The United States government’s largest offering for general business financing is the U.S Small Business Administration’s 7(a) loan. SBA 7(a) loan uses may include working capital and other operating expenses, as well as investment in owner-user real estate and equipment, up to a total of $5 million. The 7(a) loan program offers credit with reasonable costs and significantly longer payoffs than traditional business loans to enterprises that have a difficult time securing funding.

What is the SBA 7 (a) Loan?

A small business loan granted by a private lender with partial backing from the U.S. Small Business Administration is known as an SBA 7(a) loan. Due to their extended payback durations and affordable interest rates, SBA 7(a) loans are a great choice for business financing even though they might be challenging to qualify for. Furthermore, 7(a) loans can be utilized for a number of things, such as working capital, company expansions, or the acquisition of supplies and equipment.

How to use this Loan?

7(a) Loan purposes include:

- Purchasing, financing, or renovating real estate and buildings

- Both temporary and permanent working capital

- Refinancing existing debt for a business

- Acquisition and setup of machinery and equipment, including costs associated with artificial intelligence

- Buying supplies, furnishings, and fixtures

- Ownership shifts, either total or partial

- Loans has several uses, like as any of the above

What is the Maximum Loan Amount for SBA 7(a)?

A 7(a) loan can have a maximum lending amount of $5 million. Important qualifying criteria are determined by the business’s income-generating activities, credit history, and location of operations. Your lender will assist you figure out which form of loan is most suited for your circumstances. If your company is eligible, this also includes advising that you apply for an SBA 7(a) Working Capital Pilot (WCP) loan.

Eligibility i.e. whom is it meant for?

However, no matter the type of 7(a) loan, there are standard criteria that one has to meet in order to access this loan from the SBA in addition to the current criteria provided by the lender.

Typically, the small businesses are required to follow the below mentioned criteria to qualify for an SBA 7(a) loan:

- Must be a commercial enterprise that is based in the United States.

- Must be a small business, according to the SBA regulations.

- You must be capable of demonstrating your credit standing, and your capability to repay the loan.

- Must have sought out other forms of financing before seeking an SBA loan.

- To qualify for this type of loan; you need to show the necessity of taking a loan and the business use of the funds.

- One cannot be a defaulter on any of the government’s existing loans.

- Be able to offer security for loan amounts more than $50, 000.

- Personal guarantees are required in the event the shareholder acquires more than 20% of the shares of the business.

Furthermore, the SBA doesn’t designate numerical minimums for evaluating a borrower’s creditworthiness and ability to repay a loan, lenders will want to see the following:

- The personal credit score being good and above the minimum standard of 690.

- Solid annual revenue.

- At least Two years registered in business.

Who Is Not Eligible for SBA 7(a) Loan?

- Non-profit organizations

- Foreign-based businesses

- Businesses that primarily lend money

- Life insurance companies

- Businesses involved in illegal activities

- Businesses that conduct lobbying or other political activity

- Businesses that earn more than a third of their income from gambling

- Government-owned organizations

- Multi-sales distribution businesses

How to apply for an SBA 7(a) Loan?

You will collaborate with an SBA lending partner, such as a bank or credit union, to complete an application in order to apply for a 7(a) loan. In order to obtain a loan guarantee—which ensures that the SBA would reimburse the lender for the guaranteed amount in the event of a default—the lender will send their application package to the SBA.

If you believe you could be eligible for an SBA 7(a) loan, you can finish the application process by doing the following three steps:

1. Find an SBA 7(a) lender

SBA 7(a) loans are provided by hundreds of financial institutions, including large national banks like Bank of America, Wells Fargo, and Chase. To find out whether a bank you have a relationship with offers SBA 7(a) loans, you could start by getting in touch with it.

Through its website, the SBA also provides a lender match tool that enables you to connect with local lenders by sharing details about your firm.

You can also seek SBA lenders with 7(a) loan experience because they can speed the application process, respond to any queries you may have, and maybe improve your chances of being approved.

