SBA 504 loans for small businesses are long-term, fixed-rate loans offering up to $5 million at variable interest rates, repayable in 10, 20, and 25 years.

In the case of some specific manufacturing projects or energy-efficient projects, the loan amount can go as high as US $ 5.5 million.

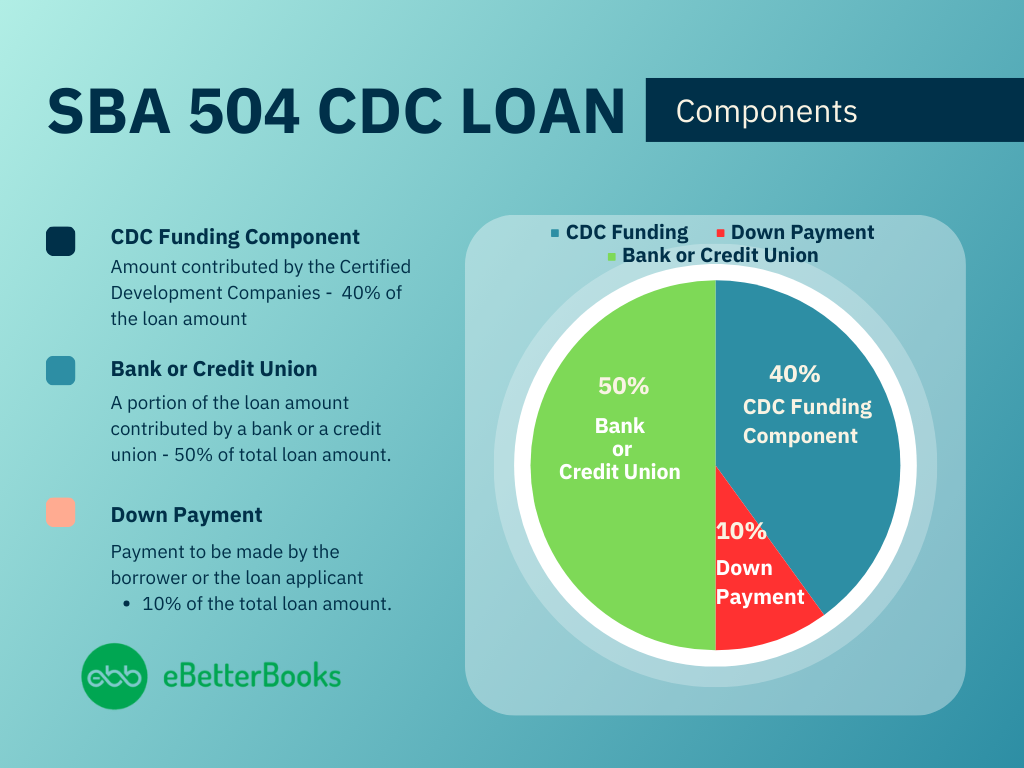

SBA 504 loans are also called the SBA 504 CDC loan program, where CDC is a certified development company. Certified development companies are nonprofit organizations that work with various banks and financial institutions for the economic development of the country.

504 SBA loan is facilitated through the US Small Business Administration.

What is Small Business Administration (SBA)?

The major role of SBA is to reduce the default risk or credit risk of a loan, thereby encouraging a lender (bank or credit union) to offer competitive rates to the borrowers. The objective of the SBA loans program is to promote business growth which further leads to job creation in the economy.

Under the SBA loans program, the SBA provides backing to the CDC portion of the loan which is funded by the sale of debentures guaranteed by the SBA.

Promoting small businesses engaged in economic activities boosts the local economy and allows small business owners to access funds at a fixed rate financing, thereby enabling them to undertake major upgrades, and also minimizing the monthly payment requirements, so that their cash flow is least affected.

A lower down payment ensures that loans are paid on time and SBA’s community-based partners can provide low-interest rate to other small business owners too in order to promote business growth.

SBA provides various types of loans like SBA Express loans, SBA 7 (a) loans, micro-loans, disaster recovery loans, etc.

How SBA 504 Loans Work?

U.S. Small Business Administration does not lend money to small business owners but provides a guarantee on the payback of the loan to SBA lenders. The guarantee is usually up to 40% of the loan amount.

The guarantee provided by SBA reduces the credit risk i.e. risk of default by the lenders. When the risk is reduced, then the lenders can provide loans at much lower interest rates as compared to traditional bank loans.

