To invoice as a freelancer, create a document with your details, client info, services, costs, and payment terms, and send it to the client after the project is complete.

As a freelancer, you have to wear many hats, and sending your invoices is one of these tasks. It is your responsibility to ensure that you are paid for the work you have completed for your clients. Invoicing is the most effective technique for collecting these payments.

You may have presented your client with a quote outlining the cost of their project request from you. The next step is to send an invoice. It is critical to understand how to fill out an invoice because it is issued following the end of your task. The invoice should clearly explain the work completed, and the amount of money you anticipate will be paid for it.

It maintains a record of the financial transactions, shows a freelancer’s professionalism, sets clear expectations for payment, and builds credibility with clients.

What is freelance invoicing?

Self-employed professionals and small business owners use invoices to request payment for a good or service and document company activities. Invoices are often one-page documents that itemize work or hours and instruct the client on how to pay you.

Sending your clients branded, easy-to-read bills demonstrates professionalism; small business and large enterprise clients expect to receive an invoice when payment is due.

Additionally, issuing invoices allows you to keep better track of project and payment status.

An invoice may include extra expenses, such as:

- Purchases done by you on behalf of a client (domain names, any software or advanced version used)

- Sales tax is an example of an applicable tax.

- Processing fees

Your contract with the client will dictate the overall number of expenses listed on your invoice.

Why Do Freelancers Need Invoices

Invoices are crucial for freelancers as they serve multiple roles in managing and growing a solopreneur business:

- Professionalism and Branding: Sharing invoices with clients shows professionalism and helps build your brand identity.

- Client Information Management: Having client information on invoices simplifies tracking payment statuses and is also important for managing invoices at the end of each month.

- Record Keeping and Legal Protection: Invoices are official records of the services rendered and payments due. All of this information is essential for legal protection, tax calculations, and tracking yearly revenue.

- Payment Options and Terms: Clear payment terms and various payment options on invoices increase the chances of receiving timely payments, improving client satisfaction and cash flow.

- Business Performance Analysis: Invoices provide insights into your solopreneur’s business performance by showing sales, client activity, and demand for services, which helps in better planning and strategizing.

How To Create An Invoice for Freelance Work?

As a freelancer, you have several options for creating and sending invoices to your clients.

Here are some common methods:

1: Manual Invoicing:

Create your invoice from scratch using basic Microsoft Word documents, Google Docs, or spreadsheets. You can also use a freelance invoice template and customize it to fit your needs.

2: Invoicing Software:

There are numerous invoicing software options available, both free and paid, that can help streamline the invoicing process. Such platforms often offer additional features like time tracking, automatic reminders, and payment integration.

3: Online Invoice Generators:

Many websites offer free invoice generator tools. You can fill in your details in an invoice template and download or send the invoice directly.

4: Accounting Software:

If you use accounting software for your freelance business, it likely includes an invoicing feature. It can be a convenient way to keep all your financial information in one place.

Comparison Among Each Method of Creating Invoices

Here is a short comparison of each method so that you can get a clear understanding of each method:

| Invoicing Method | Pros | Cons |

| Manual (Word/Spreadsheet) | Customizable, free | Time-consuming, prone to errors |

| 2: Invoicing Software | Automated, tracks payments | Monthly subscription fees |

| 3: Online Invoice Generators | Quick, accessible | Limited customization |

| Accounting Software | Comprehensive financial tracking | Complex Learning Process |

