What is Overhead Cost?

Overhead costs, or operating expenses, encompass all fixed business costs necessary for running the company but that may not necessarily be related to the company’s product or service provision. These include items such as stationery, employees’ salaries, and utilities but do not include the cost of sales.

Overhead expenses must be studied and estimated for financial planning and to understand how much profit the business should make on a service or product. For instance, if the business involves providing services, overhead costs would include the cost of the service, rent, electricity, cost of shipment, and insurance.

How to Calculate Overhead Cost?

To better understand a company’s overhead, it is useful to determine its overhead rate, which compares the total overhead costs to the total revenues or direct costs of the business.

Here’s a simple formula to calculate the overhead rate:

Overhead rate = (Total Overhead Costs / Total Direct Costs or Revenue) x 100

For example, if a company’s total overhead costs are $50,000 and its direct costs (or revenue) are $200,000, the overhead rate is:

(50,000 / 200,000) x 100 = 25%

This means that for each dollar spent on direct costs, a quarter is spent on overhead costs, and so on.

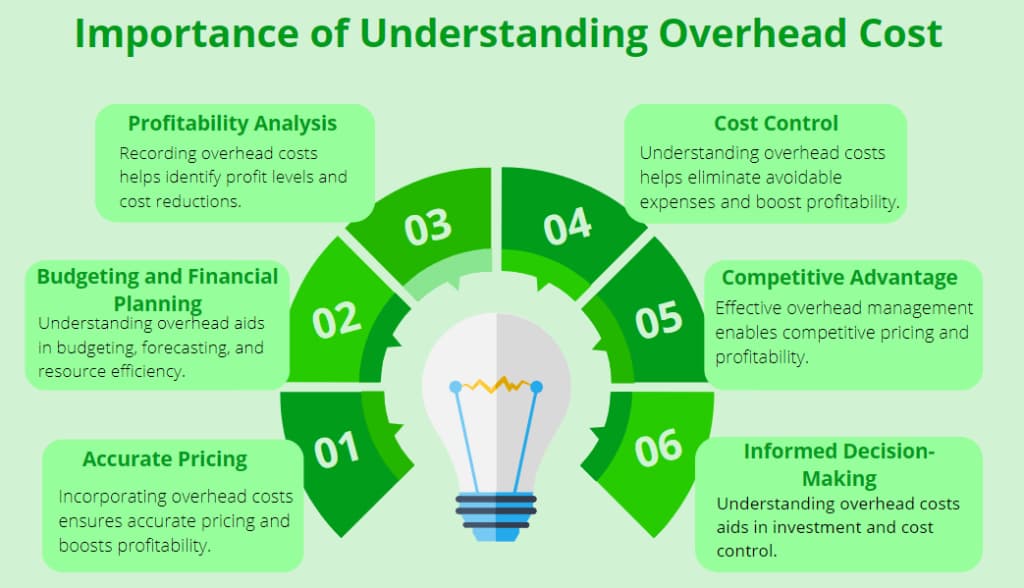

Importance of Understanding Overhead Cost

The identification of overhead costs is important in determining the success of a business as it shows the total cost needed for business operations other than the cost of production.

Here’s why understanding overhead costs is essential:

Accurate Pricing

In fact, overhead costs are an essential part of cost build-up, which determines the net price. By only focusing on the direct cost of a product, such as the raw materials used and the labor cost, in setting the price, a business can price itself out of the market and open itself up to much leaner or even negative margins.

For this reason, overhead must be known to ensure that the prices set cover the cost and generate income.

Profitability Analysis

Some overhead costs impact a company’s profitability. If the costs are too steep, they can bring down the profit, no matter how good the sales are. Business overhead analysis is used to determine points of cost reduction for businesses that have to maintain healthy margins.

Cost Control and Efficiency

Overhead control assists various industries in identifying areas that need correction. Knowing where your money is going enables you to cut down on unnecessary or excessive overhead expenses easily. This knowledge forms the basis of better decisions regarding cost containment, resource utilization, and the general functioning of the business.

