What is Capital Gains?

Capital gains represent the increased value of an asset when it is sold. These gains are generally associated with investments such as stocks & funds, bonds, real estate, or something purchased for personal use like furniture or vehicles. It occurs when you sell an asset at higher prices than what you originally paid for.

The entire value earned from selling a capital asset is considered taxable income. To be eligible for taxation during a financial year, the transfer of a capital asset should take place in the previous fiscal year. When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss.

Capital gains are realized when you sell a capital asset by subtracting the original purchase price from the sale price. According to the Income Tax Act, assets received as gifts or by inheritance are exempted in the calculation of income for an individual.

Buildings, lands, houses, vehicles, mutual funds, and jewelry are a few examples of capital assets. Also, the rights of management or legal rights over any company will be considered capital assets.

Example of Capital Gains

The profit earned on the sale of an asset that has increased in value while it was owned. For example, if you purchased 200 shares of Amazon (AMZN) stock on January 30, 2020, at $500 per share. You then decided to sell all the shares on Jan 30, 2024, at $950 each. Assuming there were no fees associated with the sale, you realized a capital gain of $45,000.

Here’s how: [($500 x 100) – ($950 x 100)] = $45,000.

Capital Gain vs Capital Erosion

Any profit or gain that arises from the sale of a ‘capital asset’ is known as income from capital gains. These gains are typically realized at the time that the asset is sold and include the type of investments, such as stocks, bonds, real estate, shares funds, etc. Almost everything someone owns and uses for personal or investment purposes is a capital asset.

On the other hand, capital erosion is a term that refers to the loss of value or purchasing power of an asset or investment over time. It can be caused by various factors, including inflation, depreciation, taxes, fees, market fluctuations, or poor performance.

Capital erosion can have a significant impact on the financial health and goals of individuals, businesses, and governments. It can reduce the income, savings, and wealth of investors, as well as the capital available for reinvestment, growth, and development. Hence, it is important to avoid or minimize capital erosion if you have long-term financial goals.

Types of Capital Gain

Depending on the tenure of holding an asset, capital gains can be broadly categorized into the following types:

Short-Term Capital Gain

If an asset is sold within one year or less, then the profits earned from it are known as short-term capital gains. However, tenure varies in the case of different assets. For mutual funds and listed shares, Long-term capital gain happens if an asset is sold after being held back for one year.

Long-Term Capital Gain

The profit earned by selling an asset that you’ve held for more than one year is known as long-term capital gains. Capital assets such as land, buildings, and house property shall be considered long-term capital assets if the owner holds them for a period of 24 months or more (from FY 2017-18). However, it is not applicable for movable assets such as jewellery, debt-oriented mutual funds, etc.

The federal tax rate for your long-term capital gains depends on where your taxable income falls in relation to three cut-off points, as outlined below:

Long-term Capital Gains Tax Rates for 2024

| Filing Status | Taxed at 0% | Taxed at 15% | Taxed at 20% |

| Single | Up to $47,025 | More than $47,025 but less than or equal to $518,900 | Over $518,000 |

| Married filing jointly and surviving spouse | Up to $94,050 | More than $94,050 but less than or equal to $583,750 | Over $518,000 |

| Married filing separately | Up to $47,025 | More than $47,025 but less than or equal to $291,850 | Over $291,850 |

| Head of Household | Up to $63,000 | More than $63,000 but less than or equal to $551,350 | Over $551,350 |

Current Holding Period Rules – Short – term vs Long – term Capital Gains

| Type of Asset | Holding Period for STCG | Holding Period for LTCG |

| Listed Equity Shares | 12 months or less | More than 12 months |

| Unlisted equity shares (including foreign shares) | 24 months or less | More than 24 months |

| Equity-oriented mutual fund units | 12 months or less | More than 12 months |

| Debt-oriented mutual funds | 36 months or less | More than 36 months |

| Immovable Assets (i.e.house, land, and building) | 24 months or less | More than 24 months |

| Moveable Assets (such as gold, silver, paintings, etc.) | 36 months or less | More than 36 months |

