Cash disbursement usually refers to payment made by one party to another on a daily basis by small businesses in regard to services or products. Cash disbursal are another critical element of correct record keeping for any business, including in your accounting, of a small business.

What is Cash Disbursement?

In accounting, a cash disbursement is defined as a payment that has been made by one party to another. It is also known as cash payments or disbursements; they can be made by check, e-check, Automated Clearing House (ACH), digital payment, and any format of payment recorded with an immediate deduction.

You can utilize cash disbursements to buy inventory, pay for office supplies, pay dividends, cover accounts payable and salaries, make business loan payments, and make any other kind of payouts that are not handled by credit account or credit card.

Some funds that are relocated by intermediaries, like a lawyer’s lawyer’s payment to some other party on your behalf, can also be considered disbursements.

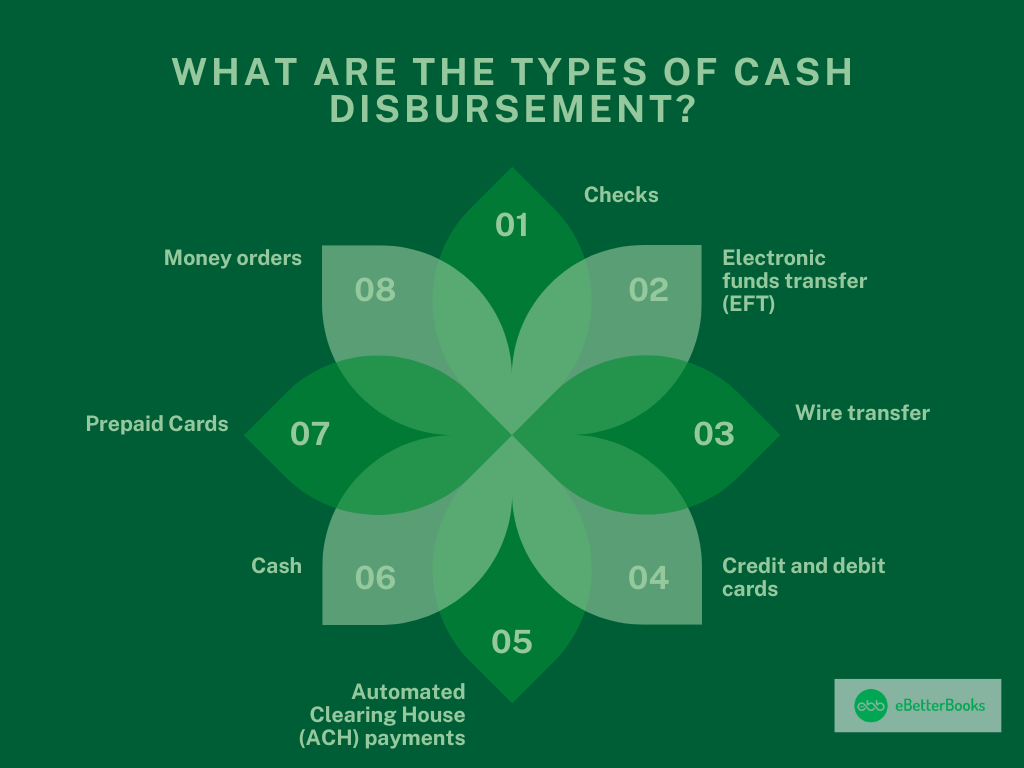

What are the Types of Cash Disbursement?

Cash disbursements can be done in many forms, each with its characteristics, benefits, limitations, and implications.

Below mentioned are the common forms of cash disbursements:

- Checks: Due to the rise of debit cards, personal checks are losing popularity, and physical checks are commonly used for routine business-to-business (B2B) payments. Checks are known as a reliable payment method that provides a tangible paper trail of transactions.

- Electronic funds transfer (EFT): EFT payments are very famous because of their speed and efficiency as they electronically transfer funds from one account to another.

- Wire transfer: Through wire transfers, you can electronically move funds from one bank account to another. These transfers only contain the information given by the senders telling their bank to move specific amounts of money to the recipient’s bank accounts, whether it is within a similar bank or any other financial institution.

- Credit and debit cards: In today’s world, card payments are the most common option, making up about 77% of all non cash payments. Credit and debit cards are both very flexible, as businesses have the choice to accept payments in person or online.

- Automated Clearing House (ACH) payments: These payments are commonly used for payroll and bill payments, and they can be done electronically, allowing direct transfer between the bank accounts.

