Bad debt is a type of accounts receivable that cannot be collected. It is a loss that a creditor or a company takes when a borrower or customer cannot pay; this may be due to the customer going bankrupt, having serious complications in their business, or being negligent.

When a company extends credit to its customers, it is taking a risk that can result in bad debt. However, these companies are resilient, making every possible effort to recover the debt before writing it off.

They employ legal actions and collection factors, proving their commitment to financial resilience and their confidence in their ability to manage bad debt.

What Is Bad Debt?

Bad debt refers to loans or credit extended to borrowers who are unlikely to repay. It typically arises when a debtor defaults or shows signs of financial instability. Businesses and lenders may write off such debt as a loss, impacting their financial health and profitability.

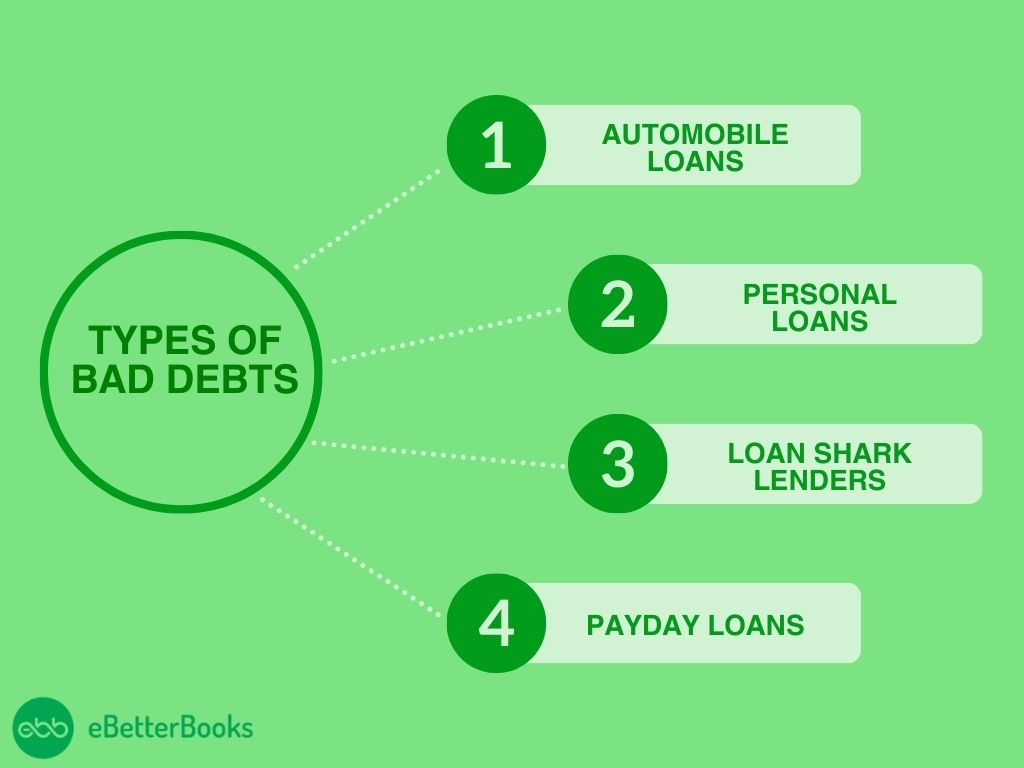

Types of Bad Debts

Automobile, personal, and payday loans are high-risk debts due to depreciating value, high interest rates, and short repayment terms, often leading borrowers into financial strain. Avoid loan shark lenders.

- Automobile Loans: These loans are viewed as bad debts since the cash value of the vehicle continues to deplete over time. Thus, the value of the car decreases due to its service history, fuel efficiency, warranty period, etc.

- Personal Loans: These loans have an extremely high interest rate, making it simple to go into debt. If you do not repay the loan on time, it might mount up quickly.

- Loan Shark Lenders: These are informal loan lenders that charge extremely high interest rates. It renders working with lenders illegal.

- Payday Loans: Payday loans are one of the most harmful sorts of bad debt since they are short-term and unsecured.

