What is Per Diem?

Per diem is a fixed daily allowance for employees to cover expenses during business travel. It includes lodging, meals, and incidental costs.

Per diem is a Latin word that means per day or for each day.

It simplifies expense management by avoiding the need for detailed expense tracking and reimbursement.

Per diem can be broken down into two key uses:

- Per diem expenses: It’s a daily budget for employees to cover costs when traveling for work.

- Per diem rates are when employees are paid by the day instead of a regular salary. They are usually for freelancers, consultants, and contractors who are paid by the day or hour.

It sounds simple, but the government has set rules about how such an income is reported and taxed.

The U.S. General Services Administration (GSA) sets standard per diem rates annually, which vary by location to account for differences in living costs.

What Does Per Diem Covers?

When your employees travel for work, per diem simplifies the process of reimbursing them for their business trip expenses.

The General Service Administration divides it into two main parts: meals and incidental expenses (M&IE) and lodging.

Meals and Incidental Expenses (M&IE)

M&IE covers expenses related to eating and minor day-to-day costs. It includes:

- All meals (breakfast, lunch, and dinner)

- Room service

- Laundry services (dry cleaning and pressing of clothing)

- Tips and fees (food servers and luggage carriers)

The GSA sets different per diem rates for cities based on their size and the business travel volume they receive.

Big cities, like San Francisco and Boston, have the highest daily M&IE allowance of approximately $92. Meanwhile, smaller but still busy cities like Tampa and Cleveland offer rates around $80.

Lodging Expenses

Lodging expenses cover your employee’s stay, which could be at hotels, motels, or resorts.

The lodging per diem is separate from M&IE, with rates varying by location.

For example, Boston’s lodging per diem for 2024 is set at $349, while M&IE is $92. In New York City, lodging rates can range from $165 to $342, with M&IE maxing at $79.

The per diem method is a nuanced approach to reimburse employees fairly to reflect the actual expenses incurred in the travel.

How Does Per Diem Work?

Per diem is an alternative to reimbursing an employee’s expense during business travel. The employer offers a predetermined allowance instead of reimbursing the employee with the exact amount.

The per diem allowance varies for different states, reflecting the cost of living in these areas. It can be paid in advance or reimbursed after the trip.

Employees may still be asked to submit an expense report despite the fact that it is a fixed daily rate. However, these reports are generally less detailed and should include information like the date and time of travel, location, total expense, and purpose of the visit.

Per Diem for Government Employees

The General Services Administration (GSA) sets per diem rates for federal employees on official travel each fiscal year. These rates are a benchmark for employers to guide their per diem policies.

The per diem rates are updated annually on October 1 to account for changes in costs due to factors like inflation and seasonal demand.

The new standard rates apply to over 2,600 United States counties and 302 high-cost areas that receive specific rates every year.

As of 2025, the standard lodging rate has been updated to $110 per day, with meals and incidental expenses (M&IE) ranging between $68 and $92. The GSA’s official website provides specific details and rates for different locations.

Per Diem for the Self-Employed

The IRS offers per diem rates for self-employed individuals that you can use only for meal expenses on a business trip. The meal expenses are not taxable income if they do not exceed federal per diem rates.

However, you need all the travel details handy, like the date and time of travel, location, purpose, etc. Also, keep your bills in case you need them for tax purposes.

For lodging and other travel expenses, you must directly deduct the related costs on your tax returns, typically on Schedule C.

Why do Companies Pay Per Diem?

Companies pay per diem for several key reasons:

- Simplifies reimbursement: Eliminates the time spent tracking single receipts and the presentation thereof.

- Covers business travel expenses: Correct remuneration requires an increase in meals, accommodation, and other expenses for the whole day.

- Cost control: It is beneficial in controlling and, to some extent, minimizing the costs since it pays a fixed amount.

- Tax compliance: Most per diem payments can be arranged so that any extra income received by the employees is tax-free.

- Efficiency: It also reduces the time spent on accounting and bookkeeping, which will, in turn, help improve the employees’ performance.

Per Diem Rates for 2025

The IRS has announced the per diem rates for the 2024 fiscal year on October 1, 2023.

The standard lodging rate has moved up from $107 to $110. As usual, lodging rates are higher in areas outside the CONUS than in other areas. For M&IE, the different tier cities will remain in the $68 to $92 range. However, the standard M&IE has moved up from $59 to $62.

