The Stratus Rewards Visa, known as the “White Card,” is an elite credit card designed for high-net-worth individuals. Unlike traditional premium cards, it focuses on luxury experiences, including private jet discounts, exclusive travel perks, and luxury hotel privileges.

The Stratus Rewards Visa represents the premier luxury and unique customer service experience together with unmatched premium features within the financial sector.

The following article examines every facet of the Stratus Rewards Visa including its advantages alongside its eligibility prerequisites and yearly charge together with its competitive position against the American Express Black Card and other elite payment methods.

What Is the Stratus Rewards Visa (The “White Card”)?

The White Card represents a private credit card issued through Stratus Rewards Visa which targets highly affluent individuals who exceed specific financial thresholds. Traditional credit cards exclude this card because it exists solely for individuals who fulfil rigorous financial requirements and still need a personal invitation to receive the card.

The card brings a range of high-end rewards that satisfy the needs of individuals who desire superior treatment and gain access to top-tier world-class services. Anyone from seasoned travelers to business kings and people who enjoy high-end luxuries can experience the refined package of the Stratus Rewards Visa.

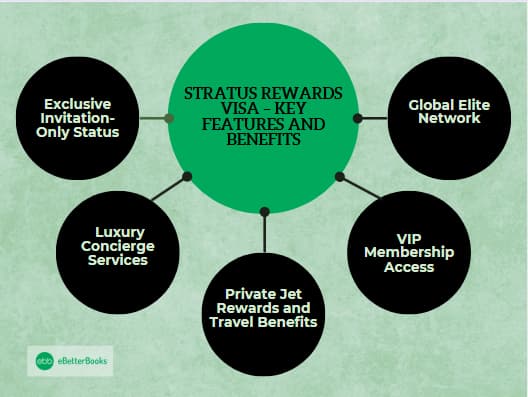

Stratus Rewards Visa – Key Features and Benefits

1. Exclusive Invitation-Only Status

The Stratus Rewards Visa stands out because the issuing company extends this credit card exclusively through invitation. Not like conventional credit cards the Stratus Rewards Visa becomes available only to those few specially chosen individuals. The issuer selects potential cardholders from applicant groups, and they preselect them according to financial standing and purchasing history combined with asset values. Both the rare membership access and the sense of mystery create an elegant image that establishes the card as a sign of being important as well as privileged.

2. Luxury Concierge Services

The Stratus Rewards Visa delivers its finest trait through its luxury concierge services. Stratus Rewards Visa cardholders receive uninterrupted 24/7 access to a concierge team that assists with travel planning along with reservations for hotels and flights and arranges restaurants and private events. Through their luxury concierge service, the concierge staff can help members obtain hard-to-find exclusive events alongside arranging private site tours in high-class places.

3. Private Jet Rewards and Travel Benefits

The Stratus Rewards Visa provides numerous travel advantages that form a major aspect of its rewards program. Stratus Rewards Visa members accumulate jet parking points as they fly which can be exchanged for private jet services. The Stratus Rewards Visa offers stylish comfort through jet travel benefits to customers who want to use their jets for business emergencies or personal vacations.

The Stratus Rewards Visa provides jet rewards for its cardholders but also includes travel benefits consisting of private airport lounge access priority boarding and VIP check-in services. This travel card provides the utter best travel experience for individuals who set no compromise limits on their travel needs.

4. VIP Membership Access

Cardholders of the Stratus Rewards Visa also gain access to a variety of VIP membership cards. Membership access grants members unparalleled entry to exclusive resorts, private clubs, and special events that cover every area of their lifestyle.

5. Global Elite Network

The Stratus Rewards Visa stands out from premium payment cards because it provides its members access to a worldwide elite networking system. The network provides cardholders with access to premier social events alongside luxury brand partnerships and restricted social scenes for networking. These special advantages involve exclusive early access to new fashion lineups as well as private show and gala attendance alongside special access to entertainment events and sports affairs.

Stratus Rewards Visa Eligibility Requirements

Individuals seeking the Stratus Rewards Visa must demonstrate both financial excellence alongside proper lifestyle requirements.

Potential Stratus Rewards Visa cardholders need to meet specific eligibility criteria according to the card issuer but common requirements that can be identified follow these guidelines:

1. High Net-Worth Individuals

Stratus Rewards Visa creators designed this exclusive payment solution for individuals with multi-million-dollar worth of assets because they belong to the high-net-worth individual (HNWI) category. Invitations for this card typically become available to people who demonstrate large-scale financial investments and substantial business interests and meet standards of high financial success.

