Migrate from Sage MAS 200 to QuickBooks and get easy-to-use accounting solutions with highly customizable features.

QuickBooks and Sage MAS 200 are two popular accounting software programs that are meant to make financial management easier for companies of all kinds. Every platform has special features and advantages designed to satisfy the various demands of companies of all sizes, from startups to multinational corporations.

Despite its many features, users choose QuickBooks over Sage MAS 200 because of its strong accounting features combined with cutting-edge distribution, manufacturing, and inventory management features.

QuickBooks is an excellent option for businesses, as businesses can monitor their spending and maintain organization with QuickBooks. For people who work remotely or from home and travel frequently, this is fantastic, as QuickBooks Online can easily manage their financial demands without ever leaving the house.

Contents

Small and medium-sized businesses have used Sage MAS 200 because it provides reliable accounting and business management solutions. But like any software program, Sage MAS 200 has its limits, which can lead companies to consider QuickBooks for accounting solutions.

Sage MAS 200 is recognized for its complexity, which can be difficult for users to use and necessitates deep training to take full advantage of its capabilities. Businesses searching for a more user-friendly and intuitive solution could be discouraged by the steep learning curve. Although Sage MAS 200 works well for a lot of small and medium-sized businesses, it might need to scale better for companies with complicated needs or those that are expanding quickly.

As businesses grow, they may encounter issues with data management, user concurrency, and customization options. By switching to a more up-to-date and intuitive program like QuickBooks, companies can manage their finances and operations with more flexibility, scalability, and efficiency.

QuickBooks is a feature-rich accounting program with a large storage capacity for data, including financial, customer, and billing data. Because of this, It is a fantastic choice for a business looking to switch to new accounting software. One of its main advantages is that it is extremely user-friendly.

QuickBooks is a very reasonably priced software choice. This implies that switching to new accounting software through QuickBooks won’t require firms to invest a large sum of money.

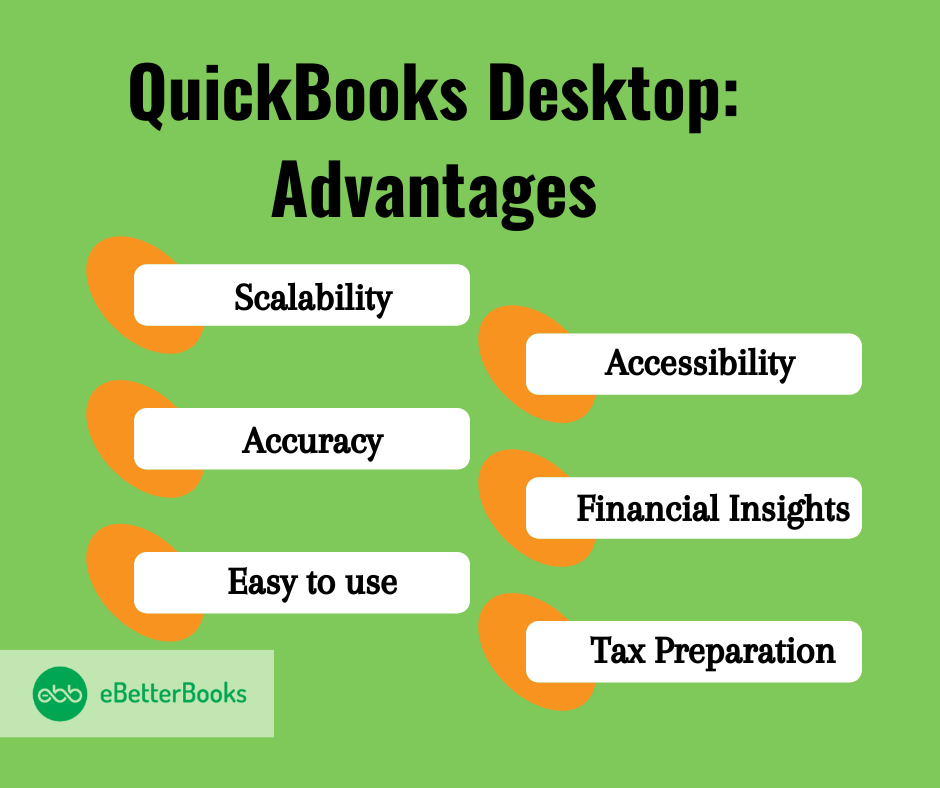

Various versions of QuickBooks are accessible, such as QuickBooks Desktop, QuickBooks Online, QuickBooks Enterprise, and others. Additionally, QuickBooks works effectively on all platforms, including mobile devices, laptops, and desktop computers. QuickBooks can assist small to medium-sized firms, while QuickBooks Enterprise is the solution for larger enterprises. Some of the advantages of QuickBooks include:

| What can be Converted? From Sage MAS 200 to QuickBooks | What cannot be Converted?From Sage MAS 200 to QuickBooks |

