Hi I’m Morgan Cohen, and I’ve run into a critical issue with QuickBooks Desktop 2024 that I honestly wasn’t expecting at the worst possible time. I logged in to process payroll like I normally do, only to see a message that says I need to ‘Reactivate Payroll’ — and now I can’t move forward with paying my team.

It’s confusing because I didn’t get any prior warning that my payroll subscription was inactive or expired. As far as I know, our billing info is up to date and I’ve been using payroll consistently for the past few months without a hitch. The worst part is, this message just appeared out of the blue, and QuickBooks has basically locked me out of payroll functionality completely.

I tried revalidating my service key and went through the steps to reactivate online, but either the system gets stuck or redirects me to an Intuit support loop with no clear fix. I also tried updating the software, thinking maybe something failed to sync, but nothing has changed. Meanwhile, my payday deadline is approaching fast, and I’m worried about delays in direct deposits and potential penalties.

If anyone else has dealt with QuickBooks showing a payroll reactivation prompt even when your subscription seems active, what actually worked for you? Is this a licensing issue, a glitch in the background, or something on Intuit’s end? I’m really trying to avoid missing payroll or spending hours on hold — so any insight would mean a lot right now.

Hi Morgan Cohen,

Thank you so much for reaching out. I completely understand how overwhelming this situation can be — especially when you’re doing everything right and payday is just around the corner. You’ve already taken all the right first steps: revalidating your service key, attempting to reactivate online, updating your QuickBooks Desktop, and checking for sync issues. That shows you’re on top of things, even in a tough situation.

Now, seeing a “Reactivate Payroll” message out of nowhere—despite having an active subscription and updated billing—is understandably confusing and frustrating. The good news? This kind of issue is more common than you might think and usually caused by background sync errors, minor licensing glitches, or corrupted internal files—not a problem with your actual subscription.

You’re not alone in this, and you don’t have to figure it out on your own. I’m here to guide you through exactly what’s causing the “Reactivate Payroll” message in QuickBooks Desktop 2024, why it might be showing up despite an active subscription, and most importantly, how to fix it step-by-step while maintaining complete control over your payroll deadlines. I’ll walk you through each step with care, so you can move forward with confidence and ensure your team gets paid right on time.

Common Reasons Behind the “Reactivate Payroll” Prompt in QuickBooks Desktop 2024

“Reactivate Payroll” message often appears due to technical or sync-related issues—not because your subscription is actually inactive. It can be triggered by outdated files, failed license validation, missing updates, or interrupted communication with Intuit’s servers.

- QuickBooks failed to sync your payroll status with Intuit’s servers.

- The paysub.ini file is outdated or corrupted.

- Your license validation token didn’t refresh properly.

- QuickBooks Desktop or your payroll tax table is not up-to-date.

- The company file was moved, restored, or significantly reconfigured.

- The payroll service key is missing, incorrect, or expired.

- QuickBooks can’t connect to Intuit due to network, firewall, or server timeout issues.

- Background processes or third-party software are interfering with subscription validation.

Try These Troubleshooting Steps to Fix the “Reactivate Payroll” Prompt in QuickBooks Desktop 2024

Whether it’s a sync issue, a service key glitch, or a license validation error, these fixes are designed to resolve the “Reactivate Payroll” message in QuickBooks Desktop 2024. Many users—just like you—have encountered the same issue unexpectedly despite having an active subscription and were able to resolve it with a few simple steps.

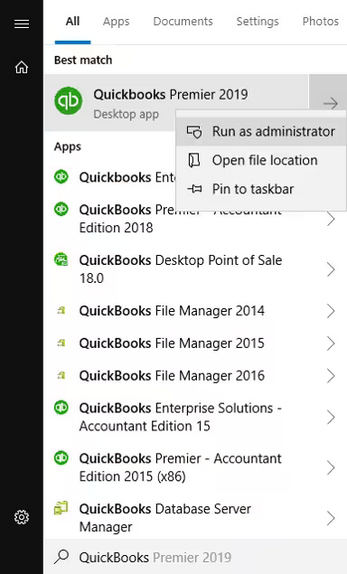

Fixation 1: Run QuickBooks as an Administrator

Make sure to run QuickBooks as an Administrator if your QuickBooks Desktop Subscription has expired unexpectedly.