Budgeting for Financial Planning

It is crucial to consider overhead costs more often when planning financial activities. Knowing both fixed and variable overhead will help a business make an accurate budget, forecast, and plan for future expenditures. This will help avoid challenges that compromise financial stability.

Break-Even Analysis

If overhead costs are excluded, it is impossible to determine the break-even point or the sales level that can cover all the costs. Understanding one’s overhead helps one set the right revenue stream to meet both fixed and variable costs and start making profits.

Informed Decision-Making

By being aware of overhead, business owners and managers can properly assess when it is time to cut expenses, outsource departments, or invest in company expansion. For example, if overhead costs are significantly high, a business can opt to make operations efficient or move to cheaper ways of handling issues.

Competitiveness

Overhead costs account for a considerable chunk of bargain prices, but control and minimization enhance the service provider’s competitiveness while not diluting their profitability. This will aid them in achieving a competitive advantage over their rivals within the market since they will be unique in their offering.

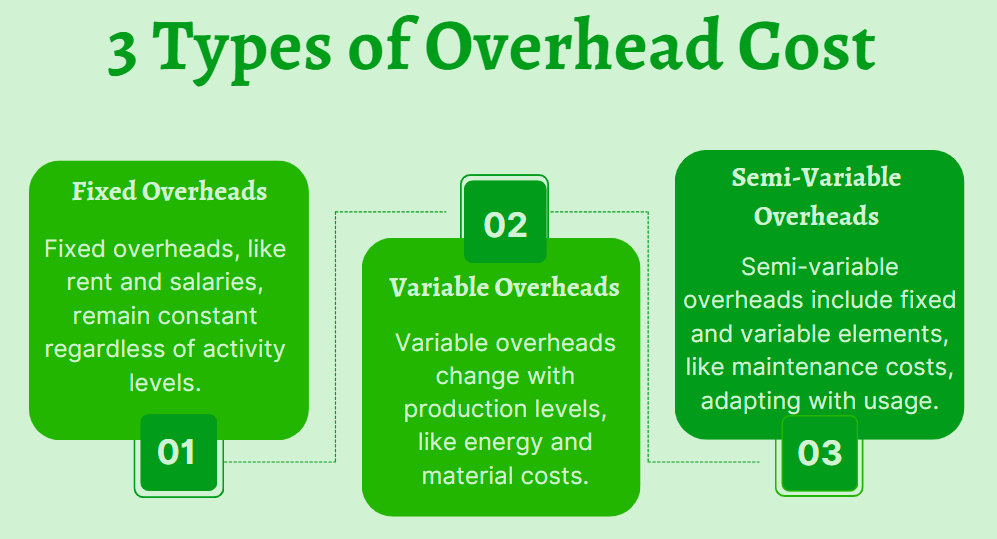

Types of Overhead Cost

Overhead costs can be divided into three main categories:

1. Fixed Overhead

In other words, these costs do not change with the number of products produced/consumed or the total number of units sold.

Examples include:

- Rent or lease payments

- remunerations of the administrative workforce

- Property taxes

- Insurance premiums

2. Variable Overhead

These expenses change in proportion to the level of production or activity taking place in the organization.

For instance:

- Light bills (electricity and water)

- Shipping and delivery costs

- Office Supplies

3. Semi-variable Overhead

Semi-variable (or mixed) overhead costs include some fixed charges and some variable charges. These costs may still be fixed right up to a certain total size of the business but change as soon as the business reaches that size.

Examples include:

- Telephone costs (rental charge for fixed telephone line + cost of call).

- Total maintenance cost – machinery maintenance vs fixed routine check-ups + variable repair costs.

Examples of Overhead Costs

Indirect costs are general expenses associated with running a company’s operations. Such expenses are not regarded as manufacturing and shipping costs but rather represent the costs required for the company to operate. Of all overhead costs, there are many different examples, and below is a breakdown of some of them, along with how they work in a business’s operation.

