The J.P. Morgan Reserve Card is the most elite and exclusive credit card globally, reserved for ultra-high-net-worth individuals. In contrast to other luxury cards that need a high credit score or a high income, this card is issued by invitation only to J.P. Morgan Private Bank clients. It provides top-of-the-line travel rewards, luxury benefits, and a metal finish that makes it a real status symbol.

In this article, we’ll explore everything about the J.P. Morgan Reserve Card, including its eligibility criteria, ultra-luxury benefits, exclusivity, spending limits, and alternative options for those who don’t qualify.

What is the J.P. Morgan Reserve Card?

The J.P. Morgan Reserve Card, previously called the Palladium Card, is an upscale, invitation-only credit card offered by Chase. It is reserved solely for customers of J.P. Morgan Private Bank and is viewed as being a notch higher than the Chase Sapphire Reserve.

This heavy metal card is among the heaviest credit cards in existence, and its heaviness adds to its prestige and value. Although its benefits are very similar to the Chase Sapphire Reserve, it provides extra benefits suited for J.P. Morgan’s high-end clients.

Eligibility: Who Can Have It?

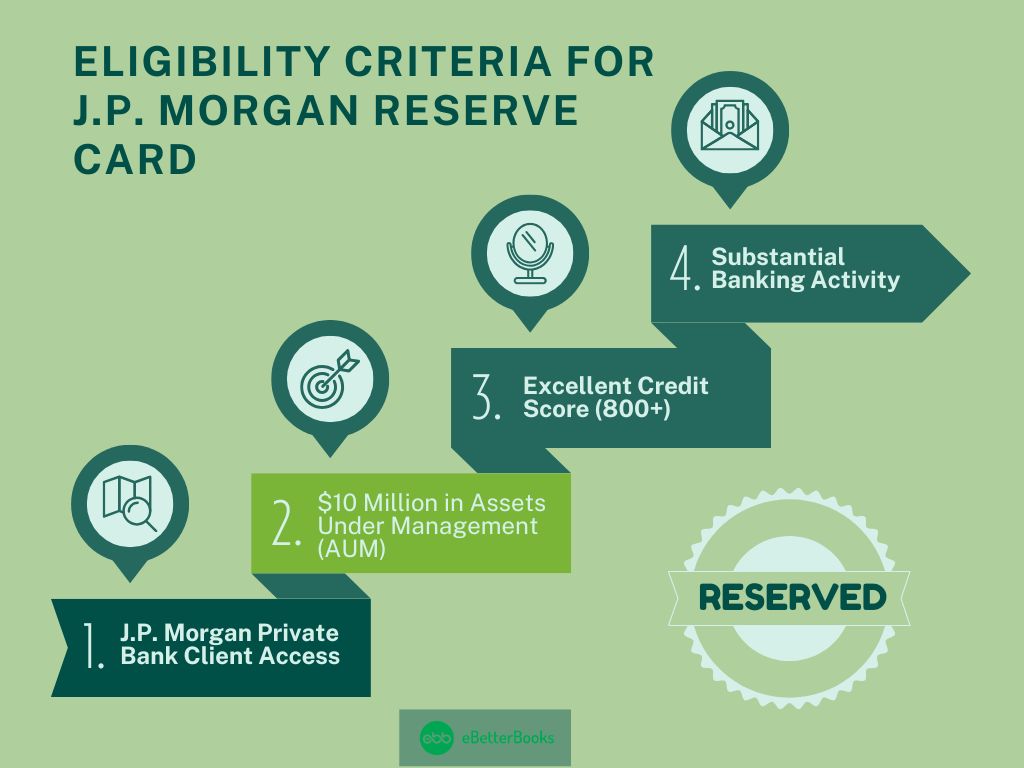

To qualify, you will need to fulfil the following:

- J.P. Morgan Private Bank Client: You should have a private banking relationship with J.P. Morgan.

- $10 Million in Assets Under Management (AUM): This requires you to have a minimum of $10 million in investments, cash, or other holdings with J.P. Morgan.

- Excellent Credit Score: While an excellent credit score (800+) is anticipated, it is not as important as the wealth aspect.

- Substantial Banking Activity: Large transactions, business accounts, or active investments with J.P. Morgan help you get an invitation.

Because this card is not open to the general population, even someone with a very high income can be excluded from it unless he or she fulfils the private banking requirement.