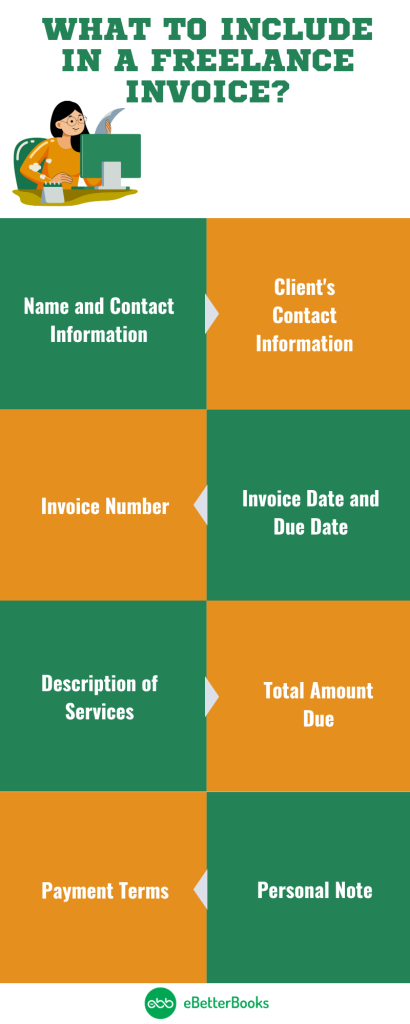

What To Include In A Freelance Invoice?

A detailed invoice not only ensures you get paid accurately and on time but also serves as a record of your work and helps maintain clear financial transactions between you and your clients.

Here are some of the key elements you should include in your freelance invoice:

Your Name and Contact Information: Include your full name, address, phone number, and email address at the top of the invoice. It ensures the client knows who the invoice is from and how to contact you if they have any questions.

Client’s Contact Information: Just below your information, include the client’s name, company name (if applicable), address, and contact details. It is important because it ensures the invoice reaches the right recipient.

Invoice Number: Assign a unique invoice number for each invoice you create. Not only will this invoice number benefit your record-keeping, but it will also help both you and your client track the invoice in case of queries or payments.

Invoice Date and Due Date: Mention the date you’re issuing the invoice and the date you expect payment. It is to set clear expectations for payment timelines. Common terms include “Net 15” or “Net 30,” which means payment is due within 15 or 30 days of the invoice date, respectively.

Description of Services: List all the services you provided, along with a brief description and other information like the date of service, the hourly rate, an itemized list of projects or tasks completed, and any expenses incurred that you are passing on to the client.

Total Amount Due: Sum up the total amount owed for all services, including applicable taxes or discounts. Make this figure prominent so it’s clear what the client needs to pay.

Payment Terms: Specify your preferred payment method (e.g., bank transfers, PayPal, checks) and provide necessary details or instructions for payment, like PayPal email address or account number for electronic payment options.

Personal Note: A brief, courteous personal touch or note (e.g., “Thank you for your business!”) can help you maintain a positive relationship with your client and encourage early payment.

Checklist for Creating Invoice

Here is a simple checklist you can use before creating the invoice for your clients next time.

Freelance Invoice Checklist:

- Your name and contact information

- Client’s contact information

- Invoice number

- Invoice date and due date

- Description of services provided

- Total amount due (including taxes)

- Payment terms and methods

- Notes, if any (optional)

How to Send An Invoice To The Client

it’s important to follow a structured approach To ensure a smooth transaction and maintain professionalism when sending an invoice to your client. Before you send out the invoice to your client, here’s what to do:

Review the Invoice: Before sending the invoice, double-check it. Ensure all details are correct, including the client’s information, services provided, payment amount, and terms.

Choose the Right Time: Send the invoice according to the agreed-upon schedule, whether it’s paid immediately after completing the work, at the end of a project, or on a recurring invoice basis.

Select the Preferred Method: Check how your client prefers to receive a professional invoice. Common methods include email, through an invoicing platform, or sometimes postal mail.

Emailing the Invoice: Use a clear subject line like “Invoice #123 for [Service/Product] due on [Due Date]”. In the email body, summarize the invoice contents and add a thank you or a personalized note. Attach the invoice as a PDF file to ensure it maintains its formatting and is easily printable if required.

Using an Invoicing Platform: If you use invoicing software, you can send the invoice directly from the platform. These often provide features like tracking when the invoice is viewed and paid.

Follow-up: If you do not receive the payment by the due date, follow up with a polite reminder email or call.

When To Send The Invoice?

The timing of when to send an invoice to your client can vary depending on the agreement you have in place and the nature of the project.

For one-time projects, it’s common to send the invoice immediately after the work is completed and delivered to the client.

For larger bulk projects, you might agree on milestone payments. In this case, send an invoice each time a milestone is reached, as outlined in your freelance contract.

If you provide ongoing services, you might send invoices regularly, such as weekly, bi-weekly, or monthly.

