Neobanks are digital-only fintechs with no physical branches, offering credit products like microloans, credit cards, bank overdrafts, etc.

Neobanks are challenger banks that help underserved and credit-invisible users like Gen Z, freelancers, and gig workers access funding quickly without traditional credit checks.

They offer low fees, quick approvals, and user-friendly alternatives powered by AI and real-time data. Consider Chime (a US neo bank), for example, now offering “Instant Loans”—three-month installment loans up to $500 with fixed interest and no credit check.

Brazil’s Nubank is turning heads with its “low and grow” approach to credit, offering incrementally expanding credit lines depending on payment behavior. Australian neo banks like Unloan are bypassing traditional hurdles by approving quick, free home loans via the web.

From overdraft protection and secured credit cards to microloans and credit builder products, Neobank’s credit game is on track. Neobanks are making unsecured credit more accessible, reshaping traditional lending, and serving financially underserved populations.

Understanding Neobank Credit Services

The majority of neo banks do not have a full banking license, unlike traditional banks. Neobanks tend to collaborate with licensed institutions or use fintech infrastructure to provide compliant and safe credit products.

What differentiates neo banks from others is that they are dedicated to accessibility, simplicity, and financial transparency. They apply alternative credit evaluation mechanisms, including income pattern flow, rent payment history, or subscription patterns, a stark difference from now-outdated FICO score reliance.

Powered by advanced AI and machine learning, neobanks judge creditworthiness more holistically, opening doors to temporary workers, freelancers, and thin-file customers (with limited or insufficient credit history) to take loans and credit cards rejected by traditional banks.

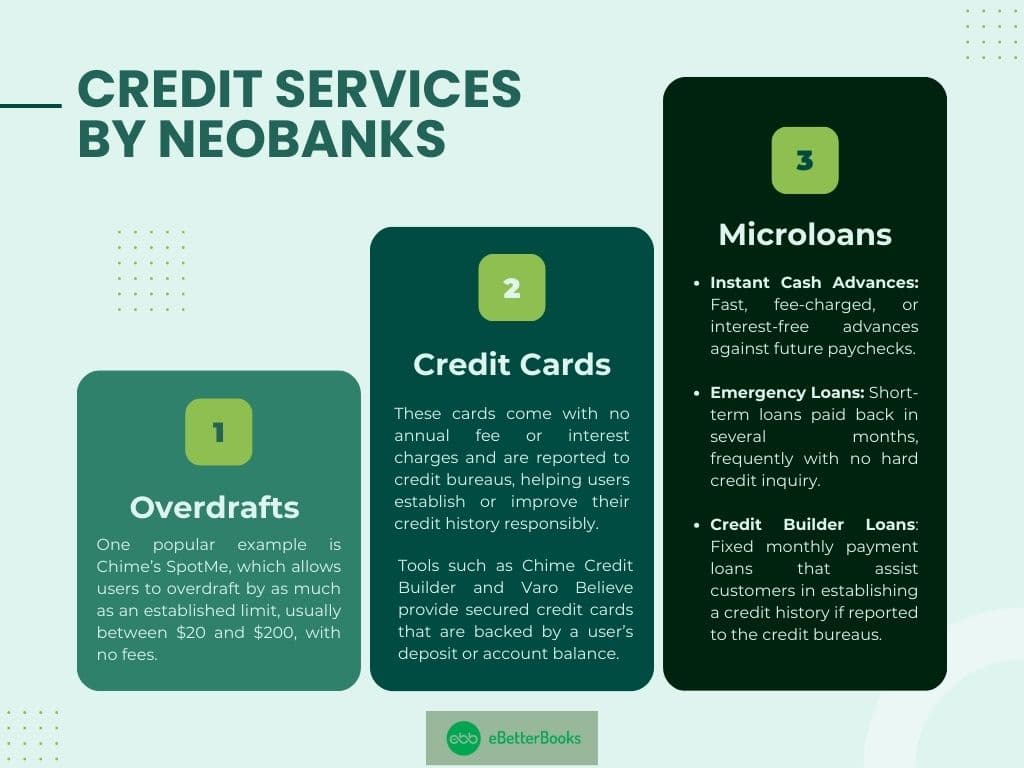

Overdrafts at Competitive Fee

Bank overdraft protection used to have prohibitive costs in implicit terms. Neobanks are providing overdraft at competitive prices, thereby rewriting the script for banks’ overdraft services.