- Rent or Lease Payments

Example: If a firm occupies an office, shop, warehouse, or factory, it pays a fixed monthly rent. This remains the same no matter the number of product units that are to be made or even sold. For instance, a software firm leasing a commercial premises for $5,000 per month will be charged this amount irrespective of the number of software licenses sold within a given month.

Relevance: Rent is a fixed direct cost that usually becomes significant in business entities with brick-and-mortar establishments.

- Expenditure on Utilities (Electricity Power, Water, Gas).

Example: A manufacturing company consumes electricity to run its equipment, heating to operate the factory, and water for employees’ needs. These costs vary depending on the level of consumption, though they remain relevant in the business’s day-to-day operations. To be more precise, if a business has an average electric bill of $1,500 each month, it will be classified under variable overhead.

Relevance: These are essential in both the office and production areas and the expenses are normally correlated with the level of intensity or utilization.

- Insurance Premiums

Example: Various types of insurance are necessary for businesses to cover liabilities. For instance, a retail business will have property insurance for its store, liability insurance for potential customer slip-and-fall incidents, and health insurance for its employees. If the annual premium for property insurance is $10,000, then this is recognized as a fixed factory overhead cost.

Relevance: Perhaps insurance is one of the most important types of security that protects and maintains a company’s financial reliability in the event of an unpredictable accident.

- Administrative Salaries

Example: Although executives and coordinators are so important to keeping the administration running, their remunerations depend more on their position and rank as office managers, human resources staff, and receptionists, for example. So, if a company pays $60,000 per year to its HR manager, then this cost is a fixed overhead cost.

Relevance: Payroll rates for the non-production workforce apply because companies need to keep other core areas such as Human Resources, legal, administration, etc.

- Office Supplies

Example: Office consumables like papers, writing instruments, toner and cartridges, printers, and laptops are inevitable necessities of business today. When a business uses $500 every month on consumables like papers, ink, pens, etc., this amount is considered a fixed overhead. However, it is plausible to support such a major sector, which appears at first glance small to amount to much when these costs are aggregated in the long run.

Relevance: Ontology has it that office stations keep a business going regarding paperwork, communication, and organization.

- Depreciation

Example: Depreciation is the process through which business property such as buildings, vehicles, computers, machinery, and others loses value over time. For example, suppose that a business buys machinery for $100,000 and expects its useful life to be 10 years. Then, the business would report $10,000 of depreciation each year.

Relevance: Depreciation represents the wearing out of assets or a decline in their cost and is important in computing financial statements and allowable tax credits.

Reasons for High Overhead Cost

High Overhead costs can result from several factors:

- Inefficient Operations: inefficiencies mean that operational costs increase because of ineffective technologies ir manual processes in business operations. For instance, a firm that processes a high level of inventory may end up with high warehousing and administrative costs.

- Excessive Administrative Staff: Excess administrative staff raises overhead costs. If a company hires administrative staff above the optimum level needed, then the salary and additional benefits to be paid can elevate overhead costs.

- High Facility Costs: Hiked overhead is also associated with higher office or manufacturing space costs, such as high rent or electricity use. For example, an organization operating from a posh business building may experience overly high rent and utilities costs.

- Inadequate Cost Control: Some of the causes of high overhead include, and could be as follows: poor cost control, expenses not being regulated, or lack of proper approval from management. For instance, overindulgence in office supplies cost or service costs that are not periodically revisited results in high overhead costs.

- Regulatory Compliance Costs: Other expenses incurred due to compliance with industrial regulations and standards contribute to overhead. For example, an enterprise may have to spend a lot of money on health and safety requirements, environmental laws, or quality standards.

- High Insurance Premiums: Some forms of insurance, such as high coverage limits or industry risk, may increase overheads because they are costly. Companies in high-risk sectors may end up paying high insurance costs, which are reflected in overhead charges.

By managing and making the right changes in these aspects, overhead costs can be minimized and kept under check.