- Cash: In the U.S., 18% of the people are still making cash payments. Although, due to the increasing popularity of digital payments, these transactions are getting less. However, they still have their significance, specifically in small-scale and in-person transactions.

- Prepaid Cards: These cards are generally used for employee travel expenses and provide controlled spending within predetermined limits.

- Money orders: These are similar to physical checks, but these are more secured documents that are provided by the government or banking institution with prepaid amounts.

How does Cash Disbursement Work?

Starting a cash disbursement requires a number of well-planned actions. Therefore, companies should be careful when handling corporate payments because proper authorization, processing, and record-keeping of disbursements might result in bad financial decisions.

Every company has a budget that serves as a roadmap for its operations over the fiscal year. There is usually an authorization choice to finish a transaction, commit to new spending, or make other financial decisions before the cash distribution procedure can start.

Step 2: Invoice or payment request

When a vendor, supplier, or other external entity requests payment, the disbursement procedure formally starts after a cash disbursement has been approved and confirmed.

An invoice or other validated document that includes the transaction details, requested amount, recipient’s contact data, and necessary payment method is typically attached to a cash disbursement request.

Step 3: Documentation and recording

The process of recording and documenting follows because it is crucial to record every step of the payment request procedure precisely.

Make sure that your financial commitments are met on time by keeping track of the payment deadlines and gaining access to copies of the purchase orders or invoices. Additionally, you could need this paperwork in the future to finish your yearly tax return or in case of an audit.

Step 4: Selection of payment method

Your firm must also decide on the payment method to be used for this cash disbursement. Different payment methods, such as cheques, wire transfers, EFT payments, or credit cards, may be needed for different transactions.

Step 5: Approval

To make sure that cash disbursements comply with corporate regulations, appropriate authorization from approved persons or departments must be obtained before the payments are made.

Depending on the organization’s organization’s size and nature, different people may be able to approve different financial distributions. When it comes to cash disbursements, small business owners may be in complete control; this may be done under their supervision by an accountant or bookkeeper. There may be more than one person authorized to handle cash payments for larger companies.

Step 6: Payment execution

The cash disbursement can be carried out using the selected payment method after the procedures mentioned above have been completed and the payment has been authorized.

Processing a credit card payment, starting an electronic transfer, or writing a paper check are all possible ways to carry out a cash distribution.

Step 7: Recording the transaction

When the payment is made, the transaction is required to be recorded in the company’s cash disbursement journal simultaneously.

Through cash disbursement journals, companies can maintain a more accurate transaction history log for more accurate expense tracking, budgeting, bookkeeping, and financial forecasting.

Step 8: Reconciliation

The process of recording cash disbursements is tedious and manual and is handled by the company’s accounting team. While using manual processes, mistakes, and human errors are likely to occur.

Because of this, businesses should perform regular reconciliations to make sure that the disbursement records match the bank’s statement and other financial records. Any discrepancies should be addressed immediately.

Step 9: Notifications

After the payment has been made successfully, all the relevant stakeholders should be notified of the completion of the cash disbursement.

The cash disbursement notification should contain information like internal terms and external parties for the correct reporting and financial tracking.

