Missing credit card bills can lead to immediate consequences such as hefty late fees and increased interest rates.

However, the long-term effects are equally significant, with a negative impact on your credit score and potential difficulties in securing future loans and credit.

Furthermore, persistent delays can lead to debt accumulation and, in the worst-case scenario, legal actions and lawsuits.

Understanding these risks will empower individuals to make informed decisions about credit card payments and avoid the detrimental effects of late credit card bill payments.

What happens when you miss the payment on your credit card?

Credit card payments become even more damaging when one defaults on them since the repercussions aggravate with time.

Every credit card company has its procedures for handling late payments, but all stick to some credit card payment cycle, which consists of different actions taken against offenders.

Here’s a detailed look at what typically happens at each stage of credit card delinquency, as outlined by Experience and other financial experts:

1 Day Late: The First Red Flag

At this stage, your payment is one day overdue.

While it might not seem serious, the following can occur:

- Late Payment Fee: All credit card companies charge a penalty fee for late payment, which can range from $25–$35 or more for the initial offence. The above penalties can be multiplied if the payment is made late severally.

- Loss of Promotional APR: If you have been used to a promotional interest rate such as 0% APR, it could be terminated abruptly, and your balance is instantly guaranteed at an applicable interest rate.

- No Immediate Credit Score Impact: At least one day of lateness will not affect the credit bureaus, though the possibility is limited at the moment.

30 Days Late: Credit Score Impact Begins

Once your payment is 30 days overdue, the situation becomes more serious:

- Credit Reporting: Day 30: Your payment is submitted to the credit bureaus (Equifax, Experian, and Trans-Union), which leads to a low credit score. Even one late report can have a serious effect on you since payment history constitutes the greatest proportion of your score.

- Creditor Contact: In most cases, your creditor will contact you and inform you that your payment is still outstanding. Some companies could help you pay off the amount owed; they have programs aimed at helping customers pay their bills.

- Interest Charges: If you fail to repay the outstanding amount, you will accrue more interest charges on the outstanding balance.

60–180 Days Late: Escalating Consequences

As your account remains delinquent, creditors become increasingly aggressive in their attempts to recover the debt:

- Higher APR (Penalty Rate): Credit card companies may apply a penalty interest rate to the most recent balance, often the legal maximum interest rate. This can make paying off your balance much more demanding.

- Repeated Credit Reporting: Every payment cycle, usually 30 days missed, increases the report to the credit bureaus and worsens the credit score.

- Persistent Collection Efforts: Any creditor would wish to receive the overdue amount, so the creditor may use frequent calls, letters, or emails to recover the amount. Some may provide some monetary satisfaction to avoid cases going to trial.

180+ Days Late: Collections and Account Closure

Most credit card companies, after six months of inactivity, classify the account as a “charge-off,” implying that the account holder is not likely to pay back the issuer again.

The following steps are usually taken:

- Account Closure: The issuer of your credit card normally closes your account, and the consumer loses the credit line.

- Debt Sold to Collections: The creditor can delegate this duty to a third-party agency that specializes in debt collection. Once this happens, the agency will take responsibility for collecting the amount through any means.

- Further Credit Score Damage: Collections and charge-offs have a negative effect and are both reported to credit bureaus. They are very detrimental and will affect your credit score for a long time.

- Potential Legal Action: In the worst-case scenario, debt collectors and creditors can sue a debtor or guarantor to recover their money. If they succeed, they can take a portion of your paycheck or put a lien on your house.