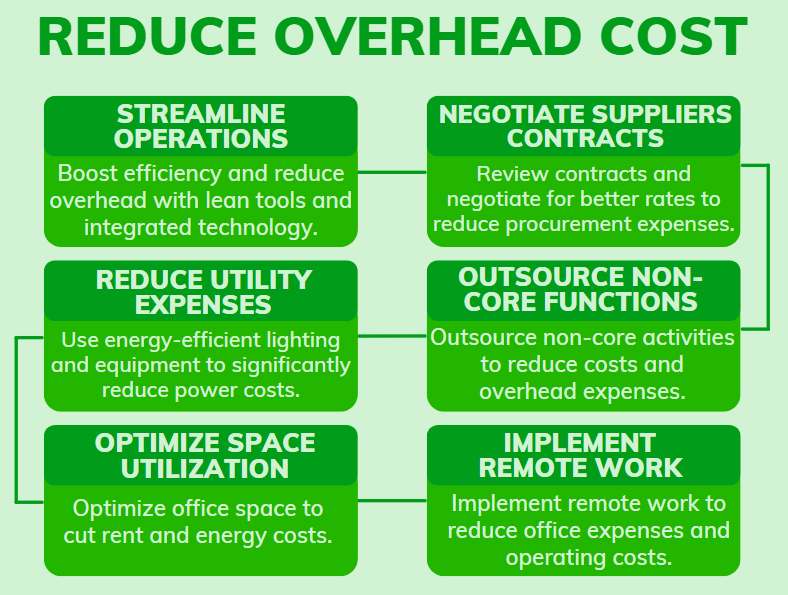

How to Reduce Overhead Cost

Several overhead costs are usually involved, and cutting or minimizing them can profoundly affect a business’s profitability and resource utilization.

Here are several strategies to achieve this:

- Streamline Operations: Increase operations efficiency and effectiveness through a systematic approach based on lean tools, elimination of wasteful activities, and use of technology solutions for common tasks. For instance, when designing an integrated software system, less work is done manually, such as typing data, hence improving overhead costs.

- Negotiate Supplier Contracts: It is advisable to review contracts and negotiate with vendors and service providers to obtain a better rate or condition. For Example, additional negotiations of some office supplies or searching for more attractive prices can reduce procurement expenses.

- Reduce Utility Expenses: Implement efficient energy usage methods, such as switching to energy-efficient lighting or procuring energy-efficient equipment, such as smart thermostats. Schemes that help curb utility use can considerably lower power costs.

- Outsource Non-Core Functions: Consider outsourcing some activities that do not directly relate to the business, such as payroll services, internal IT support, or cleaning services, to companies that can offer such services more cheaply. Such an approach can help save costs normally accrued in terms of hiring in-house staff and related overhead expenses.

- Optimize Space Utilization: Review and improve the efficiency of the office or manufacturing area in relation to the organization’s functions. Reducing the space, moving to a less expensive area, or changing the structure of the space also reduces rent and energy bills.

- Implement Remote Work: Redesign organizational structures to allow for work from home or flexible working, which can eliminate the necessity of acquiring a physical workplace and related expenses. This also helps to reduce overall office expenses, such as consumables and power costs.

Therefore, implementing the above strategies will enable businesses to minimize their overhead costs and positively impact their financial position and operational performance.

Overhead Costs in the Service Industry – Key Components and Profitability Insights

Overhead costs in a service industry represent the overall ongoing expenses that are required and necessary to run the business. Overhead costs are necessary to be incurred but are not directly related to providing services to the customer. These overhead costs can be recurring in nature and can contribute to the overall functioning of the business. Generally, these costs are fixed and are crucial in managing overall profitability and sustainability.

What Are Overhead Costs in a Service Business?

Overhead costs generally include all the necessary ongoing expenses incurred to run the business safely and efficiently.

Commonly, the overhead cost includes:

- Insurance payments

- Legal expenses

- Office rents

- Utilities like electricity and water

- Office Supplies

- Wages of staff employees

- Any kind of marketing cost, etc.

Example Calculation for a Service-Providing Industry

For example, you are running a small marketing consultancy, and you want to calculate your overhead costs for the month.