Budget 2024 New Tax Rates – Short – term vs. Long – term Capital Gains

| Type of Asset | STCG Tax Rate | LTCG Tax Rate |

| Listed Equity Shares | 20% | 12.5% (no indexation benefit; exempted up to Rs. 1.25 lakh in an FY) |

| Unlisted equity shares (including foreign shares) | Income tax slab rate applicable to taxpayer income | 12.5% (without any benefit of indexation) |

| Equity-oriented mutual funds units | 20% | 12.5% (no indexation benefit; exempted up to Rs. 1.25 lakh in an FY) |

| Debt-oriented mutual funds | Income tax slab rate applicable to taxpayer income | 20% after indexation |

| Immovable Assets (i.e.house, land, and building) | Income tax slab rate applicable to taxpayer income | 12.5% (without any benefit of indexation) |

| Moveable Assets (such as gold, silver, paintings, etc.) | Income tax slab rate applicable to taxpayer income | 12.5% (without any benefit of indexation) |

Assets to Invest for Capital Gain

Not all investments are eligible for the lower rates. The following are some assets that are and are not eligible.

| Eligible Assets | Not Eligible |

| Stocks | Business inventory |

| Bonds | Depreciable Business Property |

| Jewelry | Real estate used by your business or as a rental property |

| Cryptocurrency (including NFTs) | Copyrights, Patents, and Inventions |

| Homes and Household furnishings | Literary or Artistic Compositions |

| Vehicles | |

| Collectibles | |

| Timber | |

| Fine artworks |

The following are not included under capital assets;

- Any stock, consumables, or raw materials that are held for the purpose of business or profession.

- Personal goods such as clothes or furniture that are held for personal use.

- Land for agriculture in any part of rural India.

- Special bearer bonds that were issued in 1991.

- Gold bonds issued by the Central Government, such as the 6.5% gold bonds of 1977, 7% gold bonds of 1980, and national defense gold bonds of 1980.

- Gold deposit bonds were issued under the Gold Deposit Scheme (1999), and deposit certificates were issued under the Gold Monetisation Scheme (2015) and Gold Monetisation Scheme (2019), which were introduced by the Central Government.

Calculation of Capital Gains

The calculations of capital gains depend on the type of assets and their holding period. A few terms that an individual must know before calculating gains against their capital investments are here as follows:

- Full Value Consideration: The consideration received or to be received by the seller as a result of the transfer of his capital assets. Capital gains are chargeable to tax in the year of transfer, even if no consideration has been received.

- Cost of Acquisition: The cost of acquisition is the value of an asset when a seller acquires it.

- Cost of Improvement: The cost of improvement is the amount of expenses incurred by a seller in making any additions or alterations to a capital asset.

Calculate Short-term Capital Gains

Step 1: Start with the full value of consideration

Step 2: Deduct the following:

- Total Expenditure incurred concerning the transfer of ownership

- Cost of acquisition

- Cost of improvement

Step 3: From this resulting number, deduct exemptions provided under sections 54B/54D.

Step 4: The remaining amount is your short-term capital gain, which will be taxed

Calculate Long-Term Capital Gains

Step 1: Start with the full value of consideration

Step 2: Deduct the following:

- Expenses related to transfer such as commission, brokerage, etc.

- Indexed cost of acquisition

- Indexed cost of improvement

Step 3: From this resulting number, deduct exemptions provided under sections 54, 54D, 54EC, 54F, and 54B.

Step 4: The remaining amount is your long-term capital gain which will be taxed.

Capital Gains and Mutual Funds

In mutual funds, capital gains refer to the gains that are achieved when the fund has proceeded to appreciate through the rise in worth of its hold in undertakings.

These gains can result from two scenarios:

When You Sell Mutual Fund Units

- Short-Term Capital Gains (STCG): If you dispose of mutual fund units within a short holding period, this profit is considered short-term (for instance, if the time held was less than 12 months for equity funds.

- Long-Term Capital Gains (LTCG): If you dispose of units after a longer holding period, say over 12 months, in equity funds, the profit you earn is categorized as long-term profit.

