Creating an income statement is essential to understanding your business’s profitability. It provides a clear picture of your company’s financial health by detailing revenue, expenses, and net income. With this information, you can make informed decisions to ensure commercial success, optimize operations, and plan for future growth while addressing any potential financial challenges.

What is an Income Statement?

Financial statements also known as Income statements showcase the profitability of a business over a period of time. It shows your expenses, revenue, profit, and loss.

At times, referred to as a “net income statement” or a “statement of earnings“. Income statements are amongst the three most essential financial statements in accounting, alongside the balance sheet and the cash flow statement.

While an income statement is only made for a business’s internal use, it will be referred to as P&L (Profit and Loss) statements.

The income statement helps you in understanding the financial health of your business.

Why is an Income Statement Important?

An income statement assists the business owner to make profitable decisions for the company. Be it generating a profit by increasing revenue, or by decreasing cost, it showcases the effectiveness of the strategic plan built at the beginning of the business.

The team can refer to this statement to analyze whether or not these strategies have paid off and are they working in the right direction. However, they end up coming to the best solution based on their analysis.

Income statement resides some other things, which are as follows:

1. Frequent Reports

Whilst other financial statements are released annually, the income statement on the other hand is generated quarterly or monthly. Amid this, business owners and investors can keep a track of the business’s performance from close and make profitable decisions. This even leads to finding any shortfalls and fixing small business problems before they grow and become expensive chaos.

2. Tracking Down Expenses

This statement mainly highlights the expenses or any unexpected expense for the future which are sustained by the company. Along with the domains that are under or over budget. Expenditures generally include rent, payrolls, salaries, and other miscellaneous expenses. These expenses even involve promotion, marketing, hiring a workforce, and providing amenities.

3. Business Analysis

Investors get an overview of the business’s status in which they are investing through this statement. Banks and other financial institutions can analyze the statement to decide whether the business is worth investing in by calculating the company’s market value, loan credibility, and profitability.

Who Uses an Income Statement?

The Income statement is used by two main groups of professionals: Internal and external users.

An internal group of users mainly include the management and the board of directors who use this data to track the business financial position in the market and fix the shortcoming if any.

These statements are even used to make decisions for commercial success, plus can take actions on any concerning financial transactions.

An external group of users mainly include creditors, investors, and peers. These external users are the ones who can actually provide you the source and direction to move forward.

Investors tally the company’s market position, growth, and profitability strategies for the future, to decide whether or not to invest.

Creditors on the other hand analyze the income statements to check the cash flow to see the credit eligibility of the company and will it be able to pay off the loans or in a position to get an additional loan.

Peers are the vital group of people who set a bar in the market. Peers or competitors use your income statements to fetch details of your company to tally the success parameters of a business and understand the areas of business expenditures and where all they are spending extra.