Some freelancers require an advance payment before starting a project. If you are one of them, send the deposit invoice as soon as the contract is signed.

If you’re on a retainer, you should send an invoice for the agreed-upon retainer fee at the beginning of each billing period.

Sometimes, clients may have specific billing cycles or request that invoices be sent at a particular time.

Invoices Mistakes to Avoid as a Freelancer

As you work on your invoice, look for these typical problems and typos that can affect how quickly you are paid:

Unclear Projects: Need to properly define project work and pricing. Make it clear what work you’ve completed, how much it costs, and which project it is related to. Your primary contact at a client company may not be the person who pays the invoice, so include as much context as possible.

Missed Updates in Invoices: Neglecting to update the invoice number. If you utilize an invoice template, make sure always to update the invoice to reflect the right client and number.

Recording the Incorrect Data: Double-check your maths before sending your invoice, and if you discover a mistake, work with the client to immediately correct it by delivering a new invoice or partial refund.

Missed Updation in Fee or Pricing Details: Follow the prices and charges specified in your first contract with the client.

Omitted Payment Information: Payment information was omitted. Include all payment choices available to your clients and provide options that are convenient for them. While a small firm may be willing to pay using any app, large organizations normally require bank transfers or cheque payments.

Unregular Invoice Reminders: Forgetting to send invoices. If you want to be paid, deliver your invoices on time!

Best Practices for Freelancer Invoicing

Being a freelancer means you are a business in your own right. A key aspect of this is invoicing, which, when done correctly, ensures you get paid on time and strengthens your professional relationships.

Here are some tips:

- Automate Reminders: Set up automated reminders for upcoming and overdue invoices to reduce the mental load of tracking payments and ensure prompt payment.

- Use Descriptive Titles: Instead of just “Invoice,” use titles like “Design Project Invoice” to make it easier for clients to recognize your invoice. All your invoices should follow the same title format.

- Include a Breakdown of Time: If you charge by the hour, include a detailed breakdown of your time spent on the project to justify your charges.

- Offer a Payment Plan: For larger or multiple invoices, consider offering a payment plan to help clients manage their cash flow. Also, multiple payment methods should be provided to make the process more client-friendly.

- Include a Feedback Request: At the end of your invoice, include a polite request for feedback to show that you value your client’s opinion and are always looking to improve.

- Use Invoicing Software: Use invoicing software to streamline the invoicing process, keep track of payments, and maintain organized records.

- Be Adaptable: Your flexibility as a freelancer is a strength. Be adaptable to accommodate your clients’ preferences, making their experience seamless so clients feel valued enough to continue working with you.

Conclusion

As the freelance economy expands, with projections indicating over 90 million freelancers in the US by 2028, freelancers need to treat invoices as a strategic tool to build their business instead of a mere formality. Following the best invoicing practices and using the right tools, freelancers can streamline their billing and invoicing process and focus on what they do best.

For more insights on invoicing and financial management for freelancers, you can explore resources like Akounto’s blog, which offers a variety of articles and tips for freelancers and small businesses.

Frequently Asked Questions

Do I need to send an invoice as a freelancer?

Yes, as a freelancer, you should send professional invoices for your services. Invoices serve as formal requests for payment and help you keep track of your earnings, expenses, and taxes. They also serve as legal documents in case of disputes. Sending invoices is a standard business practice that helps ensure you get paid for your work.

Do freelancers add tax to invoices?

Whether you need to add tax to an invoice depends on the tax laws in your country and the nature of the services you provide. In many cases, freelancers need to charge sales tax, VAT, or GST on their services, which should be included in the invoice.

How do freelancers issue invoices?

To issue a freelance invoice, you can use different methods, like manual invoices in MS Word or spreadsheet, invoicing software that offers freelance invoice templates and automation, or invoicing tools. Regardless of the method, the invoice should include all necessary details to ensure clarity.

How do I make a self-employed invoice?

To create a self-employed or freelancer invoice, include your name, contact information, and a unique invoice number. Detail the services provided, with descriptions and prices for each. Specify the total amount due, including any taxes or discounts. Include payment terms, such as the due date and accepted payment methods.