Definition:

A corporate business tax deduction refers to the items or expenses that are eligible from the overall revenue in order to determine the total taxable income. These deductions are a form of tax relief that is given to businesses.

These deductions help the small businesses to lower the amount of total income that is subject to tax and this will ultimately reduce the tax liability. The corporation needs to file its tax return annually.

These returns will depict the company’s gross income and all the claimed deductions. After deducting the claimed deduction from gross income the taxable income is calculated which further will be multiplied by the appropriate tax rate. Finally, you will get the amount that the business exactly owes.

These deductions cover many common and essential costs paid during the operation of the firm. Rent, utilities, staff pay, company travel expenses, and the cost of items sold are typical examples. Depreciation on equipment, interest on business loans, and costs for expert services like accounting or legal fees are examples of additional deductions.

Small businesses can minimize their overall tax burden by lowering their taxable revenue through the use of allowable deductions. Maintaining accurate records is necessary to guarantee adherence to tax regulations.

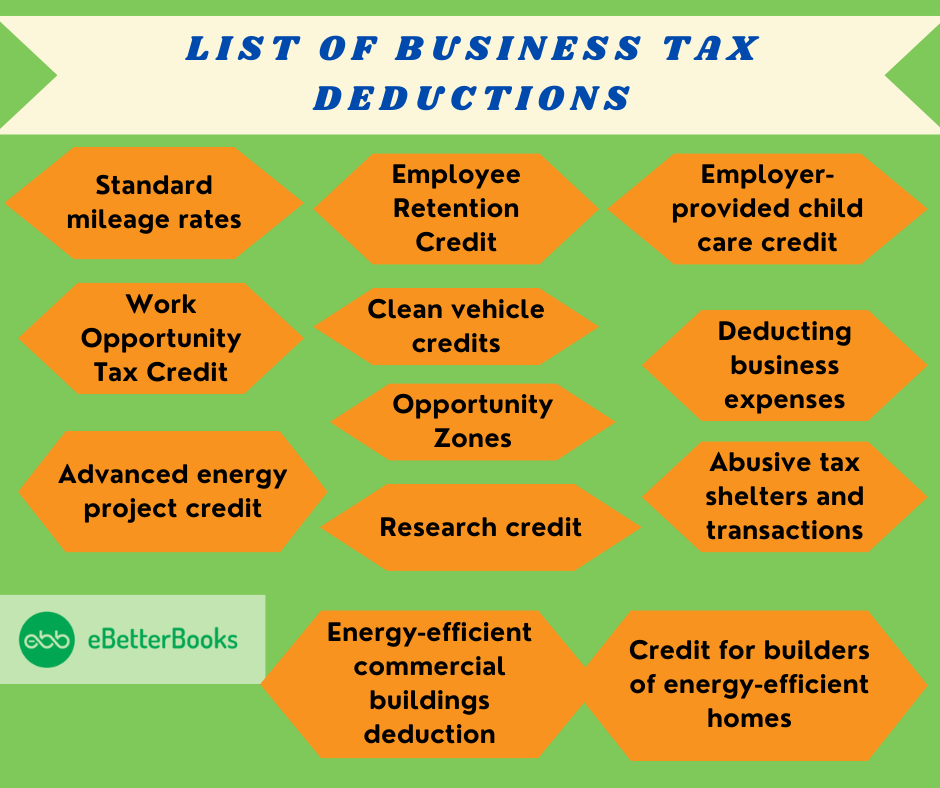

List of Business Tax deductions

1. Standard Mileage Rates

A standard mileage tax deduction is the default cost per mile for taxpayers who deduct the expense of using their vehicle for charitable, business, or medical purposes. It is set by the Internal Revenue Service (IRS).

The tax rates differ annually, and they are the same for all types of vehicles, whether electric or gas-powered. The current Standard mileage rate is 67 cents per mile.

2. Work Opportunity Tax Credit

The Work Opportunity Tax Credit is a federal tax credit for businesses. It is a powerful incentive for employers, offering tax credits for hiring individuals from certain targeted groups who have faced barriers to employment.

Employers must first get certification from a State Workforce Agency (SWA) stating that the new hire satisfies the requirements of one of the target groups before they may submit a claim for a Work Opportunity Tax Credit. IRS Form 8850 and one of two Department of Labor forms are used for this.

3. Opportunity Zones

Opportunity Zones are tax incentives to encourage investment and growth in distressed areas of the United States.

These economic development tools are used for commercial and industrial real estate, infrastructure, and housing.

4. Employee Retention Credit

Employee Retention Credit (ERC) is a refundable payroll tax credit designed to encourage employers to retain their employees during the COVID-19 pandemic tax years 2020 and 2021.

It is also known as the Employee Retention Tax. Companies who file an adjusted Form 941 X – Quarterly Federal Payroll Tax Return for the quarters in which they were an Eligible Employer are still able to apply for the ERC.

5. Clean vehicle credits

The clean vehicle credit is a nonrefundable credit meant to lower the cost of qualifying plug-in electric or another clean vehicle.

Clean vehicles include battery electric vehicles, plug-in hybrid vehicles, and fuel-cell electric vehicles. Always determine if your vehicle qualifies for the tax credit criteria or not.

6. Credit for builders of energy-efficient homes

Eligible contractors who build or reconstruct qualified energy-efficient homes can significantly boost their finances by claiming tax credits of up to $5,000 per home. This serves as a strong incentive for them to engage in energy-efficient construction.

