Navigation

- 1 What Are Retained Earnings?

- 2 How To Calculate Retained Earnings?

- 3 Statement of Retained Earnings

- 4 How to Calculate Additions to Retained Earnings?

- 5 How do you Find Retained Earnings On the Balance Sheet?

- 6 Solved Problem on Retained Earnings

- 7 How Do You Prepare a Retained Earnings Statement?

- 8 Factors Influencing the Calculation of Retained Earnings

- 9 How to Interpret Retained Earnings?

- 10 FAQs

Retained earnings represent the portion of your company’s net income that remains after dividends have been distributed to shareholders. This amount is reinvested or “ploughed back” into the company.

Retained earnings are listed in the shareholders’ equity section of the balance sheet.

To calculate retained earnings, take the prior year’s retained earnings, add or subtract the current year’s net profit or loss, and then subtract the dividends paid during the current year.

What Are Retained Earnings?

Retained earnings are the net income left for the business after it has paid dividends to its shareholders. Retained earnings surge whenever your business makes a profit and plunge each time you withdraw some of these profits as dividend payouts.

Retained earnings are net earnings that are not distributed to shareholders and that the company decides to reinvest. Since retained earnings are not connected to net cash flow, they do not appear on the cash flow statement.

Many companies turn to retained earnings as a way of financing the company, as it is an effective way to avoid the outflow of money and having to resort to new obligations (that is, more indebtedness).

How To Calculate Retained Earnings?

If you are manually calculating your retained earnings, below are the two ways through which it can be done:

How To Calculate Retained Earnings from the Income Statement?

To find retained earnings from the income statement, follow these steps:

- Start with Net Income: The ethic originated from the company’s Net income, which is the last profit of the company after deducting all costs (operating costs, taxes, and interest) from total sales. Net Income is normally located at the very bottom of the income statement.

- Subtract Dividends Paid: If the company distributes dividends to shareholders, then such payment will have to be deducted from the net income. From the following equation, it is evident that dividends decrease the amount of retained earnings.