When the Fund Distributes Gains

Some of the securities that form a basket of mutual funds may be offloaded at a gain. The above increases are paid to shareholders as capital gain distributions, which are taxable even when the distributions are reinvested.

Taxation on Mutual Fund Capital Gains

- Equity-Oriented Funds: Short-term Capital Gain is taxed at a higher rate than Long-Term Capital Gain; the latter normally enjoys a lower tax rate or is free up to a certain amount.

- Debt-Oriented Funds: Normally, STCG is taxed at the income tax rate applicable to investors, while LTCG may attract indexation to adjust for inflation.

Check more specific tax values and allowances at tax regulations in your country of residence.

Capital Gains Tax – An Overview

When stock shares or any other taxable investment assets are sold, the capital gains, or profits, are referred to as having been realized. The tax doesn’t apply to unsold investments or unrealized capital gains. Stock shares will not incur taxes until they are sold, no matter how long the shares are held or how much they increase in value.

Short-term gains occur on assets held for one year or less as these gains are taxed as ordinary income based on the individual’s tax filing status and adjusted gross income (AGI). On the other hand, long-term capital gains are taxed at a lower rate than regular income.

Under current U.S. federal tax policy, the capital gains tax rate applies only to profits from the sale of assets held for more than a year, referred to as long-term capital gains. The current rates are 0%, 15%, or 20%, depending on the taxpayer’s tax bracket for that year.

Many taxpayers pay a higher rate on their income than on any long-term capital gains they may have realized. This gives them a financial incentive to hold investments for at least a year, after which the tax on the profit will be lower.

Day traders and others taking advantage of the ease and speed of trading online need to be aware that any profits they make from buying and selling assets held less than a year are not just taxed—they are taxed at a higher rate than assets that are held long-term. If the investor owns the profits of any investment for more than one year, long-term capital gains tax applies. However, if the investor owns the investment for one year or less, short-term capital gains tax applies.

What is Capital Gains Tax?

Capital Gain Tax is a tax charged on profit derived from selling an asset that has risen in value. It is only charged on the gain (profit), not the entire sale price. The tax arises when an asset is sold for a price greater than its initial purchase price, and the rate at which it applies depends on elements such as the holding period, asset type, and the income level of the taxpayer.

The tax is levied on a broad array of assets, including:

Gains from selling securities or shares.

Profit from selling property (other than primary residence exceptions).

Selling a business for a profit incurs CGT.

Works of art, antiques, jewellery, and other precious items are taxed under CGT at special rates.

Virtual money such as Bitcoin and Ethereum are taxed like stocks.

Realized vs. Unrealized Gains

Realized gains occur when an asset is sold for a profit, triggering capital gains tax (CGT). Unrealized gains reflect value increases but remain untaxed until the asset is sold.

| Realized Gains | Unrealized Gains |

|---|---|

| Tax is levied only when an asset is disposed of. | When the value of an asset appreciates but is not sold, there is no CGT payable. |

| If you buy and sell property, stocks, or crypto at a profit, the IRS sees it as a taxable event. | Unrealized gains are only taxed when the asset is sold. |

| Example: Purchase of shares at $10,000 and subsequent sale at $15,000 creates a taxable $5,000 realized gain. | Example: If your share portfolio rises in value from $10,000 to $12,000, but you don’t sell, no CGT is payable. |

Types of Capital Gains Tax

Capital Gains Tax (CGT) is divided according to the length of time an asset is owned before it is sold. The holding period determines whether the gain is short-term or long-term, which determines the tax rate imposed.

Short-Term Capital Gains Tax

- Applied to assets owned for one year or less before selling.

- Taxed as ordinary income, so the rate is based on your income tax bracket (10% to 37%).

- No special tax rates or reduced rates are available for short-term gains.

Example: You purchase stocks for $5,000 and sell them after 6 months for $7,000. Your $2,000 gain is taxed at your ordinary income tax rate, which may be up to 37%.

Long-Term Capital Gains Tax

- Available for assets held for over one year before sale.

- Taxed at preferential rates: 0%, 15%, or 20%, based on taxable income.

- Promotes long-term investment by taxing at lower rates than short-term profits.

