For business Owners and Freelancers who use their home as an office, this deduction will be an important one. The Home Office Tax Deductions for home usage remain hidden from most, yet they have established strong tax-saving potential. Working from home enables you to receive tax deductions for portions of your rent or mortgage payments along with your utility bills and internet fees, which produces substantial yearly savings.

Multiple business owners are either confused about how to qualify for this deduction or fear possible IRS scrutiny. The good news? By following all rules and documenting your expenses properly, the home office deduction offers a secure method to reduce your taxable income.

What are Home Office Tax Deductions?

The home office tax deduction is an opportunity for eligible taxpayers to lower their taxable income by claiming the specific home spending costs if they conduct business exclusively in dedicated residence areas. Business Owners who deduct their qualified home business expenses receive decreased taxable income, resulting in reduced tax burden.

The deduction applies to both homeowners and renters and can cover expenses like:

- Rent or mortgage interest

- Utilities like electricity, internet, water, etc.

- Property taxes and homeowners insurance

- Office furniture, repairs, and maintenance

To claim this deduction, the IRS requires taxpayers to demonstrate that their business activity occurs exclusively and quite frequently in the designated space. Homeworkers’ W-2 status prohibits them from deducting these costs unless they run an outside business.

There are two ways to calculate the deduction:

- Simplified Method: A flat rate of $5 per square foot, up to 300 sq. ft.

- Regular/ Actual Expense Method: It calculates deductions through office-size-based percentages of eligible home expenses.

Business owners who track expenses correctly while fulfilling IRS requirements can substantially reduce their taxes through this deduction.

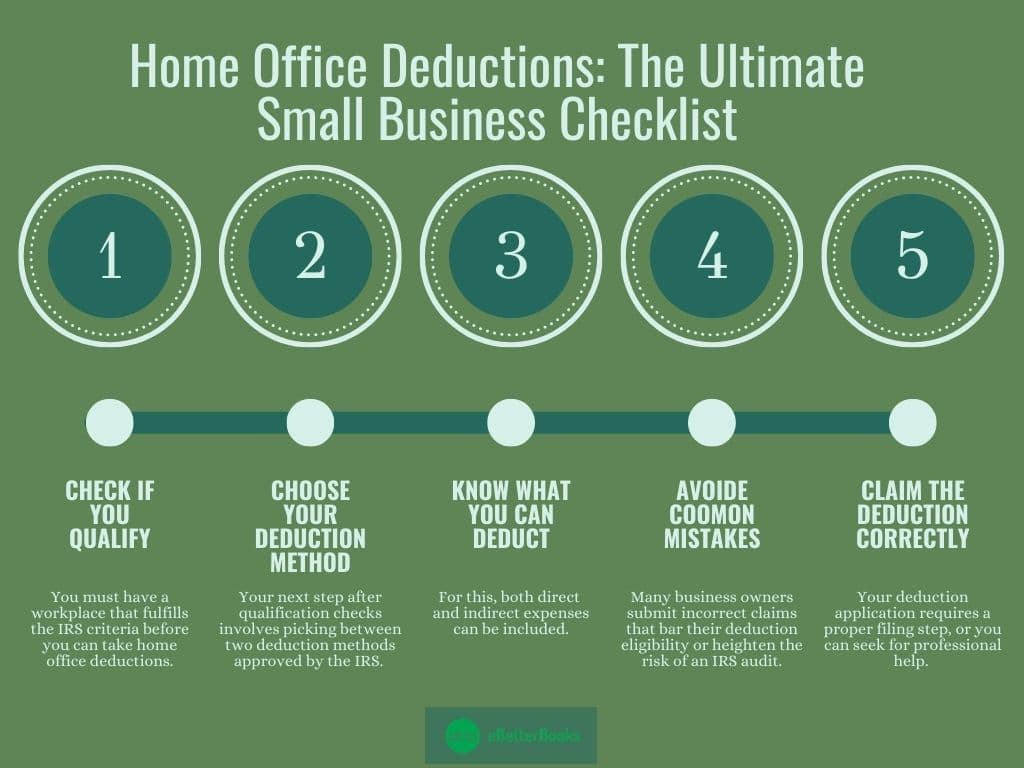

Home Office Tax Deductions The Ultimate Small Business Checklist

This manual covers essential details, including IRS eligibility requirements, calculation procedures, frequent errors, and proper deduction filing procedures. At the conclusion, users will understand both cost-saving optimization and complete IRS compliance.

