Sberbank Visa Infinite Gold Card, American Express Centurion® Card , Coutts Silk Card, China CITIC Bank Private Banking Card, JP Morgan Reserve Card , Dubai First Royale MasterCard® are some of the popular card exclusive metal credit cards, offering various benefits such as VIP concierge services, travel privileges, exclusive access to high-end events and much more. These cards are available only by invitation or under strict criteria, as they offer holders privileges and a luxury lifestyle.

Top 7 Most Exclusive Metal Credit Cards in the World [2025]

| S.N. | Name of Most Exclusive Metal Credit Cards in the World | Best Known & Value for |

|---|---|---|

| 1 | Sberbank Visa Infinite Gold Card | Best Known for offering exclusive benefits for Russian elites. |

| 2 | American Express Centurion® Card | Best Known for invitation-only access, elite concierge services, and luxury perks worldwide. |

| 3 | Coutts Silk Card | Best Known for ultra-luxury banking and exclusive personal services offered to Coutts clients. |

| 4 | China CITIC Bank Private Banking Card | Best Known for premium financial services, catering to ultra-high-net-worth individuals in China. |

| 5 | JP Morgan Reserve Card | Best Known for high rewards on travel, and premium benefits for ultra-wealthy clients. |

| 6 | Dubai First Royale Mastercard® | Best Known for gold-plated cards and access to elite luxury services and privileges in Dubai. |

| 7 | Stratus Rewards Visa® | Best Known for exclusive rewards programs and luxury lifestyle benefits for high-net-worth individuals. |

Best Exclusive Metal Credit Cards in the World March 2025

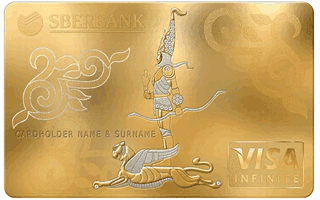

The Sberbank Visa Infinite Gold Card is an ultra-exclusive credit card crafted from solid gold and adorned with diamonds. Designed for ultra-high-net-worth individuals, it offers elite banking privileges, VIP concierge services, and luxury travel perks. With unparalleled status and premium benefits, this invitation-only card is a true symbol of wealth.

1. Sberbank Visa Infinite Gold Card

Sberbank Visa Infinite Gold Card is one of the world’s most exclusive credit cards, made of solid gold and embedded with diamonds. It offers elite banking privileges, luxury concierge services, and exceptional financial flexibility for ultra-high-net-worth individuals.

Premium Rewards and Benefits

- Issuer – Sberbank

- Payment Gateway – Visa

- Credit Score – N/A

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $2000

- International Transaction Fee – N/A

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – N/A

- Best For – Professionals

Issued by Sberbank, Russia’s largest bank, this exclusive Visa Infinite card is designed for high-net-worth individuals. It offers premium benefits, concierge services, and VIP airport lounge access. Cardholders enjoy exclusive travel perks like complimentary hotel upgrades and elite status at partner hotels, making it a prestigious choice for frequent travelers. The card also provides a high rewards rate on luxury purchases.

This card has a high annual fee, though the exact amount varies based on client eligibility. A high credit limit is available, but approval typically requires private banking membership. There is no referral program, but it includes comprehensive travel insurance, purchase protection, and priority access to international events, making it a top-tier option for affluent individuals.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Premium Benefits | Earn rewards points on purchases | Enjoy $250,000 of life and health insurance |

| Rewards | – | 24/7 concierge service |

| No late fees. | – | A personal manager at Sberbank |

| – | – | VIP access to luxury vacations and the world’s finest golf courses. |

Pros & Cons:

Pros

- Made of solid gold with embedded diamonds, it is a status symbol available only to Russia’s wealthiest individuals.

- Offers VIP banking privileges, including higher credit limits and exclusive investment opportunities.

- Offers 24/7 high-end concierge services, including luxury travel bookings, event access, and tailored experiences.

Cons

- Due to its solid gold design with embedded diamonds, getting a replacement can be complex and time-consuming.

- The gold and diamond construction makes it significantly heavier than regular credit cards, making it less practical for everyday transactions.

