What are Retained Earnings?

Retained Earnings refer to the total amount of net income a business enterprise retains or keeps as part of its profit reserves and distributes to the shareholders. The retained earnings, therefore, build up with time and are plowed back into the business for one reason or another, including expansion of operations, debt payments, research and development, or even enhancement of operational capacity.

They are listed under the stockholder’s equity section in the balance sheet and provide information on a firm’s prognosis for generating and maintaining income for business expansion.

In other words, retained earnings can be defined as the total profits that a firm has decided to retain and invest back into the business instead of paying them as dividends to its owners or shareholders.

How Retained Earnings Are Better Than All Other Incomes?

Retained earnings signifies sustainable operational capabilities along with long -term stability and growth, and a source of internal funding as compared to loans, equity, and other external borrowings.

Retained earnings refer to the part of a company’s net income that is not paid out as dividends to shareholders but is reinvested into the business.

Income other than Retained Earnings

| Other Income | Description |

| Revenue | It refers to the income generated by the business before COGS (cost of goods sold), capital costs, operating expenses and taxes are deducted. |

| External Financing | It includes the amount that comes from outside the business, which includes from loans or from investors through stocks and shares. |

| Dividends | It refers to the distribution of earnings by the company to its shareholders either in the form of stock reinvestment or from cash. |

| Net Income | It refers to the remaining amount after subtracting all the deductions and expenses from total earnings. |

Reasons – Why Retained Earnings is Better than other Incomes?

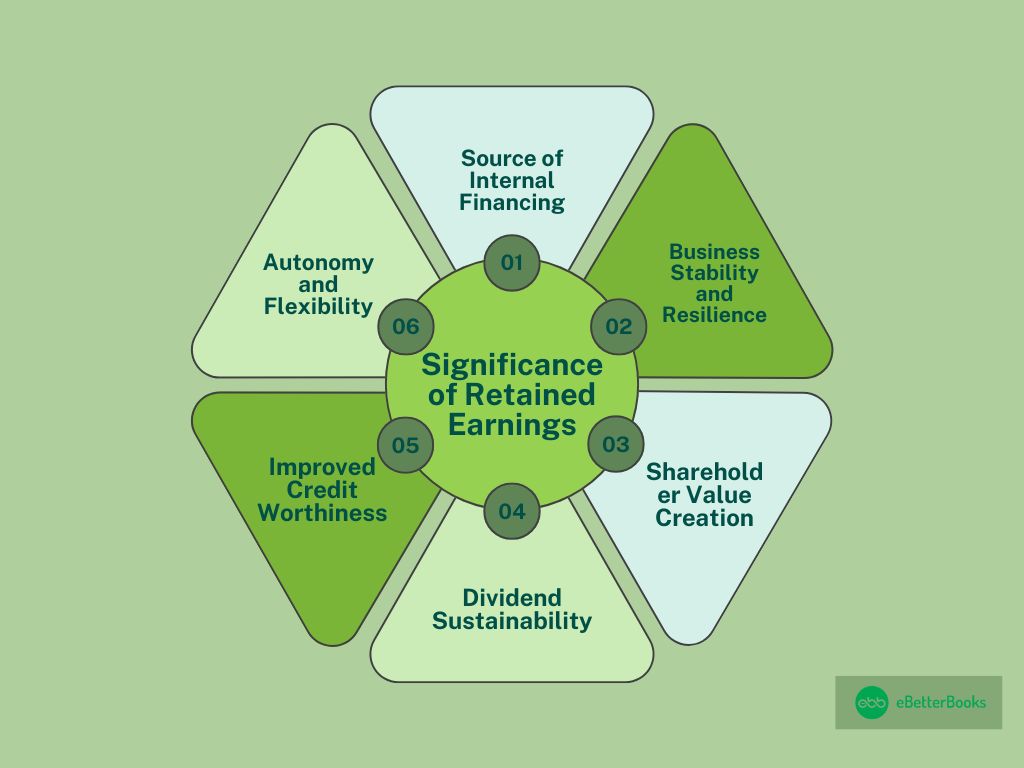

The retained earnings are hugely important concerning the strengthening and development of the company.