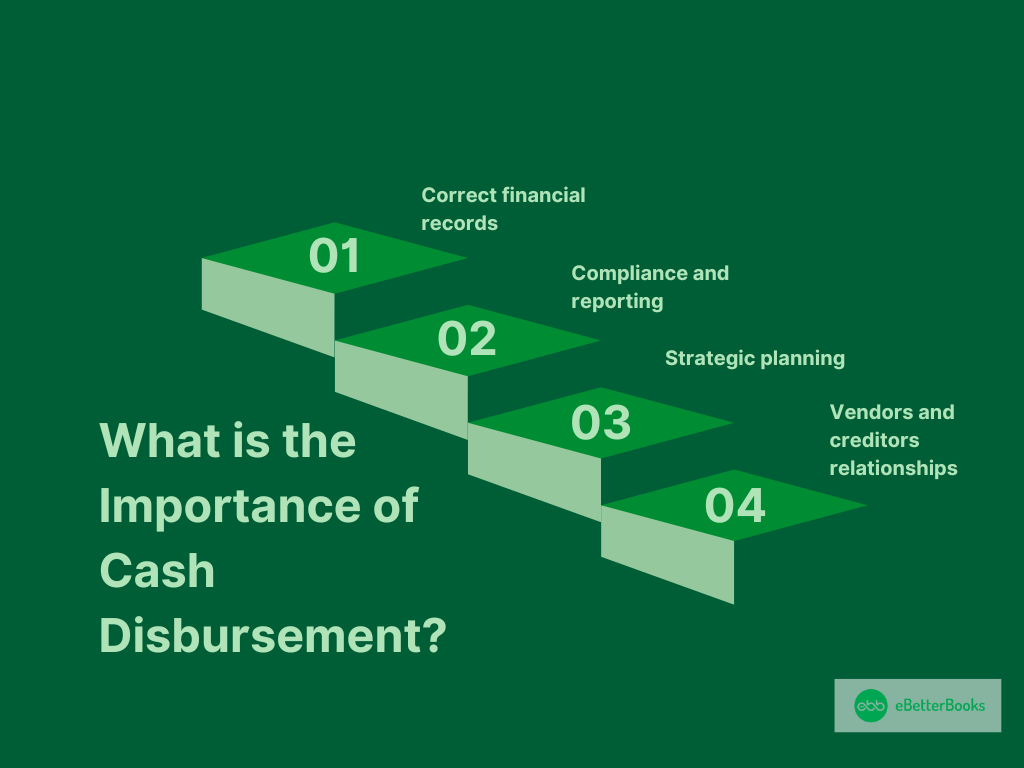

What is the Importance of Cash Disbursement?

Cash disbursements are crucial as they serve as a financial compass that guides businesses toward sustainable growth and fiscal responsibility.

Businesses can benefit from recording and managing disbursements systematically.

Four advantages of cash disbursements include:

- Correct financial records: By recording the outflows of funds from an organization, cash disbursements give a detailed record of all financial transactions, making sure that all expenses are accurately documented. This level of transparency is indispensable for audits, financial analytics, and compliance.

- Compliance and reporting: In regulated industries, you’re required to maintain the cash disbursement records as they are mandatory. If you fail to comply with the legal requirements, it will result in fines, extra taxes, and interests and will spoil your reputation. By following the legal standards, businesses can avoid penalties and legal discrepancies.

- Strategic planning: Cash disbursement data offers a lot of information for strategic planning. Through cash disbursement, businesses can recognize trends, assess spending patterns, and make well-informed decisions about resource allocation.

- Vendors and creditors relationships: Maintaining positive working relationships with suppliers, vendors, and creditors requires timely and reliable cash distributions. By ensuring that creditors and vendors can count on consistent cash flow, businesses may fortify these commercial ties and foster trust.

Businesses need to know not only how important cash disbursements are but also how these transactions are carried out.

Example of Cash Disbursement

Below mentioned are some examples of cash disbursements:

- Loans: A loan is disbursed when the amount agreed upon by the borrower is paid to them and is available for use. The cash is debited from the lender’s account and credited to the borrower’s account.

- Tuition: A student loan disbursement is the payout of loan proceeds on behalf of a student. Schools and loan servicers notify students in writing of the expected receipt of the disbursements, including the amount of the loan and its effective date. A university or college may also directly give students grant money in payments called disbursements.

- Insurance Claim: After an insurance adjuster inspects damage to a home or property, an insurance company will disburse money for repairs based on the terms and limits of policies such as a homeowner’s or automobile policy.

- Business Operations: Disbursement is a part of cash flow and a record of day-to-day expenses. If disbursements become higher than the revenues, then it can be an early warning of insolvency for a company.

- Retirement Account Withdrawal: When the money gets disbursed, then it gets recorded on the account as a balance draw down.

- Controlled disbursement: A cash flow management service for a bank’s corporate clients. Controlled disbursement allows customers to review and reschedule disbursements on a day-to-day basis. Clients maximize the interest they earn on the cash in their accounts by delaying when money is debited from the account.

- Third-Party Payments: When paying for services like an attorney, the lawyer will generally record disbursement made from the side of the client. This might include payments to any third parties for costs like court fees, private investigator services, courier services, and expert reports.

Cash Disbursement VS DrawDown

A disbursement is defined as a payment. Conversely, a DrawDown is considered as the specific type of disbursement.

For example, if a person withdraws money from their retirement account, then a retiree gets a disbursement. That disbursement shows a DrawDown on the balance in their account.

If the retiree withdraws 10% of a $100,000 balance in a traditional IRA account, then they’ll receive a $10,000 disbursement. This shows a DrawDown of $10,000, or 10%, from the retiree account, which results in a balance of $90,000.

Every company requires an efficient, correct way to track cash disbursements – an important part of understanding cash flow tracking. Tracking cash flow is also an important part of accounting itself. It reaches beyond A/R and A/P and paints a vivid, important picture of your business health.