening the QuickBooks Tool Hub, you’ll see a variety of tools for resolving different issues. Find the tool that matches your problem. For example, click the “Installation Issues” tab for installation problems, or “Program Problems” if QuickBooks is not working correctly.

Step 4: Run the tool

After selecting the right tab for your problems, you can start scanning the tools. For example, Installation Issues includes the QuickBooks Install Diagnostic Tool, and Program Problems has Quick Fix My Program. Choose the right tool and follow the on-screen instructions, so you can respond accordingly.

Step 5: Check the results

When the tool finishes scanning, it will show the results of the troubleshooting process. You will see instructions on how to fix the issue or suggestions for next steps.

Step 6: Repeat or try other tools when necessary

If the payroll errors issue is not resolved, or the first tool does not fix the problem, try other available tools in QuickBooks Tool Hub package. Run them the same way to get the results you need.

Conclusion!

You are now equipped with the right knowledge and steps to fix QuickBooks Payroll PSXXX and related update errors. In most cases, these issues can be resolved by correcting configuration settings, updating QuickBooks, or repairing payroll components — and once fixed, payroll runs smoothly again without interruptions.

If you do not see your exact error code here or still need help after trying the solutions, don’t worry — additional guides are available in our knowledge base, and QuickBooks experts are always ready to assist you whenever you need support.

With accurate troubleshooting and the right guidance, every payroll error can be resolved, helping you get back to processing payroll confidently and without delays. You are already on the right track by addressing it — and a fully working payroll environment is well within reach.

Disclaimer: The information outlined above for “How to Fix QuickBooks Payroll Error PSXXX Series: A Complete Step-by-Step Guide to Resolve Configuration and Setup Issues” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.