What is Process Costing?

Process costing in cost accounting is a technique for distributing production expenses to the units of output in industries where mass production of similar goods takes place. This method distributes the total cost per unit. Process costing is usually used for businesses that engage in flow production, such as chemicals, textiles, and food production companies.

There are three main methods of process costing: weighted average, first-in-first-out, and standard costing. It caters to multiple elements such as direct labor, overhead costs, work-in-progress, etc. Process costing is very useful for organizations as it helps in financial reporting, cost control, inventory management, etc.

Why Use Process Costing?

Process costing is an effective method for tracking product costs in several industries where the individual units of output are uniform and have relatively low value, such as reams of paper or bottles of soda. In these cases, it’s impractical or challenging to trace production costs for every individual unit. Instead, the cost of goods manufactured (COGM) is calculated using process costing which is typically reported on the income statement.

- Monitor Profit Margins

For industries that operate with high sales volumes and narrow profit margins, even a small change in process costs can significantly impact a company’s profitability. Process costing enables companies to analyze the cost of each production stage and identify specific departments for improvement that allows them to optimize their operations and maintain healthy profit margins.

- Inventory Control

Depending on the type of business, companies may require to report inventory to the IRS for tax purposes. Inventory can be a challenging task for large companies that produces thousands or even millions of products. However, process costing simplifies inventory reporting by assigning a value to each item produced and tracking materials purchased in each department.

- Uniformity in Reporting

With process costing, each department tracks its own costs, which are then consolidated to determine the overall cost of producing a specific number of items. Because all expenses must be added together, they need to be reported consistently using the same cost codes across departments. This uniformity in reporting makes it easier to track costs over time and ensures that financial statements are accurate and reliable.

Examples of Process Costing

Process costing is most appropriate for factories that engage in a steady production of goods, and the items produced are not easily distinguishable from each other.

Here are some examples where process costing is commonly used:

- Chemical Manufacturing: Chemical companies, fertilizer manufacturers, and paint-making industries use process costing as most of these products are produced in a continuous flow and are similar.

- Textile Industries: Process costing is most frequently used within the large-scale manufacturing industries of fabrics and garments since it makes sense to distribute the costs of production activities such as spinning, weaving, dyeing, and finishing.

- Food and Beverage Production: Process costing is suitable for the food and beverage company that prepares canned goods, beverages, and snack foods, for instance, where the items are standard measures of quality throughout.

- Pharmaceuticals: Pharmaceutical firms apply process costing to produce drugs and medicines on a large scale, and the products tend to be homogeneous.

- Oil Refining: The oil refining industry involves transforming crude oil into final consumer goods through a series of closely connected production steps, such as cracking and catalytic reforming.

- Paper Manufacturing: In this industry, large rolls of paper are used as raw material and undergo several stages of processing, ending up in different products. Therefore, process costing is useful in paper manufacturing.

- Plastic and Rubber Industries: Process costing is applied in companies that manufacture sub-items or items like plastics, rubber, etc., where the costs have to be apportioned across molding, shaping, and even finishing processes.

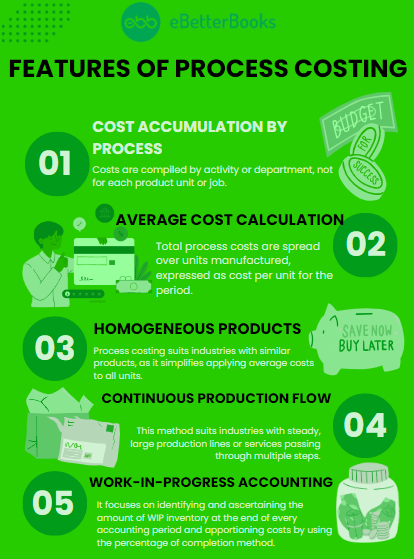

Features of Process Costing

Here are five key features of process costing:

- Cost Accumulation by Process: The costs are compiled for every activity or even department rather than for each unit of product or job.

- Average Cost Calculation: The total costs involved in each of the processes mentioned above are spread out over the total number of units manufactured for the period under consideration and expressed in cost per unit.

- Homogeneous Products: Process costing is normally used in industries that deal with similar products since it is easier to apply average costs to all units.

- Continuous Production Flow: This method is appropriate in organizations or industries that have a steady and large production line or flow of services that go through one or several steps.

- Work-in-Progress Accounting: It focuses on identifying and ascertaining the amount of WIP inventory at the end of every accounting period and apportioning costs by using the percentage of completion method.