Step 1: Check if You Qualify

You must have a workplace that fulfills the IRS criteria before you can take home office deductions.

The Home Office Must be Used Exclusively for Business

When taking the space deduction, you must maintain separate business-only use for that area. Tax agents enforce strict rules regarding this requirement; thus, taxpayers must exercise extreme caution.

Do Qualifies:

- When you transform a bedroom into a workplace, it qualifies for tax benefits.

- Your living room contains a dedicated working area that serves only for office purposes and has a defined operations space.

- You can use a garage or a basement as both a studio and inventory storage facility.

Does Not Qualify:

- You use your dining table for office work and to eat during each meal.

- A guest room that also serves as a home office.

- You use a couch occasionally to perform business duties and nothing else.

Tip: When your work area shares space with other functions, use physical dividers made from bookshelves and curtains to separate them clearly.

The Home Office Must be Your Principle Place of Business

When you combine third-party office space with home office use, you can still obtain this deduction if your residence is your main work location.

This includes:

- You handle both billing tasks, manage e-mails, and communicate with clients through administrative duties.

- Client and customer meetings occur sporadically in the workspace, although not frequently.

- Keep business inventory and equipment at your place of business.

Example: A freelance graphic designer running their business primarily from home for 80% while conducting client meetings in coffee shops maintains eligibility.

Step 2: Choose Your Deduction Method

Your next step after qualification checks involves picking between two deduction methods approved by the IRS.

There are two IRS-approved methods:

Simplified Method (Best for Small Workspaces and Simplicity)

- Flat deduction of $5 per square foot, up to 300 sq. ft.

- No need for detailed record-keeping.

- Maximum Deduction: $ 1,500 per year.

Regular / Actual Expense Method (Best for Maximizing Deductions)

- Your home expenses deduction comprises a defined percentage of office space measurements.

- Both home expenses and taxes related to mortgage, utilities, insurance, property taxes, and maintenance become deductible items.

- The complexity of this method enables larger tax deductions compared to other methods.

Example

If your home is 2,000 sq. ft. and your office is 200 sq. ft., then:

You can deduct 10% of all home costs since 200 sq. ft. out of 2000 sq. ft. makes up the percentage.

Step 3: Know What You Can Deduct

For this, both direct and indirect expenses can be included:

Direct Expenses (Fully Deductible)

These are 100% business-related costs:

- Office furniture (desk, chair, shelves).

- Home office-specific maintenance expenses (painting and repair work, etc.)

- Printing expenses (printer, paper supplies, ink cartridges, etc.)

Indirect Expenses (Partially Deductible)

These apply to your whole home, but a percentage is deductible:

- Rent or mortgage interest.

- Property taxes & homeowners insurance.

- Utilities (electricity, internet, water, etc.)

Depreciation (For Homeowners Only)

Homeowners can recover costs through depreciation by allocating sections of their residence for business operations.

Step 4: Avoid These Common Mistakes

Many business owners submit incorrect claims that bar their deduction eligibility or heighten the risk of an IRS audit.

Common mistakes include:

- Mixing Personal and Business Use: Many taxpayers fail to separate their home office from personal spaces where they perform activities such as family gatherings or hobbies. A business space needs to maintain absolute business-only usage to qualify according to IRS guidelines. Maintain this business area completely separate from all other personal space.

- Overstating the Size of Your Home Office: When you submit a home office division claim larger than your business space’s legitimate size, you become exposed to IRS disciplinary procedures. Identify the precise dimensions of your business area, and then run your home office deduction calculation from there.

- Failing to Keep Detailed Records: Failing to document expenses correctly leads both to lost deductions and potential audit failures. You should maintain every receipt and business expense record connected to your home office for at least three consecutive years.

- Claiming Ineligible Expenses: The deduction for business expenses from home improvements applies only to direct office needs, so process improvement or complete hose painting cannot be deducted. You should only deduct costs that directly affect your office space.

Tip: For automatic expense tracking, try any software like the QuickBooks Self-Employed application.

Step 5: Claim the Deduction Correctly

Your deduction application requires a proper filing step, which can be done as follows:

How to File the Deduction:

There are two methods through which the deduction can be filled:

- Simplified Method: Put the deduction on Schedule C (Line 30) during your tax return filing process.

- Regular / Actual Expense Method: First, calculate your deductible expenses using IRS Form 8829 before moving the final figure to Schedule C.

When to Seek Professional Help?

- You can write off part of your home ownership costs through depreciation if you are the homeowner.