Ultra-Luxury Benefits of the J.P. Morgan Reserve Card

The J.P. Morgan Reserve Card provides some of the ultimate high-end travel, dining, and lifestyle perks that make this one of the top premium credit cards on the market.

- Premium Travel Rewards

- 3x Points on Travel & Dining: Get triple points on flights, hotels, and restaurants.

- 1x Points on Other Purchases: Get one point per dollar on non-travel purchases.

- Ultimate Rewards Program: Use points to book flights, hotels, and special experiences.

- Annual $300 Travel Credit

- You get a $300 statement credit for travel expenses, such as flights, hotels, and car rentals, every year.

- Complimentary Airport Lounge Access

- The card features a Priority Pass Select membership, offering complimentary access to more than 1,300 airport lounges globally.

- Elite Hotel & Airline Perks

- Complimentary room upgrades, VIP service, and early check-in at certain luxury hotels. Airlines’ benefits include priority boarding and baggage fee exemptions.

- 24/7 Personal Concierge Service

- This high-end concierge service assists card members with travel reservations, fine dining reservations, and VIP event entry.

- No Foreign Transaction Fees

- Ideal for foreign travelers, this card does not impose foreign transaction fees on international purchases.

- Heavy Metal Card Design

- The J.P. Morgan Reserve Card is among the heaviest credit cards, constructed of solid metal rather than plastic. The distinctive design contributes to its uniqueness and makes it a real status symbol.

Exclusivity: Not for Everyone

The J.P. Morgan Reserve Card functions as more than an ordinary premium credit card since it signifies elite status and dignified banking relations among ultra-high-net-worth individuals. J.P. Morgan Reserve Cards exist only through invitations because applicants must finish an examination of exclusivity, which makes this premium credit card among the rarest financial instruments in the market.

Even inside the group of wealthy people, the Reserve Card remains out of reach for some users. Pursuing the J.P. Morgan Private Bank has two fundamental requirements because the Reserve Card grants exclusive use to bank customers. J.P. Morgan refuses all unsolicited Reserve Card applications since the banking institution reserves this premium credit option for individuals they invite.

Why is the card so exclusive?

This credit card stands among the most challenging to acquire because of multiple important factors.

Invite-Only Access

There exists no online or bank-based application process for this card since the J.P. Morgan Reserve Card operates as an exclusive card without public application options.

A small group of eligible people who hold an elite banking relationship at J.P. Morgan can qualify for the invitation to obtain this restricted card.

Strict Wealth Requirements

A person requires a minimum $10 million AUM with J.P. Morgan Private Bank to receive an invitation to its card program.

The assets that account for the invitation include cash, stocks, bonds, and various kinds of investment assets.

The exclusive invitation benefits apply only to those who keep their wealth within J.P. Morgan’s boundaries as it does not extend to clients from Goldman Sachs and Morgan Stanley unless they move their wealth to J.P. Morgan.

Limited Availability

Few people obtain invitations to the J.P. Morgan card because the selection process is very exclusive.

The restricted availability of the card protects both its status and its exclusivity value.

The J.P. Morgan Reserve Card serves an exclusive population since J.P. Morgan limits it to its top customers.

Not Just About Money—Banking Relationship Matters

The mere possession of $10 million cannot secure access to the J.P. Morgan Reserve Card. J.P. Morgan Private Bank issues the card exclusively to customers who currently maintain active bank and advisor relationships.

The bank extends invitations only to those who maintain an active bank relationship at J.P. Morgan Private Bank rather than people who meet wealth criteria elsewhere.

Those investors who hold business accounts at J.P. Morgan while consistently using their private banking services and making investments with the bank are most likely to receive an invitation.

A Status Symbol for Ultra-High-Net-Worth Individuals

The J.P. Morgan Reserve Card openly proclaims coveted status by letting others know its carrier is among elite banking stakeholders who receive premium financial services together with investment choices and private assistance services. This exclusive status makes the card unattainable to many, which in turn maintains its position as an extremely sought-after luxurious purchase that symbolizes both practical benefits and luxury status.

Limits of J.P. Morgan Reserve Card

Travel and lifestyle benefits associated with the J.P. Morgan Reserve Card stand as top-tier, but these features are limited compared to other luxury credit cards.