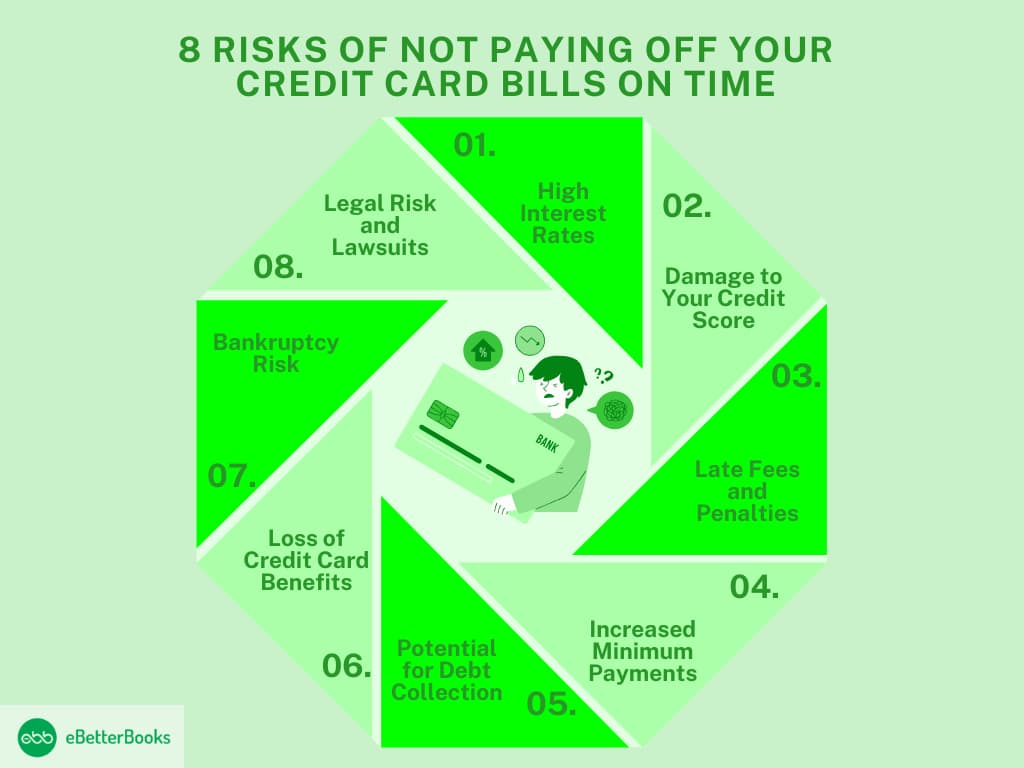

8 Risks of Not Paying off your Credit Card Bills On Time

Non-payment of credit card bills in full and failure to clear your balance can have a number of detrimental consequences. It is reasonable to pay only a minimum balance occasionally or pay off interest on a regular balance.

Still, with time, costs increase, and so do risks for both your pocket and creditworthiness.

Here’s a look at the key risks associated with not paying off your credit card debt:

- High Interest Rates

Credit cards have very high interest rates, meaning that if you pay only the minimum amount, you will be deeper in debt soon.

That means the longer you take to clear your balance, the more interest will be charged on your card, making repaying the principal even more challenging.

- Damage to Your Credit Score

Credit scores present a person’s payment history as a dominant element that affects the scores.

If one fails to pay or has a higher balance, he or she will be in trouble in terms of future loans he or she wants to apply for because it attracts a high rate of interest.

- Late Fees and Penalties

When you fail to make timely payments, credit card firms will charge penalties such as late fees and may even hike your APRs.

These fees work to your balance and make it very difficult to make satisfactory payments, and often, your monthly commitment escalates.

- Increased Minimum Payments

If your credit card balance rises, your credit card company will likely raise the minimum amount you need to pay.

This can cause you to reach the limits of your wallet and increase the amount of time it will likely take to clear the debt.

- Potential for Debt Collection

If several payments are missed, the account is passed to a collection agency, which will attempt to recover the missed payments.

Collection agencies will do anything possible to find the money you owe them, and they will charge you a fee and further damage your credit.

- Loss of Credit Card Benefits

Credit cards offer privileges, including rewards points, 0% APR introductory rates, and much more.

Defaulting on these loans means that one is stripped of these privileges and may face high-interest fees.

- Bankruptcy Risk

If your debt escalates to the point that you cannot pay it, you might be forced to declare bankruptcy, which has both short-term and long-term implications.

Bankruptcy takes a long time to be removed from one’s credit information and makes credit applications for many years.

- Legal Risk and Lawsuits

In the worst case, the creditor or the collection agency could sue you if you fail to pay the credit card bill for a long time.

They might take you to court to recover the money, and if the court rules in their favour, then they can get your wages, garnish your assets, or place liens on your property.

A judgement from a lawsuit will only worsen your credit and make it even more challenging to pay off the debt.

