What Is Form 1099-R?

Form 1099-R is an IRS information return used to report the payment of $10 or more from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, or other retirement accounts. The form is issued by a financial institution, insurance company, or plan administrator to both the taxpayer and the IRS to record the distribution and tax consequences.

The form has the total amount paid out, the taxable amount, federal and state withholding taxes, and a distribution code to determine the type of distribution. Although a non-taxable distribution, it still requires reporting it to your federal tax return.

Who Provides Form 1099-R?

The following institutions provide Form 1099-R:

- Pension plans

- Annuity providers

- IRA custodians (traditional, SEP, SIMPLE IRAs)

- 401(k) and other employer-qualified retirement programs

- Insurance firms

- Government retirement schemes (e.g., federal, state pensions)

Who Gets Form 1099-R?

Taxpayers who receive one of the following can receive a Form 1099-R:

- A retirement account distribution of $10 or more

- A rollover, conversion, or characterisation of retirement funds

- A loan is considered a deemed distribution

- A disability, death, early withdrawal, or required minimum distribution (RMD) distribution

- Even if it’s rolled over or nontaxable, the form is sent.

When Do You Get a Form 1099-R?

Form 1099-R is required to be furnished on or before January 31 of the next year after the tax year in which the distribution was made. A copy is given to the IRS and a copy is mailed or made electronically available to the recipient.

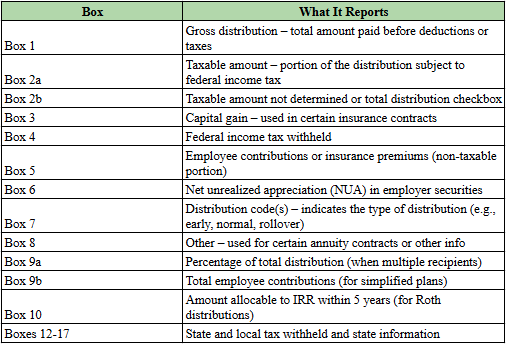

Form 1099-R Boxes and What They Report

How to Report Form 1099-R on Your Tax Return

Step 1: Gather all of your Form 1099-Rs

Collect all 1099-R forms you’ve received for the tax year. They’ll send you a separate form if you have more than one retirement distribution.

Step 2: Check Box 1 (Gross Distribution)

This is the entire sum distributed. It is not always all taxable.

Step 3: Check Box 2a (Taxable Amount)

This is the taxable part of the distribution. If Box 2b is marked (“Taxable amount not determined”), you might have to estimate the taxable amount yourself, particularly in the instance of rollovers or after-tax contributions.

Step 4: Report the Taxable Amount on your Form 1040

Report the Box 2a amount on Line 4b (IRA distributions) or Line 5b (pensions and annuities) of your Form 1040, depending on the source.

Step 5: Report Gross Amount if Necessary

If some or all of your distribution is tax-free, however, report the entire amount (Box 1) on Line 4a or 5a of Form 1040, and report the taxable portion on Line 4b or 5b.

Step 6: File Form 8606 if Necessary

Use Form 8606 to figure the taxable amount if:

- You had a distribution from a Roth IRA.

- You made nondeductible contributions to a traditional IRA.

- You rolled over a traditional IRA to a Roth IRA.

Step 7: Report Federal Withholding in Box 4

Enter the amount in Box 4 on Form 1040, Line 25b as federal tax withheld. This lowers your tax bill or boosts your refund.

Step 8: Apply Early Withdrawal Penalty if Applicable

If you are under age 59½ and the distribution is not qualified, you might owe a 10% additional tax, unless there is an exception. Use Form 5329 to report exceptions or penalties.

Step 9: Check Box 7 Distribution Code

The code describes the reason for the distribution.

Examples:

1 = Early distribution (no known exception)

2 = Early distribution (exception applies)

3 = Disability

4 = Death

7 = Normal distribution

G = Direct rollover (not taxable) Codes influence how you report the distribution and if any penalties apply.

Step 10: Report State Tax (Boxes 12–14) if Applicable

If state tax was withheld, report it on your state income tax return.

Step 11: Keep all 1099-R Forms for your Records

Keep the forms even if no tax is owed, for audit purposes and to record retirement distributions.

What to Do If You Don’t Receive a 1099-R

- Wait until mid-February – sometimes forms are delayed or mailed late.

- Log into your online account with the financial institution or plan administrator.

- Contact the payer directly if you haven’t received the form but think one is due.

- Use your year-end statements to estimate the distribution and report it on your return.

- File on time – do not wait for the form.

- If it arrives later and there’s a discrepancy, file an amended return (Form 1040-X) if necessary.

What If Form 1099-R Is Incorrect?

- Review the form against your records (distribution amount, withholding, etc.).

- If incorrect, contact the issuer to request a corrected Form 1099-R.

- If the issuer does not fix the error, report the correct figures on your return.

- Attach an explanation (with supporting documentation) if the discrepancy is large.

Backup Withholding and Form 1099-R

Backup withholding could be withheld if you didn’t give the payer or the IRS a valid TIN. Backup withholding is 24% currently. If withheld, it will be shown on Form 1099-R in Box 4 and can be applied as a credit against your tax return.

Record-Keeping Requirements

Retain Form 1099-R and supporting documents for at least three years.

You might need the:

- If audited by the IRS

- To determine the basis for future distributions during retirement

- To substantiate tax withheld

- For loan requests or financial analyses

Conclusion

Form 1099-R is essential for reporting distributions from retirement plans and similar accounts. Whether taxable or not, each distribution must be reported accurately on your tax return using Form 1040. Understand the meaning of each box, use the correct IRS forms (such as 8606 or 5329) when necessary, and always reconcile the information with your own records. Receiving this form does not always mean you owe tax—but ignoring it can result in IRS notices and penalties.

Frequently Asked Questions

What is Form 1099-R used for?

It reports distributions from retirement accounts, including pensions, IRAs, and annuities.

Is all 1099-R income taxable?

Not always. Roth IRAs may be tax-free. Rollovers and return of after-tax contributions may also be non-taxable.

When is Form 1099-R issued?

By January 31 of the year following the distribution.

What if I rolled over my IRA or 401(k)?

It is still reported on Form 1099-R but usually with Code G (direct rollover), showing it is non-taxable.

Do I have to report a 1099-R if no taxes were withheld?

Yes. Even if the distribution is non-taxable or has no withholding, it must be reported.