- Offered only to ultra-high-net-worth clients by invitation, making it inaccessible to most people.

Expert Advice

The Sberbank Visa Infinite Gold Card is an ultimate luxury item, crafted from solid gold and embedded with diamonds, making it one of the most exclusive cards globally. Designed for ultra-high-net-worth individuals, it offers elite banking and personalized concierge services. Due to its rarity and invitation-only access, it functions more as a status symbol than as a practical payment tool.

2. American Express Centurion® Card

The Centurion® Card is suited for ultra-high-net-worth individuals looking for the highest levels of luxury travel rewards, personalized concierge benefits, and elite status in the airline and hotel industry. It provides ultimate experiences, including one-on-one shopping at upscale merchants, exclusive access to special events, and free companion tickets on certain flights.

Luxury and Exclusive Benefits

- Issuer – American Express

- Payment Gateway – AMEX

- Credit Score – Invite-only

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $10,000 (initiation) + $5,000 annual

- International Transaction Fee – 0%

- Cash Advance Fee – 5% or $10

- Balance Transfer APR – N/A

- Sign-up Bonus – Invite-only

- Best For – Ultra-High Net Worth, Frequent Travelers

The most exclusive Amex card, the Centurion® Card, also known as the “Black Card,” is invitation-only and designed for ultra-high-net-worth individuals. It offers luxury travel perks, elite status with airlines and hotels, and a personal concierge.

With a reported $10,000 initiation fee and a $5,000 annual fee, it requires an excellent credit score and high annual spending. Perks include exclusive events, fine dining access, and a dedicated relationship manager.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Ultimate Luxury | 4% back on dining | Uncapped rewards & elite concierge |

| Personalized Concierge | 3% back on hotels and airfare | Top-tier travel partnerships |

| VIP Travel Access | 2% back on online purchases | – |

| – | 1% back on all other purchases | – |

Pros & Cons:

Pros

- Cardholders will get dedicated 24/7 concierge and personal account managers to assist with travel, reservations, and exclusive experiences.

- Cardholders get priority access to elite travel programs, first-class upgrades, and luxury hotel privileges

- The card offers VIP invitations to luxury events, private clubs, and hard-to-book experiences.

Cons

- The card is not available to the general public, as it requires an invite based on high spending and financial status.

- While it offers valuable travel perks, other cards provide better points-earning structures for everyday spending.

- Amex is not as widely accepted as Visa or Mastercard, particularly in some regions.

Expert Advice

To maximize value, focus on first-class and business-class travel, utilizing airline alliances and hotel elite memberships. Take advantage of the Centurion concierge for hard-to-find reservations and personalized travel arrangements. Make sure to meet the spending limits to stay eligible.

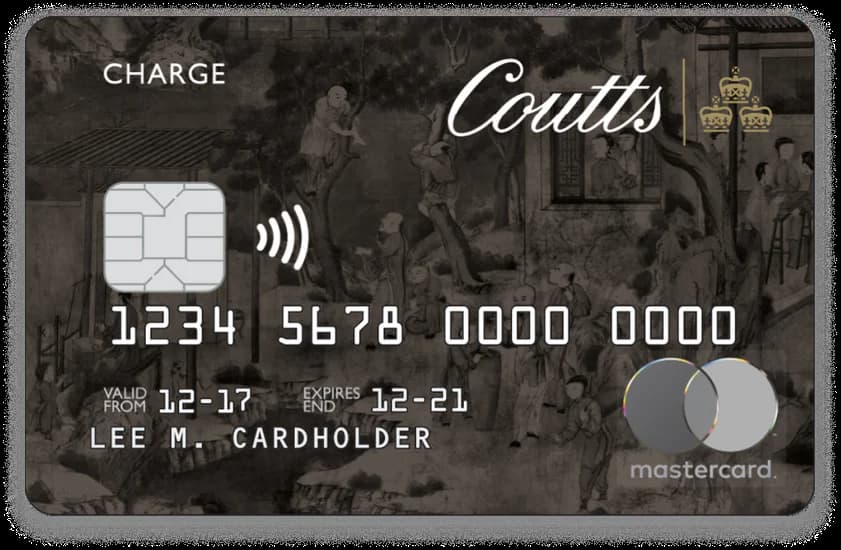

3. Coutts Silk Card

Coutts Silk Card, created for British high-net-worth individuals and social elites, the Coutts Silk Card is ideal for hassle-free global spending, VIP travel benefits, and bespoke wealth management services. It provides greater security, private banking advantages, and invitations to top events and experiences globally.

