To cancel a QuickBooks Desktop Payroll subscription (Pro or Premier), sign in using admin credentials to the Intuit account, access the Customer Account Management Portal (CAMPs), and under Products & Services, navigate to the “Manage Subscription” section to cancel the payroll subscription.

Once canceled, payroll functionalities such as paycheck creation, tax filing, direct deposit, and tax table updates will be disabled. However, historical payroll data (pay stubs, filings, pay history) will remain accessible in read-only mode.

Intuit does not offer prorated refunds unless the cancellation occurs within the 60-day money-back guarantee window.

After a payroll subscription is canceled, historical payroll data, employee pay stubs, and previously filed tax forms such as 941, W-2, and W-3 remain accessible and available for download. However, processing new paychecks, filing future taxes, and using direct deposit services will no longer be possible.

Following cancellation, the payroll center becomes read-only, and reactivation may require purchasing a new subscription. QuickBooks Desktop Payroll subscriptions are billed in advance, and prorated refunds are generally not provided by Intuit.

If you cancel mid-cycle, access continues until the end of the billing period, but no charges are reversed.

Mandatory Steps Before Cancelling Your Payroll Subscription

Before canceling, you must complete all the outstanding payroll activities.

Below are the steps that you need to follow:

- Step: Sign in to QuickBooks Desktop company file as the Primary Admin or Payroll Admin.

- Step: Go to Employees > Payroll Center.

- Step: Under the Payroll Center tab, check your Subscription Status.

- Step: Process any remaining payroll and tax filings

- Step: Print or export essential payroll reports such as pay stubs, tax forms (W-2, W-3, 941), liabilities, and summaries.

How To Cancel QuickBooks Desktop (Pro or Premier) Payroll Subscription?

The following are the steps for cancelling payroll subscriptions:

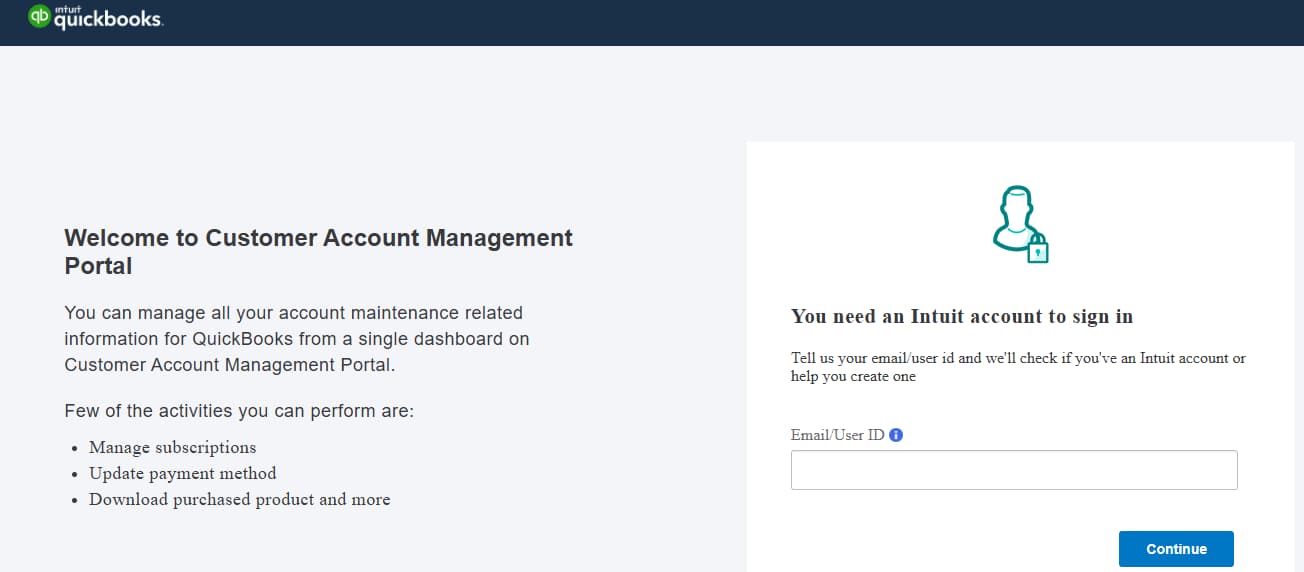

Step 1: Log in to Intuit CAMPs (Customer Account Management Portal)

- To cancel QuickBooks Desktop (Pro and Premier) Payroll Subscription, log in to the Intuit customer account management portal.

- Once all the outstanding activities are completed, log in to Intuit CAMPs accounts with valid credentials.

Step 2: Cancel Your Payroll Subscription via Intuit CAMPs (Customer Account Management Portal)

After logging in:

- Search for Products & Services, and locate your payroll subscription.

- Click on Details next to the active service.

- Select Cancel Service and follow the on-screen prompts.

Step 3: Confirm Cancellation via Email or Dashboard

You’ll receive two confirmation emails from Intuit:

- The first confirms receipt of your cancellation request (within 3 business days).

- The second confirms that the subscription has been officially canceled.

