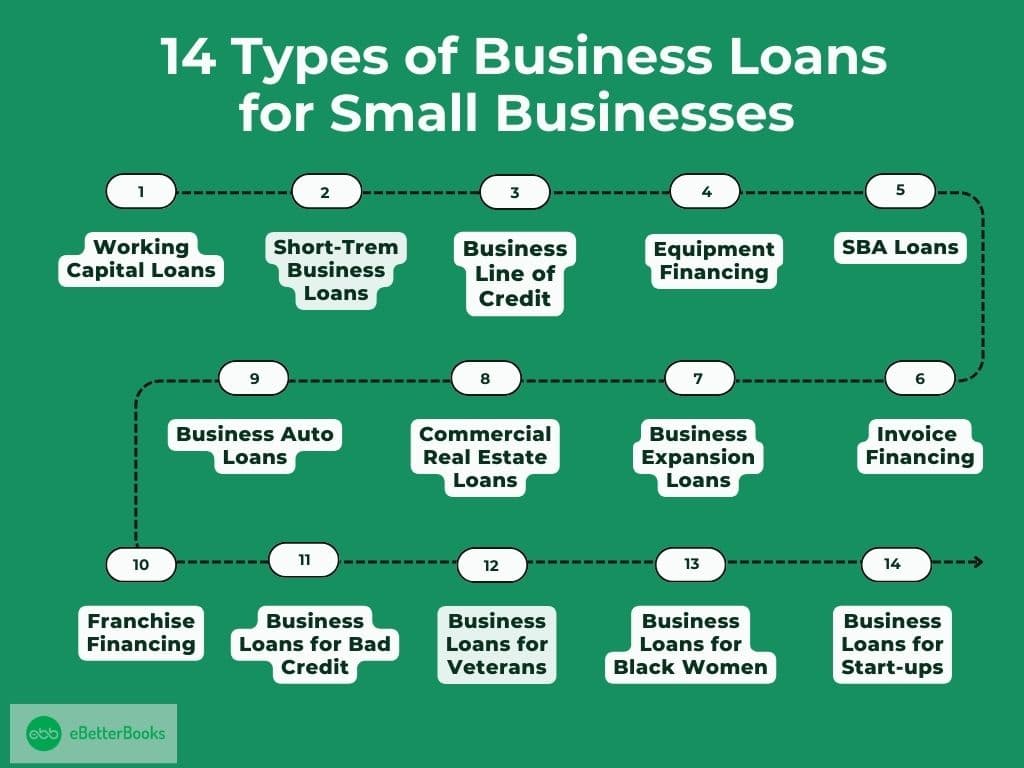

Finding the right business loan can be an essential aspect of a business start-up, growth, or continuance by business owners and managers. When speaking of different types of business loans, we could list working capital loans, SBA loans, or equipment financing as examples of possible solutions.

When it comes to working with various business loans, the fundamental question remains: which one is more suitable for a specific company’s needs and its general financial plan? Every loan type has different advantages and conditions. Such loans help entrepreneurs cope with special financing problems, adjust cash flows, or invest in other activities to gain the desired result.

1. Working Capital Loans

A working capital loan is a short-term business loan used to cover routine operating expenses such as payroll, subscriptions, managing cash flow, and paying for utilities.

Working capital loans are often tailored to small business’s cash flow needs for businesses experiencing short-term financial gaps.

Working capital loans usually have low interest rates and must be repaid in less than two years. The repayment option varies from daily to weekly, bi-monthly, monthly, etc.

Eligibility for a working capital loan depends on a combination of factors, such as annual business revenue, FICO Score (credit score), time in business, creditworthiness, collateral, or personal guarantee.

Some types of working capital loans are lines of credit, business credit cards, SBA Loans, invoice factoring/ financing, term loans, and merchant cash advances.

Best Working Capital Loan Providers for Small Businesses

- BlueVine: Offers flexible lines of credit up to $250,000 to cover daily expenses.

- Fundbox: Focuses on providing fast access to working capital loans up to $150,000 for small businesses.

- Wells Fargo: Wells Fargo’s line of credit offers loans up to $150,000 at competitive rates for businesses with at least two years in operation and a minimum credit score of 680.