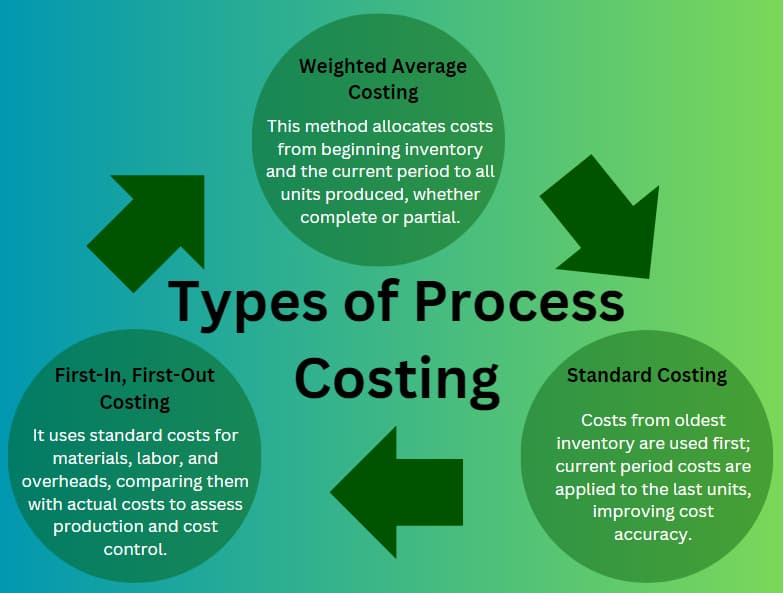

Types of Process Costing

Here are three types of process costing:

- Weighted Average Costing: This method brings the costs of the beginning inventory and costs of the current period to a middle point and allocates the amounts thus obtained to all units produced within the period, whether fully produced at the end of the period or partially.

- First-In, First-Out Costing: This means that the costs of products from the oldest inventory are charged first in the production of the initial units. In contrast, the costs of products from the current period are charged at the end of the production period and attached to the last units produced.Therefore, it is more accurate in estimating current product costs.

- Standard Costing: It involves using standard, expected, or ideal costs of materials, workforce, labor, and overheads, which are compared with the actual costs. It means identifying the differences between the expected cost and the actual cost to review production control and cost control.

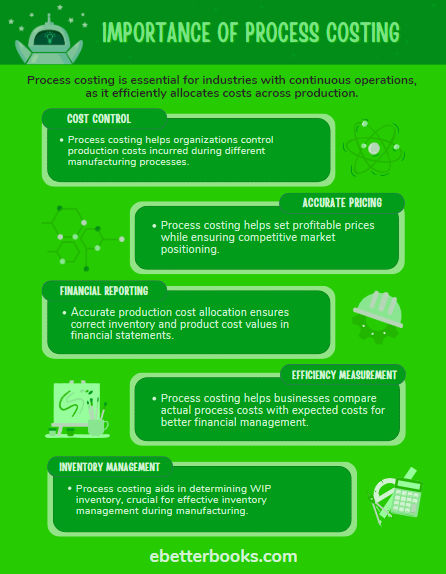

Importance of Process Costing

The relevance of process costing in cost accounting can be understood from the fact that it helps in spreading out the costs to industries whose operations are characterized by a continuous flow.

Here’s why it’s essential:

- Cost Control: Process costing enables organizations to control the various costs of production, which include the costs incurred in the various manufacturing processes.

- Accurate Pricing: Process costing helps to determine the right prices for the product so that the company can gain profit while still being able to compete favorably in the market.

- Financial Reporting: Extensive importance should be given to allocating the actual production costs since inventories, and the cost of products sold should be credited with the right values in the financial statements.

- Efficiency Measurement: Process costing assists the business in knowing the actual cost implications of each process carried out within the company and comparing it with the expected cost.

- Inventory Management: The method is useful in that it allows for the determination of WIP inventory, which is vital as a strategy for managing inventories during the manufacturing process.

5 Steps of Process Costing

Here are the five main steps in process costing:

- Accumulate Production Costs: Calculation of all expenses linked to the creation of products in a specific period, at the process or division level, including direct materials, direct labor, and overhead.

- Assign Costs to Processes: Disburse the costs collected and credit each of the processes or departments engaged in the production in accordance with the level of expense incurred for every part of the production line.

- Calculate Equivalent Units: Find the equivalent units of production using the proportion that emphasizes the amount of production completed prior to the end of the period and the work in progress that was only partly complete. For instance, if there are 3,000 units of inventory still in progress and they’re 75% complete, they are equivalent to 2,250 units for process costing purposes (3,000 x .75 – 2,250).

- Compute Cost per Unit: The expenses incurred in each process should be divided by the equivalent units produced to arrive at the cost per equivalent unit in every stage of the process.

- Assign Costs to Finished Products and WIP: Allocate the cost per equivalent unit to the completion of the actual units of the finished goods. WIP accounts for the rest of the uncompleted production, which helps give the actual cost that should be attributed to the respective products and inventories.

Solved Example of Process Costing

Scenario:

A company produces fruit juice in a single production process.