Costs More than the Benefits

The card operates with a $595 annual fee and matches the fees set by similar premium cards such as the Chase Sapphire Reserve ($550) and the American Express Platinum ($695).

The luxurious perks that accompany the fee justify its costs for users, though the expense remains significant and burdensome for card members.

Additional users added to the card account by the primary cardholder will face an extra cost.

Benefits Are Similar to Chase Sapphire Reserve

The J.P. Morgan Reserve Card features an exclusive membership, yet it provides the same benefits as the Chase Sapphire Reserve, like:

- 3x points on travel and dining

- $300 annual travel credit

- Priority Pass lounge access

- Luxury travel protections and concierge services

Obtaining the card provides additional status, but its main features exist in other bank cards that hold wider market availability.

Obtaining this card remains out of reach for most wealthy individuals since J.P. Morgan Private Bank requires exclusive membership before making an invitation.

Wealthy clients who have accounts at other financial institutions are excluded from obtaining invitations to use this card.

The card requires individuals who do not want to place $10 million assets in J.P. Morgan accounts to remain ineligible for the card.

Limited Redemption Flexibility

The Ultimate Rewards program remains valuable, yet the American Express Platinum card gives better collaboration options besides direct transfer dynamics for its redemption process.

Alternatives: Because Everyone Can’t Have It

Due to its elite and restrictive requirements, the J.P. Morgan Reserve Card extends its invitations to few people in the world. The public market has alternative luxury credit cards with equivalent benefit structures that remain available for purchase.

The Chase Sapphire Reserve Card

- Annual Fee: $550

- 3x points on travel & dining

- $300 annual travel credit

- Priority Pass lounge access

- Why Choose It? People who do not have a J.P. Morgan Private Bank relationship still receive similar benefits from this card.

American Express Platinum Credit Card

- Annual Fee: $695

- Users achieve 5x points when booking flights and hotels through Amex Travel.

- $200 airline fee credit

- Centurion Lounge & Priority Pass access

- Why Choose It? Travel perks combined with elite hotel status and premium lounge access form the main advantages.

Capital One Venture X Credit Card

- Annual Fee: $395

- 2x miles on all purchases

- 10x miles on hotels & car rentals through Capital One Travel

- Travel protections and membership to airport lounges form part of the card package.

- Why Choose It? The card satisfies those who need high-end travel benefits without breaking their budget.

These alternative credit cards deliver equivalent travel benefits together with guest lounge rights, even though they fail to reach the same elevated banking standards as the J.P. Morgan Reserve Card.

Summary Table for J.P. Morgan Reserve Card

The J.P. Morgan Reserve Card is best suited for high-end travelers who appreciate premium perks, such as top-of-the-line hotel and airline benefits, concierge services, and VIP event invitations. It offers a Priority Pass lounge membership, comprehensive travel insurance, and high returns on travel and dining charges.

Luxury and Exclusive Benefits

- Issuer – Chase

- Payment Gateway – Visa

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – 22.49% – 29.49%

- Annual Fee – $595

- International Transaction Fee – 0%

- Cash Advance Fee – 5% or $10

- Balance Transfer APR – 22.49% – 29.49%

- Sign-up Bonus – Invite-only

- Best For – Ultra-High Net Worth, Frequent Travelers

An ultra-exclusive card designed for elite Chase Private Clients. It offers luxury travel perks and concierge services. Invitation-only for high-net-worth individuals.

With a $595 annual fee, this metal card includes unlimited Priority Pass access, a high credit limit, and luxury hotel privileges. There are no foreign transaction fees, and users benefit from elite service.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Access to Priority Pass lounges | 10x points on hotels via Chase Travel | Previously known as the Palladium Card |

| Comprehensive travel insurance | 3x points on dining & travel | Designed for J.P. Morgan Private Bank clients only. |

| High rewards on travel & dining | – | – |

| Made of palladium & gold | – | – |

Pros & Cons:

Pros

- Ultra-exclusive: Available only to J.P. Morgan Private Bank clients.

- No preset spending limit: This allows flexible, high-value transactions.

- Top-tier customer service: Access to premium concierge and travel support.

Cons

- Invite-only: Not open to general applicants.

- High asset requirement: Must hold $10M+ with J.P. Morgan.

- Limited benefits disclosure: Perks are not publicly advertised.