- Accion Opportunity Fund: It provides working capital loans from $5,000 to $250,000 for businesses owned by women, minorities, and low—to moderate-income entrepreneurs with a minimum credit score of 570.

- American Express Business Loans: It provides financing for existing American Express cardholders with competitive rates and no origination fees

2. Short-Term Business Loans

A short-term business loan is a short-term funding that addresses the short-term requirements of companies, and their repayments will be made within three months to two years. These loans are suitable for the purchase of stocks, bridging short-term cash and short-term funding needs, and funding any urgent business needs. These are more expensive than long-term financing since they are for the short term, but again, the benefit of this is that they are easy and fast methods of sourcing funds.

When it comes to short-term loans, their approval process is quite relaxed and swift compared to that of normal business loans that firms look for, even the ones that have a low credit rating. Amortization of short-term loans is typically more often, although the most common is weekly or monthly installments. Such loans are useful for companies that experience variations in their sales cycle or when the company wants to take advantage of an opportunity to expand the business. There is not much difference in collateral where short-term loans are concerned, but some may request a personal guarantee.

Best Short-Term Business Loan Providers for Small Businesses

- OnDeck: It offers merchant cash advances up to $250,000 and business loans for 3 to 24 months for businesses with short-term cash needs.

- Funding Circle: It provides fully amortizing short-term business loans at affordable rates for larger sums of up to $500,000.

- PayPal Working Capital: PayPal is a financing product that enables businesses to borrow money based on their PayPal sales. The repayment is tied to a certain percentage of daily sales.

- BlueVine: Offers short-time funding, based on lines of credit upto $250,000 and terms of 6-12 months.

- Rapid Finance: Faster personal financing with the ability to get funding within 24 hours and options ranging between $5,000 and $1,000,000.

- Credibly: Provides short-term business loans with favorable repayment terms and a fast approval system for any business’s financial health.

3. Business Line of Credit

A business line of credit is a type of financing in which a business can borrow money upto a certain amount to be paid back with interest as a business needs it, just like a credit card. Business owners can access the line of credit when they want and then repay it in full, which is why it is effective for managing cash flow, as well as for receiving and repaying without help from others.

The interest charged on a business line of credit is only charged on the amount borrowed and not on the total credit limit. The credit line may be revolving, and once the borrowed amount has been paid back, it is possible to borrow more.

These financing tools or techniques are cheaper than normal loans because of their business lines of credit base, and if the financing is secured, then it will be extremely cheap. Credit facilities can be either secured and/or unsecured, where a secured credit line has assets such as stocks or receivables as security. This kind of loan is most suitable for those organizations that go through certain cycles of business activities or for companies that prefer to keep some funds on hand in case of an emergency.

Best Business Line of Credit Providers for Small Businesses

- BlueVine: Offers lines of credit up to $250,000, which are easier to qualify for with no credit check and easy repayments.

- Fundbox: Provides business lines of credit of up to $150,000 depending on business revenue, not credit scores.

- Wells Fargo: Offers business credit lines that are secured or unsecured and go up to $500,000, suitable for firms with established credit limits.

- Bank of America: This company allows businesses to access a line of credit for amounts up to $100,000, and no collateral is needed to secure loans for good credit users.

- TD Bank: It offers working capital lines of credit with possible credit limits of up to $500,000 that can be used by business organizations that need constant replenishment.

4. Equipment Financing

Business Equipment loans refer to a form of a business cash advance, which primarily extends to buying or financing the hiring of equipment, machinery, vehicles, or any tool that is necessary to run the business. It enables businesses to obtain the equipment in the absence of the full price of the asset since most industries need to optimize cash for other operational requirements. Equipment is often used to secure the loan. Because of this, it would be relatively easier for a business to secure equipment financing even if the business has bad credit.

The conditions of equipment leasing are commonly connected with the expected service life of the equipment, and the actual loan periods may vary between two to seven years. In some cases, interest rates tend to be lower than on any other unsecured loans since the equipment being borrowed stands as security for the loan. Furthermore, the payment structure of some of the equipment financing contracts may allow for the choice of a schedule, or there may be some tax benefits since the equipment may be depreciated or can be claimed under certain circumstances.