2. Gather your documents and submit your application

You can get assistance from your SBA lender in gathering the necessary paperwork to fill out and submit an SBA 7(a) loan application.

The following list of documents is not exhaustive and may change depending on the specific lender and kind of SBA 7(a) loan you are applying for:

- SBA Form 1919, Borrower Information Form.

- Business certificate or license.

- Resumes for each business owner.

- Business overview and history.

- Business lease.

- Loan application history.

- Income tax returns.

- Personal background and financial statement (SBA Forms 912 and 413).

- Business financial statements, such as balance sheets, profit and loss statements and projected financial statements.

3. Wait for approval and close on your loan

If you have applied for the SBA 7(a) loan you are then required to wait until you are approved either by the lending firm or the SBA. SBA Express and Preferred Lenders can make the decision with regard to loan for an applicant without the involvement of SBA hence less time is consumed.

When your loan gets approved your lender would begin the closing process of the loan by taking security for the loan, preparing necessary documents for the loan and other formalities that are authorized for closing the particular loan.

Your lender will then proceed to disburse your loan and you’ll pay back the loan in installments over the agreed period of the term. The application and funding process normally ranges between 60 to 90 days.

SBA 7(a) Loan Requirements

Before you apply for this loan, mentioned below are some important business and financial documents that are required to apply for this loan:

- Legal business registration documents like articles of incorporation.

- Lease agreement (if relevant)

- Financial statement from the last three years(including balance sheets, income statements, and cash flow statements)

- Three years of business and personal tax returns

- Recent profit & loss (P&L) statements and balance sheet

- Details of present debt obligations

- A detailed schedule of any collateral you are offering

Having these documents ready ahead of time will streamline the application process and improve your chances of approval.

What is the Minimum Credit Score for SBA 7(a) Loan?

The SBA 7(a) is the one of the most demanded SBA loan programs to date. It assures the small business owners about $750,000 of working capital from their local 7(a) lender, with a partial guarantee from the Small Business Administration. The minimum credit score that is needed for the SBA 7(a) business loan is 650.

Other SBA Credit Score Requirements to qualify for SBA 7(a) Loans:

- Robust cash flow statement for business

- Regarded as a small business under the SBA’s definition

- Possess a suitable amount of invested equity

- Prior to financial aid, make use of other financial resources, such as personal assets

