In finance, liquidity ratios play an important role in assessing a company’s short-term financial health and stability. These ratios give valuable information about a company’s potential to meet its immediate financial obligations and evaluate its overall liquidity position.

What are Liquidity Ratios?

Liquidity is considered a crucial part of any business. Businesses are required to have liquidity to meet their short-term obligations.

Liquidity ratio is a metric that identifies a debtor’s potential to pay off current debt obligations. It shows a company’s financial health by evaluating its current assets, like marketable securities,cash, and accounts receivable, compared to its short-term obligations, like short-term debt and other liabilities.

The liquidity ratio influences a company’s credibility and credit rating. Continuously failing to repay short-term liabilities can lead to bankruptcy. Therefore, the liquidity ratio plays a crucial role in a company’s financial stability and credit ratings.

How Liquidity Ratios Work?

The capacity to swiftly and affordably turn assets into cash is known as liquidity. The most beneficial application of liquidity ratios is in comparison analysis. Either an internal or external analysis may be done.

For example, internal analysis of liquidity ratios requires employing numerous accounting periods reported using the same accounting procedures.

Analysts can monitor changes in the firm by comparing activities from prior periods to the current ones. A corporation that has a higher liquidity ratio is often more liquid and better able to cover existing debts.

As an alternative, external examination compares a company’s or an industry’s liquidity ratios to one another. When setting benchmark objectives, this information is helpful in comparing the company’s strategic orientation to those of its rivals.

Liquidity ratio research might be less useful when examining different industries because different types of companies need different funding structures. Comparing businesses in different locations and sizes is less effective when using liquidity ratio analysis.

Types of Liquidity Ratios?

The Current Ratio, Quick Ratio, and Cash Ratio measure a company’s liquidity. Higher ratios indicate better short-term debt coverage, with each ratio assessing different levels of liquid asset availability.

Let’s discuss the different kinds of Liquidity Ratio and their corresponding formulas.

1. Current Ratio or Working Capital Ratio

The current ratio is considered one of the most used liquidity ratios. It measures the company’s ability to meet its short-term debt obligations. You can calculate it by dividing the total current assets by the total current liabilities.

A higher ratio shows that the company has enough liquid assets to cover its short-term debts. Alternatively, a low ratio might indicate that the company does not have enough cash or other liquid assets to cover its current liabilities. In general, a ratio of 1:1 is considered good for a company.

Formula: Current Assets/ Current Liabilities

2. Quick (Acid) Ratio

The quick ratio, also referred to as acid test ratio, is a measure of a company’s capability to meet its near-term obligations with quick necessities like cash or cash equivalent or working capital. It is arrived at by dividing total current asset less inventories and prepaid expenses by total current liabilities.

A higher ratio refers to the fact that the firm has adequate liquid assets in proportion to its current liabilities. Lower is the indication that the company might not be able to honour such obligations.

Formula: Current Assets – Inventory/ Current Liabilities

3. Cash Ratio

Cash Ratio is also known as Cash Asset Ratio or Absolute Liquidity Ratio

The cash ratio, which evaluates a company’s capacity to settle its short-term debt entirely with cash or cash equivalents, is the strictest of the liquidity ratios. Divide the total cash and cash equivalents held by the corporation by the total amount of its current liabilities to get this ratio.

In this case, a greater ratio means that the business doesn’t need to sell any additional assets in order to pay off all of its short-term debt. Generally speaking, a cash ratio of 1:1 or more is regarded as healthy.