Customers List Vendors List Items List Employees ListChart of Accounts Summary Trial Balance Open Invoices Unapplied Credit Memos Unpaid Bills Unapplied Bill Credits Inventory Quantities and Values | Un-reconciled Bank Transactions Closed Invoices or Bills Applied Credits or Bill CreditsCustomer Payments or Bill PaymentsEstimates Sales OrdersPurchase OrdersPayroll -No employee tax setupNo payroll items No YTD information |

Getting ready for data conversion from Sage MAS 200 to QuickBooks can be difficult, but it can go well with the right planning. Here is a detailed guide to assist you in getting ready:

By taking the time to prepare thoroughly, these procedures will help you reduce disruptions and guarantee a smooth data conversion from Sage MAS 200 to QuickBooks.

While switching the data, we should overview the key information and then decide accordingly. Here are some of the things to think about:

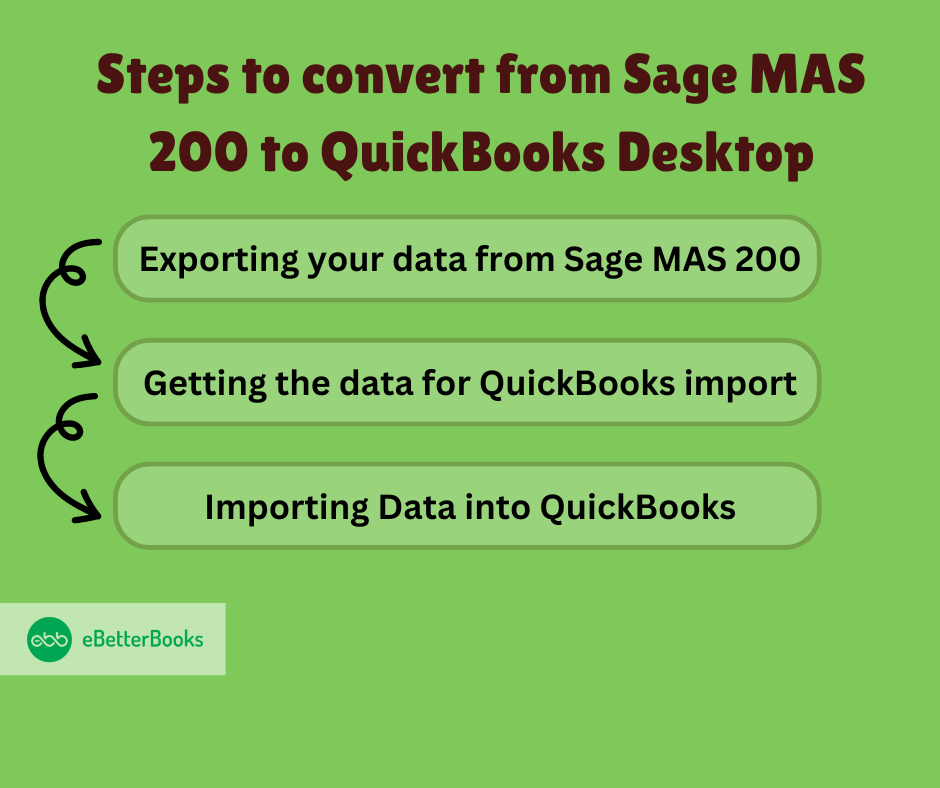

Migrating the data from Sage 200 to QuickBooks is easy if you follow the steps correctly. Below are the steps- mentioned in order to switch the data from Sage MAS 200 to QuickBooks:

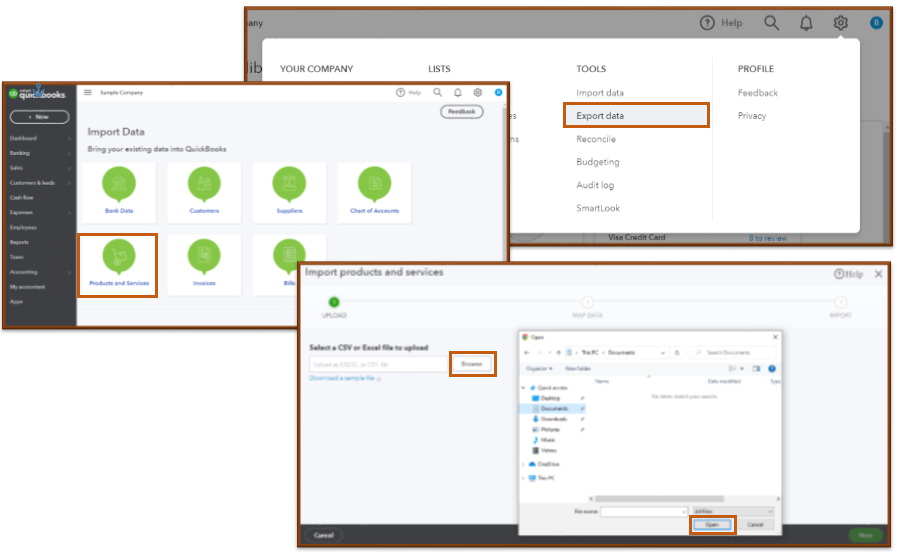

This is considered the first and foremost step in converting data from Sage MAS 200 to QuickBooks. You are required to export all the necessary information. You can use the built-in exporting tools or generate reports to extract the data. While exporting the data, make sure to use the correct format, such as Excel or CSV files.

Exporting is the data that provides you with a seamless data transformation between the two platforms. To start, navigate the “Data” menu in the Sage MAS 200 and select “Export.” You will get the option to choose a specific module or data set that you want to export, such as a vendor list, customer list, or invoice. You can easily customize your export by choosing from the filters and fields.

After you have decided on your export file type, then choose the destination for your exported file. While saving the exported file, make sure to save it in a location that is accessible easily for later import into QuickBooks.

It’s crucial to keep in mind that not all data may be compatible between QuickBooks and Sage Mas 200 during this process. Some fields or formats might need to be changed before importing them into QuickBooks. Make sure you are exporting all the data required for a seamless transition as well.

Following these instructions and correctly exporting your data from Sage Mas 200 will bring you one step closer to completing your QuickBooks conversion. Watch this space for our blog post, where we’ll discuss getting the exported data ready for QuickBooks import.

One of the most important steps in the conversion process from Sage Mas 200 is getting the data ready for QuickBooks import. By taking this step, you can be sure that your data will be structured correctly and arranged so that it will work with QuickBooks.

Your first step should be reviewing your exported data from Sage Mas 200 and removing any extraneous or duplicate entries. This will help ensure that the new QuickBooks file you have is accurate and error-free. After that, it’s crucial to classify your transactions accurately. Report generation in QuickBooks will be simpler if the right accounts and categories are assigned.

Additionally, you should check and update any vendor or customer data that changes. It’s a smart idea to check for updates to addresses, contact information, or terms of payment.

Spend some time setting up any applicable sales tax rates and any recurring transactions, such as bills or invoices, that must be input on a regular basis.

Verify the integrity of all balances by reconciling them with bank statements prior to entering the data into QuickBooks.

You may guarantee a seamless transfer from Sage Mas 200 while keeping the same quality by following these instructions to Convert Mas 200 to QuickBooks.

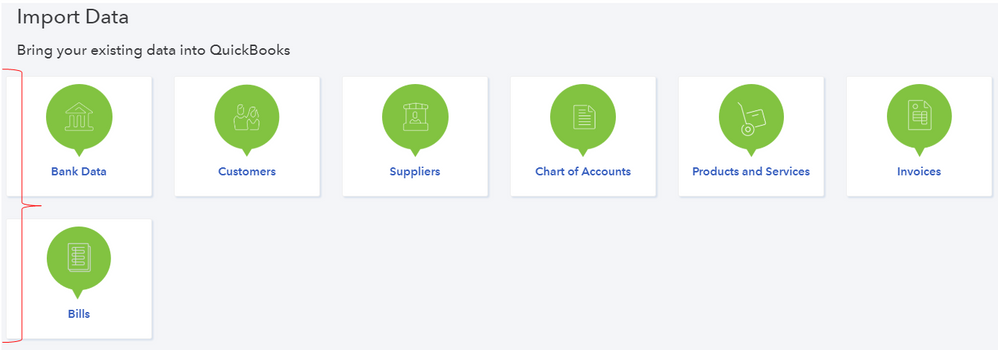

The last and most important step in transferring your data from Sage MAS 200 is to import it into QuickBooks. Ensuring a seamless transition and precise transfer of all your financial data is crucial. This is a detailed tutorial on how to import data into QuickBooks.

You can effectively convert and import your data from Sage MAS 200 into QuickBooks by carefully following these procedures, guaranteeing a seamless

During the data conversion process, you might encounter some errors. Some of them are mentioned below:

Making the switch from Sage MAS 200 to QuickBooks will help you improve your financial management skills. However, data conversion is a complex process that, if done incorrectly, carries a number of problems. You can guarantee a smooth, precise, and effective shift by hiring skilled specialists, which will enable your company to prosper with its increased financial agility.

Maintaining your competitive edge in the constantly changing world of business technology requires you to make well-informed decisions and, when necessary, seek professional support. Data conversion services are your reliable allies in making the move successful.