- Open the Windows Start menu.

- Enter “QuickBooks” into the search bar.

- You will see your results listed in the Search window.

- Right-click on the QuickBooks version and the year you want to open.

- Choose Run as administrator.

- Run the payroll update if needed.

- Close and reopen the QuickBooks software.

Fixation 2: Re-enter or Refresh your Payroll Service Key

- Navigate to the QuickBooks Home Page screen.

- Hold and press CTRL+ K on your keyboard.

- Make a note of your payroll service key numbers if you see your payroll service keys and Status is Inactive.

- Click Edit to remove and re-enter the service numbers in the box.

- Select Next until finish.

- Once done, choose OK.

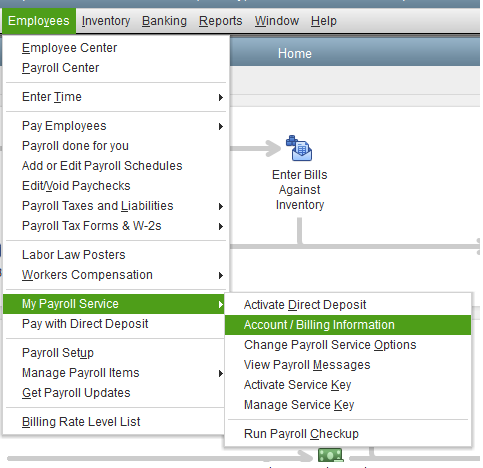

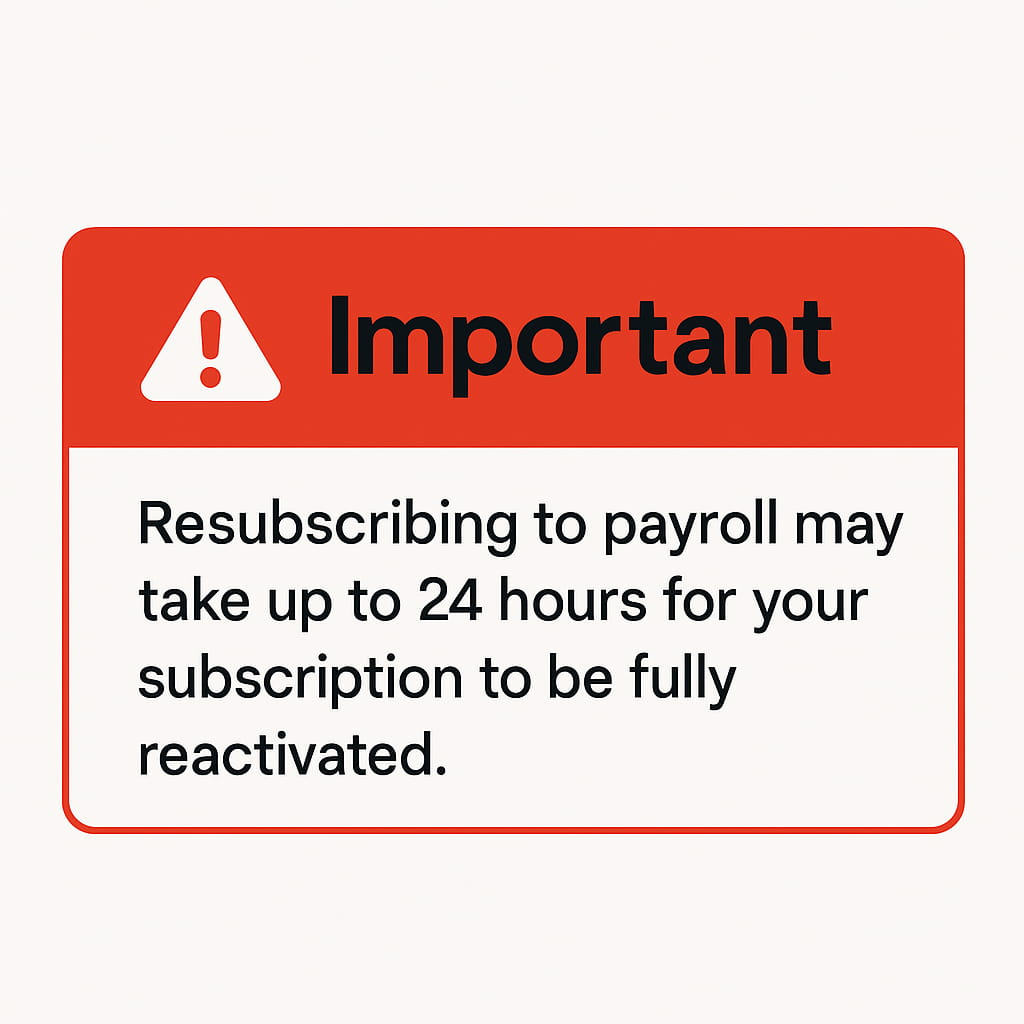

Fixation 3: Re-enable Payroll Service in QuickBooks Desktop

To turn on your payroll service in your QuickBooks Desktop company file, do the following:

- Navigate to the Employees section.

- Choose My Payroll Service from the list.

- Select the Account/Billing Info option.

