Credit cards are products used by consumers to make purchases through credit meant to be paid later. They are easy to access, offer numerous bonuses for using them, and, if enlisted, improve creditworthiness. Credit cards can be used by business owners, employees, homemakers, and students.

The basic details of a normal credit card include the cardholder’s name, the credit limit allowed, the expiration date, and the CVV number.

What is Credit Card?

Credit cards, also known as plastic or metal money, are payment cards that enable consumers to buy products, acquire cash, and pay interest. They are more like your financial partner, up as personal credit instruments from banks that enable one to purchase goods and services on the understanding that they will be paid at a later date.

A standard credit card comprises cardinal details like the holder’s name, the line of credit, the expiry date of the card, and the additional security code, also known as CVV. Periodically, users simply have to return the credited amount within the agreed time horizon. Failing to do so leads to interest charges by credit card companies.

Benefits of Credit Cards

| Convenient Payment Option: It allows you to buy goods and services or cash on an extent of credit without the necessity of physical cash. | Wide Variety of Options: Credit cards come in many varieties, including standard, gold, platinum, and more specific reward cards that best suit your daily routine. |

| Flexible Payment Terms: Users can repay the credit amount within a specified period. However, unlike credit cards, the company can charge interest on the balance when payments are due. | Secure Transactions: Credit cards offer the advantage of protection against the danger of loss through theft or embezzlement of cash during payments. |

| Perks and Rewards: A credit card offers special privileges such as cash back, travel rewards, discounts, and more. | Financial Ally: Credit cards may be considered a financial companion, providing freedom of usage while establishing a credit history. |

Whether you are looking for unmatched cashback, travel rewards, or exclusive discounts on your spending, there is surely a credit card designed just for you.

Explore the Power of Plastic: Swipe, Earn & Done, The Right Credit Can Empower Your Finance Perfectly…

What are Credit cards?

A credit card is a card made of metal or plastic, issued by a financial institution like a bank, credit card companies, fintech companies, etc., and is used to make payments for an item or service using credit.

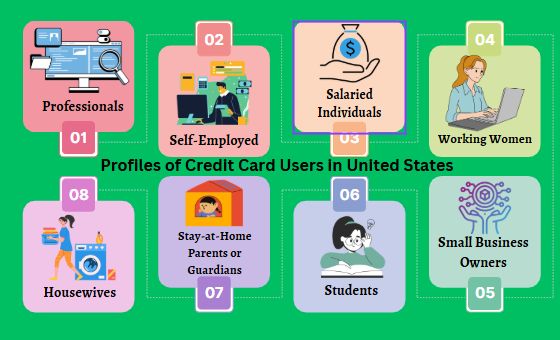

Who are the Users of Credit Cards?

The users of credit cards include self-employed individuals, homemakers, working women, students, professionals, and small business owners.

What are all the Details on the Credit Card?

Every credit card has the cardholder’s name, the credit card’s expiration date, the card’s bank identification number, the card’s security chip, and other necessary information.

What is a Metal Credit Card?

A metal credit card is a premium payment card made of metal instead of plastic, offering durability, luxury, and prestige. Typically issued to high-net-worth individuals, it often comes with exclusive perks like higher credit limits, travel rewards, and concierge services. Banks issue them for elite customers seeking status and security.

Users of Credit Cards

| User Category | Purpose of Use |

| Self-employed individuals | Managing business expenses and cash flow. |

| Homemakers | Conveniently handling household and personal purchases. |

| Working women | Balancing financial needs for work and personal life. |

| Students | Building credit history and managing small expenses. |

| Professionals | Earning rewards and simplifying financial management. |

| Small Business Owners | Covering business expenses while earning perks. |

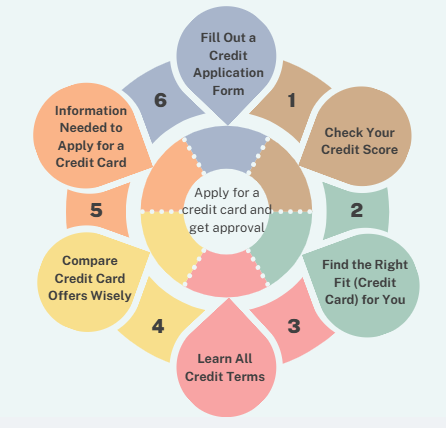

How to apply for a credit card and get approval?

You can apply directly to the bank or the credit card company via their website or customer service and apply for the credit card. Many local stores offer in-store branded credit cards, so you need to fill out the form and apply for the credit card.

One of the basic requirements to get approval for the credit card is a healthy FICO score, a regular source of income, and a sponsor in the form of a fixed deposit for non-salaried individuals or the primary card holder in case of an add-on card.

Credit cards play a powerful role when it comes to building your reliable and strong credit profile. Higher credit scores not only improve your credit background and let you apply for a new credit card, but they will also affect the financial services that are being offered to you.

The best credit card comes with a lot of added benefits and will offer users higher reward rates, heavy discounts, unbelievable travel miles, and lower interest rates on debt. So, keeping the same in mind, it is important to research a lot and to prepare in advance before applying for a credit card.

Here are things to be taken care of when you apply for a credit card:

Check Your Credit Score

To get approval for a credit card, you first have to check your credit score. The credit score is determined by the credit history, balance transfer, credit utilization, and outstanding balance of the consumer, which is a three-digit number. Numbers describe the credit scores in some special categories, such as:

| Credit Score | Credit Value |

| 720 & Above | Excellent Credit Score |

| 690-719 | Good Credit Score |

| 630-719 | Average Credit Score |

| 300-629 | Bad Credit Score |

Most credit cards are issued when you have a good and excellent credit score, so those who are struggling with a bad credit score have to improve it.

Are you looking to check your credit score for free?

Yes, you can check your credit score for free. You can check your credit score from three of the major credit agencies: Equifax, TransUnion, or Experian. Users are entitled to check credit from these three major agencies one time a year from each agency. You can get a detailed report at Annual Credit Report.com from each of the mentioned bureaus. Many credit card agencies also offer free monthly credit score facilities; you can check your lender and apply for it.

- Pro Tip: Sometimes, you may receive credit card exclusive offers with massive sign-up bonuses and or extra membership points via mail and other communication channels.

Find the Right Fit (Credit Card) for You

Finding the right crest card is important. Research a lot when you are planning to apply for a credit card.