Every business that requires the use of large equipment, tools, and machinery, including those in manufacturing, construction, health industries, and transport, should consider equipment financing.

Best Equipment Financing Providers for Small Businesses

- Crest Capital: It specializes in equipment financing, providing funds not exceeding $1,000,000 and reasonable interest rates with financing periods of up to 7 years.

- Balboa Capital: It specializes in equipment leasing and offers fast approval with equipment funding for all types of business equipment.

- National Funding: Provides equipment financing ranging from $5,000 to $50,000, and funding approval depends on the equipment being financed.

- Wells Fargo Equipment Finance: It offers credit services to small and medium enterprises, with specific payment terms based on the useful life of the equipment being financed.

- CIT Group: Its main objective is to offer reasonable rates for equipment financing for manufacturing and technology-related equipment to suit its clients.

- US Bank Equipment Finance: Defines financing and leasing opportunities for new and utilized equipment, with terms up to 60 months.

5. SBA Loans

SBA loans are conventional government-guaranteed loans aimed at financing small businesses, which could be deemed nonexistent for big financial establishments. The SBA does not offer cash or directly lend; however, it approves lenders, commercial banks, and credit unions, who, in turn, advance loans with good terms and conditions. The government often underwrites a major part of the loan, thus minimizing the risk for the funders and enabling small businesses to obtain the necessary amount of funding.

SBA loans have slightly lower interest rates and longer maturities than universal interest rates to cater to business enlargement, procurement of machinery, purchase of real estate, or capital. The common SBA loan types are the 7 (a) loan, which can be used for virtually any business need, and CDC/504 loans for real estate, green projects, and large equipment purchases. Although the application process is a little lengthy since there is much paperwork, the advantages of lower and more extended terms are worth the hustle.

Best SBA Loan Providers for Small Businesses

- Wells Fargo: It provides SBA 7 (a) and SBA 504 loans with different term periods, suitable for business expansion or equipment acquisition.

- Live Oak Bank: The company is a leader in SBA financing and is interested in healthcare, veterinary, and service business, providing loans of upto $5,000,000.

- SmartBiz: Consolidates SBA loans with ease of application and fast disbursement of funds between $30,000 and $5,000,000.

- Celtic Bank: An SBA-preferred lender providing a number of SBA loan solutions that range from 7 (a) to 504 loans.

- Huntington Bank: It is one of the largest SBA lenders in the country and provides SBA 7 (a) loans with different terms for working capital, commercial real estate, and equipment financing.

- Bank of America: It funds SBA loans for small businesses and offers a special rate for properties and business expansion.

6. Invoice Financing (Invoice Factoring)

Invoice financing, also referred to as invoice factoring, is a financing technique in which a business sells its unpaid invoices to a third-party factoring company in order to get cash immediately. They assist companies in increasing their liquidity by turning accounts receivable into cash without waiting for customers to settle the money. It’s especially valuable for business entities that suffer from late receipt of customer payments, which consequently creates cash shortages in operations.

Perhaps the biggest idea about invoice financing is that the factoring firm will pay 70-90% of the invoice’s value. After the customer pays the invoice, the rest is paid to the business, with the balance deducted by the factoring company’s fee. This kind of financing does not create liability on the business’s balance sheet and is thus attractive for businesses that require cash but would not wish to take conventional loans.

Best Invoice Financing Providers for Small Businesses

- BlueVine: It offers invoice factoring, with funding limited to 90% of the invoice value, and is an excellent funding process for small businesses.

- FundBox: It offers payday financing solutions that are different from invoice financing. It can approve qualified businesses for up to 100% of their invoice values at affordable rates.

- Triumph Business Capital: It offers industry-leading rates for factoring in the transportation, oilfield, and staffing industries, as well as high toolkit funding and specializations.

- altLINE: Invoice financing solution of The Southern Bank providing factoring services with the ability to offer upto 90% funding for B2B enterprises.

- Paragon Financial Group: It specializes in invoice factoring with no minimums, making it ideal for small businesses.

- TCI Business Capital: Transform invoices into immediate cash by factoring for all forms of industries and can fund upto 24 hours after invoices are presented.