Luxury and Exclusive Benefits

- Issuer – Coutts

- Payment Gateway – Mastercard

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – No annual fee; by invitation only

- International Transaction Fee – No Foreign Transaction Fees

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – Invitation-only; no public sign-up bonus

- Best For – High Net Worth

Issued by Coutts, a prestigious UK private bank, the Coutts Silk Card is a luxury charge card available to Coutts clients. It offers premium travel perks, concierge services, and access to invitation-only experiences. The card is ideal for individuals seeking elite financial services and seamless global spending.

The card has no publicly disclosed annual fee and is invite-only. It requires a high credit score and substantial assets managed by Coutts. Perks include global concierge services, private event invitations, and travel insurance. There is no preset spending limit, making it highly flexible.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Exclusive to Coutts private banking clients | N/A | Coutts is known as “the bank of the British royal family”. |

| Personalized concierge services | – | Focuses on bespoke financial and concierge services. |

| High-end travel benefits | – | – |

| Luxury lifestyle perks & events | – | – |

| No preset spending limit | – | – |

Pros & Cons:

Pros

- Strong Travel Rewards: Exclusive benefits for luxury travelers.

- VIP Lifestyle Benefits: Access to premium events, clubs, and services.

- Exclusive Membership: Available only to Coutts’ elite banking clients

Cons

- Only Available in the UK: Not issued in the U.S. or globally.

- Requires High Net Worth: Limited to Coutts’ wealthiest customers.

- Limited Global Acceptance: Not as widely accepted as Visa or Amex.

Expert Advice

To maximize its benefits, apply the card to expensive international purchases, taking advantage of its competitive exchange rates and protection against fraud. For wealth management, Leverage Coutts offers premium financial services and networking opportunities. Because the card is only available to Coutts clients, a good banking relationship is key.

4. China CITIC Bank Private Banking Card

China CITIC Bank Private Banking Card is an exclusive, invitation-only card for ultra-high-net-worth individuals in China, offering elite financial services, concierge assistance, and luxury travel benefits.

Premium Benefits and Rewards

- Issuer – China CITIC Bank

- Payment Gateway – Visa

- Credit Score – N/A

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – N/A

- International Transaction Fee – N/A

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – N/A

- Best For – High net worth individuals

This exclusive credit card is issued by China CITIC Bank for its private banking clients. It offers elite travel benefits, including luxury airport lounge access, personal concierge services, and VIP hotel privileges. Cardholders can also earn rewards points on high-value purchases, making it a preferred option for high-net-worth individuals and business leaders who want premium banking services.

The annual fee varies and is typically waived for private banking clients. This card offers an extremely high credit limit, but eligibility requires a minimum deposit threshold with CITIC Bank’s private banking division. No referral program exists, but benefits include comprehensive travel insurance, fine dining experiences, luxury event invitations, and dedicated relationship management services, ensuring personalized financial solutions.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Premium Benefits | Earn rewards points on purchases | N/A |

| Rewards | – | – |

Pros & Cons:

Pros

- Offers 24/7 global concierge assistance for luxury travel, event bookings, and lifestyle experiences.

- Grants VIP airport lounge access and luxury transportation services worldwide.

- Provides priority banking, wealth management solutions tailored for high-net-worth individuals.

Cons

- While powerful in China, it may not be as widely accepted overseas compared to Visa or Mastercard.

- Focuses on elite privileges rather than maximizing cashback or point-based rewards.

- Clients must meet stringent financial criteria, making it inaccessible to most individuals.

Expert Advice

The China CITIC Bank Private Banking Card is designed for high-net-worth individuals seeking exclusive wealth management, elite travel benefits, and personalized concierge services. However, its invitation-only status and limited global acceptance may not be suitable for frequent international travelers.