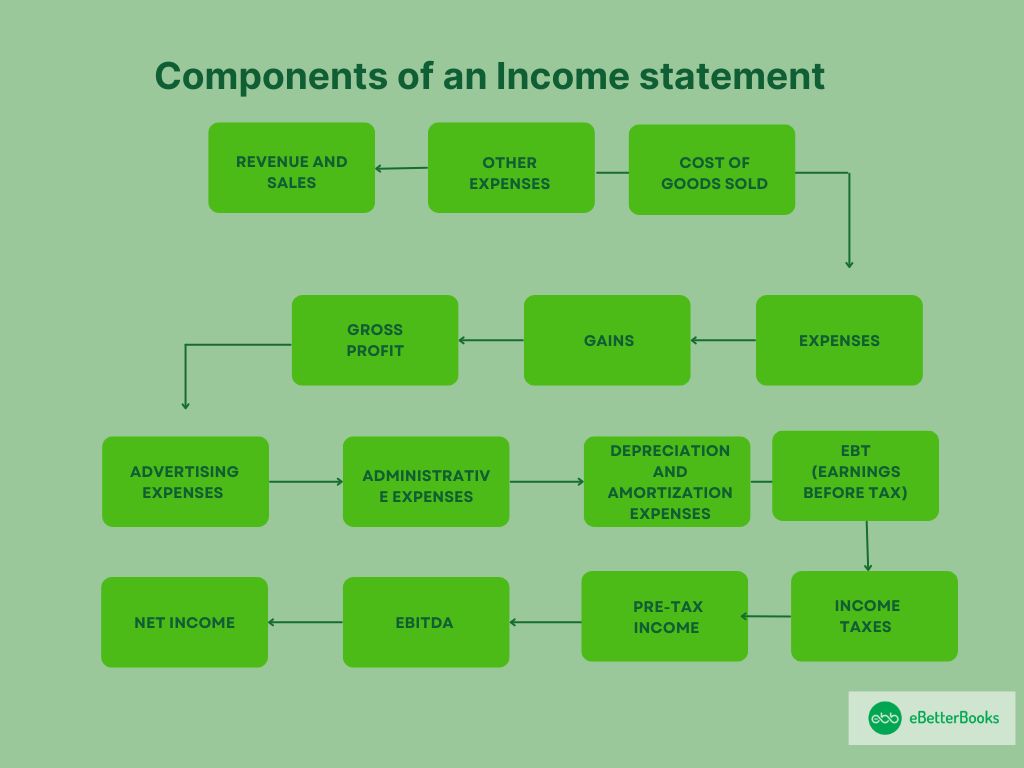

Components of an Income Statement

The format of a business’s income statement varies depending on the regularity needs, business requirements, and operating activities associated with business operations. The income statement provides a detailed summary of revenue, expenses, gains, and net income, helping businesses evaluate financial performance and profitability over time.

1. Revenue and Sales

This is the topmost section on the income statement which offers a summarized outlook of gross sales made by the company. Revenue can be differentiated into two main categories: operating income and non-operating income.

- Operating revenue is the revenue earned by a company through primary activities including, manufacturing products or services provided.

- On the other hand, Non-operating revenue is earned by activities such as operations, maintenance, or installation.

Total cost of goods or services sold, is known as cost induced to manufacture the same. Keep note that it only comprises the cost of sold products. The cost of goods sold doesn’t generally include an indirect cost.

3. Gross Profit

Also defined as net sales – the total cost of goods sold. Net sales are the total amount of money earned from goods sold, whereas the cost of goods sold is the money that you spend in producing those goods.

4. Gains

The result of an event leading to an increase in the organization’s income. Gains stipulate the amount of money registered by the company from different activities, including sales. The profit earned from non-business activities is also counted as gains.

However, gains are considered secondary revenue, both the terms are different. Revenue is the money that the company received on a regular basis whereas, the gain can be deemed from the sale of fixed assets which is generally considered as an activity that doesn’t take place that often in a company.

5. Expenses

The cost a company has to bear in order to generate revenue is considered an expense. Employee salaries, payments, and equipment depreciation are expenses that the company incurred.

Operating and non-operating expenses are two main categories of business expenses.

For example, pension, payroll account, sales commission are operating expenses. Expenses caused by the company’s basic operations are operating expenses.

Whereas, the expenses which are not caused by core activities are known as non-operating expenses. These expenses include lawsuit settlement or charges for obsolete inventory.

6. Advertising Expenses

The marketing cost to grow your clientele are simply the advertising expenses. They comprise advertisements on social media and print as well as television ads, and radio advertising. Advertising costs are part of Sales, General & Administrative expenses.

7. Administrative Expenses

The expenditure incurred by the company rather than associated with any specific department of the business. Salaries, rent, supplies for the office, and travel allowance expenses. Administrative expenses are considered as a fixed expense and exist at all levels of sales.

8. Depreciation and Amortization Expenses

Both of these costs can be categorized as non-cash expenses. These two are typically made by accountants to help in distributing the cost of capital assets such as Property, Plant and Equipment.

9. EBT (Earnings Before Tax)

The company is measured by its financial performance. EBT is calculated by deducting the expense from income, before taxes. This is amongst the line units on a multi-step income statement.

10. Net Income

Defined as the total amount of money earned after deducting general expenses of the business. Total expense minus total revenue is the net profit of the company. Whereas, gross profit can be known as the money that company earns after subtracting the cost of goods sold which is defined as the company’s earning that is net income.

11. EBITDA

Earnings before Interest, Tax, Depreciation, and Amortisation or EBITDA might not get recorded in all income statements. Generally, the EBITDA of a firm is calculated by:

Subtracting the selling, general and administrative expenses exclusive of amortization and depreciation from its gross profit.

12. Pre-Tax Income

Pre-tax income and the earning before tax are determined by subtracting interest expenses from the firm’s operating income. Also, it is the last total before achieving the net income of the organization.

13. Income Taxes

It creates the relevant taxes charged on the pre-income. The total tax expenses usually contain both the current as well as the future tax liabilities.

14. Other Expenses

This component usually includes expenses that are unique to particular industries or ventures.some of the most common ones are as follows – technology, stock-based compensation, fulfillment, research and development, proceeds from the sale of investments, foreign exchange impacts, ec.