Formula: Cash and Equivalents/ Current Liabilities

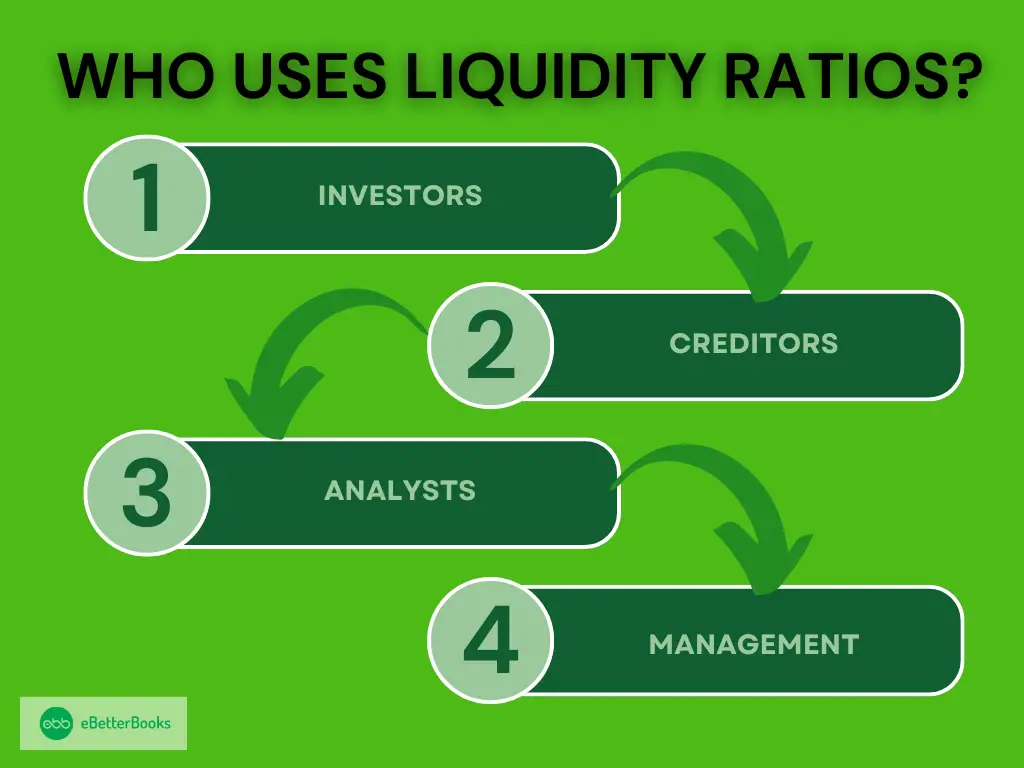

Who Uses Liquidity Ratios?

Many different people use liquidity ratios. Liquidity ratios serve a single goal, but because of their adaptability, they can be helpful to a wide range of consumers.

The following stakeholders can use liquidity ratios in different areas in different ways:

- Investors: Liquidity ratios are a tool used by investors to evaluate the short-term financial stability of businesses they are considering investing in. Investors can assess a company’s liquidity status to determine its capacity to pay short-term debt. This is crucial when attempting to lower the default risk and guarantee the security of solely investing in thriving businesses.

- Creditors: To assess a potential borrower’s creditworthiness, creditors, including banks and other financial institutions, use liquidity ratios. By examining a company’s liquidity condition, creditors can evaluate whether loans or credit facilities will be repaid on time. Greater liquidity ratios imply a decreased default risk, giving creditors more assurance when granting credit to the business. Creditors frequently impose liquidity ratio restrictions as loan covenants.

- Analysts: Liquidity ratios are useful tools for financial analysts to utilize in their thorough examination of a company’s risk profile and financial performance. By looking at liquidity data, analysts can spot patterns, evaluate possible liquidity issues, and provide customers or investors with well-informed suggestions. Analysts try to assess a company’s short-term health before making decisions about it, just like private investors do.

- Management: To track and control the organization’s liquidity condition, the company’s management makes use of liquidity ratios. Management can spot liquidity shortages, maximize cash flow, and decide which short-term assets to carry by routinely monitoring liquidity measurements.

Importance of Liquidity Ratios

Availability of liquid assets Ratios gauge a business’s ability to satisfy its short-term financial obligations. Since they show the company’s financial health, this is significant for both internal and external stakeholders.

The following are a few of the principal benefits of liquidity ratios:

1. Financial Problem Identification: One of the key benefits of Liquidity Ratios is their ability to assist in identifying possible financial issues before they get out of hand. Regularly analyzing liquidity ratios will help you identify problems early and provide your company with enough time to make necessary corrections.

2. Determining Creditworthiness: Before determining whether or not to grant credit, lenders and creditors frequently utilize liquidity ratios to determine a company’s creditworthiness.

3. Measuring Efficiency: Liquidity ratios can assess a company’s ability to manage its current assets and liabilities effectively. A company with a high liquidity ratio can pay off its debts and quickly turn its assets into cash.

4. Comparing Companies: To understand how a company is performing in comparison to its peers, liquidity ratios are used to compare businesses in the same sector or industry.

5. Bankruptcy Prediction: Liquidity ratios can also be used to predict bankruptcy. If the liquidity ratios are continuously low, the business is probably in danger of defaulting on its financial obligations.

