Tax deductions help organizations mitigate their expenditures and reinvest in their growth. Section 179 of the Internal Revenue Code is among the most valuable tax credits available to U.S. businesses. It allows businesses to deduct the entire purchase price of qualified equipment and assets within the same year they are placed in service, avoiding depreciation over multiple years.

Section 179 aims to encourage businesses, particularly small and medium-sized enterprises, to invest in equipment, technology, and other assets required for operations. Accelerating deductions reduces taxable income and increases cash flow.

The limit will be set at $1,250,000 in 2025, and the phase-out threshold will begin at $3,130,000. Small businesses that exceed $4,380,000 will not receive the full deduction. This makes Section 179 very useful, especially for businesses that plan to make huge investments.

The article will describe how Section 179 functions, who qualifies for it, its limits, and its restrictions. We’ll also examine how it can help small and large businesses and why several experts consider it a game-changer for financial planning.

Understanding Section 179

Section 179 is a tax deduction that enables taxpayers to reduce their taxable income for a business by deducting the full cost of qualifying equipment and/or assets purchased during the year they are put into service instead of depreciating the cost over many years.

Historically, businessmen have depreciated assets and received progressive claims over several years. However, under Section 179, firms can claim the full expense of eligible purchases by immediately expensing them, thereby reducing their taxable income for the same year.

Originally developed to spur investment in businesses, Section 179 is vital for all businesses. It allows SMEs to reinvest their funds into operations instead of waiting many years to recoup them through depreciation.

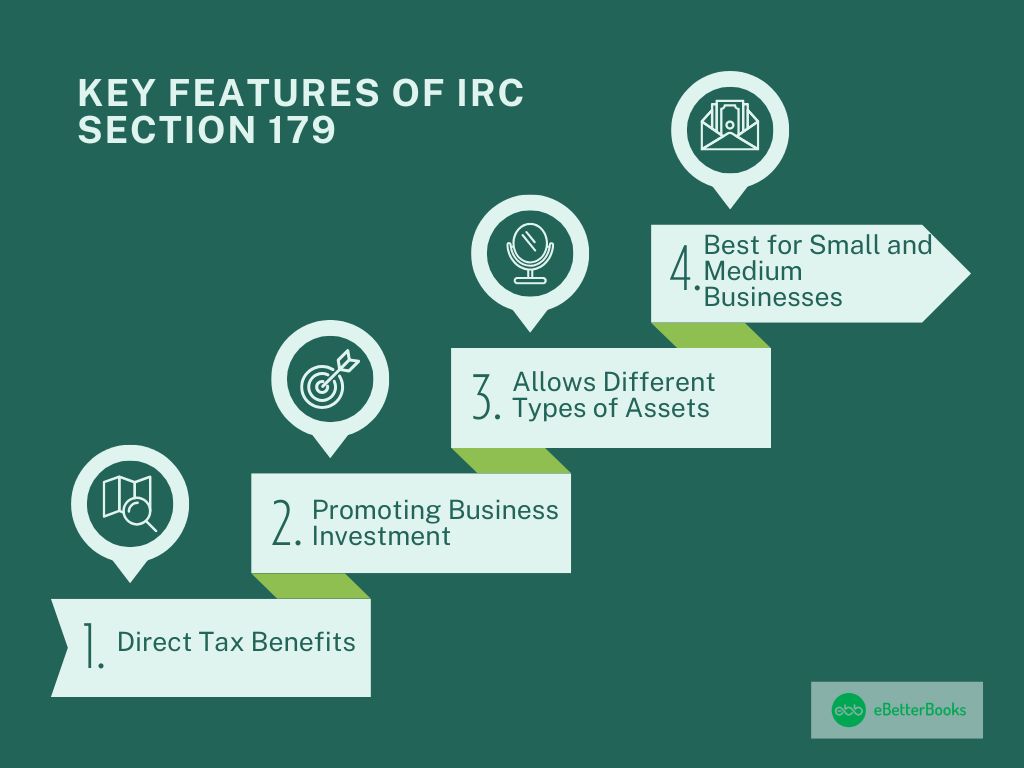

Key Features of Section 179

- Direct Tax Benefit: Businesses could claim the absolute cost of equipment instead of spreading it over multiple years as an expense in depreciation.

- Promoting Business Investment: Companies would invest in necessary equipment with the benefit of claiming the absolute cost directly.