There are many kinds of credit cards available, but you have to consider some of the things before choosing the right card for you:

- Rewards Rates: Many credit cards come with specific reward categories; you should choose a card in which you make purchases the most.

- Interest Rates: There are some cards that charge high annual charges, late fees, high interest rates, and foreign transaction fees. Choose a card with no annual fees and no foreign transaction fee.

- Sign-up Bonus: Some credit cards also come up with a huge sign-up bonus for spending some fixed amount. So you can choose wisely a good amount of sign-up bonus.

Learn All Credit Terms

Now, you are in search of a good credit card, so you will encounter a handful of terms that will create hassles when making informed choices. Knowing the terms in advance will help you to choose the right credit card that suits your financial needs and lifestyle.

Some of the crucial terms are given below:

- Annual Fee: This is an annual amount charged by the lenders in the month when the user signed up for the credit card. This fee is charged for using credit cards. Some of the credit cards have a $0 annual fee, while some of the lenders charge more than $95 per annul.

- APR: This is an annual percentage rate on which your annual interest is decided. This fee is charged when you don’t pay the full amount and carry a balance on your card.

- Balance Transfer: This is the process of transferring your loan amount balance from one credit card to another. This is usually done when you have to transfer your loan from a high-paying interest to a paying interest amount so that you can pay your debt while saving some amount on interest.

- Welcome/Sign-up Bonus: This is a one-time bonus amount given to a new cardholder after spending a fixed amount within a certain time frame.

- Foreign Transaction Fee: Some of the credit lenders charge an amount when you make any payment using online currency or use your card outside of the USA. You can avoid these charges by choosing a card that comes at a low annual fee.

- Penalty/ Late Fee: A penalty and late fee are charged when you miss a due date of payment or fail to pay the minimum amount on the due date.

Compare Credit Card Offers Wisely

Once you have decided which card is the right choice for you, you can apply for it. But before applying for any particular card, you must compare all the cards that you have added to your checklist.

You can ask these questions to help you eliminate cards that aren’t a good fit for you:

- Is it a card that provides the benefits you value most, such as a $0 annual fee, unlimited cash back, or an introductory 0% APR?

- Have you fulfilled all the credit requirements?

- Will you meet the requirements for a sign-up bonus, if applicable?

- If you intend to carry a balance, does the card have a low APR?

- Are you satisfied with the fee structure in terms of annual and foreign transaction fees?

- What is the amount of the security deposit, if any?

Information Needed to Apply for a Credit Card

After all your research and decision-making about getting a credit card, you are required to gather some information.

The information could be:

- Your legal name

- Complete date of birth

- Your Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Residential address

- Phone number

- Annual gross income

- Your employment status

- #062255

Fill Out a Credit Application Form

The most effective way to apply for a credit card is online. Online applications are the quickest and most convenient because they can be completed at any time and from any location. It also makes the most sense after comparing credit card offers online, which you should definitely do if you want to get the best deal.

Furthermore, it expedites your application to the card issuer and increases your chances of being approved immediately.

How Long Does it Take to Receive a Credit Card?

A lot of credit card issuers will mail you a physical card within ten to fourteen days. Additionally, some big companies, such as American Express, provide you with an instant credit card number so you can use it right away.

What is the Biggest Mistake you Can Make When Using a Credit Card?

The biggest mistake cardholders make while using credit cards is avoiding paying their credit card bills on time.

What is the Grace Period on a Credit Card?

Credit card grace periods vary by the card issuer, but the legally required minimum is 21 days.

FICO score to get quick credit card approvals

Having a FICO score of 750 or more will ensure that you are approved to get almost any credit card that is in circulation. A ‘fair’ credit score of 620 or above may also secure your approval for some credit cards, even if the interest rates or your credit limit may not be the best one.

For a score of 580 or below, the only option available to you is to take up a secured credit card.

These credit cards come with an option that demands a security deposit, and in case you fail to honor your commitments, the security is liable to be forfeited.

5/24 rule of credit cards

The 5/24 rule for credit cards states that if you have opened five or more credit cards within the last 24 months, you will not be approved for a new card, regardless of the issuers. This is an informal policy adopted by certain credit card issuers such as Chase.

Types & Profiles of Credit Card Users in United States

Types of Credit Card Users in United States

- Revolver: It refers to individuals who maintain a balance on their credit cards from month to month.

- Transactor: This refers to those users who pay their entire credit balance every month in order to avoid interest charges.

- Dormant: It refers to those users who do not use their credit cards frequently ( in case of emergency, travel insurance).

What are the 4 Types of Credit Accounts?

In general, there are four kinds of credit accounts in the USA: 1. Installment Credit, 2. Resolving Credit, 3. Charge Credit, and 4. Open Credit.

Profiles of Credit Card Users in United States

Credit card users have a diverse range of profiles, including professionals, self-employed individuals, and salaried employees, as well as working women and homemakers. Credit cards are used to manage daily expenses, travel, and earn rewards.

Professionals

Professionals use credit cards for travel, networking, and professional development expenses. They often use rewards programs to maximize benefits from their spending on conferences, memberships, and business-related purchases.

Self-Employed

Self-employed individuals rely on credit cards to manage business expenses, such as supplies and client meetings. They use cards to maintain cash flow and take advantage of rewards and cashback offers that align with their business needs.

Salaried Individuals

Salaried individuals use credit cards to manage monthly expenses, pay bills, and make large purchases. They often take advantage of instalment plans and reward programs to maximise the value of their regular spending.

Working Women

Working women use credit cards to balance both professional and personal expenses, from work attire to childcare services. These cards offer cashback, travel points, and discounts on shopping and dining.

Housewives

Housewives utilize credit cards to manage household budgets, grocery shopping, and family-related expenses. They often look for cards that offer cashback or rewards on everyday purchases to maximize their household budgets.

Stay-At-Home Parents or Guardians

Stay-at-home parents or guardians use credit cards to cover the costs of running a household, including children’s needs and utility bills. They prioritize cards with rewards or low interest rates to manage expenses efficiently.

Students

Students use credit cards to cover educational expenses, such as books and supplies, as well as personal costs. They often choose cards with low credit limits to build their credit history while learning financial responsibility.

What is Credit Card Profiling?

Credit Card Profiling means evaluating someone’s credit history, assessing creditworthiness, repayment patterns, and financial information to determine the risk associated with lending money or extending credit.