Expert Advice

To get the most out of this card, apply it to high-end travel reservations and big-ticket purchases, taking advantage of its purchase protection and extended warranties. Combine it with Chase’s Ultimate Rewards program for better point redemptions. Since it is initiation-only, having a solid banking relationship with J.P. Morgan Private Bank is essential.

Beyond luxury perks and metal aesthetics, the J.P. Morgan Reserve Card carries strategic depth few understand. These exclusive subtopics uncover what truly influences eligibility, status, and long-term cardholder privileges. If you’re aiming to break into this ultra-elite circle, these are the insights that actually matter.

How the J.P. Morgan Reserve Card Compares with Centurion by American Express

Both the J.P. Morgan Reserve Card and the Amex Centurion (Black Card) are invite-only, but they cater to different elite tiers. The Centurion requires $250,000+ annual spending and a $10,000 initiation fee, while the J.P. Morgan Reserve needs $10 million in assets with J.P. Morgan Private Bank—no spend minimum, just deep banking ties. Centurion offers 5x points on Amex Travel, elite hotel status, and personal shoppers. In contrast, J.P. Morgan Reserve focuses on banking-integrated concierge, $300 travel credit, and heavy metal prestige. If you’re banking-first, go J.P. Morgan. If you’re lifestyle-first, Centurion fits better. Both are status-defining, but not interchangeable.

The Role of Relationship Managers in Securing a Reserve Card Invitation

J.P. Morgan doesn’t issue Reserve Card invites based on wealth alone. Your relationship manager plays a decisive role—handling $10M+ in AUM is just the beginning. You need at least 3+ years of consistent investment activity, 2+ products under advisory (like trusts or portfolios), and active dialogue with wealth advisors. Managers evaluate loyalty, engagement level, and long-term strategy alignment. The deeper your interaction, the stronger your case. Clients who regularly consult on estate planning, tax strategies, or philanthropy get prioritized. It’s not just money—it’s your banking behavior, reputation, and alignment with J.P. Morgan’s elite ecosystem that triggers an invite.

Can Business Owners Leverage Corporate Accounts to Get Closer to Eligibility?

Yes, but not automatically. Owning a business with $10M in assets won’t qualify you unless those funds are under J.P. Morgan Private Bank’s direct management. You’ll need 1 corporate account, 2+ linked investment products, and active usage of J.P. Morgan’s commercial services. Relationship managers assess how involved you are in the bank’s ecosystem—frequent treasury activity, private lending, or M&A advising boosts eligibility. Business liquidity, not just valuation, matters. Owners who consolidate personal and business assets under one J.P. Morgan umbrella significantly improve their invitation chances. Separate accounts? Less impact. Integrated banking equals better visibility and faster recognition.

The Psychological Appeal of Ultra-Exclusive Credit Cards Among Billionaires

For billionaires, it’s not about points—it’s about presence. Ultra-exclusive cards like the J.P. Morgan Reserve signal 3 things instantly: financial authority, elite connections, and institutional trust. With just 0.01% global accessibility, this card isn’t flexed—it’s recognized. Psychologically, it satisfies identity, security, and social signaling needs. It tells private bankers you’re committed, tells peers you’re vetted, and tells staff you’re protected by premium services. Unlike generic luxury, this exclusivity offers quiet dominance, not loud branding. For the ultra-wealthy, who already have everything, rare access—not rewards—becomes the true currency of power and personal satisfaction.

What Happens If a Cardholder Leaves J.P. Morgan Private Bank?

Losing Private Bank status means losing the Reserve Card—no exceptions. Once AUM drops below $10M, or your active banking relationship ends, a 30–60 day closure notice is triggered. You’ll retain points for 45 days, but lose concierge access, lounge entry, and travel benefits immediately after deactivation. J.P. Morgan doesn’t convert the account to a Sapphire Reserve or downgrade option. Users must redeem or transfer points fast, close out auto-pay links, and switch to alternative premium cards. The card’s benefits are tied directly to your private banking status—once that’s gone, so is your elite financial footprint.

Exclusive Layers Behind the Reserve: Supplementary Insights You’ve Likely Missed

While most focus on perks and eligibility, the real story behind the J.P. Morgan Reserve Card lies in its hidden structure, history, and behind-the-scenes mechanisms. These supplementary insights reveal how the card evolved, who truly qualifies, and why even millionaires get turned away. If you’re aiming for access, these are the details that actually move the needle.