The interest rates are exceedingly high, reaching 400 percent. Due to late penalties and different providers, any missed due dates might triple the bankruptcy.

Consequences of Bad Debts

Below are the consequences of bad Debts:

- Reduced Profitability: Because bad debts result in additional expenses, it has a floor effect of dampening its net income and profitability.

- Cash Flow Issues: Irrecoverable payments interfere with the liquidity of the cash flow systems thus posing a problem to any firm.

- Weakened Financial Position: Higher bad debts damage the balance sheet, thereby reducing investors’ confidence.

- Higher Credit Risk: A high frequency of bad debts may lead to poor credit management; hence, it will be more difficult for one to be offered any loans or credit.

- Strained Business Relationships: Non-payment issues affect the relationship between stakeholders and customers.

- Reputation Damage: Under this line, items that portray the company’s credit policies, and the ability to manage risks of bad debts are viewed as consistently poor.

- Operational Disruptions: The denial of expected revenue results in exercises like laying off employees or reducing resource procurement.

- Legal Costs: Going after those bad debts and collecting them through law courts involves added costs.

The right credit assessment and credit recovery approaches must be used to help avoid such effects.

Example of Bad Debts

| Income Statement (Partial) for year one | – |

| Revenue | – |

| Sales | $100,000 |

| Operating Expense | – |

| Bad debt Expense | $7,000 |

| Balance sheet (Partial) at the end of year one | – |

| Current Assets | – |

| Account Receivable | $100,000 |

| Allowance for Doubtful accounts | $7,000 |

| Account Receivable, Net | $93,000 |

How do you record bad debt?

There are two methods to record bad debts in accounting.

They are as follows:

- Writing Off Bad Debt

This method is used for income tax purposes in the USA. While the straight write-off technique records the precise amount of uncollectible debts, it does not adhere to accrual accounting’s matching principle or generally accepted accounting standards (GAAP).

The matching principle requires costs to be matched to relevant revenues in the same period of accounting in which the revenue transfer takes place.

The major problem when dealing with write-offs is the uncertainty of when the expense may appear.

For example, when a company has one customer with large account receivables, the direct write-off technique would record 100% of the expenditure not just during the selling period but also during an unpredictable time.

When applying the direct write-off technique to record bad debt, the entries result in a debit to “Bad Debt Expense” and a credit to “Accounts Receivable.” The entry receivable can be written off with only one posted entry and no allowance.

- Allowance Method

The allowance method is an accounting method that helps to avoid overstating potential profits by factoring in anticipated losses in a company’s financial statements.

To prevent an overstatement of an account, a company will determine an expected amount of its receivables from current-period sales that will be uncollectible.

In the case of accounts receivable, there is practically no time gap between the sale and the payment, and hence, a company cannot predetermine which accounts will be paid and which will default.

Consequently, an allowance for doubtful accounts is created out of an expected figure, expected to be written off as a loss.

An organization will decrease the accounts receivable through this expense by debiting bad debt expenses and increasing this allowance account by crediting it.

The allowance for doubtful accounts is a contra-asset account that is offset against the accounts receivable, meaning that it decreases the total balance of receivables when both balances appear on the balance sheet.

It can be taken to a balance and remains in the account, which may be changed from one accounting period to the next.

How do you estimate the bad debt?

There are two methods for calculating the amount of accounts receivable that will not be collected. Bad debt expenses may be predicted using statistical modelling, such as failure probability, to quantify anticipated losses due to outstanding and bad debt.

The statistical calculations can use both company—and industry-specific recorded data. The percentage will normally grow as the receivable age increases, indicating an increased likelihood of default and lowered collectibility.

Similarly, estimating a bad debt expense by taking a percentage of net sales, based on the company’s background with bad debt collection, can help.

Companies regularly adjust their allowance for losses in credit entry to ensure that it corresponds to the latest statistical modeling allowances.

- Ageing Method

The aging of the accounts receivables collection involves classifying all the remaining receivables by age and applying a percentage to each category.

The sum of all the groups’ results is the estimated uncollectible balance. For instance, while a company might have $70,000 of account receivables that are less than 30 days outstanding, s/he has $30,000 of account receivables that are more than 30 days.