What is the Credit Profile of a Customer?

A customer’s credit profile is a kind of credit report that explains the customer’s credit history and creditworthiness to evaluate the credit risk associated with the customer.

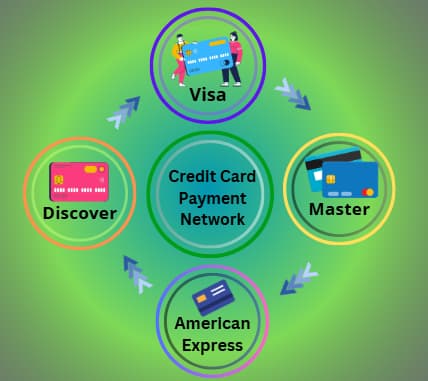

Credit Card Payment Network

MasterCard, Visa, American Express, and Discover are the four main credit card networks. Additionally, Discover and American Express provide their own credit cards. This sets them apart from card networks like Visa and MasterCard.

Here is a quick brief about them:

Visa

There are currently more than 4.4 billion Visa cards in circulation globally, and Visa card is accepted in more than 200 countries and territories. Visa, one of the biggest credit card networks in the world, offers a network for transactions rather than directly issuing cards. They are popular both in the USA and globally.

Master

Master cards are frequently utilized because this card network is operational in over 210 nations and globally. Mastercard is a worldwide payment network, just like Visa. Additionally, it does not directly issue cards; instead, it collaborates with financial institutions to offer the network necessary for credit card transactions.

American Express

This is one of the biggest credit card networks in the world. American Express issues its own cards and runs the payment network. It is renowned worldwide for its premium quality services and better customer service but is not as widely accepted as Visa.

Discover

Discover is one of the most popular payment networks in the USA, and it issues its own cards as well. It is also known for unlimited cashback, an amazing rewards policy, and other perks. Discover networks operate globally in more than 200 countries and have a reach of 345 million cards.

What is a Credit Card Payment Network?

Credit card networks work with merchant banks and credit card issuers to process consumer transactions successfully and securely.

What is the Best Credit Card Network?

Visa and Mastercard are two of the most used credit card networks in the world.

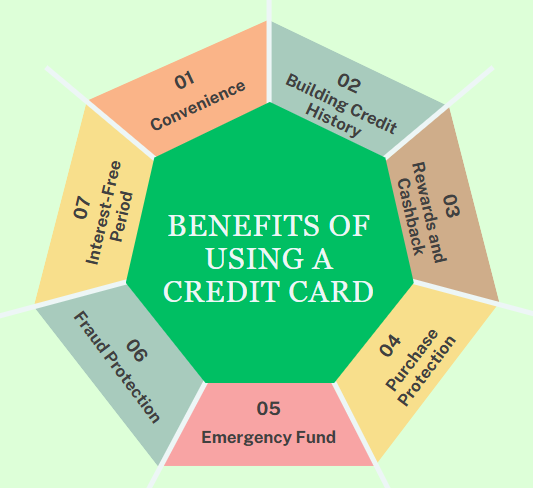

Benefits of Using A Credit Card

Convenience

Credit cards provide an easy and quick way to make purchases both online and in-store without needing cash.

Building Credit History

The responsible use of a credit card helps build and improve your credit score American Express, which is crucial for securing loans, mortgages, and other financial products.

Rewards and Cashback

Credit cards offer rewards points, cashback, and other incentives for spending, which can be redeemed for travel, merchandise, or statement credits.

Purchase Protection

Credit cards usually come with purchase protection, which covers you in case of damaged or stolen goods, offering refunds or replacements.

Emergency Fund

Credit cards serve as an emergency fund, allowing you to cover unexpected expenses when you don’t have immediate access to cash.

Fraud Protection

Credit card companies offer robust fraud protection, monitoring for suspicious activity, and offering zero-liability policies for unauthorized charges.

Interest-Free Period

Many credit cards offer an interest-free grace period on purchases if the balance is paid in full by the due date. This allows you to manage short-term cash flow without incurring interest.

What are the 5 Advantages of Credit Cards?

Credit cards have five advantages: credit miles, rewards, cashback, fraud protection, and potential interest breaks.

What are the 3 Benefits of Using a Credit Card for Purchases?

Here are the 3 major benefits of using a crest card:

It offers you unlimited cashback and rewards in your chosen category.

This works as an interest-free borrowing.

It increases your credit score when making full payments.

Perks Offered by Credit Card Companies in The USA

- Cashback Rewards: Cashback is offered at certain merchants on all purchases, or it can be advertised as giving a certain percentage of the purchase, such as 1 to 5 percent.

- Travel Rewards: Award points or mileage that are earned to be used in flying, booking accommodation, and other pertinent expenses for travel.

- Sign-Up Bonuses: Big extra points rewards or cashback for making some specific number of purchases within the first few months.

- 0% Intro APR: Providing free interest on purchases for a certain period, usually a range from 12-18 months, on balance transfers.

- No Annual Fees: Some cards do not charge an annual fee; although the card has it, it is reasonable to use this card for years without any additional payments.

- No Foreign Transaction Fees: Minimize the foreign charges that may be incurred when using the card when traveling.

- Airport Lounge Access: Complimentary entry to exclusive airport lounges.

- Purchase Protection: Bought with the card, the damaged/stolen items will be compensated.

- Extended Warranties: Extra financial protection beyond the manufacturer’s guarantee or warranty.

- Travel Insurance: These are cancellation and delay benefits, which cover lost baggage, as well as auto rental when one rents a car.

- Access to Exclusive Events: Festivals, musical nights, meal plates, and sporting occasions.

What is a Sign-Up Bonus Credit Card?

A bonus is given to the customer in the first few months of using the given credit card after making some specific amount of purchases. Example: Chase Sapphire Preferred® offers to earn 60,000 points in the first three months when the card is used to spend 4,000$.

How to Increase your Credit Score While Using a Credit Card?

Don’t delay payment; better maintain balances low, & ensure you do not go up to the credit limit.

Understanding Credit Card Fees

Here are eight frequent credit card fees and ways to avoid them:

Annual Fee: Many credit cards carry an annual fee, which usually ranges between $95 and $500.

How To Avoid: Choose a card that charges no annual fee, such as the Citi Double Cash® Card.

Interest charges: These interest charges happen when you hold a balance on your credit card and do not pay it off in full.

