BNPL is suited for planned, frequent purchases where you pay before the due date, credit cards are suited for flexible spending, offering rewards, robust purchase protections, and credit-building opportunities.

BNPL divides the particular expenditure into regular payments, usually associated with one purchase, while credit cards allow the consumer to borrow money and spend it on many transactions with more long-term freedom.

Buy Now, Pay Later and Credit cards both let you purchase any product and service and allow you to pay over time.

BNPL and credit cards are both forms of payment methods for in-store and online purchases. BNPL and credit cards have quite similar functionalities, such as installment payment or late fee charges, but you will understand the differences later in this article, which will enable you to make the right choices regarding your money.

What is Buy Now, Pay Later?

Buy now, pay later [ BNPL] is a type of short-term instalment loan accepted at most retailers and online shops. BNPL provides a solution to credit, but it might lead to overspending.

Some of the firms that have incorporated the BNPL deals are Walmart, Sephora, Sam’s Club, Target, Ikea, etc.

Each buy-now-pay-later plan is unique, but generally, you’ll find a few things in common. Many BNPL companies only perform a soft credit check to approve shoppers for loans, which means that applying will not harm your credit rating. However, some of them do a hard credit check, particularly in the cases of longer plans.

Some applicants have little to no eligibility criteria, wherein still, from most, you have to be at least 18, own a mobile phone number, and have a debit/credit card for repayments, and the company must be able to confirm your identity.

Different BNPL providers commonly set the number of installments at four, and some give borrowers the ability to choose the frequency of payments as well. In most cases, no interest is required on the payback period, but BNPL may charge late fees ( in case of missed / late payments).

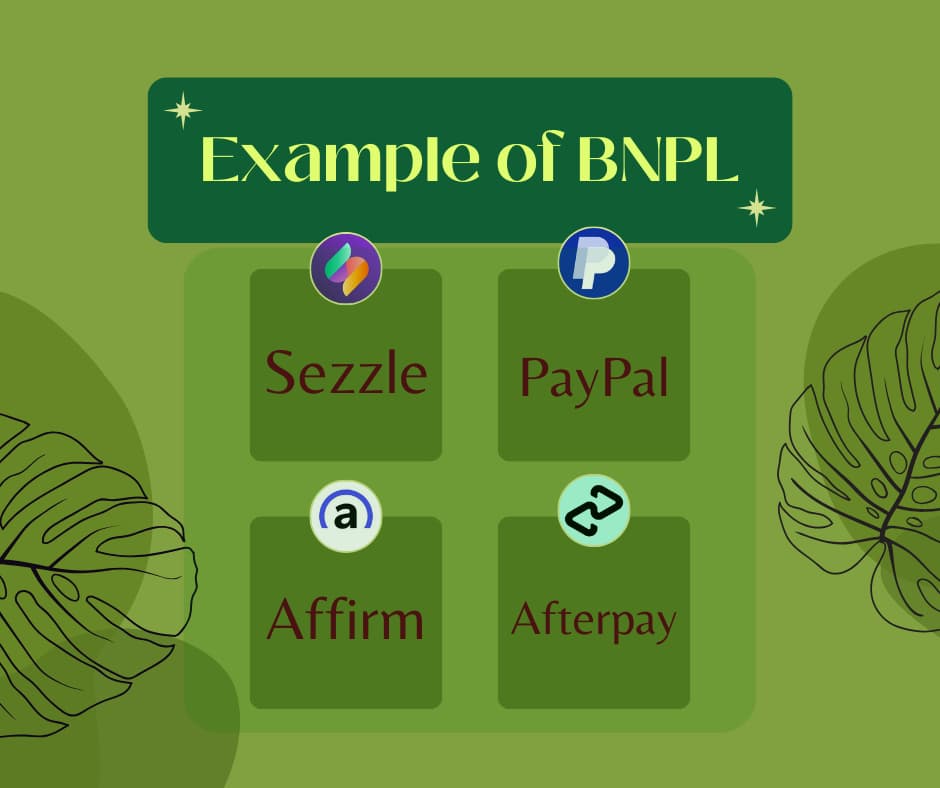

Example of BNPL:

- Sezzle

- PayPal

- Affirm

- Afterpay

What are Credit Cards?

A credit card, a thin metal plastic, offers a convenient way to pay for purchases at merchants who accept the card for payments, making transactions quick and hassle-free.

Credit card holders are required to repay the borrowed sum and any fees, interest rates or any additional agreed-upon charges, either in full by the billing date or over time.

In addition to the standard credit line, the credit card issuer may allow cardholders a separate cash line of credit (LOC), where one can borrow money in the form of cash advance through the teller, ATM, or credit card convenience checks.

Credit cards are still considered one of the most widely used types of payment, and a huge number of companies still allow customers to make purchases with cards.

