The cost of sales is often considered one of the primary costs that affect sales revenue and is critical in the financial management of organizations of different types and scales.

Cost of sales is used to determine how much is spent producing a syllable item. With an actual number in the cost of sales, the company can make many decisions, whether in terms of budgeting, taxation, or even general analysis of the company’s overall financial health.

What is the Cost of Sales?

In simple words, the cost of sales is when you add Administrative or Office overheads, cost of production, and selling and distribution overhead to the Cost of Goods Sold (COGS).

Important Note: Cost of Goods Sold (COGS) is not Cost of Sales (COS)

Although these terms are often used interchangeably, there is a significant difference between these two terms. COGS specifically refers to the direct costs related to producing goods or obtaining inventory that has been sold during a particular period. On the other hand, COS includes the direct cost of goods sold and other costs that are directly related to generating revenue, such as direct labor and direct overhead. Essentially, COS contains a broader range of expenses than COGS, as it may include additional costs associated with delivering the product or service to the customer.

Key Components of the Cost of Sales

The cost of sales is defined as the key concept in accounting that helps businesses decide the profit based on the expenditure in producing and delivering the products to customers.

It has two key components, and that is:

- Direct Costs: As the name indicates, these costs include all expenses directly linked to the production of goods or services. They involve costs connected to raw materials, labor, and manufacturing overhead. For instance, the cost of the raw materials used in a product, the wages of the workers involved in its production, and the electricity used in the manufacturing process are all direct costs.

- Indirect Costs: Sometimes, certain indirect costs are also related to the production process, and that’s why they are added to the cost of sales. These costs include administrative expenses, shipping expenses, quality control expenses, and many more.

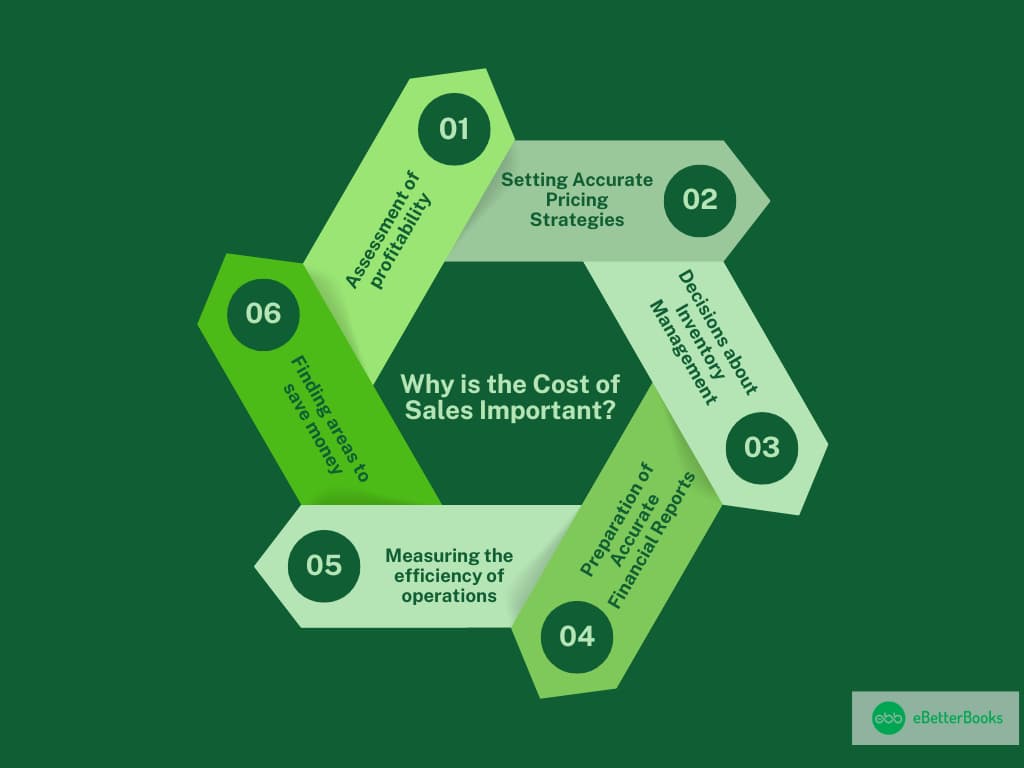

Why is the Cost of Sales Important?

For businesses, cost of sales (COS) is an important financial metric as it provides detailed information on many aspects of operations. Businesses can depend on this metric to make well-informed decisions and achieve financial success. Moreover, it also helps in assessing many things, such as setting the right price for products to ensure profitability, understanding the profit margin, managing inventory levels to avoid overstock or stockouts, and more.

Mentioned below are some reasons behind the importance of COS:

- Assessment of profitability: Profit is evaluated based on the revenue left after accounting for the costs related to producing or procuring goods or services. This is why the cost of sales is considered a critical indicator of a company’s profitability. It also tells how efficiently a company is converting revenue into profit.