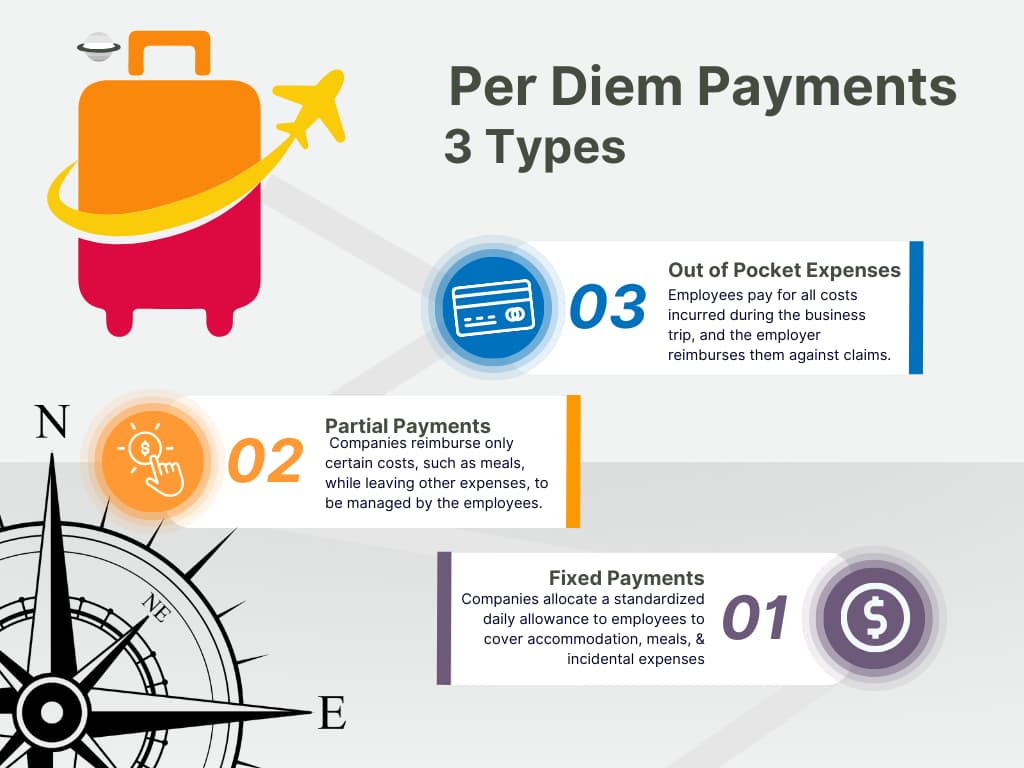

Types of Per Diem Payments

When companies manage per diem payments, it is usually through the 3 most common ways:

- Fixed rates

- Partial payments

- Out-of-pocket expense

The payment methods differ based on organizational policies and employee needs.

Fixed Rates

The fixed-rate method involves companies allocating a standardized daily allowance to employees to cover accommodation, meals, and incidental expenses.

This rate is generally predetermined and factors in the cost of living in the travel destination and IRS guidelines. It is a simple process, and employees enjoy complete autonomy in managing travel expenses.

Employees who use personal cars for business travel can also be reimbursed according to mileage. The IRS recently updated the standard mileage rates for 2024.

The rate for business use is now 67 cents per mile, an increase of 1.5 cents from 2023. Starting January 1, 2024, employers can use this rate to calculate the deductible costs when an employee uses his vehicle for business.

Partial Payments

Partial payments are much more flexible. For this payment method, companies can reimburse only certain costs, such as meals, while leaving other expenses, like lodging or transportation, to be managed by the employees.

Most employers use this payment method for shorter trips or where a full per diem allowance is not required.

Out-of-Pocket Expenses

Out-of-pocket expenses mean the employees pay for all costs incurred during the business trip, and the employer reimburses them against claims.

But in this case, employees need to provide bills for the claims, which may demand more administrative effort from both the employer and employee.

How to Calculate Per Diem?

There are two ways to calculate per diem: federal rates and the high-low method.

Federal or Standard Rates

Most counties in the CONUS (continental United States) operate under a standardized per diem rate, consisting of two components: the maximum lodging allowance and the meals and incidental expenses component.

As of 2025, the standard per diem rate is $178, which includes $110 for lodging and $68 for meals and incidental expenses. However, on the first and last days of their travel, employees receive only 75% of the standard rate for meals and incidental expenses.

Calculate Per Diem Using Standard Rate

Say an employee travels to Boston for business.