The total expenses are as follows:

- Rent: $2,000

- Salaries (admin staff): $3,000

- Insurance: $200

- Depreciation (office equipment): $100

- Office supplies: $150 (this fluctuates based on how much work is done)

- Utilities (electricity, internet, etc.): $300 (based on the amount of work done)

- Contract labor (outsourcing part of the marketing work): $1,000 (based on the number of projects)

Now, let’s say you have two departments in your consultancy: Project Management and Research & Strategy. You want to allocate the overhead based on their time spent.

- Project Management: Works 60% of the time

- Research & Strategy: Works 40% of the time

Calculate the following:

- Total Fixed Costs

- Total Variable Costs

- Total Overhead Costs

- Allocate Overhead Costs to Departments

The Step-Wise Calculation Can Be As Follows:

Step 1: Identify Fixed and Variable Costs

Fixed Costs (Stay the same regardless of how much business you do):

- Rent: $2,000

- Salaries (admin staff): $3,000

- Insurance: $200

- Depreciation (office equipment): $100

Variable Costs (Change based on activity or service level):

- Office supplies: $150 (this fluctuates based on how much work is done)

- Utilities (electricity, internet, etc.): $300 (based on the amount of work done)

- Contract labor (outsourcing part of the marketing work): $1,000 (based on the number of projects)

Step 2: Calculate Total Overhead

- Total Fixed Costs = $2,000 + $3,000 + $200 + $100

= $5,300

- Total Variable Costs = $150 + $300 + $1,000

= $1,450

Total Overhead Costs = $5,300 (Fixed) + $1,450 (Variable)

= $6,750

Step 3: Allocate Overhead Costs to Departments or Projects

Fixed Costs Allocation:

- Project Management = $5,300 × 60%

= $3,180

- Research & Strategy = $5,300 × 40%

= $2,120

Variable Costs Allocation:

- Project Management = $1,450 × 60%

= $870

- Research & Strategy = $1,450 × 40%

= $580

Step 4: Final Allocation to Each Department

- Project Management = Overhead: $3,180 (fixed) + $870 (variable)

= $4,050

- Research & Strategy = Overhead: $2,120 (fixed) + $580 (variable)

= $2,700

Accounting Practices for Overhead Costs

Simple methods to track and account for these costs:

| Methods | |

| Manual Record Keeping | The use of spreadsheets can be the best option to maintain a record. Regularly comparing the actual and projected budget for monthly tracking. |

| Cost allocation Method | Time-based allocation needs to be done in every department. Physical space-based allocation can also be done such as allocating on a square foot basis. |

| Expense Tracking Tool | Keeping all the digital or hard copies of all the invoices and receipts. Tracking all the expenses through bank account statements. |

Introduce software tools or systems as more advanced options:

| Methods | |

| Accounting Software | QuickBooks: The most popular tool that allows you to track all the expenses. Xero: Another great tool to track all the overhead expenses. |

| Project Management and Time-Tracking Tools | The use of project management tools can also help allocate tracking all the overhead costs such as Trello or Asana. The utilization of time-tracking tools also helps you to track the number of hours each employee spends on a particular activity, in order to allocate the overheads more precisely. |

| Enterprise Resource Planning (ERP) Systems | ERP systems such as SAP or Netsuite allow individuals to manage all the activities correspondingly. |

Impact of Overhead Costs on Profitability

Achieving an appropriate equilibrium between operational performance and minimizing expenses represents a fundamental obstacle in overhead cost management. Due to expensive rental costs properties located in prime areas could drain profits from your business. Likewise, investment in state-of-the-art technology yet creates additional maintenance expenses and improves the overall efficiency.

Profit margins are greatly influenced by overhead expenses. Businesses can more accurately assess their profitability and decide whether to expand into new markets, scale operations or invest in growth by being aware of these costs.

Overhead expenses take a sizable portion of a company’s budget, regardless of its size or sector. Effective management is necessary to guarantee sustainability and long-term success.