Here is the Reasons:

- Source of Internal Financing: Consolidated retained earnings become an internal and cheaper source of finance and, hence, do not require external borrowings or the sale of equities. This means that companies can raise money to undertake expansion, research and development, and other growth processes without issuing debts or sacrificing ownership.

- Cost Effective: Retained earnings are considered cost-effective compared to other incomes, providing a way to fund business operations and focus on expansion. On the other hand, other incomes, such as capital raised through equity, often come with associated costs like underwriting fees, interest payments, or dividends.

- Business stability and Resilience: Economic problems or emergencies always tend to lower investor returns; however, companies with strong retained earnings balances are stable enough to overcome these challenges. These earnings provide capital reserves during difficult times without requiring an outside infusion of capital.

- Long-Term Financial Stability: Retained earnings are a reliable source of internal funding. Unlike loans or equity financing, they don’t require repayment or dilute ownership, allowing the company to maintain control over its finances without additional liabilities.

- Shareholder Value Creation: When retained earnings are used wisely, they will generate more profits, meaning the shareholders benefit from capital appreciation. This creates long-term value for investors, more so when there is little or even no dividend distribution.

- Dividend Sustainability: Sustained adequate reserves of retained earnings guarantee a company to declarant or more enhanced divisions, especially during a period of decline. This makes it possible for investors to earn income from it and enhances the shareholder’s confidence.

- Improved Creditworthiness: Retained Earnings are a plus for a company’s creditworthiness. Creditors and lenders feel that the company is less likely to default, so the likelihood of default is low. It also helps mobilize funds from external sources where they are required on more gradated terms.

- Autonomy and Flexibility: To some extent, retained earnings as a source of funds make the company’s strategic decisions more independent. Unlike external financiers, some formalities or conditionalities do not dictate them; thus, they respond faster and do not make decisions that slow down operations.

- Independence from External Influencers: Retained earnings reduce a company’s dependence on external investors or creditors, allowing businesses to make decisions without the pressure of meeting external expectations or obligations.

- Reduces Financial Risk: Companies with strong retained earnings are viewed as financially stable and creditworthy. Using retained earnings minimizes financial risks associated with debt, such as interest rate fluctuations or repayment schedules.

How are Retained Earnings Generated?

Retained earnings are built from the compound profit of a firm, which has not been distributed to the shareholders by way of dividends.

Here is the process:

- Revenue Generation: Business revenue refers to the revenue that results from an organization’s line of business, such as sales of goods or services.

- Deductions of Expenses: Out of the revenue, all the operating expenses, which include the cost of sales, selling general and administrative expenses, taxes, and incidence in profit.

- Net Income Calculation: A company’s net income for a specific period is the total income minus expenses incurred during the same period. It is reflected in the company’s income statement.

- Dividend Distribution: The company may pay part of its net income as dividends to its shareholders. But when it does not distribute it, what remains goes to retained earnings.

- Addition to Retained Earnings: That part of the net income that is not distributed as dividends increases the retained earnings account, which appears under the equity section on the balance sheet.

- Cumulative Effect: Year after year, retained earnings increase through the addition of retained profits realized, excluding losses and paying out dividends.

The formula for calculating retained earnings is:

Retained Earnings = Current Retained Earnings + Net Profit/Loss – Dividends Paid – Withdrawals

This balance increases over time as the business makes and retains its profits in order to reinvest them within the firm.

Benefits of Retained Earnings Over all Other Incomes

From Management’s Point of View

- Internal Funding for Growth: Retained earnings allow businesses to open new locations, develop products, or enter new markets without relying on external funding. The funds can be used for expansion, research development, and other asset purchases.

- No Debt Obligations: Retained earnings don’t have any associated interest costs that apply to loans, and there are no set repayment terms, which decreases the company’s financial pressure and keeps the cash quantity adequate.

- Operational Flexibility: Businesses can reinvest the retained earnings according to business needs or as per managerial preferences.