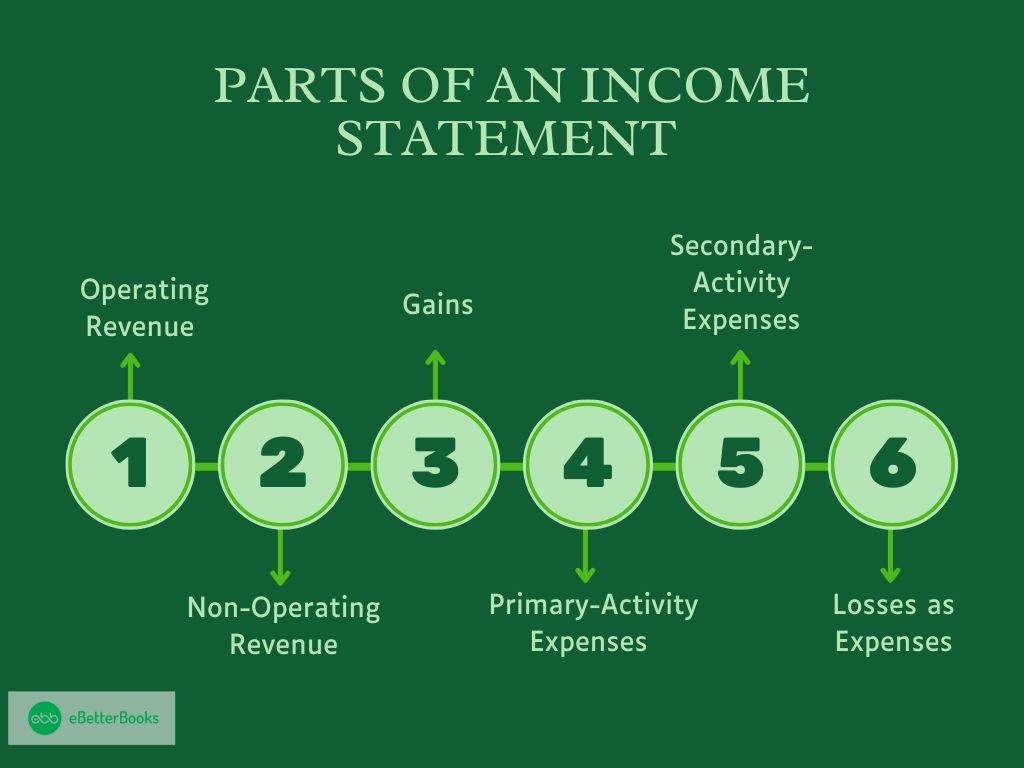

Parts of an Income Statement

The format of an income statement might vary, depending on the local regulatory requirements, the different scope of the business, and the associated operating activities. Although, regardless of the format, certain information might be present.

1. Operating Revenue

Revenue that is realized through primary activities is usually known as operating revenue; for a company that is manufacturing a product for a wholesaler or retailer associated with the business of selling that product or distributor, the revenue from primary activities is known as revenue obtained from the sale of the product.

Similarly, for an organization (or its franchisees) in the business of offering services, the revenue from primary activities is like the reward for their hard work, the fees earned in exchange for offering those services.

2. Non-Operating Revenue

Revenue which is realized through secondary or non core business activities are often known as nonoperating, recurring revenue.

This revenue is sourced from the earnings which are outside the purchase and sale of goods and services like income from:

- Interest which is earned from business capital in the bank

- Rent business property

- Strategic partnership such as royalty payments

- Advertisements that are placed on business property

3. Gains

This is also known as other sundry income; gains show the net money which has been made by other activities like the sale of long-term assets. These add to the net income realized from one-time non-business activities, like a company selling out its old transportation van, unused land, or a subsidiary company.

Revenue should be distinct from receipts. Payments are generally accounted for during the period when sales are done, or services are delivered. Receipts are known as the cash received and are considered when the money is received.

4. Primary-Activity Expenses

These are considered as expenses incurred for earning the average operating revenue which is linked with the primary activity of the business. They add the (SG&A) expenses; amortization or depreciation, cost of goods sold (COGS); selling, general, and administrative and research and development (R&D) expenses.

Some typical items that make up the lists are mentioned below:

- Employee wages

- Utilities

- Transportation

- Sales commissions

5. Secondary-Activity Expenses

These are considered as expenses which are linked to non core business activities, such as interest paid on loan money. They might be recurring or happening only once.

6. Losses as Expenses

These are known as expenses which go towards a loss-making sale of long-term assets, that to only one-time or any other unusual costs, or expenses toward lawsuits.

Income Statement Structure and Example

Below given is an example of an income statement for a fictional company that shows the main components which create an income statement. This will not only provide a suitable income statement example but also give a fair idea about the ideal structure of income statement.

