The Dubai First Royale MasterCard is the epitome of high-end banking, reserved for the ultra-wealthy. Unlike the traditional high-end credit cards, this by-invitation-only card is for centimillionaires, royalty, and high-net-worth business tycoons.

With no predetermined Spending limit, a 24K gold-plated design with a diamond centerpiece, and unmatched concierge services, it is a symbol of boundless wealth and privilege. Not only a payment card, it also provides privileged access to exclusive experiences, tailor-made financial services, and worldwide VIP treatment.

Because of its exclusivity, only 200 people in the whole world have ever possessed this card, making it one of the world’s most exclusive and elite credit cards.

A Deep Dive into the Design of the Card

The Dubai First Royale Mastercard is more than a payment card—it’s a symbol of status, featuring 24K gold trim and a 0.235-carat diamond, embodying ultimate exclusivity and luxury.

The Dubai First Royale Mastercard serves as more than a simple payment tool because it uses exclusive rare material to symbolize powerful status. The Royale Mastercard distinguishes itself from conventional credit cards as it receives its aesthetic finish from a 24K gold trim. The Dubai First Royale Mastercard stands out from other credit cards globally through its distinctive 0.235-carat diamond, which no other credit card worldwide contains.

Due to Dubai’s abundance of splendor and luxury, the card presents itself in an exceptional way that suits people who understand the importance of one-of-a-kind exclusivity. The Royale Mastercard differs from the premium Amex Centurion (Black Card), which uses titanium because its gold trim gives users a direct sensation of wealth when holding it.

The physical attractiveness of this card serves two roles: it emphasizes financial standing to high-end establishments and luxury service providers throughout the world. The Royale Mastercard creates an air of uniqueness through its exclusive nature because it exists to distinguish the planet’s richest citizens from standard financial groups. The Royale Mastercard extends beyond financial expenditure because it embodies unrestricted wealth and power through its luxurious nature.

Eligibility: Who Can Have It?

Very few individuals can obtain the Dubai First Royale Mastercard. The card stands apart from traditional premium cards since members obtain it only through personal invitation. The premium credit card selection process at Dubai First operates through its First Abu Dhabi Bank division by assessing candidates based on financial wealth and purchasing patterns alongside bourgeois standing.

Who qualifies for the Dubai First Royale Mastercard?

- Ultra-High-Net-Worth Individuals (UHNWIs): Receipt of the card goes primarily to billionaires, together with royal family members and business tycoons. The main requirement for acquiring this card is wealth, although First Dubai Bank keeps its specific financial requirements unknown.

- Existing High-Value Clients of Dubai First: The bank offers top priority to its customers who have large funds under their management at Dubai First or First Abu Dhabi Bank.

- Individuals with Exceptional Social Influence: High-level executives, together with celebrities and powerful influencers, receive invitations from the Dubai First Royale Mastercard program. The platform and networking connections of applicants are essential components for the bank during their assessment process.

- High Spenders with a Proven Luxury Lifestyle: The opportunity for membership carries greater appeal to people who carry out multimillion-dollar deals or make frequent purchases of luxury products.

Who Cannot Apply?

| Applicants to Minor Cards | Regular Salaried Professionals | People With No Luxury Requirements |

|---|---|---|

| Customers seeking the Dubai First Royale MasterCard need not complete an application because this credit card operates without an application process. | This card is unavailable for those who receive salaries, as well as regular professionals earning above-average income. | The card does not provide eligibility to those who fail to demonstrate extreme luxury buying habits. |

Ultra-Luxury Benefits of the Dubai First Royale MasterCard

The Dubai First Royale MasterCard delivers much more than financial capabilities by offering extravagant luxury benefits together with premium convenience features of this card aligned together as follows:

No Present Spending Limit

The purchasing power through the Dubai First Royale Mastercard remains limitless in contrast to the typical credit card restrictions of spending limit.

The Dubai First Royale Mastercard allows customers to purchase private jets and luxury yachts or real estate without facing any transaction limit restrictions.