How To Avoid: To avoid interest, pay off your debt in full each month or get a card with a 0% APR.

Late Payment Cost: If you miss a payment, you may be charged a cost, which can range up to $40.

How To Avoid: Set up recurring payments to guarantee you never miss a due date and avoid late penalties.

Foreign Transaction Fee: Many credit cards charge around 3% for foreign purchases.

How To Avoid: To avoid international transaction costs, choose a card with no fees when going overseas.

Balance Transfer Fee: When you transfer a balance, a fee of 3-5% is usually levied.

How To Avoid: Look for a credit card that does not charge balance transfer fees.

Cash Advance cost: Withdrawing cash from your credit card normally results in a cost of 3-5%.

How To Avoid: Plan ahead of time and use other means to acquire cash.

Above-the-limit Fee: Some cards impose a fee if you go above your credit limit.

How To Avoid: Opt out of over-limit coverage so you can't spend more over your limit.

Returned Payment cost: If your payment is returned for insufficient funds, you may be charged a cost of up to $40.

How To Avoid: To prevent this penalty, make sure you have adequate cash in your account before completing the payment.

Understanding and proactively controlling these fees allows you to cut needless spending and make your credit card work for you.

Do all Credit Cards Have Annual Fees?

Many of the cards, for instance, the Citi® Double Cash Card, have no foreign transaction fees or charges, but there are cards like the American Express® Gold Card that do have charges.

What is the Credit Limit?

That is how much of your credit card’s limit you can spend. The limit depends on the card type and credit limit.

What Happens if you Exceed your Credit Limit?

Again, some cards will attract extra charges if you continue making purchases even after exceeding the credit limit, or your purchase may be rejected. A majority of cards no longer charge the customers a fee for going over-limit.

What Does the Term ‘Foreign Transaction fee’ Mean?

A charge is made (normally in the range of 3%), and this is charged especially for purchases made in foreign currency. Example: What is good about Capital One Venture® is that it has no foreign transaction fees.

Understanding Credit Card Interest

Credit card interest refers to a cost incurred by the cardholder when they use the card beyond the due date of the billing cycle credit card. In the U.S., this interest is at a card’s Annual Percentage Rate (APR), which usually falls between 15% and 25%.

Credit card debt is known to attract interest, and the longer you continue with the balance, the more you attract, making you deep in debt. Interest is compounded daily, so even such an amount is added every day to contribute to the growth of the fund.

If you do not wish to pay interest charges, be sure to pay off the entire amount you owe by the due date each month.

If you can only pay a part of the balance or cannot afford to pay immediately, you could use a card with a 0% introductory APR or avoid using the card to make purchases, which will only make the balance bigger. The best thing one can do is to ensure that the bills are paid on the due dates. This way, interest charges will be avoided.

What is the Meaning of Having a 0% Interest Rate, Fees, and Charges for the First 18 Billing Cycles?

A promotion wherein purchases or balance transfers are free of interest for a specified period. Citi Simplicity®’s 18-month 0% APR deal is an illustration.

What are the Ways that I Can Avoid Incurring Interest Charges for My Credit Card?

For instance, if you want to pay for a product on credit, it is wise that you pay the full amount so that you do not incur interest charges.

Understanding Credit Card Payment Due Date and Grace Period

The credit card grace period is usually 21 to 25 days, during which you can pay off the full balance without being charged interest. Some cards offer up to 55 days. To avoid interest, clear your balance by the billing date. Making only minimum payments can harm your credit score and result in more costs.

What Happens if I Miss the Credit Card Payment?

If you miss your credit card payment, then it might lead to late fees, lower credit scores, and higher interest rates.

Welcome Offers and Bonuses for Credit Card Users

Credit card firms in the United States frequently utilize appealing welcome offers and incentives to recruit new members.

Here’s a more in-depth look at the sorts of incentives you might anticipate:

Sign-Up Bonuses

Example: If you make $4,000 worth of purchases within the first 3 months of using the Chase Sapphire Preferred® Card, you can get your hands on 60,000 bonus points.

Benefit: These 60,000 points can be leveraged for $750 towards travel when such bookings are made through Chase Ultimate Rewards®, thereby increasing the original number.

0% Introductory APR

Example: For 18 months, the Citi Simplicity® Card has attracted users with features such as 0% on purchases and balance transfers.

Benefit: It enables you to settle expensive items or borrowations without incurring interest on the initial period, hence saving you a lot of interest.

Bonus Rewards

Example: The Discover it® Cash Back card provides users with up to 5% on rotating categories such as grocery stores, gas stations, and restaurants, among others, with a cap of on the first $1500 of spending per quarter.

Benefit: This way, you can get the most out of your purchases as the more money you spend within these categories, the more cashback you will indeed get and, therefore, save money.

No Annual Fee for the First Year

Example: The American Express® Gold Card charges $250 on annually, though the card offers the first year free.

Benefit: Fixed-value benefits, such as dining credit and travelling rewards, may be obtained without the initial money, allowing the consumer to decide whether it is worth entering into a long-term relationship with the card.

Travel Benefits

Example: Currently, the credit card, The Platinum Card® from American Express, includes free access to more than 1,200 airport lounges across the globe.

Benefit: Business travellers working for particular airlines can benefit from getting access to luxury lounges as they save on the cost of food and drinks in addition to having the best experience ever.

Referral Benefits

Example: You get 15,000 points for each referral (up to five referrals a year) when your referred person signs up for the Chase Sapphire Preferred® Card.

Benefit: Referring friends opens up another avenue for earning more points, thus increasing your rewards without having to spend more money.

Welcome Gift Offers

Example: There is a Hilton Honours American Express Card, which offers a $100 Hilton gift card upon signing up and meeting specified spending requirements.

Benefit: You get a physical welcome offer, which could be in the form of statement credits towards a hotel you need as a cardholder.

These incentives are intended to appeal to a variety of spending habits and lifestyles, resulting in significant benefits for new credit card users. You may maximize the benefits of these perks by carefully picking the proper deal.

Factors to Consider While Choosing A Credit Card

Choose a credit card and decide whether you want to pay off the debt every month or carry it over. Look for credit cards that offer perks like cash back or points if you pay in full. If not, concentrate on using low-interest credit cards to cut expenses.

Understanding the annual percentage rate (APR), minimum payback amounts, yearly fees, and costs for overseas transactions or late payments is crucial. By comparing promotional deals on interest rates and contrasting reward schemes, you can make informed decisions.