- Different Types of Assets: Qualifying assets include machinery, vehicles, office furniture, and business software.

- Small and Medium Businesses: Qualifying entities must have expenses of less than $4.38 million.

This is very different from bonus depreciation, which allows businesses to deduct a certain percentage of the cost of the assets over time. Although these incentives both help reduce tax liability, Section 179 offers more immediate benefits.

2025 Deduction Limits and Caps

The IRS annually caps the amount of how much businesses can qualify for under Section 179.

For 2025, the deduction limits are as follows:

- Maximum Deductions: $1250000. Total that businesses are able to expense through Section 179 for purchases in one year on qualifying assets.

- Phase-out Threshold: $3130000. If the total exceeds this number, deductions will be made dollar-for-dollar for each amount exceeding the phase-out threshold.

- Full Phase Out: $ 4380000. Total expenses over which business will not qualify for the use of Section 179.

- Special Limits for Certain Assets: The special limit for cars, trucks, and certain heavy vehicles is $31,300.

Importance of Section 179 to Businesses

Section 179 is a vital tool for businesses, especially small and mid-sized companies, since it provides instant financial relief and encourages investment.

Key Benefits:

- Increased Cash Flow: The immediate full expense deduction puts cash on the business’s books without requiring compliance with depreciation schedules.

- Urges Businesses to Upgrade Equipment: Businesses can upgrade their older equipment, which will relieve them of the burden of long-term maintenance.

- Lowers Taxable Income: Section 179 lowers businesses’ overall tax burden by allowing sizeable investments that may be expensed entirely in one year.

- Encourages Business Growth: Section 179 incentivizes businesses to reinvest their tax savings toward further expansion and innovation.

Eligibility Criteria for Section 179

Certain criteria indicate what qualifies you for Section 179.

Who Qualifies?

- Small and Medium-Sized Enterprises: Except for large companies, most of them include sole proprietorships, partnerships, LLCs, and corporations.

- Business Owners without Contract Employees: Freelancers and independent contractors purchasing business equipment may qualify.

What Types of Assets Qualify?

- Tangible Property: Include any apparatus, such as vehicles, office furniture, computers, and tools.

- Software: The software qualifies for it, which is purchased for business.

- Business Use: More than 50% of its usage should be for business.

Restrictions

Although Section 179 offers businesses several tax advantages, various restrictions and limits apply in certain circumstances.

- Business Income Limitations: The total deduction cannot exceed the business’s net taxable income for the year. If the deduction amount exceeds taxable income, the excess cannot be carried forward to future years.

- Phase-Out Deductions: Once the total purchases exceed $3130000, the deduction begins to reduce dollar-for-dollar. At $4380000, the deduction is completely phased out.

- Special Limits for Certain Assets:

- SUVs and Heavy Vehicles: Section 179 limits deductions for SUVs to $31300.

- Real Estate Improvements: Other kinds of building improvements, such as HVAC or alarm systems, do not qualify.