- Able to prove that you require a loan

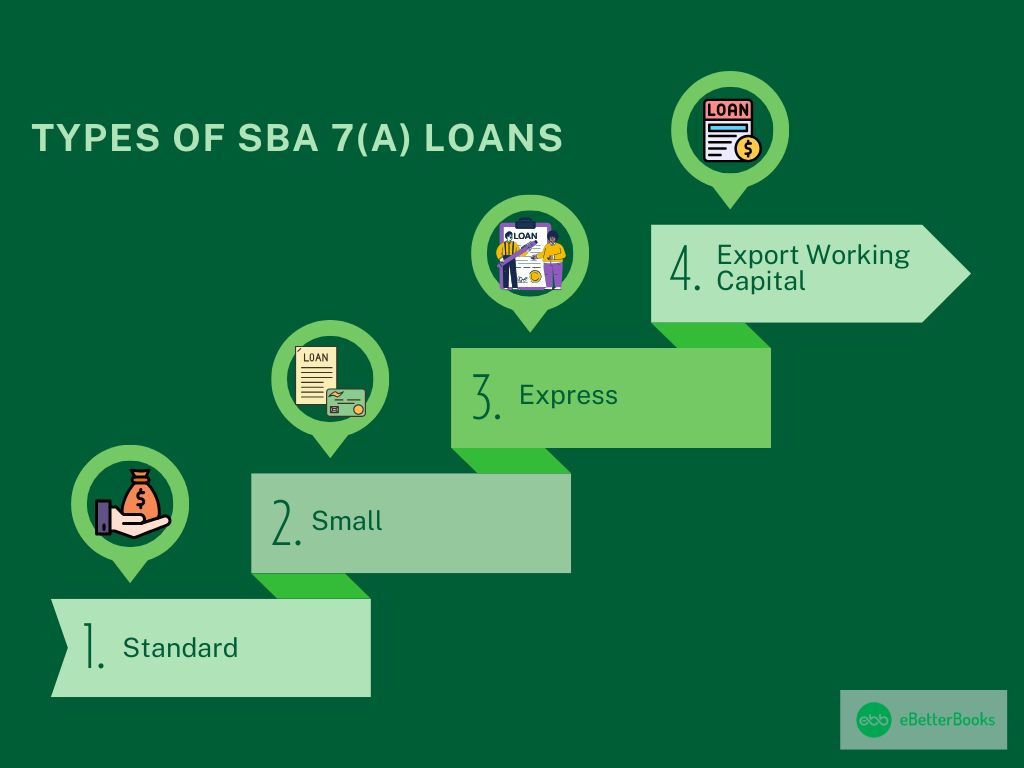

Types of SBA 7(a) Loans: Standard, Small, Express, and Export Working Capital

1. Standard

Standard loans are one of the types of the SBA 7(a) loans which are greater than $500,000, and exclude 7(a) Small, Export Express, SBA Express, CAPLines, International Trade loans, Export Working Capital Program (EWCP), and Pilot Program loans.

These loans might get processed under Preferred Lender Program (PLP) delegated authority or non-delegated through the Loan Guaranty Processing Centre (LGPC).

| Loan amount | $500,000 to $5 million |

| Maximum SBA guarantee % | 75% |

| Interest rate | Lenders and borrowers have the option to negotiate the interest rate, but it should not exceed the SBA maximum |

| Revolving lines of credit | Authorized only under SBA Express, CAPLines, or Export Express |

| SBA turnaround time | 5-10 business days |

| Forms | SBA Form 1919 is necessary for every loan |

| Collateral | SBA will consider a loan fully secured if the applicant has pledged all the business assets acquired, refinanced, or to be used to improve, or fixed assets available to the 7(a) loan applicant, with a combined adjusted net book value equivalent to the amount of the loan.Other conditions apply – see SOP 50 10 for more details. |

| Credit decision | SBA or qualified lenders may be given delegated Authority to process, close, service and or liquidate the loan without referring to SBA directly. |

2. Small

7(a) Small are term (non- revolving) 7(a) loans with an amount of $ 500 000 and below and may be processed via PLP delegated authority or otherwise via non delegated LGPC.

7(a) Small loans exclude: SBA Standard 7(a) loans, SBA Express, Export Express, CAPLines, Export Working Capital Program (EWCP) and SBA Pilot Program.

| Maximum loan amount | $500,000 |

| Maximum SBA guarantee % | 75% for loans greater than $150,000 and 85% for loans up to $150,000 |

| Interest rate | Lenders and borrowers have the option to negotiate the interest rate, but it should not exceed the SBA maximum |

| SBA turnaround time | 2-10 business days |

| Forms | SBA Form 1919 is necessary for every loan |

| Collateral | For loans $50,000 or less: No collateral is needed for an SBA loan, except for International Trade, where the loan conditions differ somewhat. For loans $50,001 to $500,000: Lender is required to follow the written collateral policies and procedures developed and put in place for the similarly sized non-SBA guaranteed commercial loans; however the loan shall not be turned down due to lack of acceptable collateral. |

| Credit decision | SBA or qualified lenders may be given delegated Authority to process, close, service and or liquidate the loan without referring to SBA directly. |

3. SBA Express

The SBA Express enables lenders to usually adopt their own systems and practices in return for a lower SBA guarantee rate. SBA Express lenders can commit authority in respect of processing, closing, servicing and working out of the 7(a) loan without the participation of SBA.