By prior experience, it is found that 1% of net credit sales that are aged below 30 days will not be recoverable, and 4% of credit sales with more than 30 days period will be non-recoverable.

Thus, the company will record an allowance and bad debt expense of $1,900 (($70,000 * 1%) + ($30,000 * 4%).

To illustrate, if an estimated amount of $2,500 is expected based on outstanding accounts receivable in the next accounting period, only $600 ($2,500 – $1,900) will be considered bad debt in the second period.

- Percentage of Sales Method

The sales method involves applying a fixed percentage over the total dollar amount of sales throughout the period.

For instance, if the historical facts show that 3% of the net sales are uncollectible, then the management of the business organization will anticipate that 3% of the net sales are bad debts.

When total net sales for the period equal $100,000, the company creates a $3,000 Allowance for Doubtful Accounts and records a $3,000 Bad debt expense.

If actual net sales of $80,000 occur in the following accounting period, $2,400 will be added to the allowance for doubtful accounts, and $2,400 will be written off in the second period as bad debts.

The total amount in the allowance for doubtful accounts when all the above two periods are taken into consideration is $5,400.

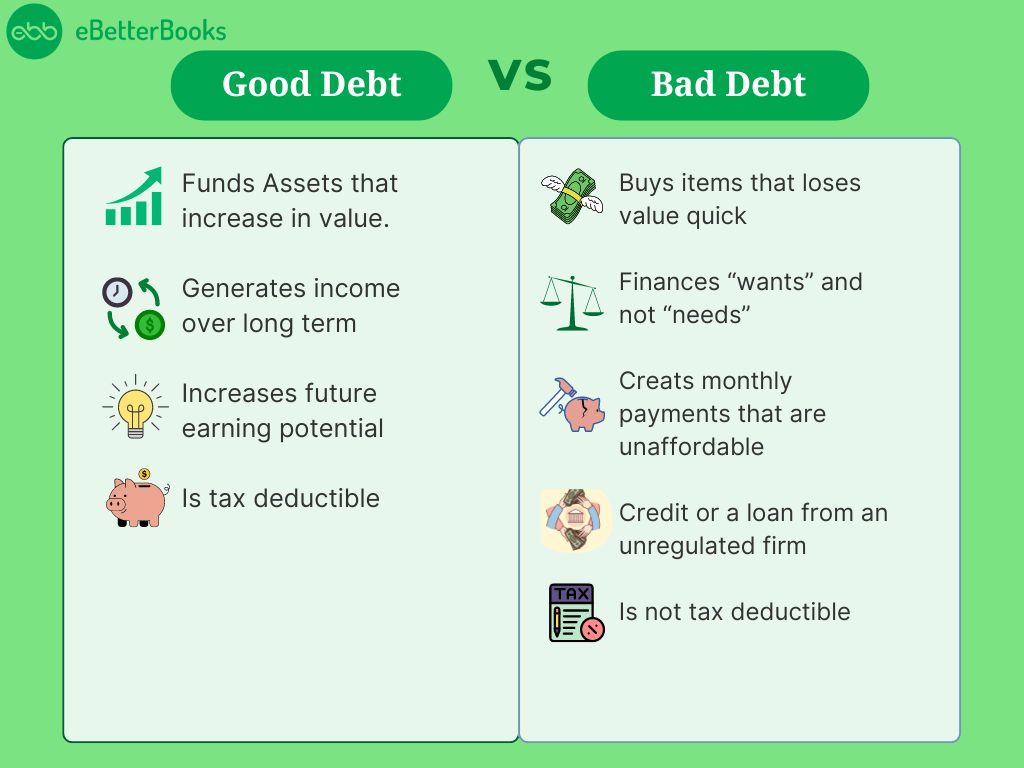

Good Debt vs. Bad Debt

Good Debt

Good debt helps you reach goals like being a mortgage-free owner or earning a loan-free graduation degree. In the long run, having good debt allows you to acquire something beneficial and eventually increases your wealth and pleasure.

If you maintain your payments, it also helps you improve your credit score. That is useful for other significant purchases that you may wish to make.