- Setting Accurate Pricing Strategies: A business might fail to set a relevant pricing strategy if it lacks knowledge of the cost of sales (COS). When a business lacks any idea about COS, it might charge prices that are either too low or too high, which results in a lack of competitiveness.

- Decisions about Inventory Management: The cost of sales is important for a business to follow and monitor the value of inventory at the beginning and end of the accounting period. This calculation is very important in making tough decisions about stock levels, orders, and inventory replenishments.

- Preparation of Accurate Financial Reports: COS is a line item in the statement of financial expenses and the income statement. It is pivotal to preparing an income statement and providing an overall outlook of the organization’s revenues and expenditures. Mistrust with key stakeholders may arise if the business does not have COS information to follow accounting standards.

- Measuring operations efficiency: Gross profit margin is usually measured in relation to COS. A higher profit value demonstrates that a company is doing a good job controlling direct costs. On the other hand, a lower profit value depicts a need for control.

- Finding areas to save money: When a cost of sales calculation is available, it becomes easier for a business to save costs in an organization. The COS information can be used to develop strategies for reducing production costs and boosting the company’s profitability.

How to Calculate Cost of Sales?

Understanding the Use of Cost of Sales

- Beginning Inventory: It is the total value of goods available for sale at the start of the accounting period. This includes all unsold items carried over from previous periods that reflects the cost of inventory on hand.

- Purchases Made: This component accounts for the cost of additional inventory acquired during the accounting period. It includes expenses related to raw materials, finished goods, and components essential for production that contribute to the overall inventory available for sale.

- Ending Inventory: Ending inventory represents the total value of unsold goods at the conclusion of the accounting period. It consists of all items that remain in stock and have not been sold, which indicates the cost tied up in unsold inventory.

To determine the cost of sales, subtract the ending inventory from the sum of the beginning inventory and purchases made. This calculation clearly shows the direct costs associated with generating revenue during that period.

Formula to Calculate Cost of Sales

Cost of Sales = Beginning stocks + Purchases – Ending stocks

We are fully aware of the basic cost of sales formula that can enable us to arrive at the total cost of sales.

For instance, if a company’s inventory amounts to $30,000 at the beginning of a month, it then spends roughly $10,000 on wages for the acquisition of raw products and delivery services. It realizes $18,000 worth of inventory by the end of the month, so the cost of sales during the month can be arrived at using the cost of sales formula.

As we know,

Cost of Sales = (Beginning Inventory + Purchases) – Ending Inventory

So,

Cost of Sales = (30,000 + 10,000) – 18,000 = 22,000

However, to accurately calculate the total cost of sales, a company must gather the following information:

- Determine the total quantity of direct materials required for the items intended for sale

- Assess the total expenses incurred for acquiring and maintaining inventory available for sale

- Include all direct labor costs, such as wages and salaries, paid to personnel involved in the selling process

- Ensure that all sales data is recorded within the designated accounting period to facilitate accurate reporting of the company’s financial performance

- Calculate net sales by subtracting returns, allowances, and discounts from gross sales

- Divide the gross margin by net sales to determine the gross margin percentage associated with revenue generation

What Should Be Included in a Cost of Sales Calculation?

One of the most crucial considerations when calculating the cost of sales is determining which costs should be included and which should be excluded. A key guideline is that if stopping payment for a particular expense does not hinder your ability to produce goods or provide services, that cost should not be part of the cost-of-sales calculation. Conversely, if omitting a specific expense would prevent production altogether, it must be included.

Here are some key expenses that should be factored into your cost of sales calculation:

- Any software licenses required for production or service delivery should be included.

- Costs associated with materials and resources that are essential to the production process must be accounted for.

- The expenses related to packaging products for sale should also be included.

- Any costs incurred for storing products or materials before they are sold need to be factored in.

- Salaries and wages for employees directly involved in the production or delivery of both tangible and intangible products are essential components of the cost of sales.

You can provide a more accurate and effective cost of sales calculation by carefully evaluating these expenses.

What should not be Included in the cost of sales calculation?

The specific items excluded from the cost of sales calculation varies depending on the unique characteristics of each business. Factors such as the type of business structure and the products being manufactured determine what is excluded.

However, there are some general guidelines for expenses that are typically not apart of the cost of sales:

- Costs that are not directly or indirectly related to the production process should be excluded from the cost of sales. This can include overhead costs, administrative expenses, and other operating costs not tied to manufacturing.

- Expenses incurred for upselling products or services to existing customers are not considered part of the cost of sales. These costs are more closely associated with sales and marketing efforts.

- Salaries, commissions, and other compensation paid to sales personnel are not included in the cost of sales.

- General expenses recorded in the sales and marketing department, such as advertising, promotions, and trade shows, are not part of the cost of sales.

- Some overhead costs, such as rent, utilities, and insurance for non-production facilities, are not included in the cost of sales calculation.

- Expenses incurred for research, development, and innovation of new products are not part of the cost of sales.

The cost of sales figure provides a more accurate representation of the direct costs associated with producing the goods sold by excluding these types of expenses.