| Maximum loan amount | $500,000 |

| Maximum SBA guarantee % | 50% |

| Interest rate | Lenders and borrowers have the option to negotiate the interest rate, but it should not exceed the SBA maximum |

| Revolving lines of credit | Up to 10 years |

| Forms | Lender primarily uses own forms and procedures, plus SBA Form 1919 |

| Collateral | Loans for amounts up to fifty thousand do not need collateral from the borrowers. They may continue to apply the collateral policy of the collateral policy of loans greater than $50,000 save for the fact that a loan shall not be turned down on grounds of insufficient collateral. |

| Credit decision | Made by the lender |

4. Export Working Capital

7(a) Export Working Capital Program (EWCP) loans are to specific businesses that require export sales to make their sales and require working capital to do so. The exporter should inform his region’s U.S. Export Assistance Center location where he is obtaining assistance from the loan provider.

| Maximum loan amount | $5 million |

| Maximum SBA guarantee % | 90% |

| Interest | The SBA does not set a maximum interest rate and lenders and borrowers determine interest rate. |

| Revolving lines of credit | Terms of 36 months or less |

| Forms | SBA Form 1919 |

| Collateral | In general, the export-related inventory produced and foreign accounts receivables resulting from the export sales funded will be deemed to be sufficient in collateral coverage. |

| Credit decision | SBA or qualified lenders may be given delegated Authority to process, close, service and or liquidate the loan without referring to SBA directly. |

Is there Any down payment required in SBA 7(a) Loan?

The down payment on the popular SBA 7(a) loan typically begins at 10% but can rise to 30% for new firms and startups. Business owners can use the proceeds of up to $5,000,000 for inventory, working capital, machinery, commercial real estate, and other purposes.

SBA 7A vs Microloan

| SBA 7(a) | Microloan | |

| Definition | These are the most standard loans that the SBA provides. | SBA Microloans, as the name indicates, are intended for much smaller reasons than their 7(a) equivalents. These loans are managed by a number of charitable lending institutions. |

| Use of Funds | These loans can be used for many purposes, including: Acquiring additional real estate propertiesEquipmentInventoryRestructuring DebtHaving additional working capital on-hand | Although business owners cannot use business microloans to settle current debt, they can be utilized for other things like: Investing on new equipmentGrowing your company’s operationsObtaining the extra working capital that is required |

| Loan Amount | $5 million is the maximum amount under the SBA 7(a) program. | The SBA microloan program has a maximum loan amount of $50,000 because, as the name suggests, it is a microloan. |

| Term Lengths | Your ability to repay the loan and how it is used will determine when it matures. For instance, loans taken out to buy real estate usually have lengthier terms than loans taken out for working capital. | The six-year maximum duration of the SBA microloan program is somewhat short in comparison to other SBA loan programs. |

| Interest Funds | The prime lending rate, loan amount, loan term, and additional premium all affect the highest interest rate that can be charged on the loan. Furthermore, the highest interest rate for loans that are returned in fewer than seven years is 4.25 percent over the prime rate. | There is usually an additional premium of up to 8.5 percent on the interest rates, which might vary based on the administering partner. |

| Qualifying Process | You must have a for-profit company with a track record of timely loan repayment in order to be eligible for an SBA 7(a) loan. Generally speaking, SBA loans are easier to qualify for than conventional bank loans. Despite how quickly the procedure moves forward, approval is not assured. You will be able to benefit from better cash flow and long-term finance if you are qualified. | The requirements for a 7(a) Loan and an SBA Microloan are identical. |

What is the current SBA 7(a) interest rate?

SBA loans are in high demand because of the competitive interest rates and increased affordability for business owners. Despite the lengthy underwriting procedure, SBA loans remain one of the most popular financing choices for entrepreneurs and business owners across the country.

| Loan Amount | Maximum Rate | Maximum Rate Allowed (w/ Current 8% Prime Rate) |

| $0 to $25,000 | Prime + 8% | 16% |

| $25,001 to $50,000 | Prime + 7% | 15% |

| $50,001 to $250,000 | Prime + 6% | 14% |

| Above $250,000 | Prime + 5% | 13% |

SBA 7(a) Payment Conditions

The maximum term lengths for SBA 7(a) loans typically depend on the use of loan proceeds:

- 25 years for real estate.