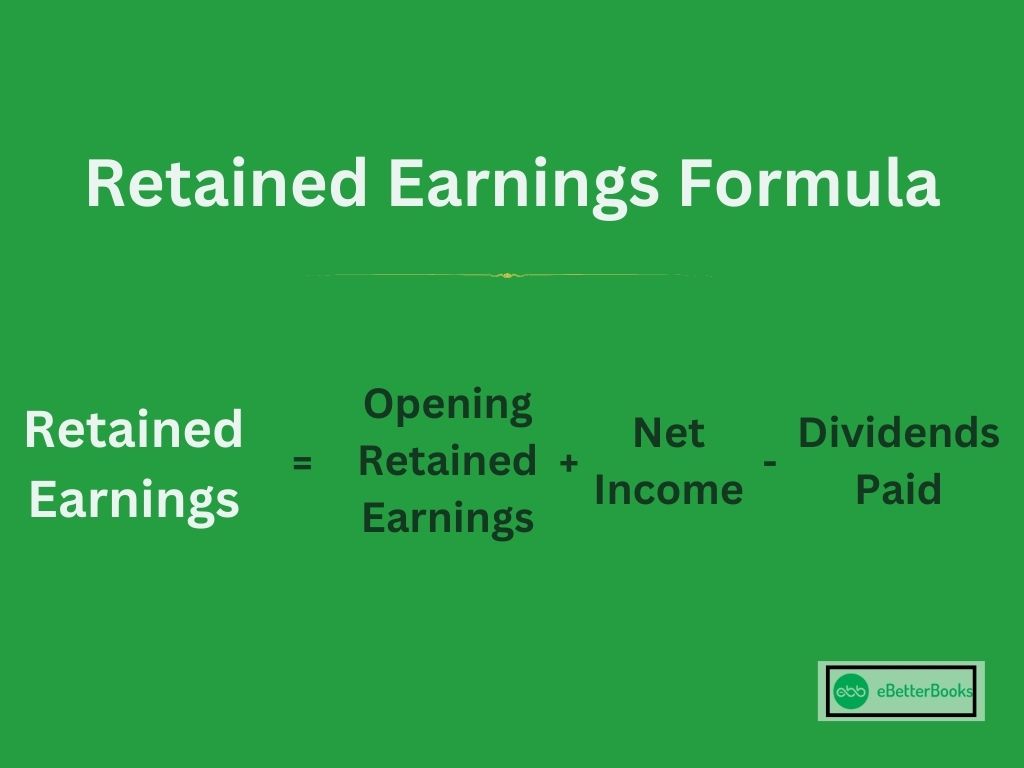

Retained Earnings formula is as follows:

Retained Earnings = Opening Retained Earnings + Net Income – Dividends Paid.

- Add to Previous Retained Earnings (if available): It is also important to note that in cases where you have to determine retained earnings for subsequent periods, then you need to add after-tax net profit to the previous period’s retained earnings as found in the balance sheet.

How to Calculate Retained Earnings on a Balance Sheet?

Anyone can calculate retained earnings by using assets and liabilities, which are the components of a balance sheet. The formula is

Shareholder’s Funds = Total Assets – Total Liabilities

Retained Earnings = Shareholder’s Funds – Share Capital – Reserves

Here’s a breakdown of the components of the formula:

- Shareholders’ Funds: This is the total of shareholders’ funds and represents the total combination of share capital, reserves, and retained earnings.

- Share Capital: The value that a shareholder is willing to commit in the process of buying shares of stock of the business.

- Reserves: These are the Profit & Loss reserves retained for particular objectives such as capital redemption.

Statement of Retained Earnings

The table format allows you to calculate the retained earnings easily.

Below is a free template for the same:

| Statement of Retained Earnings | |

| For the year ending December 31, 2021 | |

| Particulars | Amount |

| Opening Retained Earnings | xxx |

| Add: Net Income | xxx |

| xxx | |

| Less: Dividends | xxx |

| Closing Retained Earnings | xxx |

How to Calculate Additions to Retained Earnings?

When calculating additions to retained earnings, net income is specific to that which is retained by the business after it has distributed its dividends to the shareholders. It gives the part of the price that is good for reinvestment by the company and not for distribution.

The additions are directly influenced by:

1. Net Income: A higher net income increases the potential addition to retained earnings by disclosing an increased potential of augmented boosts to the retained earnings.

2. Dividends: The higher the dividend payout, the less is added to the retained earnings component of the company.

Hence, additions to retained earnings represent an increase in a company’s financial reserves, which are available for future use in investment, debt repayment, or any other corporate use. Therefore, the change in retained earnings for the period under consideration does not include the final figure.

How do you Find Retained Earnings On the Balance Sheet?

To find retained earnings on the balance sheet, the concept can be explained straightforwardly without much detail:

- It falls in the Equity Section of the balance sheet. This figure is derived from earnings that the company has not paid as cash to the shareholders in the form of dividends.

- If net income is produced, it is combined with the retained earnings at the end of the financial period and subtracted from the dividends paid. The Income Statement is used to do this calculation, and the result (net income) is transferred to the retained earnings in the balance sheet.

So efficiently, retained earnings can be interpreted as a share of the profits that belong to the company and are kept in it, as well as shown on the balance of shareholders’ equity.

Solved Problem on Retained Earnings

The below situation will help you identify the formula and then solve for the retained earnings balance at the end of the period:

How do you Calculate Retained Earnings on an Income Statement?

Let’s assume ABC Ltd. has the following financial insights:

Net Income: $200,000

Dividends Paid: $50,000

Previous Retained Earnings: $300,000

Therefore, retained earnings will be:

Retained Earnings =Opening Retained Earnings + Net Income – Dividends Paid

Retained Earnings Calculation:

Retained Earnings = 300000 + 200000 – 50000 = 30000 + 200000 – 50000 = 450000

Thus, the Earnings retention after this period will be $ 450,000

How Do You Calculate Retained Earnings on A Balance Sheet?

