American Express Centurion Card, widely known as “Amex Black Card,” is an ultra-exclusive status symbol offering unparalleled luxury benefits and services reserved for those who meet its strict requirements and can afford its substantial fees.

American Express has never made public the criteria for net worth along with spending that is necessary to be invited to their exclusive club of cardholders. American Express Centurion Card is reserved for the company’s wealthiest clients who meet certain net worth, credit quality, and spending requirements.

The Centurion Card is crafted from anodized titanium, featuring laser engraving and accents of stainless steel. It is reported to credit bureaus and has no preset credit limit.

Who Uses the American Express Centurion® Card?

The American Express Centurion® Card is designed for high-net-worth individuals, celebrities, business executives, and luxury travelers who require exceptional concierge services, exclusive travel benefits, and flexible spending options.

This card is available by invitation only and targets those who spend hundreds of thousands to millions of dollars each year on travel, dining, and luxury experiences.

Privileges of the American Express Centurion® Card

- Access to American Express Centurion Lounges at several US airports

- Complimentary companion airline tickets on international flights

- Centurion cardholders get top priority from Amex concierges – such as 24/7 access to a personal concierge

- Generous travel rewards, including elite status with hotel and car rental programs

- Personal shoppers at retailers such as Gucci, Escada, and Saks Fifth Avenue

- No pre-set credit limit

- Access to a comprehensive suite of exclusive benefits

- Complimentary access for cardholders and two guests to partner lounges at airports in 140 countries.

- First-class flight upgrades

- Access to Priority Pass Select lounges, Escape Lounges, Plaza Premium lounges, and Lufthansa lounges and other Global Lounge Collection partner lounges

- Access to additional lounge privileges based on the country the card is registered in

- Complimentary enrollment in Easirent Car Hire Platinum Service and the Avis Rent a Car President’s Club

- Hotel benefits include one free night

- The lounge offers services such as spa services,family room, wine tasting, shower suites, signature cocktails, and more.

American Express Centurion® Card

The Centurion® Card is suited for ultra-high-net-worth individuals looking for the highest levels of luxury travel rewards, personalized concierge benefits, and elite status in the airline and hotel industry. It provides ultimate experiences, including one-on-one shopping at upscale merchants, exclusive access to special events, and free companion tickets on certain flights.

Luxury and Exclusive Benefits

- Issuer – American Express

- Payment Gateway – AMEX

- Credit Score – Invite-only

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $10,000 (initiation) + $5,000 annual

- International Transaction Fee – 0%

- Cash Advance Fee – 5% or $10

- Balance Transfer APR – N/A

- Sign-up Bonus – Invite-only

- Best For – Ultra-High Net Worth, Company Employees, Frequent Travelers

The most exclusive Amex card, the Centurion® Card, also known as the “Black Card,” is invitation-only and designed for ultra-high-net-worth individuals. It offers luxury travel perks, elite status with airlines and hotels, and a personal concierge.

With a reported $10,000 initiation fee and a $5,000 annual fee, it requires an excellent credit score and high annual spending. Perks include exclusive events, fine dining access, and a dedicated relationship manager.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Ultimate Luxury | 4% back on dining | Uncapped rewards & elite concierge |

| Personalized Concierge | 3% back on hotels and airfare | Top-tier travel partnerships |

| VIP Travel Access | 2% back on online purchases | – |

| – | 1% back on all other purchases | – |

Pros & Cons:

Pros

- Cardholders will get dedicated 24/7 concierge and personal account managers to assist with travel, reservations, and exclusive experiences.

- Cardholders get priority access to elite travel programs, first-class upgrades, and luxury hotel privileges

- The card offers VIP invitations to luxury events, private clubs, and hard-to-book experiences.

Cons

- The card is not available to the general public, as it requires an invite based on high spending and financial status.

- While it offers valuable travel perks, other cards provide better points-earning structures for everyday spending.

- Amex is not as widely accepted as Visa or Mastercard, particularly in some regions.

Expert Advice

To maximize value, focus on first-class and business-class travel, utilizing airline alliances and hotel elite memberships. Take advantage of the Centurion concierge for hard-to-find reservations and personalized travel arrangements. Make sure to meet the spending limits to stay eligible.