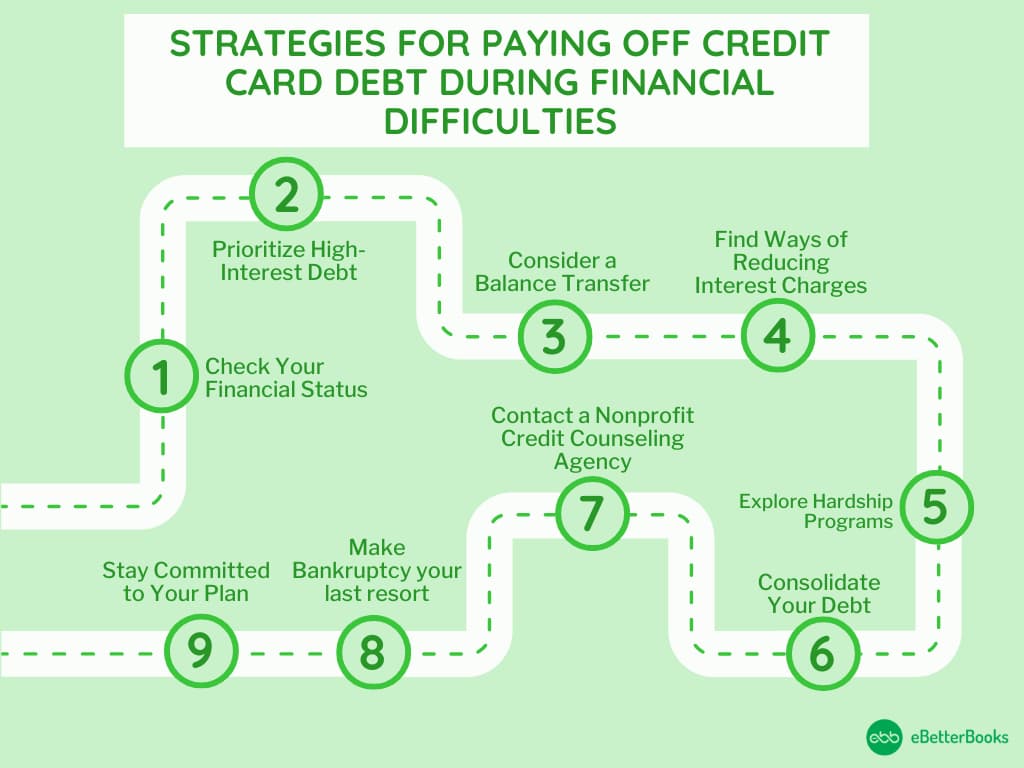

Strategies for Paying Off Credit Card Debt During Financial Difficulties

Debt repayments can be extremely frustrating and stressful, especially when you have lost your job.

Still, there are several methods you can employ to assist you in reducing your credit card balance and managing your money more successfully.

Though it might take some time and a great deal of commitment, the right strategies exist for paying one’s debts without missing any payments and weathering economic storms.

01. Check Your Financial Status

The first approach in identifying a potential credit card management strategy is to evaluate one’s credit card position.

- List all your debts: List your credit card debts, the interest rate that you are charged, and the minimum amount payable every month.

- Create a budget: Determine your monthly income and spending aside to pay off credit card debt.

- Cut back on discretionary spending: Determine areas in which one can or may have to cut back, such as eating out, magazines, movies, and the like.

02. Prioritize High-Interest Debt

Credit cards are usually costly financial tools often associated with high interest rates that just fund if not repaid on time.

Use the DCA ( Dollar-Cost Averaging) method, where more attention is given to a card with the highest APR, while on the other, one only pays the minimum balance.

Various debt repayment strategies exist; one of the most effective is the debt avalanche method mentioned above, which can minimize the overall interest paid.

There is also the debt snowball method, which means that payments are made based on the amount owing on the card with the smallest balance. This can be encouraging as people get to pay off some debts as soon as possible.

03. Consider a Balance Transfer

If your credit is good, see if you can transfer your high-interest credit card balances to a card with a 0% introductory rate on balance transfers.

This will reduce the amount of interest you will be charged and enable you to clear the debt earlier.

Avoid or limit the balance transfer fees. When the introductory offer expires, high interest rates may apply.

04. Find Ways of Reducing Interest Charges

If you are experiencing high interest rates, do not hesitate to call your credit card company and explain your current situation.

Most issuers are willing to reduce interest for a customer in trouble, especially if you were a good client and did not default on payments earlier.

It is easier to pay off your balance and costs less than a credit card’s higher APR.

05. Explore Hardship Programs

Most credit card issuers have programs for those who are experiencing some form of hardship and are no longer able to pay for the card. These programs may enable you to delay loan payments or get lower interest on outstanding balances. Talk to your credit card provider to find out more about the opportunities and conditions.

06. Consolidate Your Debt

Loan consolidation is the process of transferring many credit card balances into a single loan or credit line, usually at a lower interest rate.

It eases your payment and reduces the amount of interest you would have to pay, hence clearing the debt.

Types of consolidation include a personal loan, a home equity loan, and a debt consolidation loan.

07. Contact a Nonprofit Credit Counselings Agency

If your financial status could be better, then consult with a certified credit counsellor.

Three kinds of credit professionals may assist you in working out a budget, dealing with your creditors, or discussing DMPs (Debt management plans).

A DMP enables you to pay a given credit counseling agency one calendar month’s payment, and the agency distributes the payment to the various creditors, normally at agreed-upon interest rates.

08. Make Bankruptcy your Last Resort.

Sometimes, debt becomes unbearable, and if you try all legal means to pay for it, you can consider bankruptcy as a solution.

Credit cards can be discharged in bankruptcy, but this strips you of your freedom and continues to have a long-term impact on your credit score.

However, it is always wise to consult a bankruptcy lawyer to determine whether this is the best option for you.

09. Stay Committed to Your Plan

When credit card respondents are experiencing a financial crisis, paying off credit card debt may take some time, but the important thing is to keep on with the plan.

- Track your progress: Pay off cards in full and reward yourself when you have or when your overall balance decreases.

- Stay focused on your goals. Remember the advantages of living without credit, such as better economic stability and the opportunity to start saving.

The Bottom Line

Failing to honour your credit card obligations often results in a host of costly and credit-harming outcomes. However, you are not necessarily doomed to work with the worst of them if you do not pay off your card in full.

Minimum payments are not perfect, but at least they will keep the account current, helping the consumer avoid commonly associated penalties such as fees, penalty APRs, and credit score deterioration.

Managing your cash with a budget helps you avoid using your credit card for expenses that you cannot easily cover.

However, if your problems are not related to excessive spending, communication with your creditors or applying to a nonprofit credit counselings agency might be the best option for you.