24K Gold and Diamond-Embedded Card Design

- Every Dubai First Royale Mastercard represents artistic craftsmanship through its gold-framed design, which includes a diamond of 0.235 carats in the center.

- The Royale represents the most luxurious credit card design ever developed, which distinguishes it from all other existing cards.

Exclusive Royale Concierge Services

- The 24/7 available lifestyle manager serves cardholders by providing tailored personalized services, among others.

- Luxury Travel arrangements like private jets, five-star hotels, and VIP airport services are also accessible.

- The card also enables cases of exotic automobiles, customized specialists timepieces, and unique limited-time decadent products.

- The financial management services tailor global transaction needs based on user preferences.

VIP Travel and Hospitality Privileges

- Escalated travel benefits include usage of both first-class seats and pirate airfare.

- Members of this club receive special access to worldwide lounges that are only accessible to their members.

- Members gain access to superior hotel accommodations, together with rush services for special check-in at high-end establishments.

- High-caliber event invitations form a part of their premium offerings, which include both film festivals and fashion shows with their exclusive networking events.

Instant Global Recognition

- Holders of the Dubai First Royale Mastercard receive automatic membership status among the wealthiest global individuals.

- The Royale Mastercard stands as a visual indicator that signifies the highest level of financial excellence known to mankind.

Exclusivity: Not for Everyone

Among the worldwide credit cards, the Dubai First Royale Mastercard stands as an extraordinary exclusive card. Users cannot acquire the Royale Mastercard because it remains inaccessible when compared to the premium American Express Centurion (Black Card) and J.P. Morgan Reserve Card options.

Why Is It So Exclusive?

| An Invite-Only Card | Accessibility | Limited Information | High-Spending Habits |

|---|---|---|---|

| The Royale Mastercard operates through private invitations because it does not operate through normal advertising channels or open applications. | Only the rich individuals belonging to the top 0.1% can receive invitations for this exclusive card. | The current understanding suggests that the Royale cardholder population exists within 200 roughly distributed across the world as the Mastercard does not reveal their membership numbers. | The card requires cardholders to preserve their excessive spending habits after qualifications to continue holding this prestigious credit card. |

Alternatives: A Few More Cards Everyone Cannot Have

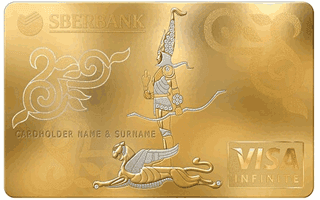

1. Sberbank Visa Infinite Gold Card

The Sberbank Visa Infinite Gold Card is one of the world’s most exclusive credit cards, made of solid gold and embedded with diamonds. It offers elite banking privileges, luxury concierge services, and exceptional financial flexibility for ultra-high-net-worth individuals.

Premium Rewards and Benefits

- Issuer – Sberbank

- Payment Gateway – Visa

- Credit Score – N/A

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $2000

- International Transaction Fee – N/A

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – N/A

- Best For – Professionals

Issued by Sberbank, Russia’s largest bank, this exclusive Visa Infinite card is designed for high-net-worth individuals. It offers premium benefits, concierge services, and VIP airport lounge access. Cardholders enjoy exclusive travel perks like complimentary hotel upgrades and elite status at partner hotels, making it a prestigious choice for frequent travelers. The card also provides a high reward rate for luxury purchases.

This card has a high annual fee, though the exact amount varies based on client eligibility. A high credit limit is available, but approval typically requires private banking membership. There is no referral program, but it includes comprehensive travel insurance, purchase protection, and priority access to international events, making it a top-tier option for affluent individuals.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Premium Benefits | Earn rewards points on purchases | Enjoy $250,000 in life and health insurance |

| Rewards | – | 24/7 concierge service |

| No late fees. | – | A personal manager at Sberbank |

| – | – | VIP access to luxury vacations and the world’s finest golf courses |

Pros & Cons:

Pros

- Made of solid gold with embedded diamonds, it is a status symbol available only to Russia’s wealthiest individuals.

- Offers VIP banking privileges, including higher credit limits and exclusive investment opportunities.