Use comparison websites for card choices, but remember that applying for more than one card may impact your credit score.

To determine the suitability of a credit card in the U. S. or the need to purchase a credit card, anyone must consider a number of factors.

Here are the key points to consider:

1. Payment Preferences

Your choice of paying off your bills month by month or carrying balances forward is significant.

If you pay in full, look for credit cards that offer perks like cashback and reward points. If you prefer to maintain a balance, consider cards with low-interest charges to reduce costs.

2. Annual Percentage Rate (APR)

The interest rate is displayed as APR. You will be charged if you don’t pay off the balance of your cost every month.

If you have a balance of some amount, compare the annual percentage rates to select a card that provides better rates.

3. Minimum Repayment Amounts

Remember to learn the minimum amount required to be paid so that one is not charged more fees or interest charges.

It is important to know how much money any individual should spend monthly in order to avoid reaching a state of financial emergency.

4. Annual Fees

Particular cards include annual fees, which may range from $95 to $500 or more.

If you want to look for cheap options, it’s preferable to get a card without an annual fee; if not, compare the benefits of premium credit cards, even though they may have a fee that meets the value of the reward.

5. Foreign Transaction Fees

You should especially check whether the card has foreign transaction fees if you frequently travel or make purchases from international merchants—they generally cost about 3%.

For example, if you plan to make transactions in a foreign country, look for a credit card that charges no foreign transaction fee.

6. Late Payment Fees

Failure to pay on time leads to a penalty fee of $15 -$40.Choose cards that allow some flexibility in the payment timeline or even regular monthly payment plans to avoid such penalties.

7. Promotional Offers

This type of card usually offers other deals, such as promotions the card issuer might offer, like an intro rate of 0% APR on purchases or balance transfers.

These offers try to match, particularly if a big purchase needs time to be paid or if the existing balance needs to be transferred with no interest charge.

8. Reward Programs

It’s important to compare the reward schemes, whether it’s cashback, travel points, or any other type of incentive. Choose a program that aligns with your spending habits to maximize its benefits.

Physically, choose a program that will, in one way or another, affect your spending habits so that you get the most out of the program.

9. Payment Gateway and Acceptability

If you make a cross-border purchase or travel frequently, check that the card is accepted on the Internet and at a physical point of purchase.

10. Interest Rate

If you are likely to keep the balance because you cannot pay it off fully for some time, then you should opt for credit cards with low-interest charges.

11. Card Comparison

To compare the credit card offers, visit the comparison tools online, but only apply for the credit cards in large numbers as this may harm the credit rating.

When a person considers these factors, he or she will be able to select the credit card that is most suitable for his or her financial needs.

What Does it Mean to Transfer a Balance?

Transferring a balance from one credit card to another at a better interest rate may sometimes involve charges. Citi® Diamond Preferred offers balance transfers with as low as 0% APR for the first 21 months.

Can I Get into Trouble by Applying for More than One Credit Card?

Yes, multiple applications can cause a temporary drop in the credit score due to his or her inquiries.

What is the Credit Card Billing Cycle?

A credit card billing cycle is a defined period that lasts between 28 to 31 days during which all the transactions made on the credit card are recorded. This cycle begins the day after the previous statement’s closing date and ends on the closing date of the current statement. At the end of each cycle, your credit card issuer generates a statement that details all your purchases, payments, interest charges, and any applicable fees incurred during that period. This statement also indicates your total balance and the minimum payment due that provides a clear snapshot of your credit activity.

It is important to understand your credit card billing cycle for effective financial management. The payment due date usually falls 21 to 25 days after the statement closing date which provides you with a grace period to pay off your balance without incurring interest charges. The balance reported at the end of each cycle can impact your credit utilization ratio. If you manage your payments strategically within the billing cycle you can avoid late fees, reduce interest charges, and maintain a healthy credit profile.

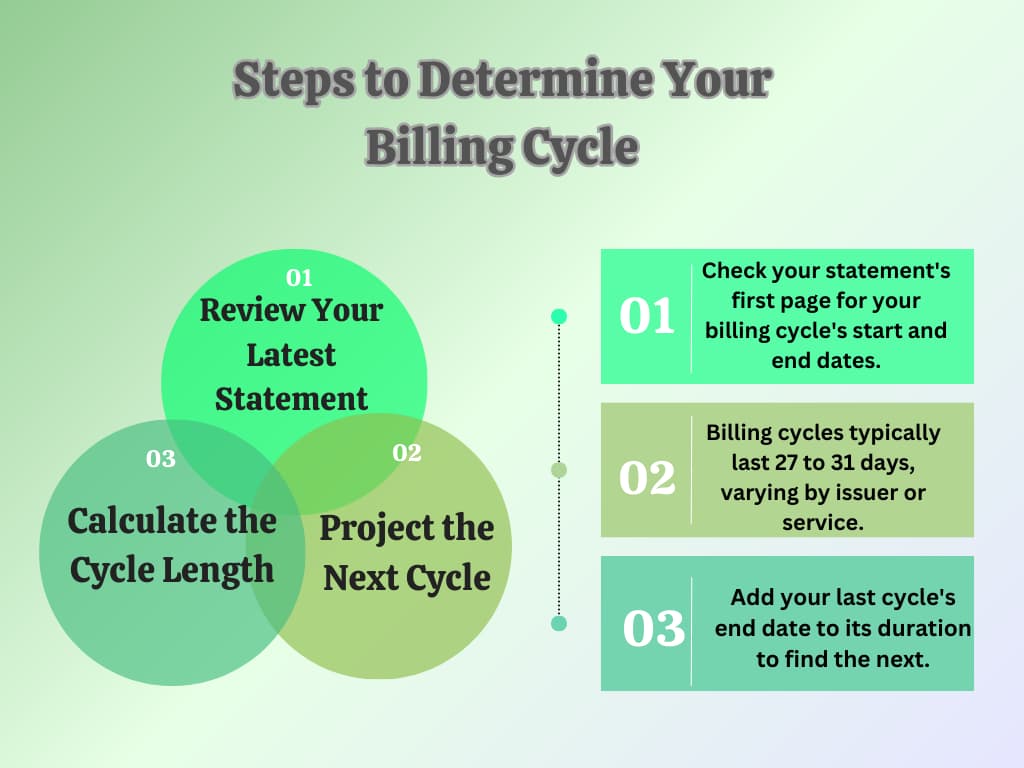

Steps to Determine Your Billing Cycle

1. Review Your Latest Statement

- Check the start and end dates of your most recent billing cycle on your credit card or service provider statement. This information is generally shown at the first page of the statement.