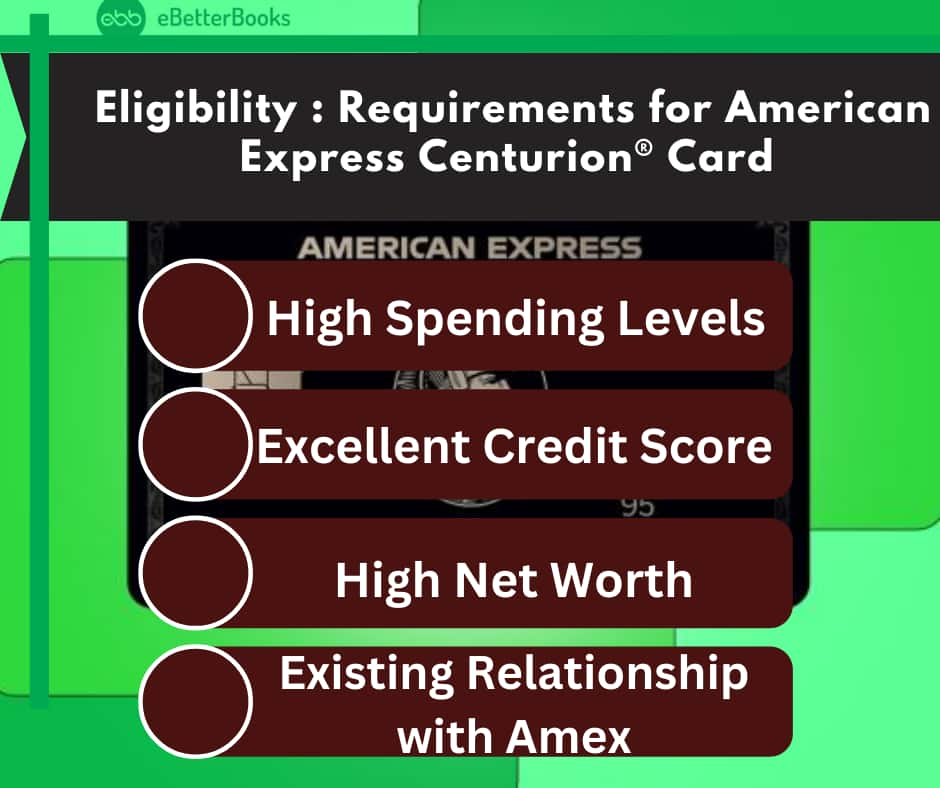

Eligibility: Requirements for American Express Centurion® Card

If you visit the American Express website, you won’t find specific requirements for the Amex Centurion Card. While there are no official qualifications listed, it is well-known that this exclusive card is reserved for a limited group of individuals.

However, there are certain factors that American Express considers when issuing invitations, and aligning with these aspects can improve your chances of being approved:

- High Spending Levels: One of the main criteria for the American Express Centurion Card is your spending habits. To qualify, prospective cardholders typically need to spend between $500,000 and $1 million annually. This level of spending demonstrates financial capacity and reliability.

- Existing Relationship with Amex: Regardless of your income and spending, you need to have a long-term relationship with American Express. This usually involves holding and actively using their credit cards, preferably top-tier ones. Demonstrating loyalty to the brand is essential.

- Excellent Credit Score: Applicants with excellent credit scores (800 or above) have a higher likelihood of being considered. An exemplary score reflects a strong financial history, responsible debt management, and a low risk of default.

- High Net Worth: It is widely recognized that Centurion cardholders are typically high-net-worth individuals with substantial liquid assets, investments, and overall financial stability.

You can give Amex a call if your banking and Platinum Amex spending match up to the mark. To get the card, you’ll have to be invited by American Express or request an invite.

One possible way to request an invitation for Centurion Membership is as follows:

- Visit the Amex website.

- Complete the “Interested in Centurion Membership” form.

- Here, you will need to enter your name and current American Express card details.

- Submit your request and wait for a response from American Express.

If Amex determines that you are a suitable candidate, they will send you an official invitation. However, this is only the first step in the process.

- Respond to the invitation using the designated phone number or personal contact provided within the invitation to express your interest.