Income Statement

| Particulars | Amount |

| Net Sales | $ 4,358,100 |

| Cost of Sales | $ 2,738,714 |

| Gross Profit | 1,619,386 |

| Selling and Operating Expenses | 560,430 |

| General and Administrative Expenses | 293,729 |

| Total Operating Expenses | 854,159 |

| Operating Income | 765,227 |

| Other Income | 960 |

| Gain (Loss) on Financial Instruments | 5,513 |

| (Loss) Gain on Foreign Currency | (12,649) |

| Interest Expense | (18,177) |

| Income Before Taxes | 740,874 |

| Income Tax Expense | 257, 642 |

| Net Income | $483, 232 |

Single-Step Income Statement

A single-step income statement shows the total revenue, total expenses and the bottom line profit or loss as earned by the business, but they provide this information in a single step because a single equation is used to calculate profits.

The equation used in a single-step income statement is:

Net Income = (Revenues + Gains) – (Expenses + Losses)

The single-step income statement provides a classic snapshot of the financial activities of your company. It is quite easy to understand and relatively easy to prepare.

Multi-Step Income Statement

Global companies operating on a huge level with a wide range of services and goods as well as involved in partnerships and acquisitions have to follow a complex way of maintaining the income statements.

Due to such a wide range of activities involved, they have to comply with precise reporting methods. These companies go for multi-step income statements, in which operating expenses, operating revenues, and gains are classified separately from non-operating expenses, non-operating revenues, and losses.

They follow a four-level structure while preparing the income statements which involves: operation, gross, Pre, and post-tax.

How to Prepare an Income Statement?

Here’s a step-by-step guide to preparing an Income Statement:

- Gather Financial Data: Hear all necessary financial data including total revenues and total expenses for the period.

- Determine Reporting Period: This usually depends on the time interval you would wish to keep your income statement (monthly, quarterly or yearly).

- Calculate Revenue: Total all revenue of goods or services.

- Calculate COGS: Identify fixed costs of delivering products or services (e.g., rent, salaries of permanent employees).

- Compute Gross Profit: Subtract COGS from revenue.

Formula: Gross Profit = Revenue – COGS

- List Operating Expenses: Hoping for rents, utilties, wages, marketing, etc.

- Calculate Operating Income: By taking out the operating expenses from the gross profit, you get operating profit.

Formula: Operating Income = Gross Profit – Operating cost.

- Account for Non-Operating Items: Usage of Other Note other income or expenses such as interest income or expenses.

- Compute Net Income Before Tax: Formula:

Before-tax Operating Profit = Operating Profit + Other Sources of Income – Total expenditure

- Deduct Taxes: Subtract cost of taxes to get the total net income.

- Net Income: Net profit or loss for the period or end of the accounting period.

Uses of Income Statement

Below are the uses of income statements:

- Assesses a company’s profit or loss within a certain time of operation.

- Management can use it to measure the effectiveness and the cost control in their operations.

- Supports investors in deciding on the tendencies of the financial result and profitability.

- Enables serving key needs for the preparations of budgets and strategies.

- Helps to make a comparative analysis with other companies and related industries.

- Helps the lenders to determine the credit standing of the company.

- Used in organization tax returns’ preparations and with other agencies or authorities for legal and other purposes.

- Revenue growth or decline is determined, hence helpful during performance assessment.

- Helps in decision-making on whether to expand or not or where to cut cost or to invest.

- Helps provide the required financial and sustainable information to the stakeholders.

Understanding Financial Ratios in an Income Statement

The ratios based on an income statement concern profitability and performance:

- The gross profit margin reflects revenue multiplied by a percentage that indicates how much of the company’s overall revenue has been generated after all costs of the production process are deducted.

- The operating profit margin is used to calculate the level of effectiveness in controlling the operating costs.

- They used the net profit margin which shows the proportion of the amount of revenue that remains after all costs have been paid.

- The EPS shows the percentage of profitability per share for shareholders.

- Following the same structure as the profit margin, the expense ratios are used to compare particular expenses to revenue in order to analyze the control of costs.

These ratios assist in the ability to make an objective assessment of a company’s financial standing.

Conclusion

An income statement is a vital source of information about the business’s financial position and the key factors responsible for its profitability. It offers you timely updates as it releases much more information on frequent time periods than other statements.

The income statement showcases the expense, income, losses, and gains of the company, which can be easily calculated by mathematical equations to get the net profit and loss for a given period.

This data helps you to make profitable decisions as well as build and restructure your strategic plans for making your business a success.

FAQs!

What is the Basic Income Statement?

The income statement is one of the most common financial reports that show a company’s revenues and expenses over a specified period, as well as its profit or loss.

What is a P&L Account in Accounting?

Another term used for a P&L account is Income statement, is a statement that records the revenue, cost, and gross profit/loss of a business in a specific period of time.

What is the Difference Between a Balance Sheet and an Income Statement?

- Balance Sheet: A record of a specific period at a particular time with respect to assets, liabilities together with shareholders’ equity.

- Income Statement: An account producing revenues, expenses, profits, and or losses within a specific period of time indicating the performance of the business.