Example: When you purchase a property for $200,000 and sell it after 5 years for $300,000, your $100,000 gain will be taxed at a lower long-term CGT rate (15% or 20% based on your income).

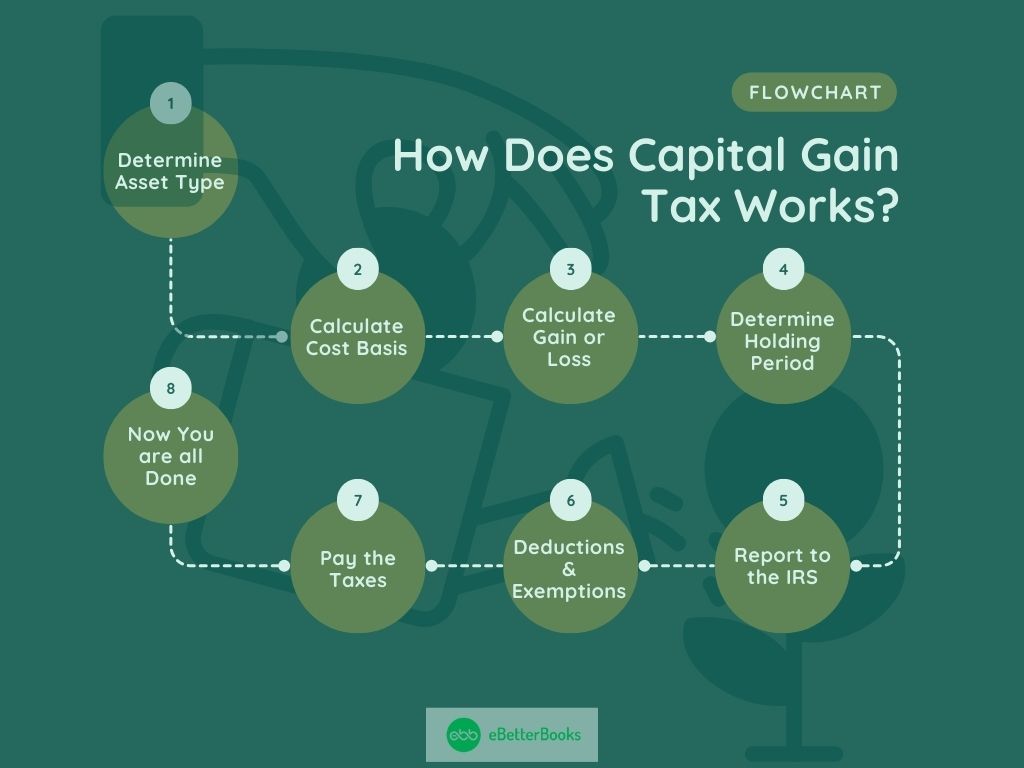

How Does Capital Gains Tax Work?

Capital Gains Tax depends on how long you own an asset and how much profit you make when you sell it.

Step-by-Step Process:

Step 1. Determine Asset Type

Decide if the asset is a share, property, cryptocurrency, or other taxable asset.

Step 2. Calculate Cost Basis

Determine the original purchase price plus associated costs (e.g., transaction fees and real estate improvements).

Step 3. Calculate Capital Gain or Loss

Subtract the purchase price from the selling price.

Step 4. Determine Holding Period

- Short-Term (Less than 1 year): Taxed at ordinary income tax rates (10%–37%).

- Long-Term (More than 1 year): Taxed at a lower CGT rate (0%, 15%, or 20%).

Step 5. Report to the IRS

- Report individual transactions with Form 8949.

- Summary of total gains and losses using Schedule D (Form 1040).

Step 6. Use Deductions & Exemptions

In real estate, offset gains from losses (tax-loss harvesting) or use exemptions, such as the primary residence exclusion.

Step 7. Pay Taxes

- The ultimate amount of tax incurred is a function of your tax bracket and the nature of an asset.

- Knowing CGT laws and planning beforehand helps the investor to cut down their taxable amount and grow profits.