The Data for July is as Follows:

Beginning Work-in-Progress (WIP)

Units: 100 liters (40% complete)

Costs: $300

Costs Added During the Month:

Direct Materials: $600

Direct Labor: $200

Overhead: $100

Units Completed and Transferred Out: 800 liters

Ending WIP: 200 liters (50% complete)

Step 1: Accumulate Production Costs

Beginning WIP costs: $300

Costs added during the month: $600 (Materials) + $200 (Labor) + $100 (Overhead) = $900

Total Costs: $300 + $900 = $1,200

Step 2: Assign Costs to Processes

The total cost of $1,200 is accumulated in the single production process.

Step 3: Calculate Equivalent Units

Equivalent units for completed units: 800 liters (since they are 100% complete)

Equivalent units for ending WIP: 200 liters × 50% completion = 100 equivalent units

Total Equivalent Units: 800 + 100 = 900 units

Step 4: Compute Cost per Unit

Cost per Unit: $1,200 (Total Costs) ÷ 900 (Total Equivalent Units) = $1.33 per liter

Step 5: Assign Costs to Finished Products and WIP

Cost assigned to completed units: 800 liters × $1.33 = $1,064

The cost assigned to ending WIP: 100 equivalent units × $1.33 = $133

Summary

Total Cost for Completed Units: $1,064

Total Cost for Ending WIP: $133

Elements of Process Costing

Elements of process costing are specifically identified as relevant for reporting and assigning costs in production.

They include:

- Direct Materials: This involves the actual input materials added during the production of the goods. As in process costing, the cost of material is first matched and then apportioned to the number of completed units.

- Direct Labor: Remuneration of employees whereby only the wages and salaries of those employed whose primary working involves the production of the goods will be considered here. It is calculated by identifying the direct labor costs for each department or process concerned and dividing these by the number of units of production.

- Overhead Costs: Those costs that are incurred in the course of producing a certain commodity but cannot be clearly attributed to it. Overhead relates to the other recurring expenses that are incurred during the management of the business, including electricity bills, depreciation of equipment, and salaries of supervisors.

- Work-In-Progress Inventory: The amount of money tied up in inventories of WIPs at different levels of production. The WIP inventory is accounted for and stated according to the relative progress of the production units.

- Equivalent Units: This is one tool used to apportion costs between fully finished goods and partially finished goods or inventory. Equivalent units are directly related to the amount of work carried out and partially completed items to the extent that they could have produced fully formed goods.

These elements assist in making specific guarantees that cost is well observed, charged, and stated across the production cycle.

Pros and Cons of Process Costing

Pros of Process Costing

- Efficiency in Cost Allocation: Process costing helps ease the process of cost assignment in industries where products are produced in large quantities and are similar.

- Cost Averaging: It offers a rather simpler approach to sinking the cost of production across all the units within a facility and, therefore, has a positive impact on the way the costs are reported across all units.

- Suitable for Mass Production: Recommended for industries that deal with large numbers of standardized items, such as chemical and textile industries, in which items are usually manufactured in a similar manner.

Cons of Process Costing

- Less Accurate for Diverse Products: Unsuitable for large-scale operations such as industries dealing with numerous products/styles or taking custom orders as it smoothes the costs across all products or units may not truly represent each product’s cost.

- Difficulty Tracking Specific Costs: Costing methodology may sometimes make it difficult to see where exactly a certain amount was used or to attribute an amount to a certain product or process, which could result in issues of variability in costing.

- Complexity in Work-in-Progress (WIP) Valuation: Costing WIP inventory is often a difficult task, mainly due to identifying the level of completion and thus costing it.

Process Costing vs. Job Costing

Process costing and job costing are two different methods of cost accounting.

Here are the major differences between the two:

| Basis | Process Costing | Job Costing |

| Purpose | This method of production suits industries with large production sizes with less product differentiation. | This method of production is suitable for industries with high product differentiation and various production processes. |

| Type of Product | Standardized product | Customized product |

| Cost Reduction | There is a high scope for cost reduction as the production size changes | There is less scope for cost reduction as every product has its production cycle. |

| Examples | Pharmaceuticals, Food and Beverages, Chemicals, etc. | Consulting Services, Interior Decoration, Advertising Agency, etc. |

Conclusion

Process costing is very helpful in industries where there is continuous production of a homogeneous product, as it provides a quick method to spread the costs over a large number of units. They make financial reporting and cost control easier in Industries such as chemicals and food processing industries where the numbers are large. This, however, might be inefficient, especially if the business is in a complex production line with diversified or customized products where, through job costing, costs are better estimated and controlled. This knowledge allows me to choose the proper cost management strategy that is suitable for the business.

FAQs!

What is Process Costing?

Process costing is an accounting method used to determine the cost of production at each stage or process in industries that produce large quantities of similar or identical products.

What are Equivalent Units in Process Costing?

Equivalent units represent the number of units that would have been completed if the work-in-progress inventory had been finished.

What are the Key Steps in Process Costing?

The key steps in process costing include:

- Accumulating total production costs (beginning WIP costs + new costs).

- Calculating equivalent units for both completed and in-process units.

- Computing the cost per unit.

Can Process Costing be Applied to all Industries?

No, process costing is most suitable for industries that mass-produce similar or identical products.