2. Substantial Annual Spend

Members of the Stratus Rewards Visa program need to pay at least multiple hundred thousand dollars per year through their card. The main requirement for getting invited to submit a Stratus Rewards Visa application exists. The mandatory high annual spending balances two aspects: it ensures the operation of an elite rewards program and confirms the opulent life that cardholders lead.

3. Invitation-Only Process

The credit card remains unavailable for use by the public. People can request an application to join the program after evaluation based on their financial situation together with their habits and other suitable requirements. Stratus Rewards Visa maintains its reputation of exclusiveness because acceptance requires only invitations.

Stratus Rewards Visa Annual Fee and Other Costs

| The Stratus Rewards Visa stands apart from regular credit cards because it has an annual fee that surpasses the standard fees. Every Stratus Rewards Visa member pays an annual charge that typically amounts to thousands of dollars annually. The numerous exceptional benefits connected to this card make the annual charge reasonable in the opinion of most users. | Customers who possess Stratus Rewards Visa must pay costs for annual membership as well as transaction fees for specific purchases and costs for extra included services beyond basic membership benefits. The available fees from the Stratus Rewards Visa extend to private jet chartered transportation and VIP exclusive event tickets as well as premium lifestyle experiences. Clients who receive the card experience greater benefits than its fees due to their qualification status. |

Summary of Stratus Rewards Visa

- Issuer – Stratus Rewards

- Payment Gateway – Visa

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $1,500 annual membership fee

- International Transaction Fee – No Foreign Transaction Fees

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – Invitation-only; no public sign-up bonus

- Best For – Ultra-High Net Worth

| Key Features | Reward Rate |

|---|---|

| Private Jet Rewards | Points redeemable for private jet flights |

| Luxury Benefits | Exclusive hotel and car rental privileges |

| Concierge Services | – |

Stratus Rewards Visa vs. American Express Black Card (Centurion Card)

The rewards program of Stratus Rewards Visa gets mentioned frequently in analyses that include the American Express Black Card (officially known as the Centurion Card).

The American Express Black Card (Centurion Card) stands alongside Stratus Rewards Visa as the leading exclusive financial services products although they provide different advantages:

1. Invitation Process

Invitations to join serve as the only pathway to these cards although the Amex Centurion Card remains notoriously difficult to gain acceptance into. Membership invitations for the Centurion Card emerge only after customers demonstrate substantial spending on their regular American Express accounts that exceeds $250,000 annually.

To gain access to a Stratus Rewards Visa individual members must possess an exceptional level of overall net worth, unlike the Centurion Card.

2. Benefits and Perks

The luxury service benefits stretch from private concierge assistance to VIP membership and membership in private jet pools through these two payment cards. The Stratus Rewards Visa adds extra features to its service that might attract those concerned with elite global networks and branded collaborations.

Users indicate that the Stratus Rewards Visa surpasses the American Express Centurion Card in terms of exclusivity because it builds itself around premium travel benefits that include private jet rewards.

3. Annual Fee Comparison

The American Express Centurion Card sets higher rates for its initial fees and annual renewal compared to the Stratus Rewards Visa however the cost stands at an expensive level to match their luxurious services and benefits.

4. Global Access and Experiences

The rewards and benefits of these two cards grant members entry to exclusive clubs and private events along with VIP admission. The Stratus Rewards Visa stands apart from the American Express Centurion Card by providing members access to distinct benefits which include elite networking events across the world together with hard-to-reach exclusive events.

Why Does the Stratus Rewards Visa Stand Out

The Stratus Rewards Visa provides an exceptional package of exclusive benefits through its private jet perks together with luxury concierge services and privileged access to elite events which render it the premium choice for those who want only the best. Its invitation-only membership adds exclusivity which makes this card symbolize luxurious status for privileged clients.

Conclusion

The Stratus Rewards Visa (White Card) stands as one of the top-notch exclusive credit cards that features exceptional benefits intended for ultra-high-net-worth individuals. The card offers luxury concierge support and private jet awards in addition to invitations for elite global events which cater to individuals who expect premium features only. The expensive annual scheduling fee becomes reasonable since the benefits surpass the financial cost for users qualifying through high eligibility standards.

This Visa card stands out among the rest of luxury cards including the American Express Centurion Card because it delivers distinctive advantages that position it as an excellent choice for the most elite financial experiences.