The Evolution of the Palladium Card into the J.P. Morgan Reserve Brand

The card began as the ultra-rare Palladium Card in 2009, made of actual palladium and gold, and offered quietly to J.P. Morgan’s top 1%. In 2016, it rebranded as the J.P. Morgan Reserve Card, aligning with Chase’s Ultimate Rewards platform. Despite the change, it retained 3 legacy traits: invite-only access, Private Bank requirement, and prestige-metal design. Unlike mass-market upgrades, this evolution preserved its exclusivity while enhancing redemption value via Chase Travel. The rebrand wasn’t cosmetic—it marked the merging of old-world prestige with modern banking tools, offering elite users both status and tech-driven flexibility under one iconic product.

Security Features and Metal Composition Breakdown of the Reserve Card

The J.P. Morgan Reserve Card isn’t just heavy—it’s engineered for security and status. Weighing around 27 grams, it’s crafted from a custom alloy blend of palladium and stainless steel, making it nearly twice as dense as regular metal cards. Security-wise, it includes EMV chip protection, encrypted contactless pay, and unique account monitoring protocols exclusive to Private Bank clients. Fraud alerts are handled by a dedicated high-net-worth security team, not general customer service. Even the card number is laser-etched for longevity and tamper resistance. In short, it’s built to defend both your assets and your image—without compromise.

Stories and Anecdotes: How Real People Were Invited to the Reserve Card Program

Invites to the J.P. Morgan Reserve Card often come quietly—via a discreet call from a relationship manager or a personal note during a portfolio meeting. One client received it after maintaining $15M AUM and actively using estate planning services for 2+ years. Another got the invite after selling his tech company and consolidating assets across 3 J.P. Morgan divisions. Consistent traits? Long-term loyalty, multi-generational planning, and strategic financial behavior. No flashy spending or direct applications—just high trust and full integration. These real-world stories prove: it’s not about asking for the card, it’s about living in a way that earns it.

Behind the Scenes: How J.P. Morgan Selects and Screens Potential Invitees

Selection isn’t random—it’s algorithmic, advisor-led, and compliance-verified. Every quarter, J.P. Morgan screens accounts with $10M+ AUM, but filters go deeper. They assess 5+ banking touchpoints—like private lending, trust services, and philanthropic advisory use. Clients are scored on relationship tenure (3+ years preferred), asset diversity, and portfolio stability. Advisors then submit a shortlist to internal committees, where legal and compliance verify client standing. Even if qualified, you might wait a year or more before getting invited—because timing, discretion, and brand fit also matter. Simply put, J.P. Morgan doesn’t just invite wealth—they invite alignment.

Why Most Millionaires Still Don’t Qualify—A Closer Look at the Requirements Gap

Being a millionaire isn’t enough. Over 22 million U.S. households have $1M+ in assets, yet less than 0.01% qualify for the J.P. Morgan Reserve Card. Why? The gap lies in 3 core areas: consolidated AUM of $10M+ at J.P. Morgan, active Private Bank engagement, and long-term relationship depth. Many millionaires spread assets across institutions or use retail banking—not private advisory. Others lack multi-product usage like trusts, lending, or investment portfolios under one roof. J.P. Morgan seeks integration, not fragmentation. This card rewards centralization, consistency, and elite behavior—not just net worth on paper.

Conclusion

J.P. Morgan Reserve Card represents one of the world’s most exclusive credit cards, which it issues through invitations to manage $10 million in assets with J.P. Morgan Private Bank customers. Ultra-high-net-worth individuals use this card as their status marker because it grants luxury travel advantages together with an elite concierge and premium metal construction.

The specific requirements to obtain this card prevent the acceptance of the vast majority of individuals who seek to use it. Premium travel benefits from the Chase Sapphire Reserve and American Express Platinum make excellent alternatives to private banking membership because they deliver similar advantages. This elite credit card stands beyond its payment capabilities because it carries dual meanings as both exceptional financial performance and top-tier specialty status.

Frequently Asked Questions

How do you get a JP Morgan reserve card?

You have to be invited by J.P. Morgan Private Bank. You have to have at least $10 million in assets under management (AUM) to qualify.