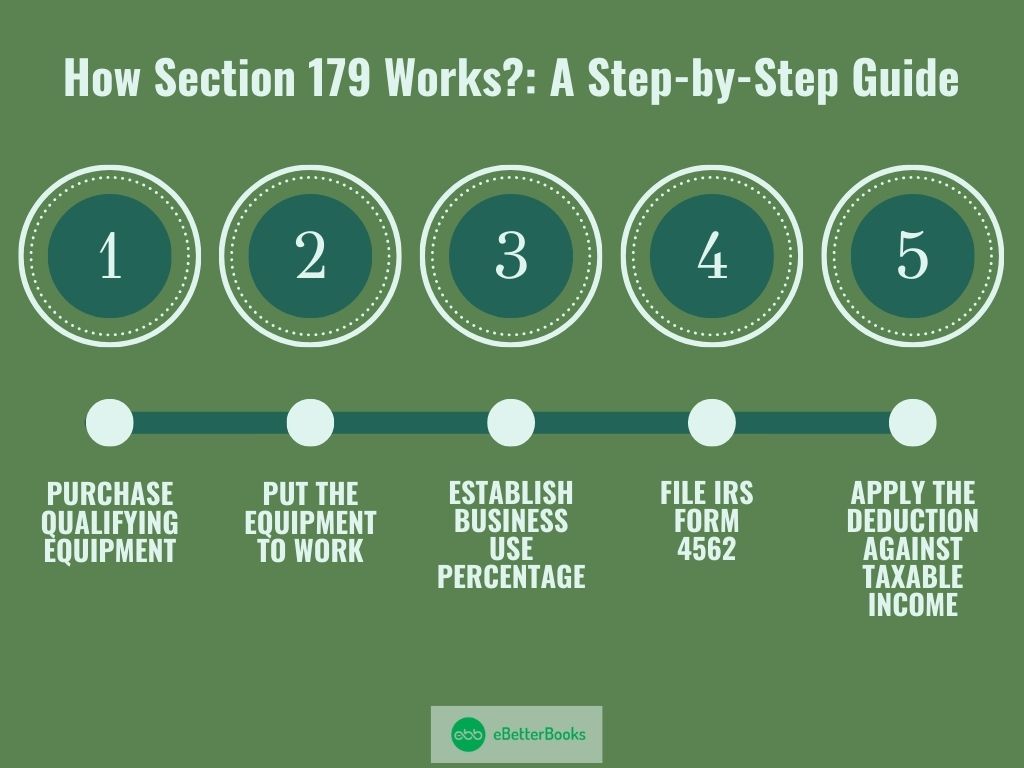

How Section 179 Works?: A Step-by-Step Guide

It is very important to understand how to apply Section 179 to optimize tax savings properly.

Here is a step-by-step guide for taking the Section 179 deduction:

Step 1: Purchase Qualifying Equipment

The equipment assets must be new or secondhand but qualify as new to your business. They must be categorized as qualifying property under IRS standards.

Step 2: Put the Equipment to Work

Acquiring an asset doesn’t qualify it as an expense; it must be put into service for business during the same tax year.

Example: A company acquired machinery in November 2025, but its usage started in January 2026. They can’t write it off for 2025 since the machinery was not placed into service until 2026.

Step 3: Establish Business Use Percentage Qualifying for Section 179

The asset has to be in service for business purposes for us for about 50%. Whatever portion is used personally is not deducted. Only the business-use portion is eligible for deduction under Section 179.

Example: Assume that a truck is used 80% for business and 20% for personal use. The deduction in Section 179 is limited to business usage only or 80% of the truck’s basis.

Step 4: File IRS Form 4562

A business must include Form 4562 (Depreciation and Amortization) with the tax return to claim the deduction.

Step 5: Apply the Deduction Against Taxable Income

The amount of the deduction cannot exceed the total business income. If your taxable income is less than Section 179 deductions, you may not have the benefit of taking such deductions.

Common Mistakes to Avoid

By realizing the Section 179 tax benefit as a transaction on its merit, some businesses make costly errors in claiming the deduction.

- An Asset Was Not Put in Service

Simply buying the equipment isn’t enough; one must also use it for business before the end of the year.

Solution: Ensure the asset is in operation before the 31st of December to deduce.

- The Business Income Limitation’s Exceeding

The deduction is still the lower of Section 179 or one’s net business income; hence, if the taxable income is below a particular minimum limit, the deduction would be zero.

Solution: If there is low or no taxable business income, consider spreading the deduction over several years.

- Miscalculation of the Business-Use Percentage

If an asset is utilized for both business and personal purposes, only the percentage related to business ensuing from such use is deductible. For example, only 60% of the cost of the vehicle could be deducted if it was used 60% of the time for business purposes.

Solution: Maintain detailed usage logs to support deductions.

- Failing to Consider the Deduction Phase-Out Limit

Businesses that invest over $3,130,000 in assets will have their deduction reduced gradually.

Solution: To remain underneath the limit, purchase items in multiple years.

- Failing to File IRS Form 4562

For Section 179, businesses must file IRS Form 4562 at least on their income tax return.

Solution: Work with a tax professional to ensure the form is filed correctly.

Businesses can avoid the above mistakes by maximizing their tax savings while following IRS rules.

Conclusion

Section 179 is a very strong tax incentive that allows businesses to deduct the full cost of qualifying equipment and assets in the year they are purchased and placed into service. The deduction limit for 2025 is $1,250,000, and the phase-out starts at $3,130,000, making this tax provision particularly useful for small and medium-sized businesses looking to improve cash flow and reinvest in growth.

Educating yourself more deeply about Section 179 can help business enterprises reduce their tax burden by ensuring eligibility and keeping expenses under a certain limit. Take advantage of the deduction and make informed purchasing decisions to derive the maximum benefit.