2024 & 2025 Capital Gains Tax Rates (As Per IRS Guidelines)

Capital gains tax rates are renewed every year by the IRS with inflation-adjusted income levels. The following are the short-term and long-term tax rates in 2024 and estimates in 2025.

Short-Term Capital Gains Tax Rates (2024 vs. 2025)

Short-term capital gains are considered ordinary income. Hence, they obey the regular income tax brackets.

2024 Short-Term Capital Gains Tax Rates

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $11,600 | $0 – $23,200 | $0 – $11,600 | $0 – $16,550 |

| 12% | $11,600 – $47,150 | $23,200 – $94,300 | $11,600 – $47,150 | $16,550 – $63,100 |

| 22% | $47,150 – $100,525 | $94,300 – $201,050 | $47,150 – $100,525 | $63,100 – $100,500 |

| 24% | $100,525 – $191,950 | $201,050 – $383,900 | $100,525 – $191,950 | $100,500 – $191,950 |

| 32% | $191,950 – $243,725 | $383,900 – $487,450 | $191,950 – $243,725 | $191,950 – $243,700 |

| 35% | $243,725 – $609,350 | $487,450 – $731,200 | $243,725 – $365,600 | $243,700 – $609,350 |

| 37% | $609,350+ | $731,200+ | $365,600+ | $609,350+ |

2025 Short-Term Capital Gains Tax Rates

| Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

|---|---|---|---|---|

| 10% | $0 – $11,925 | $0 – $23,850 | $0 – $11,925 | $0 – $17,000 |

| 12% | $11,925 – $48,475 | $23,850 – $96,950 | $11,925 – $48,475 | $17,000 – $64,850 |

| 22% | $48,475 – $103,350 | $96,950 – $206,700 | $48,475 – $103,350 | $64,850 – $103,350 |

| 24% | $103,350 – $197,300 | $206,700 – $394,600 | $103,350 – $197,300 | $103,350 – $197,300 |

| 32% | $197,300 – $250,525 | $394,600 – $501,050 | $197,300 – $250,525 | $197,300 – $250,500 |

| 35% | $250,525 – $626,350 | $501,050 – $751,600 | $250,525 – $375,800 | $250,500 – $626,350 |

| 37% | $626,350+ | $751,600+ | $375,800+ | $626,350+ |

Long-Term Capital Gains Tax Rates (2024 vs. 2025)

Long-term capital gains are levied at lower rates on the basis of taxable income and filing status.

2024 Long-Term Capital Gains Tax Rates

| Filing Status | 0% Rate Up to | 15% Rate Range | 20% Rate Over |

|---|---|---|---|

| Single | $47,025 | $47,026 – $518,900 | $518,900 |

| Married Filing Jointly | $94,050 | $94,051 – $583,750 | $583,750 |

| Married Filing Separately | $47,025 | $47,026 – $291,850 | $291,850 |

| Head of Household | $63,000 | $63,001 – $551,350 | $551,350 |

2025 Long-Term Capital Gains Tax Rates

| Filing Status | 0% Rate Up to | 15% Rate Range | 20% Rate Over |

|---|---|---|---|

| Single | $48,350 | $48,351 – $533,400 | $533,400 |

| Married Filing Jointly | $96,700 | $96,701 – $600,050 | $600,050 |

| Married Filing Separately | $48,350 | $48,351 – $300,025 | $300,025 |

| Head of Household | $64,750 | $64,751 – $566,700 | $566,700 |

Main Changes in 2025

- Tax thresholds for tax brackets will be modified to account for inflation.

- Potential new tax guidelines on cryptocurrency and wealthy investors.

- These tax levels illustrate the merits of long-term investments, whereby more than one holding considerably lowers the tax bill.

| Note: The IRS adjusts income tax brackets annually for inflation. For the most accurate and up-to-date information, please refer to the official IRS guidelines or consult a tax professional. |

How Are Capital Gains Reported?

Proper capital gain reporting is essential to prevent penalties or IRS audits. Capital gain reporting varies depending on the asset sold and whether it incurred a gain or a loss.

IRS Forms Used in Reporting Capital Gains:

- Form 8949: Reports every capital gain or loss on the sale of assets, including stocks, real estate, and cryptocurrency trades.