- Offers 24/7 high-end concierge services, including luxury travel bookings, event access, and tailored experiences.

Cons

- Due to its solid gold design with embedded diamonds, getting a replacement can be complex and time-consuming.

- The gold and diamond construction makes it significantly heavier than regular credit cards, making it less practical for everyday transactions.

- Offered only to ultra-high-net-worth clients by invitation, making it inaccessible to most people.

Expert Advice

The Sberbank Visa Infinite Gold Card is an ultimate luxury item, crafted from solid gold and embedded with diamonds, making it one of the most exclusive cards globally. Designed for ultra-high-net-worth individuals, it offers elite banking and personalized concierge services. Due to its rarity and invitation-only access, it functions more as a status symbol than as a practical payment tool.

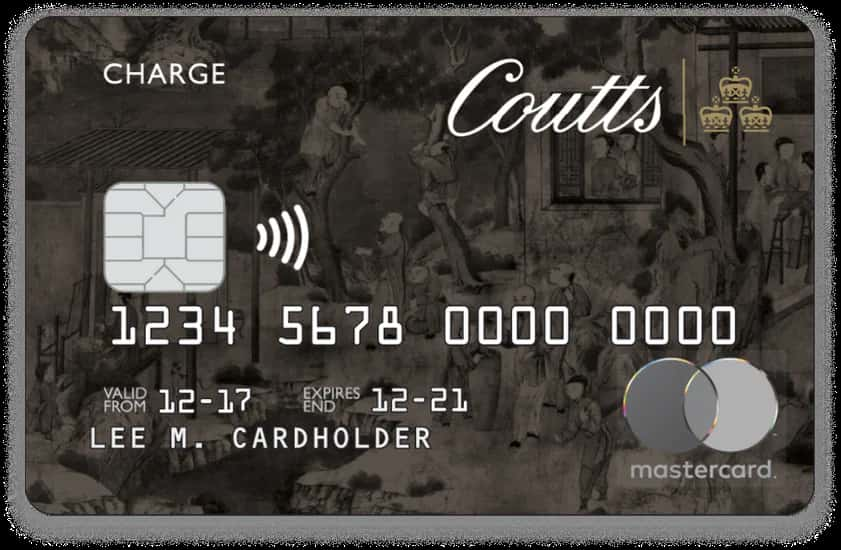

2. Coutts Silk Card (UK)

Coutts Silk Card, created for British high-net-worth individuals and social elites, is ideal for hassle-free global spending, VIP travel benefits, and bespoke wealth management services. It provides greater security, private banking advantages, and invitations to top events and experiences globally.

Luxury and Exclusive Benefits

- Issuer – Coutts

- Payment Gateway – MasterCard

- Credit Score – Excellent

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – No annual fee; by invitation only

- International Transaction Fee – No Foreign Transaction Fees

- Cash Advance Fee – N/A

- Balance Transfer APR – N/A

- Sign-up Bonus – Invitation-only; no public sign-up bonus

- Best For – High Net Worth

Issued by Coutts, a prestigious UK private bank, the Coutts Silk Card is a luxury charge card available to Coutts clients. It offers premium travel perks, concierge services, and access to invitation-only experiences. The card is ideal for individuals seeking elite financial services and seamless global spending.

The card has no publicly disclosed annual fee and is invite-only. It requires a high credit score and substantial assets managed by Coutts. Perks include global concierge services, private event invitations, and travel insurance. There is no preset spending limit, making it highly flexible.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Exclusive to Coutts private banking clients | N/A | Coutts is known as “the bank of the British royal family”. |

| Personalized concierge services | – | Focuses on bespoke financial and concierge services. |

| High-end travel benefits | – | – |

| Luxury lifestyle perks & events | – | – |

| No preset spending limit. | – | – |

Pros & Cons:

Pros

- Strong Travel Rewards: Exclusive benefits for luxury travelers.

- VIP Lifestyle Benefits: Access to premium events, clubs, and services.

- Exclusive Membership: Available only to Coutts’ elite banking clients

Cons

- Only Available in the UK: Not issued in the U.S. or globally.