- A significant deduction size requires professional guidance to minimize tax audit exposure.

- Home-based business owners who manage multiple operations must correctly allocate costs among these individual entities correctly.

Accurate records of workspace details, receipts, and floor plans are essential. This documentation helps defend your claim during tax agency audits. When facing uncertainty, you should obtain tax professional advice.

Final Thought

When executed properly, the home office tax deduction can help you save substantial revenue each year. Maximizing your tax deduction and protecting yourself from audits depends on understanding and adhering to IRS guidelines for both the simplified and actual expense methods while maintaining proper documentation.

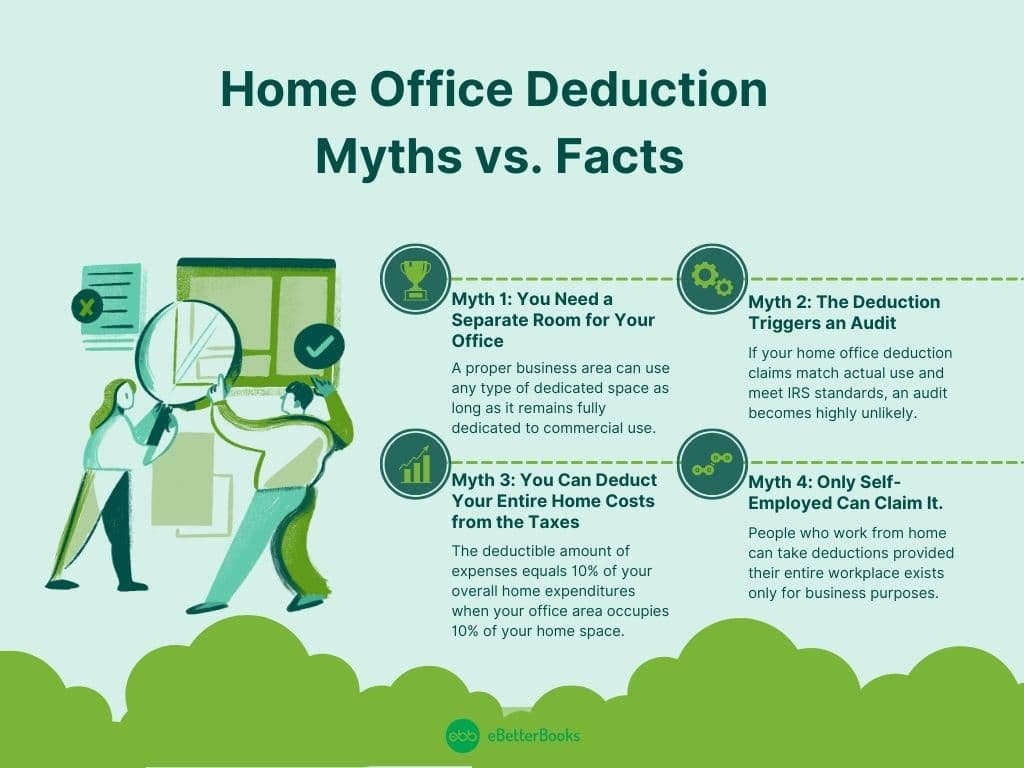

Home Office Deduction: Myths vs. Facts

Myth 1: You Need a Separate Room for Your Office

- Fact: A proper business area can use any type of dedicated space as long as it remains fully dedicated to commercial use. For the deduction to apply, an office space in a corner of your living room will do, as long as it contains only work materials.

Myth 2: The Deduction Triggers an Audit

- Fact: Taking the home office deduction does not lead to an IRS audit. If your home office deduction claims match actual use and meet IRS standards, an audit becomes highly unlikely.

Myth 3: You can Deduct Your Entire Home Costs from Ths Deduction

- Fact: Your business deductions apply only to the areas designated for workplace use. The deductible amount of expenses equals 10% of your overall home expenditures when your office area occupies 10% of your home space.

Myth 4: Only Self-Employed Can Claim It

- Fact: People who work from home can take deductions provided their entire workplace exists only for business purposes.

Conclusion

Business operators can substantially decrease their taxable expenses through the powerful deduction available for home offices. Your ability to claim this deduction depends on meeting IRS workspace requirements together with proper deduction selection and maintaining accurate records while avoiding IRS trigger points.

Proper documentation and compliance are key requirements for both simplified and actual expense methods. A well-designed approach can decrease your tax burden while maximizing profitability, allowing you to redirect tax savings into your business operations.