Upon deactivation of the payroll subscription, services such as Direct Deposit, tax filing, and software updates will cease. However, historical payroll data will remain accessible within the QuickBooks Desktop file, allowing continued reference to records as needed.

Important Notes:

- Canceling Payroll does not cancel your QuickBooks Desktop license.

- If you switch to QuickBooks Online, you still need to cancel Desktop Payroll separately.

- If you’re within the 60-day money-back window (and purchased directly from Intuit), your refund will be issued automatically.

Need Help Managing Your QuickBooks Subscription?

Impact of Cancelling QuickBooks Payroll – What You Lose vs. What You Keep

The table below illustrates what functionality is still available and what services are lost upon the cancellation of your QuickBooks Desktop Payroll subscription, along with suggested actions to take prior to cancellation in order to minimize disruption.

| Feature / Data Type | Still Accessible After Cancellation | Unavailable After Cancellation | Recommendation |

|---|---|---|---|

| Employee Pay History | Yes (Read-only) | Cannot edit or process new paychecks | Export reports before canceling |

| Tax Forms (W-2, 941, W-3, etc.) | Yes | Cannot file or submit after canceling | File all forms before finalizing cancellation |

| Direct Deposit | No | Fully disabled | Inform employees and issue physical checks |

| Payroll Tax Table Updates | No | Updates stop immediately | Download the latest updates before canceling |

| Payroll Liabilities & Payments | View-only | Can’t create or pay new liabilities | Pay all dues before canceling |

| QuickBooks Desktop Software | Yes | Not affected | Continue using QuickBooks for accounting |

| Reactivation of Payroll | No (requires new subscription) | The existing subscription is closed | Only cancel if you’re sure — no pause option |

Summary

Canceling a QuickBooks Desktop Payroll subscription (Pro or Premier) disables all active payroll functions, including paycheck processing, direct deposit, tax filings, and payroll updates. However, historical payroll data remains accessible in read-only mode, meaning you can view past records but cannot make changes or process new payroll activities.

All outstanding payroll tasks, such as running final payroll and filing tax forms, must be completed before initiating cancellation. The process must be performed manually through Intuit’s Customer Account Management Portal (CAMPs), and you’ll receive email confirmations once the request is received and finalized.

Refunds are only available if the subscription is canceled within Intuit’s 60-day money-back guarantee period. Additionally, migrating to QuickBooks Online does not cancel your existing Desktop Payroll subscription, so you must cancel it separately to avoid continued billing.

Frequently Asked Questions:

What happens to my payroll tax tables after my QuickBooks Desktop Payroll subscription becomes inactive?

Once a payroll subscription becomes inactive, QuickBooks Desktop stops updating federal and state tax tables. Users can still view historical payroll data, but they cannot process new paychecks with updated rates.

Will I lose access to my historical employee W-2s and pay stubs after cancelling?

No, but your access method changes. Because you are using QuickBooks Desktop, your raw data remains safely stored in your local company file (.qbw) on your hard drive. You can still view historical payroll transactions in your company file, but you cannot generate new tax forms or repopulate old ones using the active payroll engine. For official tax forms filed prior to cancellation, you must access the Payroll Tax Center (PTC) via a specific Intuit login to view or print copies for up to 12 months after cancellation.

Can I cancel my QuickBooks subscription and get a refund?

Refunds are generally not offered unless you cancel within Intuit’s 60-day money-back guarantee window (if eligible).

Does cancelling Payroll affect my ability to use QuickBooks Desktop for accounting?

No. Your QuickBooks Desktop software license and your Payroll subscription are separate entities. You can continue to use QuickBooks Desktop Pro or Premier for invoicing, bill pay, and general accounting without interruption. Only the “Employees” menu features (Pay Employees, File Forms, Direct Deposit) will become inactive or prompt you to resubscribe.

What happens to pending Direct Deposit paychecks if I cancel today?

Cancellation can strand pending transactions. Intuit requires that you cancel at least 2-3 business days after your last Direct Deposit payroll has been successfully debited from your bank account and deposited to employees.

Risk: If you cancel while a Direct Deposit batch is “In Process,” the system may fail to transmit the funds to employees, yet the funds might still be held or debited, requiring a lengthy resolution process with the Intuit Risk Management team.

Can I manually enter payroll data into QuickBooks Desktop after cancelling to keep my books accurate?

Yes, but it requires manual journal entries. You cannot use the “Pay Employees” workflow to calculate taxes automatically. You can manually record payroll expenses by creating checks or Journal Entries to debit “Wages Expense” and credit “Bank/Liability” accounts. This keeps your financial reports (P&L) accurate, but it will not track individual employee tax liabilities or accrue sick time.

If I reactivate my Payroll later, will my previous employee data still be there?

Yes. Since your data lives in your local QuickBooks Company File, your employee list, Year-to-Date (YTD) totals, and tax setups will remain exactly where you left them.

Note: Upon reactivation, you may need to enter “History” adjustments if you paid employees using a different system during the gap period, to ensure your W-2s at the end of the year are accurate.