- Financial Stability: The retained earnings help the company preserve its financial stability and respond to leaders or unpredictable losses without extra capital solicitation.

- Long-Term Share Value Appreciation: By using retained earnings, the company can return great profits to the shareholders in the long term.

- Consistent Dividend Payments: They boost earnings per share, providing shareholders with stable income and a consistent dividend base, and allowing retained earnings to pay dividends during low-profit periods.

- Avoid Dilution of Ownership: When profits are held back and reinvested into the business, then the business need not issue any equity shares, thus the ownership of present investors or equity holders is not diluted.

- Tax Efficiency: Reinvesting retained profits can benefit shareholders by minimizing double taxation. They avoid paying both income and dividend taxes.

Retained Earnings: A Gain or A Loss?

Retained earnings are not gains or losses of the company despite the fact that they are aggregates of the net income a firm has earned and retained after declaring dividends to the shareholders.

Here’s how it works:

When a company has positive retained earnings, this implies that the company has realized more profits than the amount it has paid out to its shareholders in the form of dividends and has kept these profits for reinvestment, repayment of its debts, or reservation. Therefore, from this angle, retained earnings can be seen as a financial asset or revenue as much as profit is retained in business.

When a company has negative retained earnings, it is because it has had losses in previous years or has provided its shareholders with dividends more than its net income. Negative retained earnings, also called an ‘accumulated deficit,’ indicate a loss for the company; they imply financial difficulties or poor performance in the prior periods.

Retention of the sum has been described as prestige, as it is a plus that the company can utilize to enhance its overall financial situation. This figure shows a loss and entails past periods of poor financial performance or excessive dividend distributions.

Types of Retained Earnings

Reserves and surplus are two ways to segment the retained earnings, both of which are used in the management of the accumulated profits.

Here’s a breakdown of these two types:

Reserves

This is a part of retained earnings that have been set as a particular point in time for definite use. It is used as a form of reserve or safety and is usually applied to future undertakings, investments, or any other business necessity. These are fashioned by setting aside some of the profit, which would have been useful in issuing dividends to the shareholders.

Reserves can be further divided into several types:

- General Reserves: These are the reserves that the company establishes but without the purpose of a particular asset. The company can utilize them for any future requirement or business prospect, whether it involves growth, contingencies, or contraction. General reserves are indicators of good financial practices as the company prepares for future contingencies.

- Specific Reserves: These reserves, as the name suggests, are created for a specific use or a particular requirement of the company. For example:

- Capital Reserves: Funds derived from sources other than the normal business operations of the enterprise, such as selling fixed assets or issuing shares at a premium. They are mainly used for long-term operations, such as investment, buyout of bonds, or capitalization.

- Dividend Equalization Reserves: To guarantee that the company can afford dividends in some poor-performing financial periods. This ensures that shareholders’ returns are stabilized, hence befitting their interest.

- Legal or Statutory Reserves: These are reserves that are set due to a statutory requirement, whereby a certain portion of the amount is kept for contingencies or as per the requirement of a certain industry.

Surplus

Surplus means any amount of retained earnings that has not been set aside or allocated for reserves. Such elements are part of retained earnings after all kinds of reserves are established and all dividends are distributed. This is available for various business purposes or can be distributed to the shareholders in case the company wants to give more dividends in the future.

- Profit and Loss Surplus: This refers to the amount of profit kept from the company’s profit and loss statement account for the next accounting period. Suppose the company’s net income is only partially distributed to the shareholders in the form of dividends. In that case, the residual amount is called a surplus, which can either be reinvested or used in other business operations if necessary.

- Free Reserves: These are amounts that are over and above requirements that are earmarked for a given use and can, therefore, be judiciously used by the firm for any business activity, to expand its operations, or for future dividends.

Statement of Retained Earnings

A Statement of Retained Earnings (RE) is an account that records the progress of a firm’s retained earnings after a given financial period. It demonstrates the relationship between the net income or dividend paid on the company’s retained earnings account. It is usually made up at the end of each specific period, along with other accounting statements such as balance sheets and absolute profit and loss account.

