Hi everyone, I’m Christopher Carlson. I’ve been using QuickBooks Online to manage my business finances, and now I’m trying to set up merchant services so I can receive ACH payments within one business day instead of waiting the usual 2–5 days.

I’ve already linked my bank account and verified my business details, but I can’t figure out how to enable or qualify for faster ACH Deposits times. There’s not a lot of clear info out there, and support hasn’t given me a straight answer yet.

Do I need to apply separately for one-day ACH, or is it something QuickBooks offers only to certain types of accounts or businesses?

Any help or step-by-step guidance would be really appreciated — especially from someone who recently got this set up. Just trying to make my payment process quicker and smoother for my clients.

Thanks in advance!

Hi Christopher Carlson,

If you’re looking to speed up ACH Deposits and cut down the typical 2–5 business day wait to just one, but still can’t figure out how to activate it — you’re not alone.

One-day ACH deposits aren’t automatically enabled for every QuickBooks Payments user. Instead, eligibility depends on several factors including your account history, transaction volume, chargeback risk, and sometimes a manual review and approval process by Intuit. So even after verifying your bank account and business details, the faster deposit option may not show up unless your account meets their internal criteria.

Why Does One-Day ACH Not Showing Up in Your QuickBooks Account?

QuickBooks Online does support one-day ACH deposits, but this feature is not automatically available to everyone. It depends on several internal factors that QuickBooks doesn’t display publicly, such as:

- Account history – New merchant accounts often start with the standard 2–5 day ACH window. QuickBooks assesses your track record over time before offering one-day access.

- Payment consistency and volume – Regular, timely transactions signal reliability. Frequent or large payments can trigger a review for faster deposit eligibility.

- Low chargeback rate – High refund or dispute rates raise flags. A clean history of successful payments improves your chances of qualifying.

- Complete bank and business verification – An unverified bank account or missing business details can limit your deposit speed.

- Business type and risk profile – Some industries are deemed higher risk (like cannabis or adult content), which may delay or prevent approval.

You’ll only see “one-day ACH” if your account meets all of these criteria and QuickBooks has approved you. There’s no user-accessible toggle in the dashboard.

How to Check If You Already Have Instant or One-Day ACH?

Since you’ve already linked your bank account and verified your business details, Christopher, the next step is to check whether your QuickBooks Payments account has been approved for faster ACH or Instant Deposit. QuickBooks doesn’t always send a clear notification — so you’ll need to check manually inside your account settings.

Here’s how to do that in QuickBooks Online:

- Step: Sign in to QuickBooks Online.

- Step: From the left menu, go to Sales > then click Deposits.

- Step: In the Deposits dashboard, look at the top-right corner for any message or button that says:

- “Enable Instant Deposit”

- or “Get deposits faster”

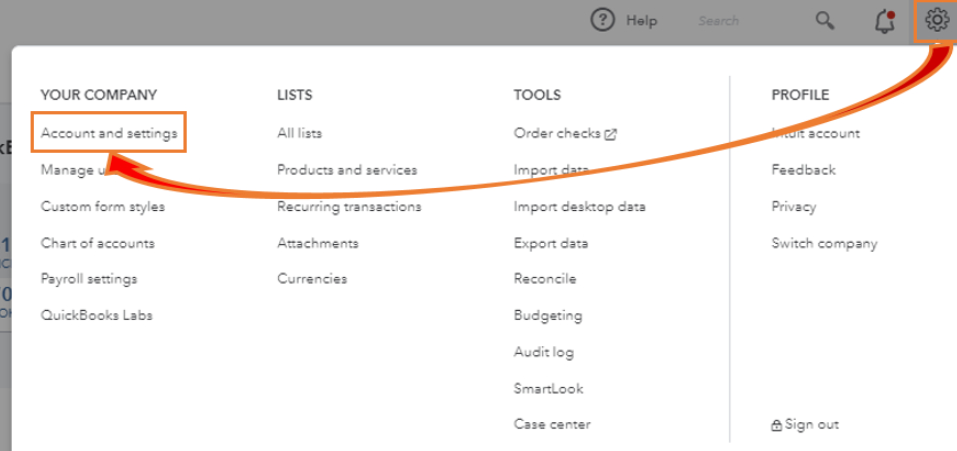

- Step: You can also go to Settings > Account and Settings > Payments tab — and scroll down to the Deposit Speed section.

- If you see Instant Deposit or Next-Day ACH mentioned, it means you’ve been approved.

- If there’s no mention of faster deposit options, it likely means your account hasn’t been approved yet.

QuickBooks only offers faster deposit speeds to accounts that meet certain eligibility requirements (based on business history, transaction volume, and risk evaluation). So even if your bank is verified, you won’t see the option unless you’ve already been approved behind the scenes.