One popular example is Chime’s SpotMe, which allows users to overdraft by up to an established limit, usually between $20 and $200, with no fees. These free-of-charge overdrafts are automatically refunded by the user’s subsequent direct deposit, leaving the experience frictionless.

Neobanks determine these limits based on real-time account behavior rather than hard credit checks to ensure the product is calibrated to user requirements. The aim is to avoid letting users get trapped in debt and not to take advantage of their mistakes, which is the opposite of how brick-and-mortar banks approach things.

Credit Cards by Neobanks: The Secured Revolution

Neobanks is servicing customers who are new to credit or looking to rebuild their credit by providing secured credit cards. Tools such as Chime Credit Builder and Varo Believe provide secured credit cards backed by a user’s deposit or account balance.

These cards come with no annual fee or interest charges and are reported to credit bureaus, helping users establish or improve their credit history responsibly. Unlike traditional cards, there’s no risk of revolving debt, making them ideal for credit-invisible users.

These innovative offerings show how neobanks combine financial literacy tools with products designed to build long-term financial health.

Microloans & Small Credit Lines by Neobanks

Microloans from neo banks are becoming a popular choice for short-term borrowing, especially as alternatives to payday loans. Platforms like Dave, MoneyLion, and Varo Advance offer small, instant cash advances, typically under $500, with minimal or no interest.

The application process is digital and fast and often doesn’t require a traditional credit check. Repayments are usually automated and tied to incoming deposits. These loans are ideal for emergency expenses, managing cash flow, or avoiding overdraft fees, all with the convenience of a mobile app.

Types of Microloans provided by Neobanks include:

- Instant Cash Advances: Fast, fee-charged, or interest-free advances against future paychecks.

- Emergency Loans: Short-term loans paid back in several months, frequently with no hard credit inquiry.

- Credit Builder Loans: Fixed monthly payment loans that assist customers in establishing a credit history if reported to the credit bureaus.

By offering small-scale loans with flexible repayment terms, neobanks are addressing a key financial gap for individuals with cash flow shortfalls, medical expenses, or unexpected bills. These loans are meant to assist, not ensnare, users in a debt cycle—a silent departure from the predatory practices of old-school payday lenders.

Alternative Credit Models by Neobanks

One of Neobank’s strongest advantages is alternative credit scoring. While established banks mainly focus on FICO or Vantage scores, neobanks draw from alternative sources of data, such as rent payments, utility bills, streaming subscriptions, and gig earnings, to assess a user’s creditworthiness.

Startups such as TomoCredit and Petal are leading the way with this innovation. For instance, TomoCredit provides a credit card without a credit check based on real-time income and expenditure patterns. These models are particularly useful for freelancers, gig workers, and credit invisible consumers who are usually left out of mainstream credit systems.

Neobanks are utilizing AI and machine learning for custom credit limits, risk scoring, and fraud monitoring. This technology-based strategy enhances approval rates, increases financial inclusion, and promotes responsible lending.