2. Calculate the Cycle Length

- Count the number of days between the start and end dates of your previous billing cycle. Most of the billing cycles range from 27 to 31 days, but this can vary by card issuer or service.

3. Project the Next Cycle

- To determine the end date of your next billing cycle, add the calculated number of days to the end date of your previous cycle. For instance, if your last billing cycle ended on March 15 and lasted 30 days, your next cycle will end on April 14.

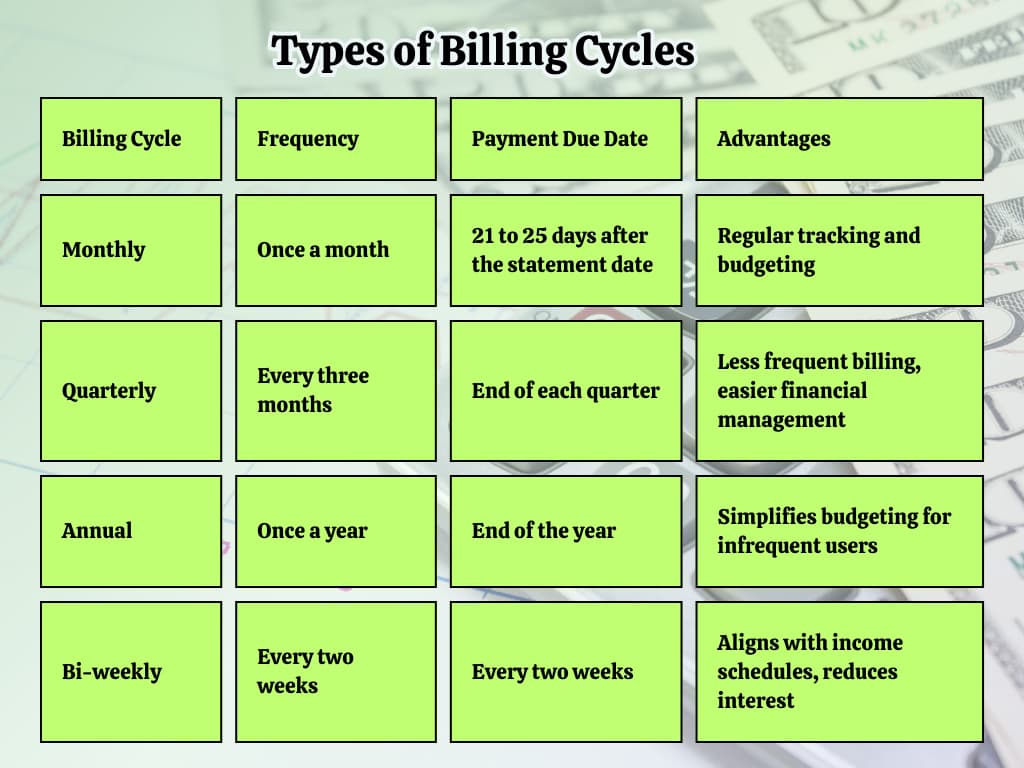

Types of Billing Cycles

Benefits of Credit Card Billing Cycle

If you adjust your billing dates according to your income payments, such as salary or freelance payments it will help you to provide sufficient funds available to cover your bills. This will help you to avoid late payments and the associated fees which can strain your finances. This shows that aligning your billing cycle with your income schedule is essential for effective cash flow management.

- Budgeting and Financial Planning

Individuals can allocate their funds according to their due bills which allows them to ensure that their necessary expenses are covered without overspending in other areas. This predictability helps you to create an accurate monthly budget and helps in planning for other personal spending.

- Avoiding Late Fees and Interest Charges

Understanding your credit card billing cycle helps you stay informed about your payment deadlines, which can help you avoid late fees. It also reduces the risk of incurring additional charges, such as increased interest rates, that can negatively impact your financial health. Keeping track of your credit card billing cycle will also help you manage your credit scores.

- Impact on Credit Score

Timely payments within the billing cycle are crucial for maintaining a good credit score. Your credit card payment history is a significant factor in credit scoring models, and consistently paying bills on time enhances your creditworthiness and can lead to better loan terms in the future.

- Flexibility in Payment Management

Many card issuers allow customers to change their billing cycles. This flexibility in change of billing cycle can be beneficial if there are changes in income or spending habits. Individuals can manage their cash flow better and avoid periods of low liquidity before receiving income by requesting a shift in billing dates.

Frequently Asked Questions

Transfer Money from Credit Card to Bank Account without any Fees?

Transferring money from a credit card to a bank account without any fees is challenging, as most methods come with costs.

However, you can explore these options:

- Third-Party Services: Certain services or apps might allow credit card transfers to bank accounts, but they often charge fees. Look for services with lower fees or special offers.

- Balance Transfer Checks: Some credit cards offer checks that you can use to transfer funds to your bank account. Check if your card issuer provides this service without fees.

- Cash Advance with No Fee Promotions: Occasionally, credit cards have promotions for cash advances with no fees. Look for such offers but be mindful of the high-interest rates that may apply.

What are the Risks of Using a Credit Card?

Using a credit card comes with several risks:

- Fraud Risk: Credit cards can be targets for fraud. If your information is stolen, it can lead to unauthorized charges and require time to resolve.

- High Interest Rates: If you carry a balance, you’ll pay interest, which can quickly add up, especially with high APRs.

- Debt Accumulation: It’s easy to spend more than you can afford, leading to accumulating debt that can be difficult to manage.

- Credit Score Impact: Missing payments or using too much of your credit limit can harm your credit score, making it harder to get loans or other credit in the future.

- Fees: There may be fees for late payments, cash advances, or exceeding your limit, which can increase your financial burden.

How Can I Increase My Credit Card Limit?

To increase your credit card limit, you can:

- Wait for Automatic Increases: Some issuers periodically review accounts and may automatically increase your limit based on your credit use and payment history.

- Request a Limit Increase: Contact your credit card issuer and ask for a higher limit. They might review your account and financial situation to approve the request.

- Improve Your Credit Score: Paying bills on time and reducing your debt can boost your credit score, making you more likely to get a higher limit.