It offers important insights into the company’s financial health in addition to aiding in cost control and pricing setting. Knowing your overhead costs is crucial, but so is comprehending overhead rates in a corporate context. It is comparable to the opposite and just as enlightening and helpful.

This might seem like a bunch of numbers and ratios, but the truth is the overhead rate plays a significant role in your business.

Here’s why:

- Cost Pricing: It helps you appropriately price your goods and services. Without knowing your overhead rate, you may end up underpricing your products, which can lead to losses.

- Financial Analysis: Overhead rate aids in analyzing financial performance. A high rate might indicate inefficiencies, while a lower one could signify sound cost management.

- Budgeting: It assists in creating realistic budgets. By predicting future overhead costs, you can allocate resources more efficiently.

Best Overhead Ratio Depending On the Company Size

The overhead ratio in terms of total revenue varies depending on the size of the company.

Following are the reasonable overhead ratios according to the company size:

- Small Businesses (Up to 50 employees):

Best Overhead Ratio: 36-60%.

- Small businesses usually have a greater overhead expenditure as they can’t take advantage of economies of scale. Expenses such as utilities, rent, or other administrative expenses usually take a larger portion of the total overhead expenses. A ratio closer to 50% is common, but it can go higher for businesses in high-cost locations or industries (e.g., legal services).

- Medium-Sized Businesses (50 to 250 employees):

Best Overhead Ratio: 30-50%.

- Medium-sized businesses begin to benefit from economies of scale, allowing them to spread fixed costs over a larger revenue base. They may be able to reduce overhead through better efficiency, technology, and process improvements. A healthy range here is generally 35-45%, though it can vary by industry.

- Large Businesses (250+ employees):

Best Overhead Ratio: 20-35%.

- Larger businesses benefit significantly from economies of scale, allowing for better negotiation power, streamlined operations, and more efficient use of resources. As a result, large companies typically maintain an overhead ratio between 20-35%. They can manage higher fixed costs due to higher revenue, ensuring overhead does not take a disproportionate share.

Conclusion

Managing overhead is critical because it impacts the financial health and day-to-day functioning of any enterprise. Since these costs consist of fixed, variable, and semi-variable costs, control of indirect expenses enables firms to make appropriate decisions, increase efficiency, and improve performance.

Measures such as rationalizing processes, bargaining some contracts, and efficient and effective space management are typical ways of reducing overheads to a large extent, and this leads to improved organizational financials and competitive advantage.

-

Overhead Allocation for The Manufacturing Industry – A Complete Guide

The manufacturing industry relies on cost accounting through overhead allocation as its fundamental principle. This approach allocates expenses that are not directly used in production,…

-

Overhead Costs in Service Businesses vs. Product – Based Businesses

Introduction The difference between a service-based business and a product-based business can be seen in the way overhead costs are set up and allocated. Product-based…

-

Complete Guide to Overhead Allocation Methods for the Construction Industry

Overhead allocation is an important aspect of the construction industry to manage their work better and make money. A business’s standard operational expenses appear throughout…

-

Integrating Overhead Costs in Financial Statements

Overhead costs significantly impact the flow of financial data, so their correct allocation is essential in reporting. They also form a substantial part of a…

-

How to Reduce Overhead Costs – Practical Tips

Overhead costs are those costs that your business accumulates and these are not direct costs of production of goods or delivering services. Hence these are…

-

Overhead Allocation Methods – A Guide for Small Businesses

Every organization incurs overhead costs associated with its business. These costs involve operating expenses such as rent, utilities, administrative salaries, etc. Overhead allocation involves spreading…

-

Overhead Cost Vs Operating Expenses – What’s the Difference?

When operating a small or large business, comprehending your costs is essential for maintaining profitability and guaranteeing long-term success. Two significant classifications of business expenses…

-

Difference Between Overhead Costs and Capital Expenditures

Overhead costs are easily distinguishable from capital expenditures (CapEx), and their classification plays a significant role in operational effectiveness and compliance. Overhead costs are common…