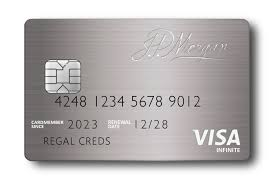

5. JP Morgan Reserve Card

JP Morgan Reserve Card is best suited for high-end travelers who appreciate premium perks, such as top-of-the-line hotel and airline benefits, concierge services, and VIP event invitations. It offers a Priority Pass lounge membership, comprehensive travel insurance, and high returns on travel and dining charges.

Luxury and Exclusive Benefits

- Issuer – Chase

- Payment Gateway – Visa

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – 22.49% – 29.49%

- Annual Fee – $595

- International Transaction Fee – 0%

- Cash Advance Fee – 5% or $10

- Balance Transfer APR – 22.49% – 29.49%

- Sign-up Bonus – Invite-only

- Best For – Ultra-High Net Worth, Frequent Travelers

An ultra-exclusive card designed for elite Chase Private Clients. It offers luxury travel perks and concierge services. Invitation-only for high-net-worth individuals.

With a $595 annual fee, this metal card includes unlimited Priority Pass access, a high credit limit, and luxury hotel privileges. There are no foreign transaction fees, and users benefit from elite service.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Access to Priority Pass lounges | 10x points on hotels via Chase Travel | Previously known as the Palladium Card |

| Comprehensive travel insurance | 3x points on dining & travel | Designed for J.P. Morgan Private Bank clients only. |

| High rewards on travel & dining | – | – |

| Made of palladium & gold | – | – |

Pros & Cons:

Pros

- Top-Tier Customer Service: Access to premium concierge and travel support.

- Ultra-exclusive: Available only to J.P. Morgan Private Bank clients.

- No Preset Spending Limit: This allows flexible, high-value transactions.

Cons

- High Asset Requirement: Must hold $10M+ with J.P. Morgan.

- Limited Benefits Disclosure: Perks are not publicly advertised.

- Invite-Only: Not open to general applicants.

Expert Advice

To get the most out of this card, apply it to high-end travel reservations and big-ticket purchases, taking advantage of its purchase protection and extended warranties. Combine it with Chase’s Ultimate Rewards program for better point redemptions. Since it is initiation-only, having a solid banking relationship with J.P. Morgan Private Bank is essential.

6. Dubai First Royale Mastercard®

Dubai First Royale Mastercard® is a highly rare card ideal for individuals who need no credit limits and require white-glove service globally. It offers a personal relationship manager, VIP access, and tailor-made concierge services, so it is great for those who regularly indulge in high-end retail, private journeys, and premier experiences.

Luxury and Exclusive Benefits

- Issuer – Dubai First

- Payment Gateway – MasterCard

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – No annual fee; undisclosed

- International Transaction Fee – No Foreign Transaction Fees

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – Invitation-only; no public sign-up bonus

- Best For – Ultra-High Net Worth

The Dubai First Royale Mastercard is one of the world’s most exclusive credit cards, designed for ultra-high-net-worth individuals. Issued by Dubai First, this card features no credit limit, a 24/7 personal concierge, and a design adorned with gold and diamonds. It offers luxury services, including access to elite travel experiences and financial privileges.

The card is strictly invite-only and has an undisclosed annual fee. It requires an extremely high net worth and impeccable credit history. Benefits include no pre-set spending limits, bespoke financial solutions, and a dedicated relationship manager to handle all financial needs.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| 24K gold-plated with a diamond | N/A | Invite-only for ultra-high-net-worth individuals |

| Unlimited credit line | – | One of the rarest credit cards globally. |

| Dedicated relationship manager | – | – |

| Personalized concierge service | – | – |

| Features a gold crest on the front as a signature design. | – | – |

Pros & Cons:

Pros

- No Spending Limits: Truly unlimited purchasing power.

- Ultimate Status Symbol: One of the rarest and most luxurious credit cards.

- Elite Concierge Service: Personalized, high-end financial and travel support.