The per diem rate for meals and incidental expenses (M&IE) in Oxford, Mississippi, is $68 daily. The breakdown includes $11 for breakfast, $22 for lunch, $35 for dinner.

On the first and last days of travel, the employee gets only 75% of the standard rate for M&IE, which is $51.

The daily standard lodging rate for Oxford is $110.

Now, if the employee stays in Oxford for 3 days, the per diem reimbursement will be calculated as follows:

Lodging: $110 x 3 = $330

Meals and Incidental Expenses:

The employee receives the full M&IE rate of $68 per day for the one day between travel days. On the first and last days, he receives 75% of the standard rate, which is $51.

So, the total reimbursement for M&IE for the trip would be

Full days: $68 x 1 day = $68

Partial days: $51 x 2 days = $102

Total M&IE reimbursement: $68 + $102 = $170

Total per diem = M&IE + lodging = $170 + $330= $500

So, the total reimbursement under standard rates will be $500.

Calculate Per Diem Using High-Low Per Diem Method

The high-low per diem method is used when the rate is higher in some cities than in others. For example, Boston, Massachusetts, has a per diem rate of $197 per day, with an additional $92 for M&IE.

In other cities within the Continental United States (CONUS), the rate is $214 per day, including $68 for meals.

So, if you need to calculate per diem for higher-cost cities outside CONUS, use the highest rate, and if the destination is not to a high-cost area, calculate using the lowest for CONUS cities.

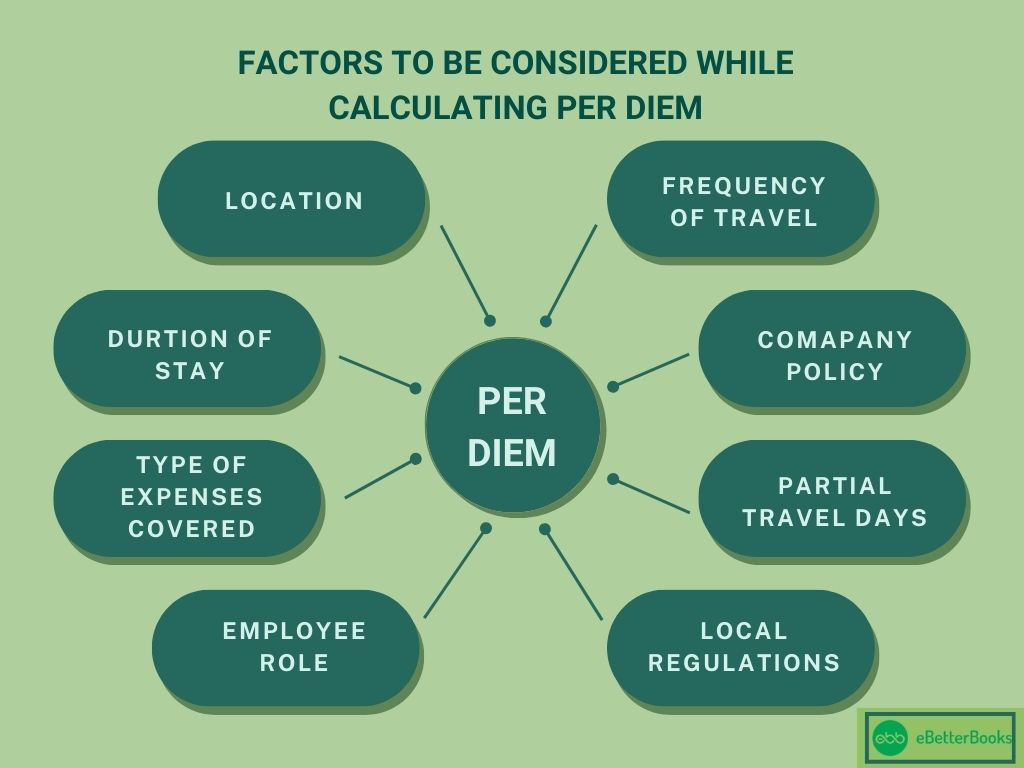

Factors to be Considered while Calculating Per Diem

When calculating per diem, companies should consider the following factors:

- Location: Charges differ according to the destination country or city of the journey.

- Duration of stay: The per diem expense is calculated depending on the duration of the business trip that the employee will be undertaking.

- Type of expenses covered: The per diem may include meals, lodging, or both.