- Schedule D (Form 1040): Collates the overall capital gains and losses from Form 8949.

- Form 1099-B: Provided by brokers on stock sales, showing cost basis, sale price, and taxes withheld where necessary.

- Form 1099-S: Utilized for real estate sales reporting, ensuring that property sales capital gains are reported.

Reporting Process

- Obtain Transaction Information: Document all sales transactions, including the cost basis, sale price, and sale date.

- Complete Form 8949: Document each sale and short-term or long-term designation for gains.

- Carry Forward Totals to Schedule D: Add up all gains and losses and then adjust by any offsetting such as tax-loss harvesting (utilizing losses to decrease taxable gains).

- Report on Tax Return (Form 1040): The ultimate capital gains tax obligation is determined and reported in your total tax return.

Example: You earned a $10,000 gain on the sale of stocks and a $3,000 loss on another transaction. You report a net gain of $7,000 to be taxable on Schedule D.

Special Cases & Exceptions in Capital Gains Tax

Some assets have specific tax rules that differ from the general capital gains tax rates. Knowledge of these special exceptions informs tax planning and minimizes liabilities.

Collectibles (28% Tax Rate)

- Comprises art, antiques, collectible coins, precious metals, and older wines.

- Rather than the 0%, 15%, or 20% rates of CGT, collectibles are taxed at a uniform rate of 28% if gains are made.

Example: Selling a collectible painting for $100,000 profit will be subject to 28% ($28,000 tax) rather than normal long-term CGT rates.

Real Estate & Capital Gains Tax Exemptions

Primary Residence Exclusion

- Homeowners are allowed to exclude up to $250,000 (single) or $500,000 (married) of capital gain from taxation if they qualify according to the IRS:

- Must have occupied the home for two out of the last five years.

- The home must be the primary residence.

Example: A married couple purchases a home for $300,000 and sells it for $800,000. Their $500,000 profit is tax-free with the primary residence exclusion.

1031 Exchange (Investment Properties Only)

- It permits real estate investors to postpone capital gains tax if they invest the proceeds in an equivalent property within 180 days.

- Applies only to investment properties, not primary homes.

Example: If you sell a rental property for $500,000 profit and reinvest the entire amount in another property, you won’t owe capital gains tax until you sell the new property without reinvesting.

Cryptocurrency & Capital Gains Tax

- Cryptocurrencies are considered stocks for taxation purposes.

- Short-term or long-term CGT rates apply to gains on crypto sales based on the holding period.

- Crypto trades, sales, and buys are taxable events.

Example: Buying Bitcoin for $20,000 and selling it a year later for $40,000 results in a $20,000 long-term capital gain, taxed at 0%, 15%, or 20% based on income.

If the sale happens within 6 months, the gain is taxed as ordinary income (short-term CGT rates). These special cases and exemptions allow investors and homeowners to reduce their capital gains tax liability through strategic planning.

Strategies to Reduce Capital Gains Tax Liability

Taxpayers have access to different methods that help reduce capital gains taxation and stretch out tax obligations to achieve tax-efficient investments. These methods prove to be the most successful strategies in reducing capital gains tax exposure.

Hold Investments Longer

The duration of asset ownership impacts the capital gains tax rates because assets held beyond one year trigger the 0%, 15%, or 20% rates as opposed to the higher short-term rates.

Example: The 15% capital gains tax applies to investment stock sales at age 14 months instead of the short-term tax bracket, which ranges from 22% to 37% when selling in any year less than 14 months.

Tax-Loss Harvesting

Capital losses can be utilized to reduce taxable income through the sale of underperforming assets. One can use capital losses to reduce one’s taxable income by the exact value of one’s gains.

Example: If you gain $10,000 from stocks but sell another stock at a $4,000 loss, your taxable gain is reduced to $6,000.

Use Tax-Advantaged Accounts

401(k)s and IRAs, together with Roth IRAs, enable investment assets to grow tax-free or tax-deferred. Roth IRA and IRA account holders do not need to pay capital gains taxes until they withdraw funds or indefinitely for Roth IRAs.