There’s no separate application process for one-day ACH. The system automatically evaluates your account over time — and enables faster deposits when you qualify.

What to Do If You’re Not Seeing the Option?

If you’re not seeing the option to enable faster ACH deposits in your QuickBooks Online account, don’t worry — you’re not alone. QuickBooks doesn’t offer a direct “apply now” button for faster deposit speeds. Instead, it quietly evaluates your account over time based on how you use QuickBooks Payments.

Here are a few proactive steps you can take to improve your chances of getting access to 1-day or instant ACH deposits:

1. Continue Processing ACH Transactions Regularly

QuickBooks is more likely to approve faster deposit speeds for businesses that show reliable transaction behavior. If you’ve just started using ACH, regular volume helps build a payment history that Intuit uses to assess trust.

2. Avoid Sudden Refunds or Payment Disputes

Frequent chargebacks, refunds, or reversed transactions can be a red flag in QuickBooks’ internal risk system. These signals may slow down your eligibility for faster deposits or prevent it altogether. Make sure your invoices are clear, your refund policy is visible, and that you’re communicating well with clients to reduce misunderstandings that lead to disputes.

3. Contact QuickBooks Payments Support to Request a Manual Review

While eligibility is mostly automatic, you can still reach out to QuickBooks Payments Support to ask if your account is under review or if there’s something holding it back. In some cases, they might trigger a manual eligibility review or provide insight into your current standing. Where to go:

- Sign in to QuickBooks Online

- Go to Help > Contact Us

- Type “Faster ACH” and follow prompts to connect with a payments specialist

4. Re-check Your Payment Settings Weekly

QuickBooks doesn’t always send a notification when you’ve been approved. New options — like “Enable Instant Deposit” or “Get deposits faster” — can appear without warning in your Payments Settings tab. Make it a habit to check your settings weekly just in case the option has become available.

If none of these steps work immediately, don’t get discouraged — faster ACH is typically granted after a period of consistent, trustworthy usage. Stay active, stay consistent, and the option may unlock sooner than you think.

What Happens After You’re Approved?

Once QuickBooks determines your business is eligible for faster ACH deposit speeds — whether it’s 1-day ACH or Instant Deposit — you’ll start seeing new options directly in your QuickBooks Online dashboard. Here’s what typically happens after your account gets approved:

1. You’ll See an “Enable Instant Deposit” or Similar Option

Head to your Payments Settings by clicking ⚙️ Settings > Account and Settings > Payments. If you’ve been approved, you’ll see a new option like “Enable Instant Deposit”, “Get Deposits Faster”, or something similar under the Deposit settings section.

This is your confirmation that faster ACH processing is now available to you.

2. You Can Choose Deposit Speed When Receiving Payments

Once enabled, you’ll be given the choice to decide how fast you want your funds deposited every time you process an eligible payment.

- Standard ACH (1–5 business days) is still available.

- 1-day ACH becomes the new standard if your account qualifies.

- Instant Deposit can be selected when you need money right away — even nights, weekends, or holidays (eligible cards/banks only).

This flexibility helps you manage cash flow based on your business needs.

3. Instant Deposit May Come with a 1% Fee

If you use Instant Deposit, QuickBooks typically charges a 1% fee per transaction, up to a set maximum. This is separate from your standard QuickBooks Payments fee. However, 1-day ACH deposits (when enabled) usually don’t carry any extra fees — they just settle quicker.

Frequently Asked Questions

Can I schedule ACH deposits to occur on specific days of the week?

QuickBooks does not allow you to schedule ACH deposit days in advance like a calendar tool. However, once a customer pays you through ACH, the funds will be automatically processed based on your deposit speed (standard, 1-day, or Instant). If you want more control over timing, you can delay invoice sending or use third-party tools to manage payment flows.

Can I accept ACH payments from international clients using QuickBooks?

No, QuickBooks Payments only supports ACH payments from U.S.-based bank accounts. For international payments, you’ll need to use other payment processors that support wire transfers, international credit cards, or third-party solutions like PayPal or Wise.

Is there a limit on how much I can receive through ACH in QuickBooks?

Yes, Intuit places processing limits on ACH transactions to reduce fraud risk. These limits vary by business and may include:

- A per-transaction limit (e.g., $10,000)

- A daily limit

- A monthly volume cap

To increase your limits, you can request a review by contacting QuickBooks Payments Support with documentation showing your average transaction size and monthly revenue.

Disclaimer: The information outlined above for “Can’t Enable Faster ACH Deposits in QuickBooks Online? Here’s What You Need to Know” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.