Example of credit cards:

- Rewards crest cards

- Secured Credit cards

- Retail cards

- Student credit cards

How Do Buy Now, Pay Later vs Credit Cards Work?

Working of Buy Now, Pay Later

Buy Now Pay Later (BNPL) is a time-based payment model that enables the consumer to divide the total cost of the purchase into smaller installments for a specified period (weeks or months). If the payment is not made on time, it will lead to fees and penalties.

During the checkout, customers choose BNPL as their preferred mode, and the provider makes full payment to the merchant on behalf of the buyer. The customer then pays the BNPL provider back in installments ( weeks – months). Some BNPL services are tied to certain merchants, and merchant approvals may require either a soft credit check or a financial profile.

Working of Credit Cards

A credit card is a type of revolving line of credit where the consumer can borrow money up to a certain amount and reuse the same card indefinitely to make other purchases. Each month, cardholders get a statement outlining their spending and are required to pay at least a minimum balance by the statement’s end.

Credit cards also include features such as purchase protections, rewards, and fraud liability. The responsible use enables credit, and the journey helps to restore credit scores while missed payments result in charges, higher interest rates, and affect scores.

Major Differences – Buy Now, Pay Later vs Credit Cards

Account Opening Criteria and its Usage

| Account Opening Process and Using an account | |

BUY NOW, PAY LATER | Application Process: There are providers that will conduct a ‘soft’ credit check on you; others will approve you based on your spending patterns. Details required: Name Email Address Phone Number Preferred Payment Method ( Credit card/Debit card/ Bank Account). Using the Account: Upon signing up, kindly choose the BNPL payment method during the purchase process. Can be used with the retailers of your choice. Might get limited access due to various factors Your BNPL access could be limited by several factors, including your prior use of BNPL with the provider, the amount you are able to spend, the type of product you are purchasing, and the category of the store you are purchasing from. |

CREDIT CARDS | Application Process: The requirements are not the same for each credit card company and each kind of credit card. Details Required: Name Email Address Phone Number Income details Credit History Credit score. Using the Account: After you get a credit card, you are free to use it anywhere until the credit card limit has been achieved. |

Paying off Purchases

| Loan Repayment | |

BUY NOW, PAY LATER | Most BNPL providers allow consumers to pay in four instalments. Takes one payment at the time of the purchase; then, three equal payments are paid every two weeks for the next six weeks. Some BNPLs also have longer payment terms than other credit products in the market. |

CREDIT CARDS | Make part payment on the total balance and be able to roll over the rest of the amount to the next period. Minimum required payment is a small percentage of your total balance. If you make minimum payments only on your credit card, your statement should tell you the number of months it will take to clear the balance. |

Interest and Fees

| Interest and Fees | |

BUY NOW, PAY LATER | BNPLs typically do not charge any fees. BNPL allows the customers to “pay in four” commonly, which involves no interest rates. If there is a missed payment or late payment, BNPL providers may charge late fees. |

CREDIT CARDS | Generally charge an annual fee. Other charges like:Balance transfer FeeLate Payment Penalty (APR)Interest rateForeign Transaction Fee. In the case of a purchase you make at the beginning of your billing cycle, you will generally be allowed between 30 days of the billing cycle and more than 21 days before the due date, and thus, no interest is charged. |

Age Restrictions

| Age Restrictions | |

BUY NOW, PAY LATER | BNPL loans are available for individuals who are minimum 18 years of age Some BNPL providers can have older age restrictions, such as 21 years Identification and an associated payment method is required. |

| CREDIT CARDS | Legal Credit Card Age = 18 years ( as per Credit CARD Act of 2009). Age <18, can become authorized user of familiar person account ( advisable) |

Protection

| Protections | |

BUY NOW, PAY LATER | Offer no or limited purchase protection. Issues ( defective item / undelivered item) occurred during the transaction, so you may need to resolve the issue directly with the merchant. Has a slow dispute process. ( if available). |

CREDIT CARDS | Offer purchase protection ( for a specific period of time). Offer charge-back rights to the customers. Offer zero liability for unauthorised transactions. Provides added benefits such as trip cancellation insurance, return protection, or coverage for online fraud. |

Benefits and Rewards

| Benefits and Rewards | |

BUY NOW, PAY LATER | Benefits: Easy approval Sim mediate access to goods or service Interest free financing No need for credit cards. Rewards: No annual fees Merchant-specific discounts. |

CREDIT CARDS | Benefits: Purchase protection Build credit history Fraud protection Global acceptance. Rewards: Cash back Welcome bonus Travel rewards. |

How Does BNPL and Credit Card affect Credit Score?