- Sign in using your Intuit Account login credentials. This will direct you to your QuickBooks Account page.

- Click Resubscribe under Status.

- Follow the on-screen instructions to reactivate your payroll service.

Fixation 4: Update Billing/ Payment Info

Updating your billing information or payment method helps to avoid payroll service disruptions due to failed transactions, ensure timely subscriptions renewal, maintain accurate account records, and prevent late fees or access issues.

- Log in to the Customer Account Management Portal (CAMPs) as an admin user.

- Choose QuickBooks Desktop from the Products & Services list.

- Select Details next to your QuickBooks Product.

- In the Billing Information section, locate Payment Method and click Edit. Then, update your payment info.

- Once done, click Save and Close.

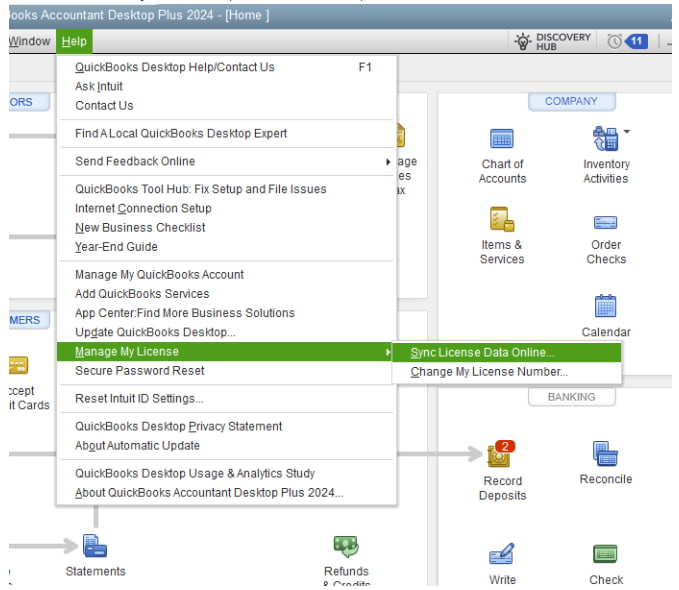

Fixation 5: Sync Your License Data

- Open QuickBooks Desktop and log in as an Admin.

- Navigate to the Help menu and select Manage My License.

- Choose Sync License Data Online.