Cons

- Exclusive to Billionaires: Only offered to royalty and ultra-high-net-worth individuals.

- Not Available in the U.S.: Issued only to select individuals globally.

- No Public Benefits List: Perks and rewards remain undisclosed.

Expert Advice

Maximize its benefits by utilizing personal banking services and high-end lifestyle perks. The no-limit spending feature makes it ideal for investment purchases and once-in-a-lifetime experiences. Since it is an invite-only, maintaining a strong financial standing and elite social connections enhances eligibility.

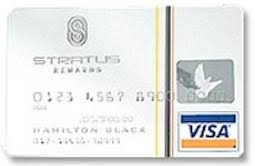

7. Stratus Rewards Visa®

Stratus Rewards Visa® is designed for luxury travelers who desire private jet flights, exclusive lifestyle experiences, and individualized concierge service. Members are able to redeem points for private aviation, hotel stays, and tailored experiences, which is a high-end lifestyle card.

Luxury and Exclusive Benefits

- Issuer – Stratus Rewards

- Payment Gateway – Visa

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $1,500 annual membership fee

- International Transaction Fee – No Foreign Transaction Fees

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – Invitation-only; no public sign-up bonus

- Best For – Ultra-High Net Worth

The Stratus Rewards Visa, known as the “White Card,” is an elite credit card designed for high-net-worth individuals. Unlike traditional premium cards, it focuses on luxury experiences, including private jet discounts, exclusive travel perks, and luxury hotel privileges.

The card operates on an invite-only basis with a $1,500 annual fee. It requires a high credit score and significant financial assets. Unique benefits include points that can be redeemed for private jet travel, custom concierge services, and access to elite networking events.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Luxury travel rewards | Points redeemable for private jet flights | Known as “The White Card, ” contrasting traditional black cards |

| Private jet & elite hotel discounts | Exclusive hotel and car rental privileges | Created for celebrity and elite members seeking luxury perks. |

| Exclusive access to high-end resorts | – | – |

| High reward points for unique experiences | – | – |

| Membership-based (invite-only) | – | – |

Pros & Cons:

Pros

- Unique White Metal Design: A rare alternative to black cards.

- Strong Travel Perks: Rewards for private jets, luxury hotels, and first-class flights.

- VIP Event Access: Exclusive invites to top-tier entertainment and social events.

Cons

- Less Recognized than Amex Centurion: Not as well-known or prestigious.

- Hard to Obtain: Invite-only for high-net-worth individuals.

- Limited Redemption Options: Reward points can only be used for select travel perks.

Expert Advice

To maximize the card’s use, use the points to buy expensive travel opportunities instead of average purchases. Meet other card members at exclusive events. As this is an invitation-only card, one’s good credit profile and lavish spending behavior determine whether one will qualify.

Summary Table

| Card Name | Sberbank Visa Infinite Gold Card | American Express Centurion® Card | Coutts Silk Card | China CITIC Bank Private Banking Card | JP Morgan Reserve Card | Dubai First Royale MasterCard® | Stratus Rewards Visa® |

|---|---|---|---|---|---|---|---|

| Issuer | Sberbank | American Express | Coutts | China CITIC Bank | Chase | Dubai First | Stratus Rewards |

| Payment Gateway | Visa | AMEX | MasterCard | Visa | Visa | MasterCard | Visa |

| Credit Score | N/A | Invite-only | Excellent | N/A | Excellent | Excellent | Excellent |

| Annual Fee | $2000 | $5000 | No annual fee | N/A | $595 | No annual fee | $1500 |

| Sign-up Bonus | N/A | Invite-only | Invitation-only; no public sign-up bonus | N/A | Invite-only | Invitation-only; no public sign-up bonus | Invitation-only; no public sign-up bonus |

| Reward Rate | Earn rewards points on purchases | 4% on dining,3% on hotels, 2% on online purchases | N/A | N/A | 10x points on hotels via Chase Travel, 3x points on dining & travel | N/A | Points redeemable for private jet flights, Exclusive hotel and car rental privileges |