SBA 504 Loans Guarantee

The certified development companies issue 504 debentures to raise the financing. The certified development companies are nonprofits, so these debentures are backed by SBA.

An investor which can be an individual or an institution buys these 504 debentures from a certified development company providing funds for small business owners. The backing by SBA makes these investment options attractive and safe for investors.

SBA Loans – Application Process – Steps to Apply

The application process for an SBA 504 loan program begins through the CDC.

Step 1: Locate a CDC. Click this link to find the CDC near you.

Step 2: Check with the CDC if you qualify for the loan or not by submitting the following documents:

- A copy of a personal finance document that can be your personal tax return for the past 3 years.

- A summary of your personal assets and liabilities, expenses, etc., is comprised of a personal finance statement.

- Business tax return of past 3 years.

- Any interim financial document showing the financial position of the business at the time of applying for the loan.

Step 3: Identify the purpose of your loan, i.e., the eligible asset under the loan program.

You may get a quotation from the equipment seller, the service company, contractors undertaking the improvement of facilities, etc.

Step 4: Prepare a cost document for applying for equipment loans and contractor estimates for construction loans.

These quotes will help you determine the loan amount and calculate the 10% you will need to pay.

Step 5: Review your loan application before submitting it through your selected CDC. To prepare your application, visit the 504 Authorization File Library.

Step 6: Apply for your preferred CDC.

- The approval process for an SBA 504 loan generally takes around a month, and

the due diligence process itself takes up to three weeks.

Eligibility Requirements to Get an SBA 504 Loan

SBA 504 loan is not allowed for an entity engaged in speculative activities, passive activities, or a nonprofit organization.

To apply for an SBA 504 loan you must meet the following criteria:

- Should be a for-profit company in the US.

- Having a tangible net worth of less than US $15 million.

- There is no minimum credit score set by the SBA.

- For the previous 2 years before filing your application, your average net income should be less than US $5 million after paying federal income taxes.

- Having a feasible business plan.

- Falling under SBA size guideline.

- Ability to repay the loan.

- Qualified management expertise and good character.

- Any other additional criteria set by banks and credit unions.

Use or Application of SBA Loan Amount

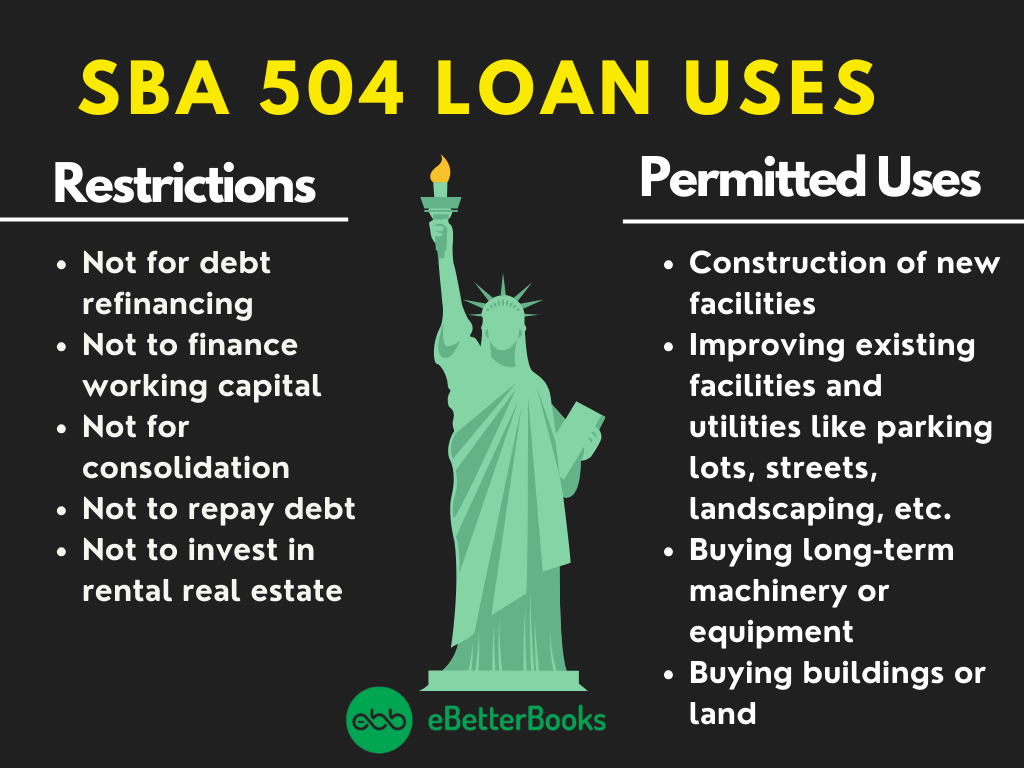

The restrictions for the SBA 504 loan amount are as follows:

- Not for debt refinancing

- Not to finance working capital

- Not for consolidation

- Not to repay debt

- Not to invest in rental real estate

The SBA 504 loan amount is meant for the following purposes:

- Construction of new facilities

- Improving existing facilities and utilities like parking lots, streets, landscaping, etc.

- Buying long-term machinery or equipment

- Buying buildings or land

SBA 504 Loan Fees

The fees for the SBA 504 loan are included in the loan amount.

The fee consists of:

- Upfront guaranty fee = 0%

- Annual service fee = 0.4405% of the outstanding loan amount.

- CDC Processing Fee = Now abolished.

- The lender participation Fee = Now abolished

SBA 504 Down Payment

The down payment for the SBA 504 loan is only 10% for eligible for-profit businesses in the US.

SBA 504 Loan Repayment Terms

The loan repayment terms are decided between the CDC and the borrower, thus they vary from one loan agreement to another.

There is fixed-rate financing which means that your instalments are fixed and will not change. The interest rate generally is around 3% of the total debt and can be financed with a loan.

Interest rate is calculated by adding a spread over the current market rate of 10-year US Treasury issues.

Pros and Cons of the SBA 504 Loan Program for Small Businesses

Pros:

- Almost all small businesses qualify for SBA 504 CDC Loans

- The funding is up to 90% of the loan amount.

- Fixed-rate financing and longer amortization period.

- No large payments at the end of the term, it is more like repaying the mortgage.

- Lower downpayment as compared to conventional financing and loans.

Cons:

- Complex and time-consuming underwriting process

- Extensive documentation

- Longer approval period which can go above 2 months.

Alternatives to SBA 504 Loans

In case you do not meet the eligibility criteria or get rejected for SBA 504 loans, then SBA also offers other small business loans to promote economic development.

Check other SBA loans as an alternative to SBA 504 loans:

- SBA 7(a) Loans: Offered by SBA and usually have a 10% down payment requirement with flexible usage of funds. It offers various types of loans and has a repayment tenure of around 25 years and 10 years. It can be used for inventory purchases, working capital financing, refinancing debt, buying equipment, etc.

- SBA Express Loans: Expedited loans for small businesses, that can be processed within 3-4 days to a week. In express loans, the guarantee by SBA is up to 50% of the loan amount. SBA Express loan program is well suited for a small business. These loans can be of even US $ 50,000 and can be extended up to US $ 500,000.

- Conventional Loans from Banks: If a borrower has a good credit score and sound finances of the business to portray financial responsibility, then the loan can be taken from community banks, credit unions, and commercial banks.

- Lease Financing for Purchasing Equipment: Lease financing is another alternative as it offers you to use the equipment and then purchase it in the end at a negotiated price. This is one of the most economical ways of purchasing business equipment without making a large upfront payment.

- Crowdfunding: Utilising an online crowdfunding platform allows you to raise funds via online campaigns. You can offer rewards, equity, and debt-based financing for funding.

- Microloans: Many nonprofit organizations and community development financial institutions (CDFIs) offer microloans as a means of short-term financing for startups and small businesses.

- Venture Capital and Angel Investors: A high-growth and high-potential business can raise capital from venture capitalists. For this, there should be a feasible business plan, a proven concept, a tested revenue model, and positive cash flow projections for at least 3-5 years. A venture capitalist provides loans, capital, and in some cases expertise to grow your business.

Conclusion

Taking a loan is a financial responsibility and must be put in to either maintain the current state of business or further business growth. The usage of loans is meant to give a boost to the business. Many small businesses and startups often get left out by conventional banking loan programs. For them, SBA 504 loans are much more feasible and affordable But before taking a loan, you should check interest rate, repayment terms, lender terms, etc.

For more information on finance, accounts, and bookkeeping to manage your finances like a pro, visit Akounto’s blog.