A few categories of “good debt” exist. But keep in mind that if you take on more debt than you can reasonably pay back or if the interest rate is too high, even good debt can become bad.

- Mortgage

A mortgage is the most debt you’ll ever have. If you buy a property with a 30-year mortgage at the age of 30, you may only be able to pay it off once you retire.

Mortgage debt is excellent debt—with a few exceptions.

Calculate the monthly amount before signing the contract; otherwise, you won’t know if it matches your budget. Many financial gurus recommend that you spend at most one-third of your total earnings on housing.

If the cost of the mortgage, including taxes, interest, and insurance, does not exceed 33% of your family income, the loan may be a beneficial investment.

Why is mortgage debt seen as “good?” When you accept it, you become an owner of property. Making mortgage payments instead of rent can help you create long-term equity.

Home prices do not often grow as quickly as other investments, but they tend to climb consistently over time. That is known as “building equity.”

Furthermore, mortgage interest is usually deductible from taxes (up to a specific limit). Consider using the tax deduction to decrease the loan’s “effective” interest rate.

- Student Loan

The expense of attending college might be overwhelming. Costs have been growing faster than inflation for decades, and the situation appears to be worsening year after year.

According to Federal Reserve estimates, as of early 2022, US people owe an aggregate of $1.75 trillion in loans for education, with the average student owing about $29,000. More than 60% of American college students owed money on their student loans.

College debt, on the other hand, indicates that you have put money aside for your future earnings.

The Social Security Administration found that males with bachelor’s degrees earn $900,000 more as annual income than high school graduates. Women earn $630,000. These figures are significantly higher among individuals with master’s degrees.

Even after adjusting for socioeconomic and demographic variations, the SSA’s findings indicate “significant long-term financial advantages associated with college education.”

- Business Loans

If you or your family members start a business and need to borrow money in the future, it’s an investment that may appreciate if you manage it well.

The craft brewery or business consultancy you launch may regrettably fall into the group of small enterprises that fail.

However, if you’ve done your homework, crunched the statistics, have a strategy, and are willing to put in the necessary work to see it through, it may end up being not just excellent debt but terrific or even wonderful debt.

Bad Debt

Good debt acts as a system that guarantees a user smooth operations, while bad debt is similar to working against the current.

- Credit Cards

Indeed, most of us have, at one time or another, come across this one. You should already be aware that the charges on credit card balances are very high, and if not controlled, outstanding balances may feed on themselves.

According to the Federal Reserve, the average American cardholder has a credit card balance of more than $5,000.

One can attempt to shop without the intention of using credit at all or only pay the due amount in full each month. Specialize it, bargain it out, then solemnly eliminate it.

- Luxury Goods

Most of the appearing luxuries are customary to be worthless and reduce in value within a short period. Other than, of course, being new and shiny, they could be more practical.

Yes, of course, a pair of old Untouched Air Jordans from 1980 would easily be sold for many times the price one paid for them at the store, but generally, luxury items depreciate.

The idea of luxury can be good if one can seek to afford it. However, borrowing for the purchase will divert you from this track.

- Payday and Title Loans

These loans are known as ultra-short-term, which are likely to cover a small budget shortage that a user is experiencing before payroll.

Thus, if one is unable to repay the loan within a couple of weeks and more than 80 % of the borrowers cannot do so, as pointed out by the Consumer Financial Protection Bureau, then the interest rate spikes and makes it nearly impossible to repay the loan.

Unemployment is high, credit scores plunge, and you can be deprived of your vehicle’s title altogether. Interest rates that skyrocket in the short term and nosebleed loans are enemies of goals.

IRS Guidelines for Bad Debts

The IRS has specific regulations on how business entities should treat the bad debts for the law.

These guidelines generally focus on the following:

- Deductibility of Bad Debts

Business Bad Debts: The IRS permits businesses to use what is known as a bad debt deduction in relation to some unrecoverable amount. This includes debts that arise out of in the supply of products and services in ordinary business operations.

Non-business Bad Debts: It’s only deductible as short-term capital losses, and such losses can only be claimed in the year that the debt is deemed worthless.