- Increase Your Income: If your income has gone up, inform your credit card issuer. A higher income can support a higher credit limit.

- Use Your Card Responsibly: Regularly using your card and paying off the balance can demonstrate responsible credit use, which might lead to an increase in your limit.

How Do Credit Cards Affect My Credit Score?

Credit cards affect your credit score by influencing your payment history, credit utilization (the ratio of your balance to your limit), and the length of your credit history. Paying on time and keeping your balance low helps improve your score.

How Credit Card Limit is Decided?

Your credit card limit is influenced by factors like your credit score, income, credit history, and existing debt levels. Issuers evaluate your ability to repay based on these factors to set an appropriate limit.

What Are the Benefits of Using Credit Card Purchase Protection?

Credit card purchase protection covers you against fraud, theft, and damage of items bought with the card. Benefits may include extended warranties, return protection, and insurance for lost or damaged purchases.

What are Credit Card Rewards Programs and How do they Work?

Credit card rewards programs provide valuable incentives for spending. Users can earn points, cash back, or miles for every dollar spent, which can be redeemed for a variety of rewards like travel, merchandise, or statement credits. Many cards offer bonus rewards for specific categories, such as dining, groceries, or gas, allowing you to maximize benefits based on your spending habits. By choosing the right card and strategically using it, you can enjoy significant savings and perks over time.

How Do I Check My Wells Fargo Credit Card Statement?

To check your Wells Fargo credit card statement, follow these simple steps:

Wells Fargo also offers an option to go paperless, which means you’ll receive your statements electronically instead of by mail.

Log In to Wells Fargo Online:

- Visit the Wells Fargo website or use their mobile app.

- Enter your username and password to access your account.

Navigate to Your Credit Card Account:

- Once logged in, go to the “Accounts” section.

- Find your credit card account listed among your other accounts.

View Statements:

- Click on your credit card account.

- Look for a tab or link that says “Statements” or “Transaction History.”

- Here, you can view your current statement or past ones.

Download or Print (Optional):

- If you need a hard copy, you can download the statement as a PDF or print it directly from the site or app.

Enroll in Paperless Statements (Optional):

- Wells Fargo also offers an option to go paperless, which means you’ll receive your statements electronically instead of by mail.

How Do I Activate My American Express Credit Card?

To activate your American Express card, you can either visit the website or use the mobile app by signing in and entering your card details, follow these steps for a seamless process:

Online Activation

- Visit the Amex website: Go to the official American Express card activation page at americanexpress.com/confirmcard.

- Log in or create an account: If you already have an online account, sign in using your credentials. If you’re new to Amex, you’ll need to create an account by providing some basic information.

- Enter your card details: Input your 15-digit card number and the 4-digit card security code (located on the front of the card).

- Follow the prompts: Once entered, follow the instructions to complete the activation. You’ll receive confirmation when it’s done.

Activation via the Amex Mobile App

- Activate your card: Navigate to the card activation section, where you’ll be prompted to enter your card details. The process is similar to online activation, and you’ll get a confirmation notification once it’s successful.

- Download the app: Install the American Express app from your device’s app store if you haven’t already.

- Sign in or create an account: As with the website, log in with your existing Amex account or sign up if you’re new.

What is Credit Card Churning?

Credit card churning is the practice of repeatedly applying for credit cards to earn sign-up bonuses, such as points, miles, or cash back, and canceling them before fees are due. While profitable for some, it risks credit score damage and financial instability if not managed carefully. To learn more, visit: What is Credit Card Churning?.

What is Credit Card Auto-Pay?

Credit Card Auto-Pay is a service that automatically schedules payments for your monthly credit card bills, ensuring timely payments without manual effort. It offers flexibility in choosing the payment amount—minimum due, full balance, or a custom amount—and helps avoid late fees while maintaining a good credit score. To learn more about Credit Card Auto-Pay.

How to Apply for a Pre-Approved Credit Card?

To apply for a pre-approved credit card, check your eligibility through the issuer’s website or mailed offers, review the terms, and submit your application, which may involve a hard credit check. Pre-approval boosts your chances but doesn’t guarantee approval. Read more about applying for a pre-approved credit card.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a flexible payment option that allows customers to split their purchases into interest-free installments, provided payments are made on time. It offers financial convenience but requires responsible usage to avoid late fees or credit score impacts. Read more click here for detailed insights on BNPL.

Which is the Best Digital Wallet?

The best digital wallet depends on your preferences and needs, with options like Apple Pay®, Google Pay™, and Samsung Pay® offering features like contactless payments, biometric authentication, and loyalty rewards. For peer-to-peer transfers, Venmo and Cash App are popular choices. To explore more about digital wallets, their features, and benefits, you can read the detailed guide here.

What is the Minimum Settlement Amount?

The Minimum Settlement Amount refers to the lowest amount you must pay on your credit card each month to keep your account in good standing. It is usually calculated as a percentage of your balance (typically 1%-3%) or a fixed minimum amount (e.g., $25 or $35). While paying the minimum prevents penalties, it leads to accumulating interest, making debt repayment longer and costlier. Read more about Minimum Settlement Amount.

What is the Best Payment Schedule for Credit Cards?

The best payment schedule for credit cards involves timely payments, prioritizing high-interest balances, and maintaining an optimal credit utilization ratio. This approach helps manage expenses effectively, avoids late fees, and boosts credit scores. To learn more about creating an effective payment schedule for credit card.

What are the two most important dates in your credit card billing cycle?

The two critical dates are the statement date, when your bill is generated, and the due date, which is when payment must be made. The statement date marks the end of your billing cycle, while the due date typically falls 21 to 25 days later, giving you time to pay off your balance without incurring interest.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule suggests that you should aim to use no more than 20% of your total credit limit (2), pay off at least 30% of your balance each month (3), and maintain at least four open accounts to build a positive credit history (4). This helps you to improve your credit utilization ratio which is crucial for maintaining a good credit score.

Explore All Topics Around Credit Cards

-

Payday Loan vs Personal Loan: Which Is the Better Choice?

If you require a small sum of money for an emergency and it is possible for you to repay it by your next paycheck then…

-

How Can I Use My Credit Card Like a Debit Card?: Smart Spending for Maximum Benefits

Financing purchases with a credit card as a debit card implies spending what you can afford while enjoying the advantages of credit. Numerous individuals opt…

-

Should I Cash in Stocks to Pay Off a High Credit Card Balance?