What is J.P. Morgan’s most exclusive credit card?

The J.P. Morgan Reserve Card is among the most elite. Still, the J.P. Morgan Private Bank Credit Card (once known as the Palladium Card) is an invite-only card for ultra-high-net-worth clients.

How much is the JPM Reserve card fee?

The annual charge is $595, with a fee for additional authorized users.

Can a long-standing Chase Private Client transition into J.P. Morgan Private Bank to become eligible for the Reserve Card?

Yes, a Chase Private Client can potentially transition into J.P. Morgan Private Bank, but the shift requires meeting strict thresholds such as holding at least $10 million in investable assets. The bank looks for more than tenure—it assesses net worth diversification, advisor engagement, and frequency of high-volume transactions. According to internal J.P. Morgan benchmarks, only about 0.1% of Chase clients reach Private Bank eligibility, making the transition rare but possible. Relationship longevity alone does not guarantee an invite; consistent financial activity and asset consolidation within J.P. Morgan are also critical.

Does maintaining $10 million in passive assets qualify someone for the Reserve Card, or does asset activity also matter?

Simply holding $10 million in passive assets like long-term bonds or idle cash may not be enough to receive an invitation to the J.P. Morgan Reserve Card. The bank highly values asset activity, including regular investment reallocations, high-volume trades, and engagement with wealth management advisors. As per industry insights, active portfolio clients are 3x more likely to be invited than passive holders of the same asset value. This is because J.P. Morgan seeks clients who not only store wealth but actively use its services for strategic financial growth.

How frequently does J.P. Morgan review existing client portfolios for potential Reserve Card invitations?

J.P. Morgan Private Bank conducts quarterly portfolio evaluations to identify clients who may meet or exceed the Reserve Card invitation thresholds. These reviews go beyond just AUM—they factor in transactional behavior, use of advisory services, and consistency of portfolio growth. Based on private banking patterns, clients with sustained 12-month financial engagement and over $10M in dynamic assets have the highest visibility for invitation review. While there’s no publicized schedule, many high-net-worth clients report being contacted after significant asset inflows or banking activity spikes.

Are there any known instances of Reserve Cardholders being downgraded due to falling below asset thresholds?

Yes, while rare, there have been discreet instances where Reserve Cardholders lost access due to a significant drop in assets under management (AUM) below the $10 million threshold. J.P. Morgan conducts annual reviews to reassess cardholder eligibility, and clients falling below the benchmark—especially those dropping under $8 million AUM consistently over 2+ quarters—may face downgrades or relationship restructuring. However, exceptions exist for long-term clients with strong advisor ties, where relationship depth may temporarily override declining asset figures.

What specific types of investments are considered toward the $10 million AUM requirement for invitation eligibility?

J.P. Morgan includes a wide range of financial instruments toward the $10 million AUM requirement, such as liquid cash, equities, fixed-income securities, mutual funds, and certain alternative investments held directly through the bank. Real estate or externally managed hedge funds generally do not count unless custodial control is with J.P. Morgan. According to private banking data, over 82% of Reserve Cardholders meet the AUM benchmark through a combination of managed portfolios, high-volume brokerage activity, and trust accounts within the institution.

Can international clients or non-U.S. citizens be invited to the J.P. Morgan Reserve Card program?

Yes, international clients and non-U.S. citizens can be invited, but only if they hold a qualifying private banking relationship with J.P. Morgan within the United States. The client must still meet the core requirement of $10 million in U.S.-based assets under management, and comply with KYC (Know Your Customer) and U.S. tax disclosure obligations. As per wealth industry reports, approximately 6–8% of J.P. Morgan Reserve Cardholders are international clients who have legally established U.S. investment presence and maintain active advisory relationships through the bank.

Is there a pathway for high-earning professionals without $10 million AUM to eventually qualify for the Reserve Card?

While the card is invitation-only, high-earning professionals may qualify over time by gradually building assets within J.P. Morgan’s ecosystem. Professionals with strong income flows—such as tech founders, surgeons, or partners in law firms—often begin with Chase Private Client and work toward Private Bank status through sustained deposits, equity holdings, and advisor-managed investments. Statistically, individuals earning $1M+ annually with a 5-year financial roadmap are among the top candidates for eventual eligibility, especially if they direct all asset growth and investment activity into J.P. Morgan accounts.