Fixation 6: Delete/Recreate the Paysub.ini File

- Open the display hidden files or folders.

- Enter Paysub.ini in the Search field.

- When you see the Paysub.ini file, right-click on it and select Delete.

- Repeat the same steps until all Paysub.ini files are deleted.

Fixation 7: Set up Manual Payroll

To manually run payroll in QuickBooks Desktop, first enable the payroll feature inside your QuickBooks settings.

Note: Make sure to update the latest QuickBooks version so you get all the fixes and improvements before setting up manual payroll.

For QuickBooks Desktop 2018 or later

- Choose Preferences from the Edit dropdown menu.

- Select Payroll & Employees and choose the Company Preferences tab.

- Tickmark the Full payroll and the Manual Payroll checkboxes under the QuickBooks Desktop Payroll Features section.

- Under the Get payday peace of mind window, Click Next and Activate on the confirmation screen.

- Click OK to apply the changes.

- Press OK to close the preferences window.

Fixation 8: Download Updates For QuickBooks & Payroll Tax Table

Staying up to date with the latest QuickBooks Desktop and payroll tax table is essential for smooth payroll processing. These updates often include important fixes, compliance changes, and new tax rates. If your software or tax table is outdated, it may trigger reactivation prompts or even block access to payroll features. Downloading the most recent updates ensures your system runs properly and remains compliant with the latest payroll regulations.

Update QuickBooks Desktop to the latest version

An outdated QuickBooks version doesn’t allow you to download the QuickBooks Payroll Updates. Here’s how you can update your software.

- Open QuickBooks Desktop and navigate to the Help menu.

- Choose Update QuickBooks Desktop.

- Hit the Update Now tab. Tip: Tickmark the Reset Update checkbox to clear all previous update downloads.

- Select Get Updates to start the download.

- Once done, close and reopen QuickBooks to install the update again.

Get the Payroll Tax Table Updates

QuickBooks Desktop Payroll provides payroll updates to QuickBooks Desktop Payroll subscribers. These updates include the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options.

Note: The latest payroll update number is 22513 released on July 3, 2025.

- Navigate to the Employees menu and select Get Payroll Updates.

- Tickmark the Entire Update checkbox.

- Click Update.

- An informational window appears when the download is complete.

Tips to Avoid “Reactivate Payroll” Subscription Alert in QuickBooks Desktop 2024

Seeing a repeated “Reactivate Payroll” message in QuickBooks Desktop can be frustrating—especially when your subscription is already active.

We’ve some key tips to help you avoid this prompt in future and ensure smooth payroll functionality:

- Sync your license data online from the Help menu.

- Keep QuickBooks Desktop updated to the latest release.

- Verify your payroll subscription status under My Payroll Service.

- Always log in using the correct company file and admin account.

- Ensure you have a stable internet connection while using QuickBooks.

- Allow QuickBooks through your firewall and antivirus settings.

- Renew your payroll subscription before it expires.

- Update your billing information to prevent payment failures.

- Avoid switching between company files that aren’t linked to payroll.

Final Note!

Morgan, I completely understand how stressful and disruptive this situation must feel—especially when you’re doing everything right and still hitting a wall just before payday. Well, you’ve already covered the most critical troubleshooting steps, which means you’re not far from a resolution. In many cases, this type of prompt is triggered by a background sync or license validation issue, not a real lapse in your subscription.

You’re not alone in this, and you don’t have to solve it all by yourself. If the steps you’ve tried haven’t worked yet, I’m here to help you take the next steps—whether that’s reaching out to Intuit on your behalf or guiding you through deeper fixes using the QuickBooks Tool Hub.

Right now, your focus should be on your team, not chasing down software errors—and I’ll do everything I can to help lift that burden. We’ll get this resolved together and make sure your payroll goes out on time.

Disclaimer: The information outlined above for “Why QuickBooks Desktop 2024 Asking Me to Reactivate Payroll Even If My Subscription is Active?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.