“Hi, I’m Maly Robert

I just renewed my payroll subscription in QuickBooks, and while everything shows as active, the system still isn’t calculating payroll taxes. No federal, no state, no Social Security, nothing. It’s just showing gross pay, and that’s it.

I’ve updated payroll, restarted the software, checked my employee setup, tax info, all of it — everything looks right. But for some reason, QuickBooks still refuses to calculate taxes like it should.

It’s stressful because I need to get payroll out, and I don’t want to risk messing up someone’s paycheck or running into problems with tax filings. I feel like I’ve tried everything I can think of, and support wait times are long.

Has anyone else gone through this right after renewing payroll? Did you have to reset something or refresh a setting I might be missing? I’d be really grateful for any advice right now — I just want to get this fixed and move on.”

Hi Maly Robert, many QuickBooks users encounter issues after renewing their payroll subscription. The system indicates the subscription as active; however, taxes, including federal, state, and Social Security, are not calculated, and only the gross pay is displayed.

You’ve already taken all the right steps: updated payroll, restarted QuickBooks, reviewed employee and tax setup, and yet, nothing changes.

For accurate payroll tax calculations in QuickBooks Desktop, ensure you have the latest payroll tax table, synchronise license and service data with Intuit’s servers, and validate the tax setup for each employee.

Let’s pinpoint the cause of the issue and outline clear steps to resolve it. This will help eliminate the “Error while Calculating Payroll Taxes After Subscription Renewal,” enabling smooth payroll processing without affecting anyone’s paycheck or tax filings.

Root Cause of Payroll Taxes Not Calculating in QuickBooks

If a QuickBooks Payroll subscription is renewed and appears as active, but tax calculations are not occurring, there could be several reasons. Even after a successful renewal, QuickBooks won’t calculate taxes unless the payroll engine is updated and synchronised properly.

The most common reasons include:

- Payroll tax table update not installed correctly

- Employee tax profiles are incomplete or misconfigured

- Payroll subscription is not fully synced with the QuickBooks Desktop file

- Payroll components in QuickBooks are damaged

- The payroll plan in use (Basic or Standard) may lack certain automation capabilities

Versions of QuickBooks Affected by Payroll Tax Calculation Issues After Renewal

Payroll taxes may not be calculated after subscription renewal in QuickBooks Desktop and Online. Desktop users on Basic, Standard, or Enhanced Payroll may encounter issues if tax tables aren’t updated or employee setups are incomplete. In QuickBooks Online, incomplete setup checklists can prevent tax calculations.

To resolve this issue, update the tax tables, synchronise subscription data, and verify the employee and company tax settings.

Fix Payroll Taxes Not Calculating in QuickBooks Desktop

To resolve the issue where payroll taxes are not being calculated, the following actions are recommended:

Step 1: Run a Complete Payroll Tax Table Update

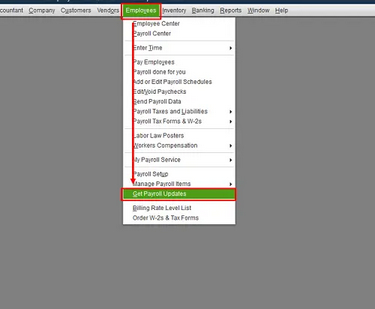

- Go to Employees > Get Payroll Updates

- Select Download entire payroll update

- Click on Update

Step 2. Sync the Payroll Subscription with QuickBooks

This step ensures that the local QuickBooks installation is properly aligned with the payroll subscription status stored in Intuit’s system.

- Go to the Help Menu

- Select “Manage My License”

- Click on “Sync License Data Online”

Step 3. Review Company-Level Payroll Settings

Missing or inactive settings at the company level can block the tax calculations system-wide.

- Go to the Edit menu > Select Preferences

- Click on Payroll & Employees > Choose Company Preferences.

- Confirm that:

- Full payroll is selected

- Federal and state taxes are activated

- The correct tax jurisdictions are enabled

Step 4. Check Employee Payroll Setup

Incomplete or inaccurate employee tax data results in zero tax deductions.

- Go to Employees > Employee Centre

- For each employee, verify:

- Federal and state tax details are filled

- Filing status and allowances are correctly selected

- The Social Security Number is entered

- No exemptions are mistakenly checked

Step 5. Run QuickBooks Tool Hub to Repair Payroll Components

This step repairs damaged components that may be blocking payroll processing.

- Download and install the latest version of the QuickBooks Tool Hub

- Open the QuickBooks Tool Hub

- Go to Program Problems > Quick Fix My Program

Step 6: Confirm the Payroll Plan in Use (Basic, Standard, or Enhanced)

This step ensures the selected plan meets your company’s payroll processing needs. If adjustments are needed, consider changing your plan.

- Visit: https://camps.intuit.com.

- Log in with your administrator credentials

- Go to the Payroll Settings in QuickBooks

- Check the active payroll plan and verify if it is Basic, Standard, or Enhanced.

Best Practices to Prevent Payroll Tax Errors in QuickBooks

- Set a monthly reminder to download the latest payroll tax table

- Regularly verify the employee tax setup

- Run payroll reports after each payroll to ensure taxes are deducted correctly

- Keep your subscription and QuickBooks software updated

- Communicate with employees about tax withholding changes

FAQs

Can payroll be processed in QuickBooks without calculating taxes?

You can run payroll in QuickBooks without calculating taxes, but it’s not a good idea. This led to wrong paychecks, compliance problems, and penalties from the IRS. Before finalising payroll, always check that taxes are included.

Will switching from Basic to Enhanced Payroll automatically fix tax calculation issues?

Switching to Enhanced Payroll can resolve tax calculation issues if feature limitations in Basic or Standard plans cause them. However, other setup-related errors may still need to be corrected manually, such as incomplete employee tax profiles or unsynced data.

What happens if payroll taxes are missing from a processed paycheck?

If a paycheck is processed without taxes, QuickBooks will not retroactively calculate them unless the check is deleted and recreated after fixing the underlying issue. It’s important to correct tax settings before finalising any payroll.

Can using a backup company file cause payroll taxes to disappear?

Yes, restoring an older backup of your company file may exclude the latest tax table or payroll configuration. Always ensure the restored file is updated with the latest payroll data and synced to your active subscription.

Disclaimer: The information outlined above for “Why QuickBooks Is Not Calculating Payroll Taxes After Subscription Renewal?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.