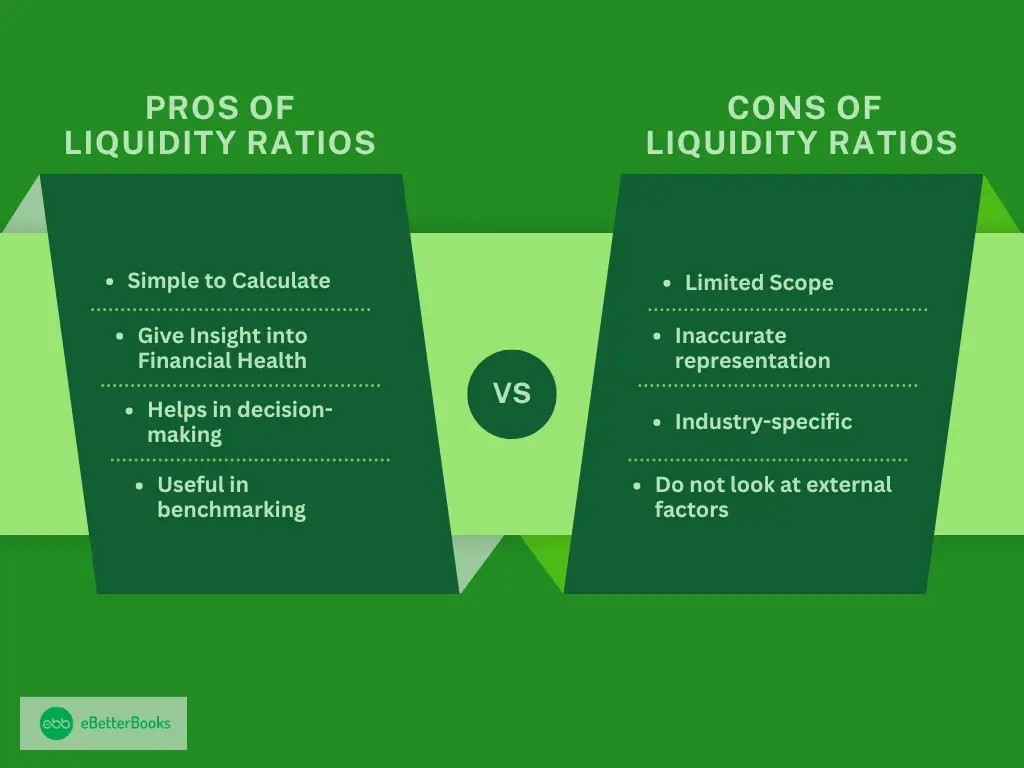

What are the Pros and Cons of Liquidity Ratios?

Liquidity ratios are easy to calculate, assess financial health, aid decisions, and support benchmarking. However, they’re limited, may misrepresent, vary by industry, and overlook external factors like economic shifts.

Mentioned below are the advantages and disadvantages of liquidity ratios:

Pros of Liquidity Ratios

- Simple to Calculate: Liquidity ratios are very simple to calculate, and the information needed to calculate them is available on the company’s financial statements.

- Give Insight into Financial Health: The liquidity ratio gives insight into a company’s financial health by measuring its ability to pay off short-term liabilities.

- Helps in decision-making: Liquidity ratios help investors and creditors make well-informed decisions about investing in or lending money to a company.

- Useful in bench-marking: Liquidity ratios are helpful for bench-marking a company’s financial health against its competitors.

Cons of Liquidity Ratios

- Limited Scope: Liquidity ratios only provide information about the company’s short-term financial health but do not consider long-term financial sustainability.

- Inaccurate representation: Liquidity ratios might not accurately represent a company’s financial health if the current assets are not easily convertible into cash.

- Industry-specific: Liquidity ratios might not apply to all industries, as each has its own unique liquidity requirements.

- Do not look at external factors: Liquidity ratios do not consider external factors like economic conditions, market trends, and regulatory changes that may impact a company’s financial health.

Liquidity Ratios VS Solvency Ratios

Solvency ratios evaluate a company’s capacity to pay off its long-term debts and financial commitments, in contrast to liquidity ratios. While liquidity is primarily concerned with current or short-term financial accounts, solvency is related to a company’s overall capacity to pay off debt and continue with business activities.

To be solvent, a business has to have more overall assets than total liabilities; similarly, to be liquid, a business needs to have more current assets than current liabilities. While liquidity and solvency are not directly related, liquidity ratios give an initial indication of a company’s solvency.

Liquidity Ratios VS Profitability Ratios

The profitability ratio measures the company’s ability to make a profit compared to its revenue, assets, or equity. These ratios determine the efficiency and effectiveness of a company’s operation and give insights into its potential to generate returns for shareholders. On the other hand, liquidity ratios concentrate on the company’s ability to fulfill its short-term financial obligations promptly.

While profitability ratios focus more on generating returns and maximizing profits, liquidity ratios concentrate more on maintaining adequate liquidity. It is important to understand that there are vastly different things.

A company has enough money on hand to operate its built-up capital; however, if the operations could be better, it might drain its reserve. On the other hand, a company might be cash-strapped but just starting a successful growth campaign with a positive outlook.

Both ratios are important for evaluating different dimensions of a company’s financial performance and risk profile. Investors and analysts often use them in combination to gain insight into a company’s financial health. Remember that a company might be profitable but not liquid, or it might be highly liquid but not profitable.

What is the Limitation of Liquidity Ratio?

Although liquidity ratios are considered as important financial tools, it has their limitations:

- Variability in Reporting Standards: The comparison becomes very difficult, as differences between accounting policies and reporting standards across companies and industries can cause inconsistencies in liquidity ratios.

- Lack of Ability to Capture Full Financial Picture: Liquidity ratios concentrate on short-term financial health and might not give a comprehensive view of the company’s overall financial condition.

- Potential for Misleading Results: Financial engineering can influence liquidity ratios, resulting in misleading outcomes that might not reflect a company’s actual financial health.

Liquidity ratios are simple but powerful metrics that give insight into a company’s ability to pay its short-term obligations promptly. They provide a quick snapshot of the liquidity position, assisting stakeholders in evaluating their financial stability and resilience and making well-informed decisions.