Most BNPL providers only perform a soft credit check, which typically does not hurt your credit score. However, if you are unable to make payments towards the BNPL plan they make, then it can be reported to the credit bureaus, which will harm your credit score. Customers are advised to ensure that they make their payments to BNPL on time.

When applying for a credit card, a hard credit check is usually performed, which can temporarily affect your credit score. However, the responsible use of a credit card can help build your score over time. Credit card issuers report your payment history to all three major credit bureaus, so making timely payments and keeping your balance low can improve your creditworthiness.

Buy Now, Pay Later with Your Credit Card

Many credit card issuers such as American Express, Chase, or Citi offer some buy now, pay later features through your credit card.

Here are some examples of these issuers’ payment plans:

Citi Flex Pay

Citi Bank has a program called citi Flex Pay that enables you to spread the cost of a purchase on your citi card, totalling $75 or more. You can find eligible purchases when you go to a citi login or the citi mobile application.

After that, the plan choices and the specific amount you will be charged will be displayed. When you choose the citi Flex Pay plan, that monthly instalment amount becomes part of the payment due on the card. You are likely to be responsible for your card’s regular fees or penalties if you do not pay at least your minimum amount by the due date.

Citi credit cards with citi Flex Pay options:

- Citi Rewards+® Card

- Costco Anywhere Visa® Card by Citi

- Costco Anywhere Visa® Card by Citi

American Express Plan It

If you normally spend $100 or more with your Amex card, you can also open an instalment plan through your American Express account.

You may order up to three plans depending on the timeline and fee; you will be clearly informed how much it will cost you in total and how much per month. Through your online account, it will be possible to link up to 10 qualifying purchases into one plan (when making through the Amex mobile app, you can do it only one time).

The payment schedules do not attract any interest implications. But if you don’t make at least that amount due to your card, which includes the monthly plan payment, then you get your normal card late fees and penalties.

These are some American Express cards that offer BNPL:

- Blue Cash Preferred® Card from American Express

- The Platinum Card from American Express

- American Express® Gold Card

Chase Pay Over Time

When you make an eligible purchase of $100 or more using your Chase card, you can choose the option to pay interest-free for the purchase over time within your online account or app.

One of the best features of the Pay Over Time plan is that you won’t be paying any fixed interest; you’ll be paying a flat fee every month. Normally you can select from up to three options for payment- a plan that may take anything from 3 to 24 months and whose charges may vary per month.

The monthly payment and fee from your Pay Over Time plan are actually included in your credit card’s minimum monthly payment. If you don’t pay at least that amount when your payment is due, it will lead to late fees or penalties.

These are some Chase Pay Over Time credit cards that offer BNPL:

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Chase Freedom Unlimited®

When Should you Use a Credit Card or BNPL?

If you’re sure that you’ll be able to pay off a purchase within the next month or two, then you should go ahead and use the credit card to earn rewards, purchase protection, and extended warranties.

But if you have to buy something and are not sure when you will be able to repay it, it is more beneficial to use the BNPL offer and thus save from credit card interest charges.

A good rule to go by is to allow at least 24 hours if you are looking to purchase an expensive item, maybe because once you get that item, you may not be able to make the right decision again, which may lead you to buy items you had never planned for.

Buy Now, Pay Later or Credit Cards – Who is the Winner?

The winner depends on the type of purchase by the consumer and some other factors:

- Spending Habits: If you are the kind of person who often spends more than you should, the BNPL plan with fixed instalments is useful.

- Rewards and Benefits: Credit cards come with certain features like rewards programs offered by card issuers, purchase protection, and others that may help you.

- Acceptance: Credit cards are universally accepted, although some BNPL options can only be applied to certain shops.

Conclusion

BNPLs are useful for short-term planning as well, especially if you can’t qualify for a decent credit card. It is crucial to understand that credit cards and BNPLs are types of credit, so they attract interest and fees. If you do not have to pay interest, you’ll have to make the purchase payable in full.

Frequently Asked Questions

Can you use a credit card to make BNPL payments?

Yes, you use a credit card to make BNPL payments and can easily access the short-term pay-in-four options. However, some banks have stopped the BNPL transactions from their cards due to potential risks for consumers and banks.

Are BNPL services cheaper than credit cards?

Yes, BNPL services are quite cheaper than credit cards because BNPL are often interest-free if you pay installments on time, but late fees can be significant.

Can I use BNPL or credit cards to build credit?

Some providers report payments to credit bureaus, but not all do. So, regular and on-time payments directly affect your credit score and help build a credit history.

Are late payments penalized?

Yes, most providers charge late fees or penalties for missed payments, which may impact your credit score. Some may also suspend your account.

BNPL or Credit Cards – which is better for large purchases?

Credit cards are better for large purchases due to higher limits, rewards programs, and promotional 0% APR offers.