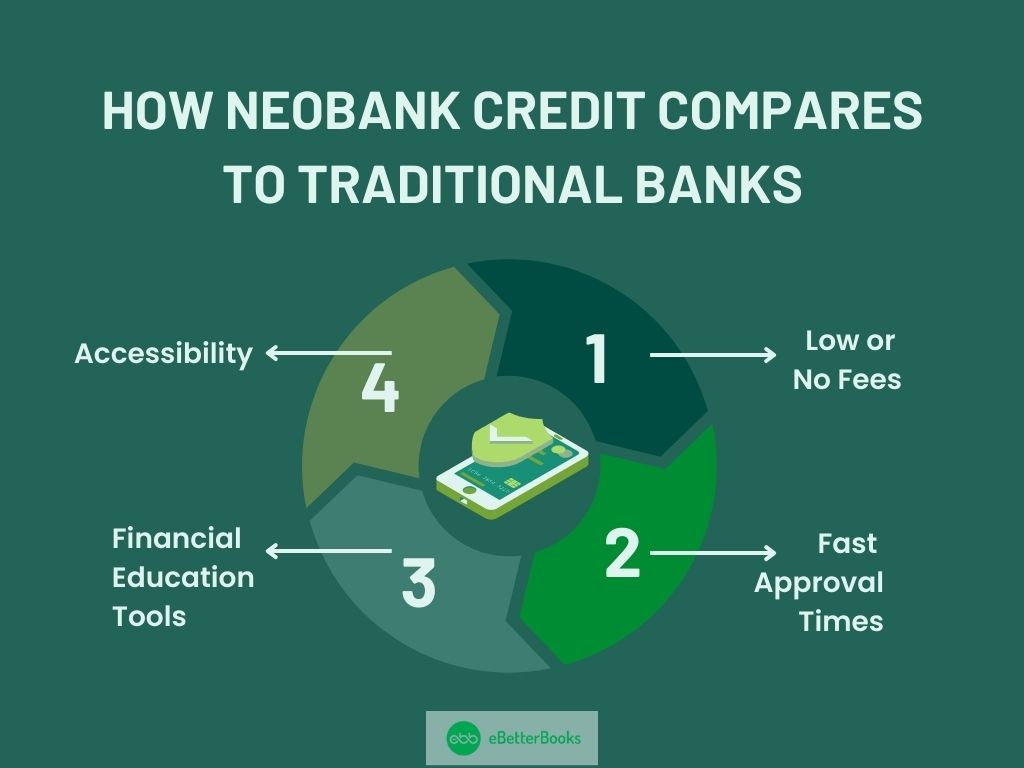

How Neobank Credit Compares to Traditional Banks

Comparing neobank credit with traditional banks, some of the benefits include the following:

- Low or No Fees: Numerous neobanks discontinue annual fees, overdraft fees, and surprise charges.

- Fast Approval Times: Digital-only platforms use automated systems for near-instant credit decisions.

- Financial Education Tools: Most of them provide insights, budgeting tools, and credit monitoring for free.

- Accessibility: Best for underserved groups such as Gen Z, millennials, freelancers, and the unbanked.

However, there are some limitations to keep in mind:

- Neobanks tend to have lower credit limits than legacy banks.

- Some of them are region-specific, so not everyone will qualify.

- Most specialize in unsecured lending; secured products such as car loans or mortgages remain a niche.

Neobanks and traditional banks have different scopes when it comes to providing banking services. Neobanks provide specialised services, while conventional banks provide a full spectrum of banking services. Neobanks are a great bet for quick access to short-term loans, credit-building credit cards, or free banking. However, when it comes to bigger financial requirements, traditional institutions might still be ahead.

The Future of Credit in the Digital Banking Era

The future looks promising as neobanks expand their credit services to become full-service financial platforms.

We can expect to see:

- Expansion of unsecured loans and complete credit card offerings.

- More integration with Visa and Mastercard networks.

- Smarter underwriting through Generative AI and open banking data.

- More collaboration with credit bureaus to enhance credit score reporting.

However, as neobanks scale, regulatory compliance will become increasingly important. Getting banking charters, upgrading anti-fraud systems, and following consumer protection regulations will determine whether they can grow sustainably.

Conclusion

Neobanks are revolutionizing how consumers borrow, combining digital convenience with transparent, user-first services. From secured credit cards and microloans to fee-free overdrafts and AI-driven evaluations, they are dismantling barriers that traditional banks have long maintained.

Although neobanks are not yet ready to completely displace traditional lenders, their products are perfect for anyone seeking low-cost, accessible, and technology-driven credit options.

If you are looking for money tools that fit your life, whether you’re just starting to use credit, are a gig economy worker, or want more control over money, a neobank could be the right solution.

Frequently Asked Questions

Do neobanks offer loans?

Yes, most neobanks provide loans, such as instant personal loans, microloans, and credit builder loans. These are generally unsecured and have a flexible, technology-enabled application process.

What is a neo lender?

A neo lender is a technology-first lending company that employs technology and non-traditional credit models to make loans, sometimes without the necessity of a physical branch or traditional credit score.

What credit score do I need for Neobanks?

Most neobanks have products with no minimum credit score requirement. They instead look at your income, spending, and alternative data. This makes them perfect for credit newcomers or those restoring credit.