Utilize Exemptions & Deductions

Under the Primary Home Exclusion, real estate gains up to $250,000 for singles and $500,000 for married couples qualify for 100% tax exemption. You should give your wealth to relatives who have lower tax rates because it lowers your capital gains tax bill.

After inheriting assets from you, the beneficiary obtains a new cost basis through step-up, which eliminates their need to pay large capital gains taxes on accumulated worth.

Donate Appreciated Assets

Much like stock donations, charitable contributions of property enable taxpayers to deduct an assessed value from taxes but still prevent capital gains tax liabilities.

Example: Donating $50,000 worth of appreciated stock avoids CGT and provides a tax deduction for the same amount.

These lawful approaches enable investors to cut their tax payments, which increases their net returns.

Common Misconceptions About Capital Gains Tax

Most individuals do not understand how CGT operates, which causes them to incur additional tax responsibilities.

These myths regarding Capital Gains Tax will be debunked through these explanations:

Misconception 1: “All Assets are Taxed the Same Way.”

Tax rules operate separately for each type of property ownership, including stocks, real estate, collectibles, and crypto-assets.

Misconception 2: “Selling My Home Always Triggers CGT.”

Those who qualify with primary residence tax rules face no obligation to pay capital gains tax.

Misconception 3: “Crypto is Tax-Free Because it’s Decentralized.”

The Internal Revenue Service taxes cryptocurrency in a way similar to stocks, which creates taxable transactions for every purchase or sale.

Misconception 4: “I Can Avoid CGT by Reinvesting in Stocks.”

The Capital Gains Tax rules for real estate via 1031 exchange do not apply when you sell stocks and then buy new ones.

Taxpayers who avoid believing such misconceptions will improve their ability to develop better investment plans and tax strategies.

Capital Gain Tax Rates in Different Countries

Here’s a table to explain what is current corporate capital gain tax rate or individual capital gain tax rate is in different countries:

| Country | Headline corporate capital gains tax rate (%) | Headline individual capital gains tax rate (%) |

| United States (US) | 21% | 20% |

| United Kingdom (UK) | 25% | 10% or 18% |

| United Arab Emirates (UAE) | 9% | NA |

| Singapore | NA | NA |

| Australia | 25% | 45% |

| India | 15% or 20% | Long-term capital gain:10%Short-term capital gain:15% |

| Brazil | 15% to 22.5% | 22.5% |

| China | 25% | 20% |

| Germany | 29.9% | 25%, plus 5.5% solidarity surcharge on tax paid (in total 26.375% plus church tax if applicable) |

| France | 25% | 30%, plus exceptional income tax for high earners at 4% |

How to Avoid Capital Gains Taxes?

If you want to invest money and make a profit, you will owe capital gains taxes on that profit.

Below, we’ve listed a number of perfectly legal ways to minimize your capital gains taxes:

- Hold your investment for more than one year. Otherwise, the profit is treated as regular income, and you’ll probably pay more.

- Don’t forget that your investment losses can be deducted from your investment profits. The amount of the excess loss that you can claim to lower your income is $3,000 a year. Some investors use that fact to good effect. For example, they’ll sell a loser at the end of the year in order to have losses to offset their gains for the year. If your losses are greater than $3,000, you can carry the losses forward and deduct them from your capital gains in future years.

- Keep track of any qualifying expenses that you incur in making or maintaining your investment. They will increase the cost basis of the investment and thus reduce its taxable profit.

- Be mindful of tax-advantaged accounts. For instance, holding securities in a 401(k) or IRA may limit the liquidity you have in your investment and options to withdraw funds. However, you may have greater capabilities in buying and selling securities without incurring taxes on gains.

- Seek out exclusions. For example, if you want to sell your house, ensure you understand rules that allow you to exclude a portion of gains from the house sale. You should be careful to intentionally meet criteria if you can to plan the timing of the sale and ensure you meet exclusion requirements.

How Are Capital Gains Taxed?