- Employee role: It should also be mentioned that it depends on the rank or position of the inspected employee.

- Local regulations: Regarding the policy of per diem allowances, one can consult the government or tax laws.

- Company policy: The company has general policies for operations, including the per diem payments, that give direction on how these payments will be made and promulgate or require specific limits/restrictions or rules.

- Partial travel days: Explain and agree on per diem for scenarios when you will spend some days in a particular place other than business days only.

- Frequency of travel: The amount depends on the number of hours taken in transit and the standards and rules of the specific company.

Key Rules for Employer Compliance for Per Diem Payments

Key rules for employer compliance with per diem payments include:

- Adherence to IRS guidelines: Ensure that the per diem rates are compliant with the Internal Revenue Service or local taxonomy authority in order to negate any tax income for employees.

- Record-keeping: Ensure timely payment of per diem and record any payments made to employees for dates of travel, as well as the where and why of these payments.

- Ensure legitimate business purpose: It is recommended that the per diem be allowed in circumstances where costs occur because of the business journey and other pertinent costs.

- Consistent application: It is important to ensure the right policies are adhered to when approving the per diem to minimize discrimination or any other compliance issues.

- Employee reporting: Nevertheless, the employees need to fill in the dates of travel, place, and purpose of business travel even if the receipts are not needed.

- Tax reporting: It is also necessary to ensure that any other additional per diem allowances in excess of the allowable government-prescribed amounts are included in the tax filings as other income sources.

- Documentation of company policy: To ensure that the company’s policy concerning the per diem allowance of the employees is clear, the companies mentioned should include such policies in their policies or even in the employees’ handbooks.

- Limit personal use: Hoping the recipient of the per diem will use it only for business and not spend it on personal expenses.

Benefits of Per Diem Payments

Per diem payments have many other benefits for employers and employees, including significantly simplifying travel expense budgeting.

- Reduce administrative work related to expense tracking

- Streamlines tax reporting

- Per diems do not require employees to track and manage travel receipts

- Ensures equitable reimbursement for travel expenses

- Employees can keep any unspent per diem amounts, though excess funds are subject to tax

Tips for Managing Per Diem Expenses

Here are tips for managing per diem expenses effectively:

- Set clear policies: Develop and share policies and procedures regarding per diem, such as the rates for reimbursement, allowable expenses, and how to submit a claim.

- Use standardized rates: When establishing the per diem rates, base them on government or industry standards to avoid or control costs and protect any undue bias.

- Monitor expenses regularly: Containing per diem expenses in a way that an employee never had the monetary amount allocated for the specific expense and perhaps find out where or how the money was most probably misused.

- Implement digital tools: Use expense management software to centrally manage, track, report on, and pay for per diems.

- Encourage cost-conscious travel: Minimise on wastage by ensuring that the employees select hotels and meals that are fairly priced.

- Adjust for location: This means organizing your travel so that you are free to set different variable per diem rates depending on the general standard of living in different places, enabling you to recover all the true cost of travelling.

- Review periodically: Certify per diem rate schedule for submission of annual reports on the increase or decrease of the rates occasioned by travel costs or corporate expenses.

- Guide Unused Funds: Explain whether employees must repay any remaining per diem money or if they can keep the money.

Final Words

Per diem is a good way for employees and employers to manage business travel expenses. However, it’s also necessary to follow the GSA rules and ensure equitable expense coverage for employees.

Also, employers need to update their annual per diem guidelines based on updated information from the IRS.

FAQs

Why do companies pay Per Diem tax?

Companies use per diem payments to simplify expense management and ensure compliance with tax regulations. These payments are for business-related travel expenses and can be tax-exempt if they adhere to IRS guidelines.

Is Per Diem reported to the IRS?

Yes, per diem payments have to be reported to the IRS. It will be treated as taxable income if it exceeds federal per diem rates or isn’t adequately accounted for.

Is Per Diem Paid Out on Weekends?

Per diem is typically paid for days an employee is working or traveling for work purposes. Whether it’s paid on weekends depends on whether those days are considered work or travel days. You should consider your company policies to confirm if they are covered.

Is Per Diem Taxable?

Per diem payments are not taxable as long as they don’t exceed the federal daily rates set by the GSA and are used for business travel expenses. Payments exceeding these rates or not used for qualified expenses may be taxable.

Can employers deduct per diem?

Employers can deduct per diem payments as business expenses when they are for work-related travel, and the payments are in line with federal guidelines.