Components of the Statement of Retained Earnings:

- Beginning Retained Earnings: This figure represents the amount of retained profits the company brought forward from the previous financial period. It is the total of profits (or losses) that the business has retained up to a particular date.

- Net Income (or Loss): This is the net income or operating loss for the current period, arrived at in the Income statement. Where net income is recorded, it will increase the amount of retained earnings, while if there is a net loss, the retained earnings will reduce.

- Dividends Paid: When the company pays dividends to shareholders, these are subtracted from retained earnings. Cash dividends have a negative impact on the retained earnings balance, while stock dividends also affect it.

- Adjustments (if any): Sometimes, adjustments for prior-period errors, changes in accounting policies, or other events that affect retained earnings may be made. These are stated separately in the statement of cash flows.

- Ending Retained Earnings: This is the balance of retained earnings for the period for which they are prepared and which is taken to the credit of the next period.

Utilization of Retained Earnings

Here are the key points regarding the utilization of retained earnings:

Source of Investment:

- Research and Development: Emphasizing research and development has the potential to improve products and services, which will be useful in creating income in the future.

- Expansion Projects: Another reason to use retained earnings is for a company to venture into new markets, new products, or expand current operations.

Debt Repayment:

- Reducing Financial Leverage: Retained earnings can also be used to pay out currently outstanding interest and, therefore, reduce the level of liabilities.

- Enhancing Creditworthiness: Sustaining lower credit debts makes it easier for the company to command credit facilities in the future.

Capital Expenditures:

- Purchase of Assets: They can also be used to purchase plant, machinery, equipment, information technology, buildings, or other structures that are critical to operations and development.

- Upgrades and Maintenance: Protecting fixed assets can greatly increase productivity and the shell life of current investments.

Dividend Payments:

- Shareholder Returns: Even though retained earnings are normally reinvested, they can be used to issue dividends to the shareholders to encourage them to continue investing and to build their trust in the supermarket chain company.

Reserve Creation:

- Establishing Reserves: Some of the retained earnings can be set aside as reserves in case future events, such as a recession or new bills, might negatively impact the company’s operations or profitability.

Acquisitions and Mergers:

- Strategic Investments: Retained earnings can be used to fund the acquisition of other companies, which will lead to expansion due to increased market share or product portfolio.

Employee Development:

- Training and Development Programs: Employee training and skills development could improve organizational employees’ efficiency and creativity.

Therefore, retained earnings, when properly deployed, can be a CSR tool to improve business growth, financial security, and returns in shareholders’ equity, which could make them ideal for long-term business plans.

What is Retained Earnings to Market Value?

Retained Earnings to Market Value is a financial ratio that enables one to evaluate how profit has been retained and their ability to grow the business through reinvestment.

Formula:

Retained Earning to Market Value Ratio =Retained Earning / Market Value of Equity

Where:

Retained Earnings: The total amount of profit retained for investment purposes in the company from the balance sheet.

Market Value of Equity: Total market capitalization means the total capital in the market, arrived at after multiplying the stock price with the total number of stocks available in the market.

Interpretation:

- Ratio > 1: This is sometimes used to express the company’s retained earnings as more than its market value, which may mean that the stock is undervalued or that the firm has great growth prospects.

- Ratio < 1: The resultant of the above divisions expresses the notion that not only can the market value the company more than its retained earnings, but it shows investor confidence in future growth or brand name.

- Ratio = 1: Looks reasonable, suggesting that the bulk of market value comprises retained earnings.

Conclusion

Therefore, retained earnings are a better income model for any business than any other income. It offers an independent and cheap source of funds and, hence, enables companies to retain earnings for expansion without increasing their leverage or floating more shares. Interest obligations and ownership dilution are two factors that restrict financial freedom and reliability; thus, retained earnings provide management with more financial opportunities than liabilities.

To shareholders, they help create sustainable shareholder value through increased stock prices and a steady stream of dividends.