- Requires High Net Worth: Limited to Coutts’ wealthiest customers.

- Limited Global Acceptance: Not as widely accepted as Visa or Amex.

Expert Advice

To maximize its benefits, apply the card to expensive international purchases, taking advantage of its competitive exchange rates and protection against fraud. For wealth management, Leverage Coutts offers premium financial services and networking opportunities. Because the card is only available to Coutts clients, a good banking relationship is key.

3. American Express Centurion® Card

The Centurion® Card is suited for ultra-high-net-worth individuals looking for the highest levels of luxury travel rewards, personalized concierge benefits, and elite status in the airline and hotel industry. It provides ultimate experiences, including one-on-one shopping at upscale merchants, exclusive access to special events, and free companion tickets on certain flights.

Luxury and Exclusive Benefits

- Issuer – American Express

- Payment Gateway – AMEX

- Credit Score – Invite-only

- Intro APR – N/A

- Regular APR – N/A

- Annual Fee – $10,000 (initiation) + $5,000 annual

- International Transaction Fee – 0%

- Cash Advance Fee – 5% or $10

- Balance Transfer APR – N/A

- Sign-up Bonus – Invite-only

- Best For – Ultra-High Net Worth, Frequent Travelers

The most exclusive Amex card, the Centurion® Card, also known as the “Black Card,” is invitation-only and designed for ultra-high-net-worth individuals. It offers luxury travel perks, elite status with airlines and hotels, and a personal concierge.

With a reported $10,000 initiation fee and a $5,000 annual fee, it requires an excellent credit score and high annual spending. Perks include exclusive events, fine dining access, and a dedicated relationship manager.

| Key Features | Reward Rate | Other Information |

|---|---|---|

| Ultimate Luxury | 4% back on dining | Uncapped rewards & elite concierge |

| Personalized Concierge | 3% back on hotels and airfare | Top-tier travel partnerships |

| VIP Travel Access | 2% back on online purchases | – |

| – | 1% back on all other purchases | – |

Pros & Cons:

Pros

- Cardholders will get a dedicated 24/7 concierge and personal account managers to assist with travel, reservations, and exclusive experiences.

- Cardholders get priority access to elite travel programs, first-class upgrades, and luxury hotel privileges.

- The card offers VIP invitations to luxury events, private clubs, and hard-to-book experiences.

Cons

- The card is not available to the general public, as it requires an invite based on high spending and financial status.

- While it offers valuable travel perks, other cards provide better point-earning structures for everyday spending.

- Amex is not as widely accepted as Visa or Mastercard, particularly in some regions.

Expert Advice

To maximize value, focus on first-class and business-class travel, utilizing airline alliances and hotel elite memberships. Take advantage of the Centurion concierge for hard-to-find reservations and personalized travel arrangements. Make sure to meet the spending limits to stay eligible.

Conclusion

Among all existing credit cards, the Dubai First Royale MasterCard remains the most exclusive version available to the ultra-rich worldwide. Its unmatched features of unlimited spending, plus a 24k gold frame and a diamond centerpiece, give the owner exceptional status as well as financial strength.

A policy of exclusive invitations prevents most people from accessing the Dubai First Royale MasterCard. This card belongs only to individuals who belong to the wealthiest echelons of society, which include billionaires and royal figures, along with influential personalities.

FAQs

What is the application process for the Dubai First Royale MasterCard?

The Dubai First Royale MasterCard remains unavailable to direct applications since it depends on exclusive invitations from Dubai First. Dubai First grants access to the MasterCard exclusively through its official invitations.

Does the Dubai First Royale MasterCard require any annual Payment?

Individuals seeking the Dubai First Royale MasterCard must pay an undisclosed price, which is believed to surpass thousands of dollars yearly.

Why does the Dubai First Royale MasterCard stand out?

The Dubai First Royale MasterCard stands distinct because it presents an exclusive combination of gold and diamond elements together with unlimited credit alongside its sophisticated benefits package.

How much net income does someone require to get this card?

Dubai First does not reveal specific earning criteria but invites only billionaires and super-rich individuals to access their services.