- Before making a final decision, you will receive detailed information about the Centurion Card, including its benefits, terms, and fees. Make sure to review this information carefully to fully understand your commitments.

- Complete a formal application form as this will require additional financial information, such as your income, assets, and spending habits.

- After submitting your application, American Express will review it and make the final decision regarding your membership.

Benefits of Having an American Express Centurion® Card – “Black Card”

- Exclusive Access to Certain Events: The Centurion® Card from American Express provides cardholders with exclusive access to popular events such as sports games, concerts, theater shows, and more. This access is particularly appealing for those who enjoy experiencing a VIP atmosphere at these events.

- CLEAR® Plus Membership: CLEAR® Plus is an expedited security membership alternative to TSA PreCheck, available at over 30 airports and 20 sports and concert venues in the U.S. Amex Centurion Cardholders can receive a statement credit for the $199 annual membership fee, including credits for up to three family members.

- Fine Dining Privileges: The card provides access to exclusive dining experiences, including reservations at world-class restaurants and curated culinary events. Cardholders can also enjoy gourmet masterpieces from renowned chefs and unique menus, often tailored specifically for Centurion members.

- Access to the Centurion Lounge: While you are traveling, especially during long layovers, cardholders get access to a comfortable airport lounge. The Amex Black Card gets you free access to more than 1,700 airport lounges worldwide, including Amex Centurion Lounges, Delta Sky Clubs when you’re flying Delta, and Priority Pass™ airport lounges.

- 24/7 Personalized Concierge Service: The Amex Black Card offers 24/7 access to a personal concierge who can assist with travel arrangements, exclusive restaurant reservations, and securing tickets to events, as well as purchasing gifts for you.

- Equinox Membership: Centurion cardholders enjoy a complimentary Equinox Destination Access Membership. This membership allows them to access over 100 Equinox gym locations across the U.S., UK, and Canada. Normally, this membership tier costs $345 per month, along with a $500 initiation fee. Therefore, this perk is quite valuable for those who are fans of the upscale fitness club chain.

- No Spending Limit” The Amex Black Card has no preset spending limits, allowing you to purchase large items without a fixed cap. However, you must pay off your balance in full each month. Your spending capacity is flexible and adapts based on your purchase behavior, payment history, and credit profile.

- Up to $1,000 Per Year in Credits for Saks Fifth Avenue: The Amex Platinum Card comes with up to $100 worth of credits for Saks Fifth Avenue per year (enrollment required), which are divided into four credits of up to $250 per quarter of the year. Cardholders can receive a statement credit by making eligible Saks purchases with their Centurion card, up to the quarterly and annual limits.

- Luxury Travel Perks: Many types of credit cards emphasize rewards programs, and the Centurion Card is no exception. Cardholders earn 1 point for every dollar spent, redeemable for travel, shopping, or card fees. While this may not seem impressive, the card focuses more on premium benefits for those who prioritize luxury over costs.

Key travel perks of the American Express Centurion Card include:

- Access to over 1,000 lounges in 120 countries.

- Exceptional service in Centurion and American Express lounges.

- Quick arrangements for private jet travel.

- Complimentary premium services at select airports.

- VIP status with international airlines for better fares and upgrades.

- Elite status with luxury hotel brands like Hilton and Marriott.

- Enhanced car rental benefits through top loyalty programs.

- Other Lifestyle Perks: The Amex Black Card distinguishes itself from the Amex Platinum and Amex Business Platinum Cards with exclusive benefits, including elite travel status, international arrival service, top-tier concierge service, and unique wine-related perks like consultations with a wine specialist and special offers.

Other Alternate Exclusive Credit Cards That Require an Invitation

- Chase Sapphire Reserve®: This card is renowned for its exceptional travel rewards. It provides 3X points on travel and dining, a $300 annual travel credit, and comprehensive travel protections, making it an excellent choice for frequent travelers.

- Platinum Card® from American Express: This card offers a luxurious travel and lifestyle experience with premium perks, including airport lounge access, hotel upgrades, and concierge services. It comes at a more affordable annual fee compared to the Centurion® Card.

- Mastercard® Black Card™: This premium metal card offers luxury travel benefits, 24/7 concierge services, and exclusive airport lounge access. However, it has a lower reward structure compared to other high-end competitors.