7. Business Expansion Loans

A business expansion loan is quite a straightforward type of funding aimed at helping businesses cover diverse costs associated with growth and expansion successfully. These are the funds required to support a range of growth activities, which means that companies can develop their operations through obtaining these liabilities. Major uses of business expansion loans include acquiring substantial capital assets that take longer to earn revenues and are usually provided at higher amounts and longer repayment periods than short-term loans.

Various interest rates for business expansion loans are likely to depend on the applicant’s credit score, the loan amount, and the financier or lender’s general requirements. It is not uncommon for the lender to ask for an asset that would be considered a surety on the loan, especially for a large amount. There are also unleveraged choices, but they tend to be slightly costlier with respect to the rate of interest.

Best Business Expansion Loan Providers for Small Businesses

- Wells Fargo: It offers flexible growth financing and reasonable market interest rates for business development.

- Bank of America: It provides funding to expand business, with secured and unsecured solutions upto $5,000,000.

- Funding Circle: This company focuses particularly on this sector of business financing and offers loans for business growth, with loan limits of up to $500,000 and fixed interest rates.

- US Bank: There is a business loan for various expansion activities, such as purchasing real estate or updating equipment.

- Capital One: It provides expansion loans with affordable rates of repaying portions of the loan without penalty and fast approval for companies that are willing to grow.

8. Commercial Real Estate Loans

Business real estate loans are specific financial products applied to the acquisition, refinancing, and rehabilitation of commercial buildings like offices, shops, storage facilities, or apartment buildings. These loans offer working capital to firms to enable them to purchase properties for their operations or for investment purposes. While commercial real estate loans have rather long maturities and can range from 5 to 20 years, the interest rates can be fixed, floating, or both.

The loan amount and terms depend on the property’s value, location, the borrower’s credit score, and the health of the business. Typically, commercial property financing entails payment of 10% to 30% of the price of the particular property. Again, the property itself is used as security, which, in a way, minimizes the lender’s risk through the borrower’s risk of losing his property.

These loans are suitable, especially for business pioneers who seek permanent premises, business expansion into new regions, or simply for business people seeking to expand their investment portfolios.

Best Commercial Real Estate Loan Providers for Small Businesses

- Chase Bank: It provides CRE financing with reasonable interest and tenors of upto 25 years across different property segments.

- Wells Fargo: Money for buying or refinancing commercial property and loans can extend upto $5,000,000.

- US Bank: It offers commercial real estate financing and can offer special terms for offices, retail stores, and any commercial building.

- PNC Bank: This bank offers several terms for funding the purchase, construction, or leasing of commercial property.

- Lending Tree: Enabling businesses to compare several offers on commercial real estate loans so that they can get the right rate and terms for their needs.

- Bank of America: It offers financing of C&I real estate projects with reasonable repayment terms and the lowest interest rates for the purchase and renovation of premises.

9. Business Auto Loans

Business auto financing is a unique vehicle funding product meant specifically to finance business-use automobiles, which can include cars, pick-up trucks, vans, or specific-use vehicles. These loans allow businesses to access basic transport means without exhausting their cash resources, making it easier for businesses to contain other expenses and expand. Most business auto loans come with attractive features that are friendly to the business, such as reasonable interest rates and attractive business financing terms, which make their payments match cash flows.

Typically, automobiles serve as the security of the loan, which can lower borrowing costs than if it were an unsecured loan. It also needs to be noted that borrowers could make tax deductions related to car use, involving interest as well as depreciation, which again opens up more benefits when looking for business auto loans.

Best Business Auto Loan Providers for Small Businesses

- Ford Credit: Ford Credit is a division of Ford that provides financing solutions for acquiring Ford motor vehicles through purchase or lease with reasonable interest rates and business terms.

- Wells Fargo: It offers business auto loans with flexible financing solutions for new and used business autos. It offers low and affordable interest rates and a business loan term as long as 5 years.

- Bank of America: It specializes in business auto loans and offers different financing methods to enable efficiency in business vehicle purchases or refinancing.

- GMC Business Elite: A program devised by GMC to facilitate business individuals seeking to lease/ purchase a GMC commercial brand.