Cost of Sales Examples

Some of the examples of cost of sales are mentioned below:

- Manufacturing: To understand cost of sales or COGS, a manufacturer sums up all the manufacturing costs that a firm incurs to produce goods. This can entail the sum of wages paid to the production staff, the cost of raw materials, or anything acquired that goes into product manufacturing.

After understanding a manufacturer’s cost of sales, it becomes possible to find out how much consumers are willing to pay for the products and how this manufacturer can price their products to enable them to achieve the maximum value worthwhile while at the same time making profits.

- Small Business: If a small business buys goods from a wholesaler, puts its stamp on the goods, and redistributes the product, then the expense of sales could be arrived at by totaling the purchase price of the product to other expenses made on the product to enable it to be sold. For instance, the cost of sales of a small business can be defined as the purchasing costs for inventory as well as the shipping costs of the received goods from the suppliers. Additionally, costs such as customization and repackaging of received units might be included in the relevant calculations made by a certain business.

- E-commerce and retail: In a retail or e-commerce business, inventory is bought from a wholesaler or directly from the manufacturer with the intent of reselling to the final consumers in a retail store or on the Internet. Sales expenses comprise the purchase cost, warehousing costs, and transportation costs of products to the final customer.

Cost of Sales VS Operating Expenses

Cost of Sales is very different from operating expenses, as it covers all the costs that are directly related to the production of goods and services. General operating expenses cover all the costs that are not directly related to the production of goods or services, but still, they are required to keep the company running.

Some examples of operating expenses are:

- SG&A (Selling, General, and Administrative Expenses): Overhead costs that are not directly related to production.

- Rent: Office space or warehouse space to store finished goods. Rent for a factory or production facility is considered the cost of sales expenses.

- Utilities: All utility expenses which are not directly related to production.

- Sales & Marketing: Advertising costs and base salary for the sales and marketing personnel.

- R&D (Research & Development): Trying out expenses for future product improvements.

Cost of Sales VS Cost of Revenue

A company’s cost of revenue is the same but not the same as the company’s cost of sales or cost of goods sold. The cost of revenue adds the total cost of manufacturing the product or service and also any distribution and marketing costs. Some companies use the cost of sales or the cost of goods sold, while other companies use the cost of revenue. This choice might change some expenses to and from the operating expenses menu of a company’s income statement.

Some example of the cost of revenue is mentioned below:

- Shipping costs

- Cost of sales

- Commissions

- Warranties

- Return

- Discounts

- Other direct costs

How to Minimize Your Cost of Sales?

The reason for minimizing your cost of sales is to increase the overall profitability of your business. The less cost invested in producing the sales, the better your profit margins get.

Below mentioned are some ways through which you can minimize the cost of sales:

1. Automate Manual Processes

Automation will lower the cost of your sales and increase the sales and productivity that will support your business’s growth. Around 30% of sales tasks are automatable and utilize current technology. Some of those tasks are order management, analytics and reporting, lead identification, and sales and operations planning.

Analyze your entire sales chain to recognize areas that will help you from automation. You can implement chatbots to generate leads, maximize your sales, and free up your sales team’s time.

Chatbot Technology will offer major benefits to both your business and your customers.

Analytic tools can be used to maximize customer acquisition and involvement, make a more personalized customer experience, and decrease customer churn.

2. Reduce Waste

Search for opportunities to decrease physical waste and inefficiencies in your production processes. This will include raw material waste, damaged or stolen goods, and shrinkage.

If you think your material waste is high, look for ways to redesign your manufacturing process to reduce it. Operational time loss or delay in the shipping process can affect your sales cost.

Search for waste in all the links of your supply chain. Reduce waste inputs through the application of lean manufacturing, where waste can be characterized.

3. Remove Unnecessary Product Features

Altering the ingredients, components, or materials used in rendering the company’s products may impact the particular costs of sales.

A point to note when you are deciding to eliminate features as a means of cutting cost is which features are those you are being stripped of that your customers will not care about.

Investigate the need for consumers’ satisfaction with your products or services. What attributes and values do they seek? Is it low cost, or possesses some functions that are peculiar in some manner, or is it of high quality?

Knowing which product attributes are valuable to the customer would enable you to reduce those aspects that they do not find useful.

4. Leverage Suppliers

Have a conversation with your suppliers about better prices or discounts on bulk purchases. By leveraging suppliers, you can take advantage of economies of scale, which provide cost savings proportionate to maximizing production or sales.

To avoid compromising on the gains made through economies of scale, the following considerations should be made: Any cost advantage achieved through bulk purchases of inventory should not be wiped out by the increased costs of storage or the cost of holding inventory in large quantities.

It is also possible to negotiate with suppliers to improve the purchase order cycles to reduce inventory lead times. This helps you place small orders and occasionally lower the quantities of stocks you have to keep.

The cost of sales is the direct cost of producing a good, including all the expenses of the materials and labor used in producing the good. It’s a key metric that has a direct impact on a company’s profit. For businesses, it is crucial to manage their Cost of Sales to achieve higher profits. If your company has the potential to reduce the COS through more production process efficiency, it will surely become more profitable.