- 10 years for equipment.

- Within 10 years for work and circulating assets or inventory finance.

There are some exceptions which include; For example, SBA CAPLines of credit have a maximum term length of 10 years and Builders line of credit can have a term of maximum of five years only.

The basics of the 7(a) loan program are provided at a general level by the SBA, which include details about maximum loan amount, term length and interest rates, but the details about your SBA 7(a) loan will be given by the participating banker.

What are the Fees for SBA 7A loans?

It’s crucial to remember that the interest rate is only one component of the total cost of a 7(a) loan. Although the SBA limits the fees that lenders can collect, most SBA 7(a) loans will include a guarantee fee, which can range from 0.25% to 3.75% depending on the size of the loan. The SBA waives guarantee costs on Express loans to veteran-owned businesses.

Depending on the lender, you may also be charged packaging and servicing fees; however, the SBA prohibits lenders from charging prepayment penalties, origination fees, renewal fees, or other similar expenses. Lenders can, however, levy a fixed fee of $2,500 per loan.

SBA 7(a) Loans vs. 504 Loans

| SBA 7(a) Loan | SBA 504 Loan | |

| Loan Amounts | Up to $5 million. | Up to $5 million to 5.5 million for small manufactures or particular energy projects. |

| Permissible Uses | An extensive variety of uses which includes working capital, obtaining another business, expanding your business, property renovation, real estate purchase, debt refinancing or equipment financing. | Real estate purchase, construction, equipment financing, property renovation. |

| Maximum Repayment Terms | Up to 10 years for equipment and working capital, 25 years for real estate. | 10, 20, or 25 years. |

| Interest Rate | Fixed or variable interest rate, which is based on the prime rate plus a lender spread. | Fixed interest rate fixed to U.S Treasury bonds. |

| Fees | SBA guarantee fee and bank fees. | SBA guarantee fee, CDC fees and bank fees. |

| Down Payment Requirements | Varies. | 10% or higher for startups or properties with a particular use. |

| Collateral Requirements | The Collateral is basically required for loans over $50,000. | The assets that are financed serve as collateral. |

| Eligibility | Meet the SBA’S basic definition of small. Should have attempted to utilize alternative financial resources. Should be for-profit business in the U.S or U.S territories. | Should be a business of net worth $15 million or less, and have an net income of 45 million or less. Project should meet the retention goals and job creation or any other public policy goals. Should be for-profit business in the U.S or U.S territories. |