Capital gains are classified into two categories: short-term or long-term, depending on the holding period. Short-term gains are defined as gains realized in securities held for one year or less and are taxed as ordinary income based on the individual’s tax filing status and adjusted gross income. Long-term gains are defined as gains realized in securities held for more than one year and are usually taxed at a lower rate than regular income.

What Is Net Capital Gain?

The IRS (Internal Revenue Service) defines a net capital gain as the amount by which net long-term capital gain (long-term capital gains minus long-term capital losses and any unused capital losses carried over from prior years) exceeds net short-term capital loss (short-term capital gain minus short-term capital loss). A net capital gain may be subject to a lower tax rate than the ordinary income tax rate.

Bottom Line!

A capital gain or loss is the difference between what you paid for a capital asset (like bonds, mutual funds, ETFs, real property, or stocks) and what you sold it for. If you sell your investment assets (for example, assets that make investment income, such as dividend-paying stocks) for more than you bought it, you’ll have a capital gain — and vice versa, if you sell the asset for less than you bought it, you’ll have a capital loss.

Capital gains are the profits that are realized by selling an investment, such as stocks, bonds, shares, or real estate. Capital gains taxes are lower than ordinary income taxes, providing tax advantages to investors over wage workers. Based on the holding term and the taxpayer’s income level, the tax is computed using the difference between the asset’s sale price and its acquisition price, and it is subject to different rates.

FAQs:

How Are Capital Gains Taxed?

Capital gains are classified into two categories: short-term or long-term, depending on the holding period. Short-term gains are defined as gains realized in securities held for one year or less and are taxed as ordinary income based on the individual’s tax filing status and adjusted gross income. Long-term gains are defined as gains realized in securities held for more than one year and are usually taxed at a lower rate than regular income.

What Is Net Capital Gain?

The IRS (Internal Revenue Service) defines a net capital gain as the amount by which net long-term capital gain (long-term capital gains minus long-term capital losses and any unused capital losses carried over from prior years) exceeds net short-term capital loss (short-term capital gain minus short-term capital loss). A net capital gain may be subject to a lower tax rate than the ordinary income tax rate.

What is the Effect of a Lower Tax Rate On Capital Gains?

This implies that the implementation of a lower tax rate for capital gains is beneficial since it allows investors to enjoy reduced tax on the profit they get from holding capital gains for longer periods. It encourages people to spend money on securities, building structures, and other forms of fixed capital machinery, leading to capital formation.

What is an Example of a Capital Gain?

If you bought a property for, say one hundred thousand dollars in cash and later sold it at a hundred and fifty thousand dollars five years later, then the capital gain was fifty thousand dollars. This would be subject to capital gains tax, and it all depends on whether it is long- or short-term.

How Much Capital Gain is Tax – Free?

The tax-free status further depends on the laws of the country. For instance, as for personal use property, US citizens are allowed to exclude up to $250,000 of capital gain from taxation ($500,000 for married people). Some profits, for instance, in retirement accounts, are known to accumulate tax-free.

Is the capital gains tax 15% or 20% in the United States?

The rate of capital gains tax varies based on your income and the duration of holding the asset. Long-term capital gains (assets held for more than one year) are taxed at 0%, 15%, or 20% depending on taxable income. Short-term gains (assets held for less than a year) are taxed at regular income tax rates (10% to 37%).

How do I avoid capital gains tax?

You can minimize or avoid CGT by:

- Holding investments for over a year to qualify for lower tax rates.

- Using tax-advantaged accounts like 401(k)s, IRAs, or Roth IRAs.

- Offsetting gains with losses through tax-loss harvesting.

- Taking advantage of real estate exclusions or 1031 exchanges.

At what age do you no longer have to pay capital gains tax?

There is no particular age when you automatically get relief from capital gains tax. However, pensioners can reduce CGT by having taxable income less than the 0% capital gains band or taking advantage of tax-efficient accounts.

What is the US capital gains rule?

The U.S. capital gains tax is imposed on gains from the sale of assets, with varying rates for short-term and long-term gains. Taxpayers are required to report gains on Form 8949 and Schedule D (Form 1040). There are special rules for real estate, collectibles, and cryptocurrency, and tax planning can minimize liabilities.