- Toyota Financial Services: This division offers business automobile finance alternatives through loans and leases on Toyota vehicles, depending on the business requirements.

- Lendio: It is a platform that connects businesses with potential lenders, making it easier for businesses to compare the available business auto loan deals and find the best deals.

10. Franchise Financing

Franchise financing is a type of credit intended for the purchase, expansion, or enhancement of a franchise business. It helps them pay initial franchise fees, equipment, real estate, marketing, and any other costs associated with the startup needs of franchising or intending to franchise the business. Franchises benefit from clearly defined brand images and recognition, as well as tried-and-tested business models that can help persuade lenders and other investors that franchises are less risky obligations than new independent businesses.

Franchise financing can be more or less formal and have terms and organizational structures that differ depending on lenders and the franchise. Such loans are usually easier to pay back, cheaper, and longer-term, which allows the franchisee to have the financial stability he needs to kick-start the business. Independent lenders also set individualized financing programs in conjunction with particular types of franchises, which simplify the procedures.

Best Franchise Financing Providers for Small Businesses

- ApplePie Capital: Franchise financing company that caters to specific loan types designed for specific franchise streams, with a maximum loan amount of $5,000,000.

- Guidant Financials: It is a complete franchise funding solution that offers options like SBA loans and other forms of franchise financing, which have been designed to help franchise start-ups.

- FranchiseDirect: Connects you with lenders who offer special franchise financing for new and growing franchisees.

- Wells Fargo: It offers franchise finance with affordable interest rates to meet franchise requirements for the most popular brands and types.

- Boefly: A place that has brought lenders for franchisees as well as those that have embraced franchise loans, such as SBA franchises.

- Crest Capital: It provides franchisors with equipment financing and any other capital required to acquire the necessary equipment for franchising a location.

11. Business Loans for Bad Credit

Loans for bad credit businesses are meant to bring a solution to business people who have low credit ratings to enable them to access funds for their businesses. As you will find out from doing business, conventional financial institutions are not quick to provide loans to companies with bad credit ratings due to the high risks involved on their part. They attract higher rates of interest and little repayment periods because the level of risk is higher. Still, they present the prospect of access to capital needed so greatly by many businesses for working capital, equipment purchase, or expansion.

It is still possible to obtain a business loan as several classes of loans can be availed by bad credit, such as merchant cash advances, invoice financing, secured loans with collateral, etc. While such options may be relatively more costly than those extended to firms with healthy creditworthiness, these options are, however, useful in providing the needed capital for purposes of running the business, for expansion, or equally useful for rebuilding credit ratings in the long run through good repayments.

Best Bad Credit Business Loan Providers for Small Businesses

- OnDeck: The platform offers short-term business loans and business lines of credit for business owners with low credit scores. Overview of OnDeck funding: It is normally processed on the same day, and the loan terms are also flexible.

- BlueVine: It offers Invoice Factoring and Business Lines for bad credit scores and aims at invoice financing and cash flow.

- FundBox: It offers credit lines for businesses that have bad credit ratings. Fund flow is a fast and easy application for the credit line with flexible terms of paying back.

- Credibly: It offers different loan services for business people with poor credit status while looking for finance, and they give working capital loans and merchant cash advances.

- QuarterSpot: It offers short-term business loans to businesses with low credit ratings, quick approval, and funding solutions.

12. Business Loans for Veterans

The business loans for veterans are meant for military veterans aspiring to undertake entrepreneurship, the development of an enterprise, or the expansion of an existing business. These loans take cognizance of the expertise that these veterans have in the field and should, therefore, be defended with incentives and loans to spur the veterans into the formation of their start-up businesses. Interest rates are generally lower, loan terms longer, and fees have been reduced to allow many programs to fund the veteran’s need to launch and expand a business.

The government supports some options, including the SBA Veterans Advantage program, which guarantees loans for veteran businesses, hence encouraging lenders as they are less risky and easy to approve. Furthermore, there are some other loan or grant programs for veterans, private or nonprofit organizations, and veteran-oriented business funding for required initial expenses or equipment or working capital. Veteran business loans are outstanding, especially for veterans who want to own a business after serving in the military.