Let us assume that in April, your business continues progressing, and you make another profit of $20,000. As you consider keeping that money for future reinvestment in the industry, you waive the cash dividend and, preferably, plan to issue a 5% stock dividend on the alternate side.

Now, if we assume that the company has a total of 15,000 outstanding shares of common stock, and as per your determination, the FMV stands at $10 for each share. This means that you would issue 100 shares in the dividend, and the reduced retained earnings for every share counts at $10:

Retained Earnings Equation:

Current retained earnings + Net Income – (No. of shares x FMV of each share) = Retained earnings

Current retained earnings + Net Income – (No. of shares x FMV of each share) = Retained earnings

$17,000 + $20,000 – (100 x $10) = $27,000

*On May 1, your retained earnings of $27,000 for the business.

How Do You Prepare a Retained Earnings Statement?

To prepare the retained earnings statement for Company, follow these steps:

Step 1: Provide a Proper Heading

The first step is to create an appropriate heading for the statement. The heading should include three components:

- The name of the company (Company A) is on the first line.

- The words “Retained Earnings Statement” are on the second line.

- The year for which the statement is being prepared (For the Year Ended 2023) is on the third line.

Step 2: Specify the Beginning Period Retained Earnings

The beginning retained earnings for the period are the retained earnings from the previous year. This figure can be found in the shareholder’s equity section of last year’s balance sheet.

Step 3: Subtract Dividends Paid to the Investors

Calculate the retained earnings for the current period by adding or subtracting the current period’s net profit or loss from the retained earnings at the beginning of the period. Next, subtract the cash and stock dividends paid by the company during the year.

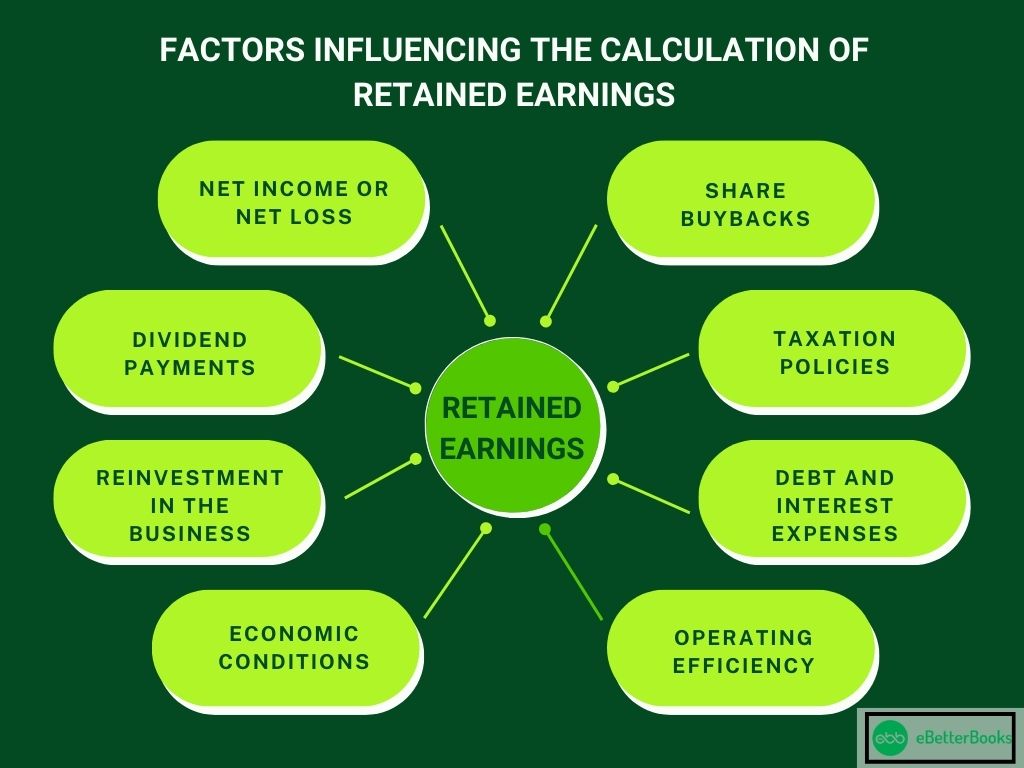

Factors Influencing the Calculation of Retained Earnings

Certainly, below is an explanation of the factors that contribute to the calculation of retained earnings.