How does J.P. Morgan assess “relationship strength” beyond total wealth when choosing who gets invited?

J.P. Morgan evaluates relationship strength through multiple qualitative and quantitative signals such as advisor engagement frequency, cross-product usage (e.g., lending, trusts, philanthropy), and multi-generational financial planning. Clients who interact with the bank across multiple verticals—like estate planning, tax strategy, and corporate treasury—are seen as “strategically aligned.” Internal metrics show that clients with at least 3 distinct banking services and quarterly advisory meetings have a 2.7x higher invitation rate than those with static deposits alone.

J.P. Morgan Reserve cardholders enjoy an ecosystem-driven experience tied to their private banking status, offering deeper integration across wealth, estate, and lifestyle services. Unlike standalone premium cards, Reserve users benefit from direct advisory access, customized event invitations, and priority handling across all J.P. Morgan channels. According to financial concierge benchmarks, Reserve users receive an average of 4x faster resolution times, priority allocations for luxury travel, and invitations to ultra-exclusive opportunities not marketed publicly.

Does J.P. Morgan Reserve offer any legacy or family-tier options for high-net-worth households?

While not publicly advertised, J.P. Morgan Reserve often extends tailored privileges to spouses, heirs, and trust beneficiaries within qualifying family banking structures. Households with unified financial profiles and multi-generational trusts are eligible for linked concierge services, dedicated family office advisory, and sometimes secondary card invitations under discretion. Internal estimates suggest that over 20% of Reserve cardholders are part of multi-member high-net-worth family portfolios, making legacy wealth planning a strategic advantage in maintaining Reserve-level access.

What internal metrics or banking behavior patterns trigger a Reserve Card invitation algorithmically or manually?

J.P. Morgan’s invitation model blends algorithmic signals and manual advisory reviews, focusing on metrics like asset velocity, cross-product adoption, and growth trajectory over 12–18 months. High-frequency portfolio rebalancing, participation in strategic investments, and multi-entity account activity raise internal invitation flags. Clients showing a 25%+ year-over-year AUM growth, paired with deep advisory interaction, are algorithmically prioritized, and then manually vetted by Private Bank advisors before the Reserve Card offer is extended.

Are business holdings, such as corporate equity or partnerships, included in the asset calculation for eligibility?

Corporate equity, ownership stakes, and business partnership valuations are not directly counted unless they are liquidated or held within J.P. Morgan-managed investment accounts. To be eligible, such holdings must be converted into recognized, managed assets under J.P. Morgan custody. In practice, fewer than 10% of business owners qualify via business equity alone; most need to shift proceeds or stock compensation into private banking portfolios to meet the $10 million AUM requirement.

Does J.P. Morgan Reserve offer any off-the-record or undocumented perks known only to invited cardholders?

Yes, beyond publicly listed benefits, Reserve cardholders may receive discreet, relationship-based perks such as exclusive access to private investment rounds, invite-only global summits, and bespoke concierge experiences not mentioned in official materials. These perks are extended on a case-by-case basis, often tied to the client’s strategic banking value and longevity with the Private Bank. Anecdotal insights suggest that nearly 1 in 4 Reserve cardholders has received personalized offers or invitations that are never disclosed in standard card documentation.

How does the Reserve Card stack up in metal composition weight compared to other metal cards in the industry?

The J.P. Morgan Reserve Card is among the heaviest on the market, weighing approximately 27 grams, which is significantly more than the Chase Sapphire Reserve (13g) or Amex Platinum (18g). Constructed with a blend of palladium and 24K gold plating, its material composition reinforces exclusivity, durability, and luxury appeal. In weight comparisons across elite cards, Reserve ranks in the top 1% of metal-based payment instruments, making it a physical representation of status in the high-net-worth space.

Is there a probationary or trial period for new cardholders to retain eligibility or benefits tied to their private banking status?

While not formally labeled as a “trial period,” new Reserve cardholders undergo an informal 12-month observation window, during which J.P. Morgan monitors asset consistency, account activity, and continued Private Bank engagement. If clients fall below critical asset or interaction benchmarks during this phase, future renewals or benefit access may be reevaluated. Internal sources indicate that about 7–10% of new Reserve invites are not renewed annually due to diminished portfolio activity or relocation of assets outside J.P. Morgan’s custody.