7. Advanced energy project credit

The Advanced energy project credit is a lucrative opportunity for manufacturers and other entities. By investing in qualifying advanced energy projects, they can benefit from this credit, available through the Department of Energy, which is designed to encourage and support such investments.

8. Employer-provided child care credit

The Employer-provided childcare credit is designed to help employers cover some childcare facilities for their employees. Companies that provide childcare for their employees become eligible for the tax credit.

Under the Employer-Provided Childcare Credit, employers can receive a tax credit of up to $150,000 annually to offset 25% of qualified childcare facility expenses and 10% of qualified child care resource and referral expenses.

9. Research credit

For those interested in the Research credit, the IRS provides comprehensive guidelines and audit technique guides to assist in the examination of research credit cases, ensuring a clear and most importantly, a fair process.

10. Deducting business expenses

It’s crucial to understand the different types of business expenses, and the general rules for deducting expenses. This knowledge will help you navigate the tax system effectively and ensure you’re not missing out on potential deductions.

11. Energy-efficient commercial buildings deduction

Energy-efficient commercial buildings tax deduction is a federal incentive designed to promote energy efficiency in commercial buildings. It is also known as Section 179D.

Building owners stand to benefit significantly by increasing energy efficiency in certain building systems by at least 25%, as they may be able to claim a tax deduction. This not only reduces their tax burden but also contributes to a more sustainable environment.

12. Abusive tax shelters and transactions

The IRS has a comprehensive strategy to combat abusive tax shelters and transactions, which includes guidance on abusive transactions, regulations governing tax shelters, and a hotline for taxpayers to report abusive technical transactions.

13. Advertising and Marketing

Your business needs to promote itself for acquiring new customers so the IRS allows tax deductibility of associated costs.

- Advertising Costs: Owners can deduct all advertising costs that appear in printed material and internet platforms including social media ads in addition to mailer expenses. You can deduct marketing expenses which include your Facebook ads and your Google Ads campaign expenses.

- Website Development: You can claim business website development expenses alongside expenses you spend to preserve or develop your digital presence. Your website development costs including designer fees and web hosting services that appear under your marketing budget are tax-deductible.

14. Depreciation

Through depreciation, you can deduct the expense of business property into smaller installments instead of taking a full deduction in one fiscal period.

- Business Assets: You can deduct tangible business property which includes buildings machinery and equipment incorporated into business operations. Through depreciation, you can distribute the tax deduction of asset costs across multiple years.

The Section 179 deduction enables small business owners to completely deduct qualifying business equipment expenditures when purchased during a year (until specific thresholds apply).

15. Professional Services

Essential professional services your business needs qualify for tax-deductible expenses.

- Legal and Accounting Fees: Expenses for legal counsel along with accounting services and consultant advice from professionals can be deducted from your business the first year you pay them. When you employ an attorney to analyze a contract and expand your business tax preparation responsibilities to an accountant these professional expenditures qualify for deduction.

16. Interest on Business Loans

You can deduct interest expenses for any business loans you receive because payments for these loans form a deductible expense.

- Loan Interest: Businesses can deduct all payments of interest they make toward loans or credit line agreements. The expense allowances extend to short-term financial arrangements along with long-term funding options.

How to claim small-business tax deductions ?

To claim small business tax deductions, you need to fill out the Schedule C tax form and then report the profit on the personal Form 1040 and calculate the taxes due from there.

The Schedule C form is used to determine the taxable profit in your business during the tax year. You then report this profit on your personal 1040 form and calculate the taxes due from there. If you are looking to choose a Tax Service Provider, eBetterBooks could be a good choice.

Get expert help for Tax Preparation and Tax Filing

Tax burdens can be greatly decreased for both individuals and corporations by fully utilizing the tax deductions.

EBetterBooks provides professional tax services that are specifically designed to guide you through the complexities of tax deductions.

Services like those provided by eBetterBooks can give crucial support if you’re looking for detailed advice on maximizing your deductions and ensuring compliance with tax rules.

These services are not just about managing your money better, but also about maximizing your tax savings.

How Eligibility Affects Your Deductions

The requirements ensure your deductions have a better chance of passing an audit examination. The IRS requires both proper documentation and a defined business need for each expense to ensure eligibility for your deductions.

Your business tax deductions depend on the expense being both “ordinary” and “necessary” for conducting your business operations alongside being used only for business functions, documented properly, and claimed correctly in the same income tax period. By maintaining excellent record-keeping practices along with tax law comprehension you can both optimize your deductions and ensure your financial compliance.

Conclusion

The value of tax deduction in a small business represents both an important tax liability reduction method and an essential practice for compliant business operations. Businesses that capitalize on pre-approved tax deductions including operating expenses alongside employee compensation, supplies, travel, and professional service can substantially decrease their taxable income and maintain greater financial control.

Taking advantage of tax deductions enables businesses to grow faster by reinvesting the saved amount. However, it’s crucial to ensure that your deductions are properly documented.

FAQs

What is the tax deduction for a small business in the USA?

A business tax deduction is an expense that a business can subtract from its gross income to reduce its taxable income, ultimately lowering its tax liability.

How many types of tax deductions are there?

There are numerous types of tax deductions, including but not limited to business operating expenses, employee compensation, supplies and equipment, travel, advertising, depreciation, professional services, and loan interest.

What is a deduction and what are types of deductions?

A deduction is an expense that reduces taxable income, and the types of deductions can include operating costs, employee wages, equipment purchases, travel expenses, and more, depending on the nature of the business.