| Foreign Transaction Fees | N/A | 0% | N/A | N/A | 0% | N/A | N/A |

| Intro APR | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| Regular APR | N/A | N/A | N/A | N/A | 22.49% – 29.49% | N/A | N/A |

| Best For | Professionals | Ultra-high net worth | High Net Worth | High Net Worth | Ultra-High Net Worth, Frequent Travelers | Ultra-high net worth | Ultra-high net worth |

| Decision Criteria | It is ideal for Russian elites seeking luxury financial services. | It is ideal for ultra-high-net-worth individuals seeking unparalleled benefits. | It is ideal for high-net-worth individuals looking for premium banking. | It is ideal for high-net-worth individuals in China seeking exclusive services. | It is ideal for frequent travelers with a high-net-worth looking for luxury benefits. | It is ideal for ultra-high-net-worth individuals in the UAE seeking luxurious services. | It is ideal for ultra-high-net-worth individuals seeking exclusive rewards. |

What Makes a Credit Card Exclusive and Prestigious?

An exclusive credit card offers invitation-only access, premium materials, elite benefits, and exceptional luxury services. This card is typically issued to ultra-high-net-worth individuals with high or no credit limits, often accompanied by personalized concierge services, private banking privileges, and luxury travel benefits.

Unlike standard credit cards, luxury metal cards are actually made with gold plating, embedded diamonds, or titanium enhancing their status as a symbol of wealth and influence. The card offers VIP access to exclusive events, hotel upgrades, and elite financial services, making it more prestigious and powerful.

Factors to Consider When Choosing an Exclusive Metal Credit Card

- Invitation-Only Access & Eligibility: Most prestigious metal cards are invitation-only and come with a set of financial criteria, such as net worth or spending on an annual basis.

- Global Acceptance & Flexibility: Ensure global acceptance, along with the corresponding benefits catering to global travel and spending.

- Annual Fees & Costs: These cards charge excessive fees but ensure the return of reward points and other benefits justify the cost.

- Luxury Benefits: Look for special privileges such as VIP access to airport lounges, concierge service, luxury travel upgrades, and personalized experiences according to your lifestyle.

- Rewards & Cash Back Programs: Analyze the rewards structure to ensure it provides the desired benefits in categories that matter to you, such as luxury travel, dining, and shopping.

Top Benefits of Holding an Elite Metal Credit Card

- Luxury Travel Benefits: Priority boarding, airport lounge access, and hotel upgrades enhance travel experiences for both business and leisure.

- VIP Access and Concierge Services: Enjoy access to 24-hour concierge support that will look after you in your travel arrangements, event bookings, dining reservations, and other personalized experiences that provide you with fabulous lifestyle elevations.

- Tailored Financial Products: Benefit from personalized financial services like private banking, wealth management, or tailor-made investment strategies to meet your very own financial goals.

- Top-Tier Security and Fraud Protection: Elite metal cards offer fraud protection as well as a greater safeguard against identity theft.

- VIP Exclusive Rewards and Points Programs: Enjoy the high premium rewards with bonus cashback or point collections that can be redeemed for luxury travel, shopping, or even for special experiences.

- Prestige and Status Symbol: Using a metal credit card often signifies wealth and influence, granting access to exclusive events, luxurious experiences, and the recognition that comes with them.

FAQs

What Makes a Metal Credit Card Exclusive?

Metal credit cards are exclusive due to invitation-only access, luxury benefits, high spending limits, and premium services like concierge and travel privileges tailored for ultra-high-net-worth individuals.

Can I Use Exclusive Metal Credit Cards Worldwide?

Yes, these cards are generally accepted worldwide and include premium travel benefits like airport lounge access and global concierge services.

What Benefits Do Exclusive Metal Credit Cards Offer?

They offer luxury perks, including VIP event access, travel upgrades, concierge services, customized rewards, and private banking access.

Are There Any Annual Fees for These Cards?

Yes, they often have high annual fees, but the luxury benefits are usually seen as worth the cost for those who qualify.

How Can I Qualify for an Exclusive Metal Credit Card?

Qualification typically requires significant wealth, high spending thresholds, and sometimes an invitation from the issuer based on annual income, assets, or banking relationships.