Here’s the information presented in a bullet-point format:

- Net Income or Net Loss:

Positive net income adds to retained earnings.

Negative net income (net loss) subtracts from retained earnings. - Dividend Payments:

Dividends paid to shareholders reduce retained earnings.

Higher dividends result in lower retained earnings. - Reinvestment in the Business:

Profits retained for reinvestment increase retained earnings.

Reinvesting in growth initiatives boosts retained earnings. - Economic Conditions:

Prosperous economic times increase profits and retained earnings.

Economic downturns led to lower profits and decreased retained earnings. - Operational Efficiency:

Efficient operations increase net income and retained earnings.

Streamlined processes contribute to higher retained earnings. - Debt and Interest Expenses:

Interest payments on debt decrease net income and retained earnings.

Managing debt impacts the level of retained earnings. - Taxation Policies:

Tax changes affect net income and retained earnings.

Taxation impacts the company’s ability to accumulate retained earnings. - Industry and Competition:

Industry challenges can reduce profit margins and retained earnings.

Effective industry navigation supports healthy retained earnings. - Profitable Growth Strategies:

Successful expansion efforts contribute to higher net income and retained earnings.

Investment in innovation and new markets impacts retained earnings positively. - Share Buybacks:

Companies buying back their shares reduce the number of outstanding shares.

This can lead to increased earnings per share and higher retained earnings. - Legal and Regulatory Factors:

Compliance costs and legal fines impact net income and retained earnings.

Adhering to regulations preserves retained earnings. - Accounting Changes:

Changes in accounting methods can influence reported net income and, consequently, retained earnings. - Market Performance:

Fluctuations in asset values and investments affect overall profits and retained earnings. - Capital Expenditures:

Investments in capital assets impact net income and retained earnings.

Strategic spending influences the accumulation of retained earnings.

How to Interpret Retained Earnings?

Retained earnings are the total retained net income that has been earned by the business over its period of operation and not distributed to the shareholders in the form of dividends. Interpreting retained earnings entails finding out the implications of this aspect to a firm to assess its financial as well as the rate of growth.

Here’s how to interpret retained earnings:

- Retained Earnings: Shares of profits earned by a company, which are not distributed to shareholders in the form of dividends.

- Indicates Profitability: High retained earnings indicate the company’s continual profitability.

- Reinvestment Potential: This illustrates the funds available for growth and expansion, financing research and development, and debt reduction.

- Low/Negative: This may signify that losses are anticipated or when dividends are used highly.

- Investor Insight: The ratio between amounts of money that are reinvested into the company and actual shareholders’ profits.

Conclusion

Within the balance sheet, these retained earnings will be reflected within the company’s equity.

It will be calculated at the end of an accounting period, and their increase or decrease will result from the net income and dividends paid in that period. Finally, they will provide a financial mechanism crucial for a company to enjoy good health.

We hope this blog was informative enough to end your issues and queries about your company’s retained earnings equation and what is included in retained earnings. Keeping track of your company’s financial health is vital; calculating your company’s total profit and revenue will support the business’s long-term commercial success.

FAQs

What is Retained Earnings?

Retained earnings are the net income stored in the business after the dividend is paid to the owners. Such earnings are utilized for reinvestment in the business, repayment of loans, or savings in some other way.

What is the Formula for Calculating Retained Earnings?

Retained earnings are calculated using the following formula:

Retained Earnings =Opening Retained Earnings + Net Income – Dividends Paid

How is Net Income Different from Retained Earnings?

Net income is one type of business income that distinguishes an enterprise’s total revenues in a given period according to the income statement. It reflects a summary of retained earnings in several periods when current dividends have already been excluded.