Best Veteran Business Loan Providers for Small Businesses

- SBA Veterans Advantage: It offers government guaranty financing, loans at a discounted rate, and guarantees loans to veteran businesses.

- StreetShares: It offers loans for veteran-owned businesses. They offer lines of credit and flexible terms for loans.

- Navy Federal Credit Union: It offers business loans and credit exclusively for veteran and military families.

- Veteran Business Fund: A non-profit organization that provides affordable small business loans to enable veterans to set up or expand their companies.

- Hivers & Strivers: It is an angel investment firm that invests in growing-stage business propositions initiated by United States military veterans.

- Like Oak Bank: it provides SBA loans and other business financing solutions for veteran entrepreneurs at low interest and with excellent service.

13. Business Loans for Black Women

Business loans for Black women are strategic lending products designed to help Black women entrepreneurs fulfill their business dreams. These loans assist in filling the credit gap commonly faced by minority women in business, providing the required finance for creating or to support or continue operating a business. It also implies that many lending institutions that Black women proprietors can approach might overwhelm them because of credit demands or the absence of security, hence the need for specialty loans. Black women seem to receive more favorable financing terms; they get better rates of interest or longer repayment terms or other facilities like training, advice, and contacts to businesses.

These loans are offered by several nonprofit organizations, the government, and other programs, as well as some private lenders who specialize in financing the needs of Black women business owners. Micro-loan programs through SBA, CDIs, or Community Development Financial Institution funds for women-led business grants are a few that can support business advancement. These loans provide chances for Black women to succeed in bypassing financial constraints and achieving business success that brings more variety to business markets and their development.

Best Black Women Business Loan Providers for Small Businesses

- Accion Opportunity Fund: This fund affords small business loans to growing entrepreneurs of color, particularly Black women, with fair interest rates and business education.

- IFundWomen of Color: Works with Black women business owners, matching them with loans or grants.

- SBA Microloan Program: Provides capital by working with smaller and more targeted organizations dedicated to minority businesses.

- Black Business Loan Fund (BBLF): This non-profit organization offers affordable funds and credit facilities to black women entrepreneurs.

- Kiva: It is crowdfunded microcredit with no interest to Black women entrepreneurs, advocating for people’s funding.

- Camino Financial: Offers micro business financing without collateral, with a focus on founders of color, particularly Black women entrepreneurs.

14. Business Loans for Startups

New business financing is especially important for startups that are unable to attract funding from other sources without business loans. Unlike traditional enterprises, start-ups hunt for credit more often due to restrictions on traditional credit in the form of a fixed credit line and lack of recognizable security. Startup loans overcome these difficulties with tailored funding options designed specifically for startups, such as working capital, equipment acquisition, marketing expenses, and cost of initial stock. These are shorter repayment terms than standard car loans and may be more costly because they are more risky from the lender’s perspective.

SBA microloans, term loans, and lines of credit are available options for startups. Term loans can help handle operational cash flows. Some lenders focus on specific industry startup loans, while others expect the business plan to show prospects of the startup’s future growth. These loans also provide the necessary funds to create credit and other resources and organize the operations of newly established startups without personal savings.

Best Business Loan Providers for Small Business Startups

- Lendio: It is a marketplace that compiles different lending types, including SBA microloans and term loans for startups.

- Accion Opportunity Fund: It offers very low interest rates on microloans to business startups, especially those run by the disadvantaged.

- Fundera: Helps startups identify lenders that provide business loans and lines of credit, which helps new businesses find the financing they need.

- BlueVine: It provides business loans and factoring products that are ideal for businesses with less than 2 years of merchant history and limited credit history.

- OnDeck: It offers short-term business loans and credit facilities for startup businesses and small business loans to new businesses with reasonable repayments.

Conclusion

Sourcing for the right business loan is crucial if the growth and sustainability of small businesses are to be achieved. Working capital loans, SBA loans, and equipment financing are all available, but each kind is designed for a particular purpose. As such, any loan has its features, terms, and benefits, which any entrepreneur should understand before taking it as a way to fund a business. Choosing between the different loans available also provides the necessary finances to address the difficulties, control the cash flow, and yield superior results in the future.