- Methods of Accounting

Accrual Basis: antennae In order to be allowed to use the accrual method, businesses must meet the requirement that they report income when earned, not when received, to be entitled to a bad debt deduction. A deduction is allowed when it is ascertained that the debt cannot be recovered.

Cash Basis: The cash method permits a business to offset the bad debts that have already been incorporated in taxable income. Usually, this is less so for the identified bad debts because there is no form of income recognition until collection is made.

- Ways of Identifying Worthlessness

Accounting reflects the rule that a debt cannot be written off and hence deducted if it retains even a drop in value. Remaining balances cannot be partially written off unless the amount of money that is recoverable has been significantly precluded.

- Documentation

It must also be documented that the amount cannot be recovered by letters to the debtor or by filing a bankruptcy proceeding. This documentation helps to ensure that the IRS allows the deduction if it is not provided, the deduction will not be allowed.

- Timing of Deduction

Bad debts are usually claimed when the debt is considered to be wholly irrecoverable, regardless of the year that it was due and owing.

This paper will show how businesses should observe the following IRS guidelines to enable them correctly, deduct bad debts and avoid trouble when filing taxes.

How to Control and Minimise Bad Debts?

To reduce bad debts, conduct credit assessments, set clear policies, use proactive collections, offer early discounts, monitor credit, automate invoicing, and build strong customer relationships.

Here are a few tips for managing your bad debt expense:

Conducting a Robust Credit Assessment

By offering credit to new customers only after verifying their credit standing, you can significantly reduce the risk of bad debts.

Create Clear Credit Policies

Management should set explicit and well-documented credit policies that include credit restrictions, payment periods, and the repercussions of delayed credit repayment.

Implement a Proactive Collections Process

It’s more effective to proactively manage collections instead of reacting to defaulted payments. By preventing specific clients from receiving goods until they clear their dues, you can minimize DSO and bad debts.

Offer Early Payer Discount

To boost clients’ ability to pay promptly, consider offering early-payer discounts.

This not only provides clients with additional small savings but also encourages them to make payments earlier than the credit period, thereby increasing collections and reducing the chance of uncollectible debts.

Negotiate Payment Plans

Where customers are experiencing financial losses, encourage them to make effortless installment payments to pay back their debts.

Build Strong Relationships

Establishing close relationships with customers can foster loyalty and honesty, leading to timely payments and reduced bad debts.

Credit Monitoring

This approach involves using automated systems to ensure that customers’ credit profiles are constantly checked to establish differences in their financial situation that can lead to debt payment default.

Real-time Customer Credit Health Visibility

To reduce the incidence of bad debts, specific controls, like automatic credit checks, should be conducted regularly.

Also, control should be made to ensure that client credit limits are updated in real-time. This would stop tallying credit limits to ideological levels and minimize the chances of bad debts.

Automate Invoicing

By adopting e-invoicing, you can significantly reduce processing time compared to manual processing.

This efficient process will assist companies in receiving their money on time, thereby minimizing bad debts arising from manual invoice processing issues.

Netting

Netting is the process of eliminating the cost of products and services by setting it against amounts due from buyers.

When practiced effectively, netting can help businesses implement proper accounts receivable management, thus minimizing bad debts and helping them control their financial health.

Conclusion

In any business organization, it is expected that any firm or company that extends sales credit to its customers will occasionally experience bad debts.

Since the likelihood of being paid by these is negligible, then equities of the sales or accounts receivables must provide for bad debts.

The comparatively small balance is often estimated and built up through an allowance account, which has a reduction in accounts receivable, or a direct write-off method, which is, however, against the GAAP.

FAQs

What is An Example of a Bad Debt?

Receivables that have accrued due to direct customer’s non-payment due to their inability due to factors such as bankruptcy are bad debts.

Is Bad Debt a Current Asset?

Bad debt is not considered a current asset. It is recognized as an expense or write-off of account receivables in the balance sheet.

Is Bad Debt an Expense or Loss?

The maintenance of bad debt is a loss, and in the statement of revenue and expenses, it is labeled as “Bad Debt Expense.”