“Hi, I’m Jeena, and I’ve been using QuickBooks Desktop 2024 to manage all my business accounting—vendor payments, monthly reconciliations, and end-of-year reports. As tax season hit, I needed to access my 1099 forms to prepare for filings, but I ran into a frustrating roadblock: I can’t seem to locate or recall the login info required to access or 1099 e-file.

When I go to the ‘Vendors’ section and try to use the ‘Print/E-file 1099s’ option, QuickBooks prompts me to sign in—apparently for Intuit’s 1099 e-file service. The problem is, I don’t remember ever setting up a separate login for that. I’ve always used the desktop version locally and never needed an Intuit login for day-to-day use. Now I’m stuck, unsure whether I’m supposed to use my company file login, my Intuit account, or some other credentials entirely.

To make things more stressful, I need to get these forms submitted soon to stay compliant with IRS deadlines. There’s no clear guidance inside QuickBooks about how to reset or recover this login info, and I’m hesitant to start over or manually file without knowing if that could cause conflicts or duplication.

Has anyone else faced this situation while using QuickBooks Desktop 2024? What’s the exact login required to access or e-file 1099s, and how do you recover it if you’ve lost access? Is there a way to still proceed with 1099 processing without losing time or risking errors? Any insight would be appreciated.”

Hi Jeena,

You might see messages like “Sign in to E-file 1099s” or “Intuit login required” when attempting to e-file your 1099s in QuickBooks Desktop 2024 — which can feel confusing if you’ve always managed your accounting locally without needing an online login.

The prompt appears because the 1099 e-file feature is part of Intuit’s connected services, which require you to sign in using your Intuit account credentials. This is not your company file login, QuickBooks admin password, or Windows credentials, it’s a separate account used for all Intuit online services like payroll, payments, or tax filing.

While you’ve been using QuickBooks entirely offline for day-to-day operations, accessing or e-filing 1099s connects you to Intuit’s cloud-based system, which mandates authentication through their platform. If you’re unsure whether you created one—or forgot the credentials—don’t worry. Here’s how to move forward without delay.

How to Recover or Set Up Your Intuit Login for 1099 E-Filing?

If you don’t recall creating an Intuit account or lost the login credentials, here’s what you can do:

Option 1: Use the Intuit Account Recovery Tool

- Go to accounts.intuit.com.

- Click on “Forgot User ID or Password?”

- Enter the email address you might have used when registering QuickBooks or signing up for any Intuit service (payroll, payments, etc.).

- Follow the email instructions to reset your password or retrieve your user ID.

Tip: If you’ve ever used payroll, merchant services, or even TurboTax, you might already have an Intuit account.

Option 2: Create a New Intuit Account

If you’re sure you’ve never created one:

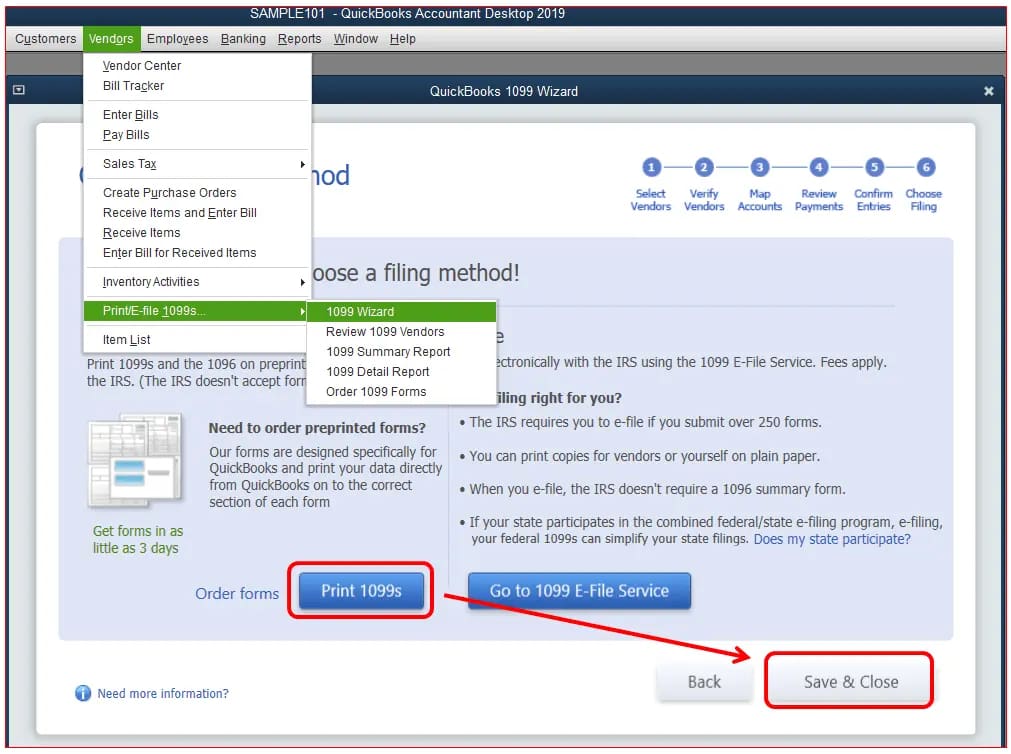

- Open QuickBooks Desktop and go to Vendors > 1099 Forms > Print/E-file 1099s.

- When prompted for login, click Create Account (usually near the sign-in window).

- Register using your business email address and phone number.

Make sure to use a valid business email so that you receive all filing confirmations, updates, and status alerts.

What If You Can’t E-File in Time? Can You Still Prepare and File Manually?

Yes, absolutely. If the e-filing process is delayed due to login issues, QuickBooks still allows you to print paper 1099s and mail them to your contractors and the IRS.

To do this:

- Go to Vendors > 1099 Forms > Print 1099s.

- Complete the 1099 Wizard (it walks you through which payments apply).

- Choose Print 1099 (Copy B) and Print 1096 summary.

- Mail Copy B to the contractor and Copy A along with 1096 to the IRS.

Note: You’ll need pre-printed IRS-approved 1099 forms for mailing.

Frequently Asked Questions

Can I print 1099 forms directly from QuickBooks Desktop without purchasing special software?

Yes. QuickBooks Desktop includes a built-in 1099 wizard that helps you generate and print 1099-NEC or 1099-MISC forms. However, to meet IRS guidelines, you’ll need pre-printed 1099 forms (such as Copy A) since QuickBooks does not print the red ink formatting required for IRS submission.

Is it possible to reprint 1099s in QuickBooks if I lose the originals or need to send corrected copies?

Absolutely. You can go back to Vendors > Print/E-file 1099s > 1099 Wizard, select the applicable tax year, and reprint forms as needed. If you need to file corrected versions, make sure to mark them appropriately using the IRS correction procedures.

Can I print 1099s from QuickBooks Desktop for multiple companies using one set of forms?

No. Each company file in QuickBooks must print its own 1099s and 1096 form separately. You cannot combine contractor data from different businesses into a single 1096 summary—even if the same person handles accounting for both.

Disclaimer: The information outlined above for “Can’t Access 1099 E-File in QuickBooks Desktop 2024? Here’s What to Do When Login Fails” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.