The decision to sell stocks to pay off a high credit card balance can be a difficult one. Credit card debt rapidly increases and can…

-

What is Your Best ‘Catch-All’ Credit Card and Why?

Catch-all credit cards are the best option if you want to earn points without having to deal with the hassle of tracking categories. These cards…

-

What is the Best 2% Catch-All Credit Card in Your Opinion?

Introduction A 2% catch-all credit card is a card that provides an across-the-board 2% cashback (or similar reward points) on all purchases regardless of what…

-

Any Drawbacks to Using Credit Card for All Purchases

Using a credit card for all purchases can lead to debt and high fees if mismanaged. You can use credit cards for traveling, grocery, gas,…

-

Credit Card Loan EMI: How to Convert Your Loan into Easy Monthly Payments

Converting credit card purchases to EMIs can lead to reduced interest rates and easier repayment, but look out for processing costs, limited credit limits, and…

-

Credit Card Cash Advance Vs. Credit Card Loan: What’s the Difference?

In financial emergencies, credit cards offer two options for getting immediate cash: cash advances and credit card loans. Even though both promise instant access to…

-

Credit Card Loan vs. Personal Loan: Which One Should You Choose?

Credit card loans offer ongoing access to specified amounts, while personal loans lend a lump sum of money upfront to the borrowers. Credit Card loans…

-

Secured Credit Cards with No Annual Fee in 2025

No annual fees and secured credit cards can be a powerful tool for credit building as these cards help you to establish an improved credit…

-

A Comprehensive Guide to Credit Card Security and Fraud Prevention

Fraudulent charges on your credit card result in financial loss, affect your credit score and create problems when applying for loans. For business owners, credit…

-

Best Balance Transfer Credit Cards with Low-Interest Rates in the USA for 2025

A balance transfer credit card can assist you in saving money on interest and settling your debt quicker by transferring your balance to a 0%…

-

Credit Score Breakdown: How Each Factor Impacts Your Score

A credit score is a number calculated based on several factors, such as payment history, credit utilization, credit history length, credit mix, and new credit…

-

Metal Credit Card: What’s the Difference, Types, Benefits and Use?

Explore All the Metal Credit Cards

-

Strategies to Pay Off Credit Card Debt Faster

Struggling with credit card debt? This guide offers practical strategies like the Snowball and Avalanche methods to help you pay off your balances faster. By…

-

The Benefits of Paying Your Credit Card Balance in Full

Paying your credit card balance in full each month helps you avoid interest charges, improves your credit score, and provides better financial flexibility. By maintaining…

-

How Does a Balance Transfer Work on a Credit Card?

A balance transfer credit card helps you move high-interest debt to a new card with a lower or 0% introductory APR, saving on interest and…

-

How Do you Get Approved for a Credit Card with Bad Credit?

If you have bad credit, getting approved for a credit card can be challenging, but it’s possible. By reviewing your credit report, paying down existing…

-

The Rise of Digital Wallets – How They Relate to Credit Cards

Digital wallets offer a secure and convenient way to store and use credit card information for both online and in-store transactions. By linking your credit…

-

Credit Card Limits – How They Are Set and How to Increase Yours

Understanding your credit card limit is crucial for managing finances, avoiding unnecessary debt, and improving your credit score. The credit limit determines how much you…

-

What is Buy Now, Pay Later (BNPL)? A Complete Guide

Buy Now, Pay Later (BNPL) allows consumers to make purchases and split payments into manageable installments, often without interest if paid on time. This payment…

-

EMV Chip Cards and Contactless Payments – How They Work in Credit Cards

EMV chip cards and contactless payments offer secure, convenient transaction methods for consumers and businesses. EMV technology reduces counterfeit fraud with one-time-use codes, while contactless…

-

What is Credit Card Churning? How Does it Work, and Affect your Credit Score

What is Credit Card Churning? Credit card churning is an act of deliberately opening the same or multiple cards in order to maximize rewards, like…

-

Late Payments on Your Credit Card – Consequences, Impacts, and Tips to Avoid Late Payments

Late payments on credit cards can lead to hefty fees, higher interest rates, and damage to your credit score. This article outlines the consequences of…

-

Credit Card Skimming – How to Protect Yourself from Card Fraud

To protect yourself, inspect card readers for tampering, use chip-enabled cards, and monitor your statements. Avoid skimmers by using your debit or credit cards at…

-

Discover Credit Cards Network – How to Apply, Types & Benefits?

Looking for a reliable credit card with cash-back rewards, low fees, and top-tier customer service? Discover Credit Cards offer multiple options, including cash-back, travel, student,…

-

Credit Card Minimum Payment – Definition, Calculation, and Risks Involved

Paying only the minimum on your credit card can seem like an easy solution, but it can lead to high interest charges and extended debt…

-

What is a Credit Card Grace Period, and How Can It Save You Money?

A credit card grace period allows you to avoid interest on new purchases by paying your balance in full before the due date. By understanding…

-

Credit Card Auto-Pay Features – How to Sing Up and Manage Your Payments?

Credit card auto-pay helps simplify bill payments by automating the process, ensuring on-time payments and avoiding late fees. It can boost your credit score by…

-

Credit Card Payment Schedule: What it is, How to Create, and Benefits

A credit card payment schedule helps you manage payments effectively, reduce debt, and improve your credit score. By organizing due dates, choosing the right payment…

-

Credit Card Pre-Approval – What Does It Mean?

Credit Card Pre-Approval means an offer for a credit card to a consumer from a credit card company after conducting a hard inquiry, and the…

-

Visa Credit Cards: Definition, Different Types, and How They Work?

A Visa credit card helps you manage your finances, build credit history, and earn rewards with each purchase. It works by allowing you to make…

-

Lines of Credit for Small Businesses

A business line of credit provides small businesses with flexible access to short-term funding, ideal for managing cash flow, covering unexpected expenses, or financing inventory…

-

Top 9 Credit Card Companies in USA

This article helps you choose the best credit card companies in the USA by highlighting the top 8 issuers based on purchase volume and card…

-

21 Types of Credit Cards Used in United States

This article provides an overview of the 21 types of credit cards available in the United States, each designed to meet specific financial needs, such…

-

The Most Used Credit Cards in The USA?

Looking for the most popular and effective credit cards in the USA? This article highlights top credit cards that cater to different needs like cash…