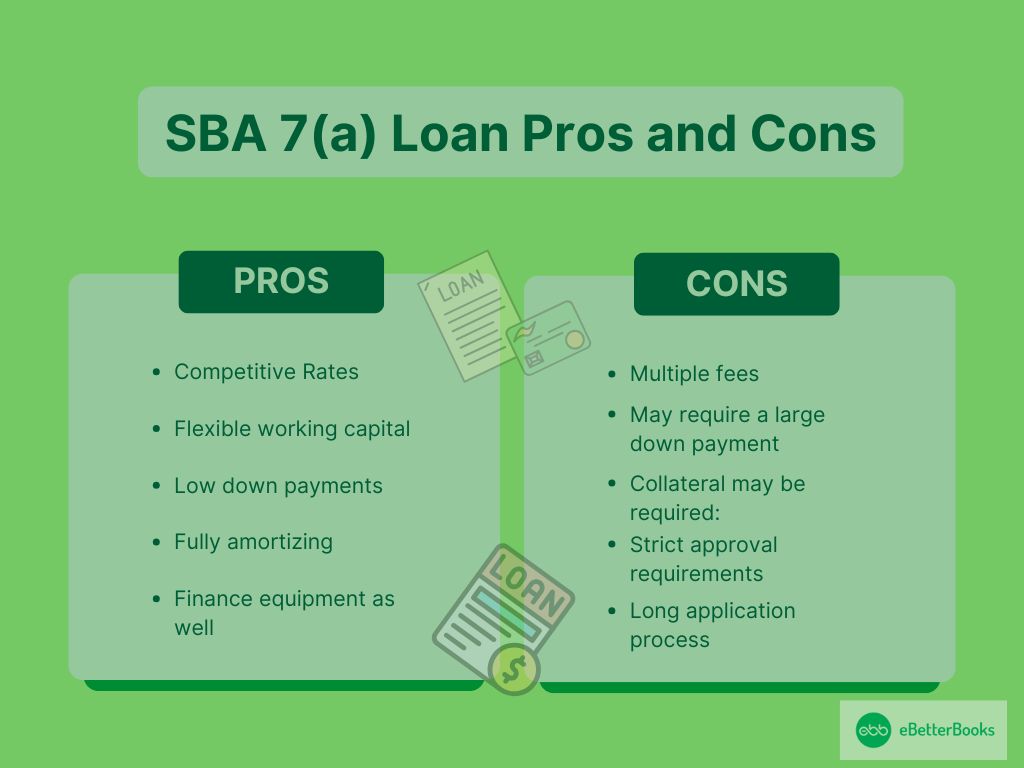

SBA 7(a) Loan Pros and Cons

Mentioned below are the pros and cons of the SBA 7(a) loan:

Pros

- Competitive Rates: If you look at online lenders rather than national banks, you’ll find that SBA 7(a) loans typically offer cheaper rates than other business loans available.

- Flexible working capital: 7(a) loans are intended to meet the demands of your expanding company. They are therefore perfect for funding inventory, hiring more staff, or any other justifiable investment.

- Finance equipment as well: Similar to a 504 loan, a 7(a) loan can be used by your company to finance equipment purchases.

- Low down payments: The down payments are generally around 10-20%.

- Fully amortizing: SBA 7(a) loans are fully amortizing, so there are no balloon payments available.

Cons

- Multiple fees: You might be required to pay a down payment and a guarantee fee in addition to any costs your lender or loan broker charges, depending on the amount of your loan.

- May require a large down payment: Depending on the amount of your loan, you may also be asked to pay a guarantee fee and a down payment in addition to any fees your lender or loan broker may impose.

- Collateral may be required: Collateral to support your loan may also need to be provided by your company.

- Strict approval requirements: These loans have very difficult approval requirements and need extensive paperwork.

- Long application process: The loan application process might take up to 30-60 days.

Alternatives to SBA loans

SBA loans can be difficult to qualify for — and you need to explore other financing options before applying. Common alternatives include bank loans and business credit cards, though there are various options to choose from.

- Bank loans: Banks and credit unions provide term loans and lines of credit to established enterprises. Many provide excellent terms and rates comparable to SBA loans.

- Alternative loans: Alternative or online lenders also provide term loans and lines of credit. These may be easier to obtain if you own a newer firm or have a lower personal credit score.

- Credit cards: Business credit cards provide a flexible option to cover common business needs. While they often have higher interest rates than lines of credit, you may be able to benefit from rewards schemes comparable to personal credit cards.

- Grants: Business grants are offered for minority and women-owned firms, as well as industry-specific incentives. However, they are typically competitive, similar to SBA loans.

- Equipment loans: If you are considering a 504 loan, you should look into equipment loans for your firm. These are secured loans, so your firm may still be eligible for cheap interest rates.

Bottom Line

The SBA 7(a) loan is offered by the U.S Small Business Administration to provide several different loans that can be used in many ways. The SBA also provides the standard maximum interest rates and allows long terms of repayment, therefore making the 7(a) particularly attractive to those small businesses. However, to qualify for it, you will have to qualify for both the SBA and the participating lender’s criteria.