SBA 504 Green Loan Program is a strong financial tool created to help small businesses expand their operations, purchase real estate, and invest in major equipment while boosting environmental sustainability.

In May 2024, the Biden-Harris administration made bold efforts to fund clean energy projects when the program lifted the cap on the SBA 504 Green Loan Program.

Earlier, SMBs could borrow $16.5 million in a combination of no more than three loans for purposes such as energy conservation measures and renewable energy systems. However, the new policy has eliminated the cap on the number of loans, so companies can avail of multiple $5.5 million loans for various clean energy projects to promote reductions in emissions and energy use.

This new rule enables more companies to afford the funds required for green projects like windmills and other renewable energy generators and energy-efficient building renovations, among others, without restrictions on total loan amounts.

This blog post offers a comprehensive overview of the program, detailing specific incentives and requirements. It discusses how Certified Development Company (CDC) loan officers can utilize these benefits to assist their clients better.

What is SBA 504 Green Loan Program

SBA 504 Green Loan Program is an extension of the US Small Business Administration’s Green Program designed to support the financing of fixed-rate long-term loans to energy-efficient or renewable energy projects of small businesses.

This work was to fund large, fixed assets such as real estate or equipment with a structure that consists of 50% of the project financed by a bank or a private lender, 40% funded by a Certified Development Company (CDC) loan that is guaranteed by SBA, and at least 10% funded by the borrower.

For green projects only, the program has recently increased the borrowing limit, and the maximum SBA guaranteed amount is $5.5 million per project. Through this financing, organizations are able to make economically viable investments in energy-efficient measures, renewable energy systems, and environmentally friendly physical improvements to buildings.

Purpose of Green Loans

The purposes of SBA 504 Green Loans include:

- Energy Efficiency Improvements: Loans to initiatives that may intend to save at least 10% of power, say mechanical, lighting, or thermal protection.

- Renewable Energy Projects: Funds are used to purchase renewable energy sources, such as photovoltaic structures and wind energy fans, to run the business.

- Sustainable Building Construction or Renovation: Promoting the construction of new structures and possible renovations of existing structures for the target level of energy efficiency, for example, LEED.

- Reducing Environmental Impact: Advertising and fundraising for initiatives that lower a company’s environmental impact and foster sustainability.

- Preserving Working Capital: Enabling many businesses to participate while ensuring they retain liquidity because the program demands a lower level of investment than other programs.

Uses of SBA 504 Green Loan Program

The uses of SBA 504 Green Loans include:

- Purchasing and Upgrading Commercial Real Estate: Purchasing property and upgrading it for energy efficiency by installing efficient window systems, heating and cooling systems, or insulation.

- Construction of Energy-efficient Facilities: Supporting the construction of new facilities that are designed and built to incorporate energy efficiency as a consideration leading to the construction of LEED facilities.

- Installing Renewable Energy Systems: Providing capital for the procurement and installation of renewable energy sources such as photovoltaic panels, wind farms, geothermal, and biomass power.

- Purchasing Energy-Efficient Equipment: Purchasing energy-saving equipment for use in business production processes to enhance the effectiveness of utilizing energy.

- Refinancing Debt for Green Projects: Financing the repaying of prior debt used for prior energy conservation measures or renewable energy projects if the initial project qualifies under this program.

For more such details, you can check the official website of SBA Green Loans.

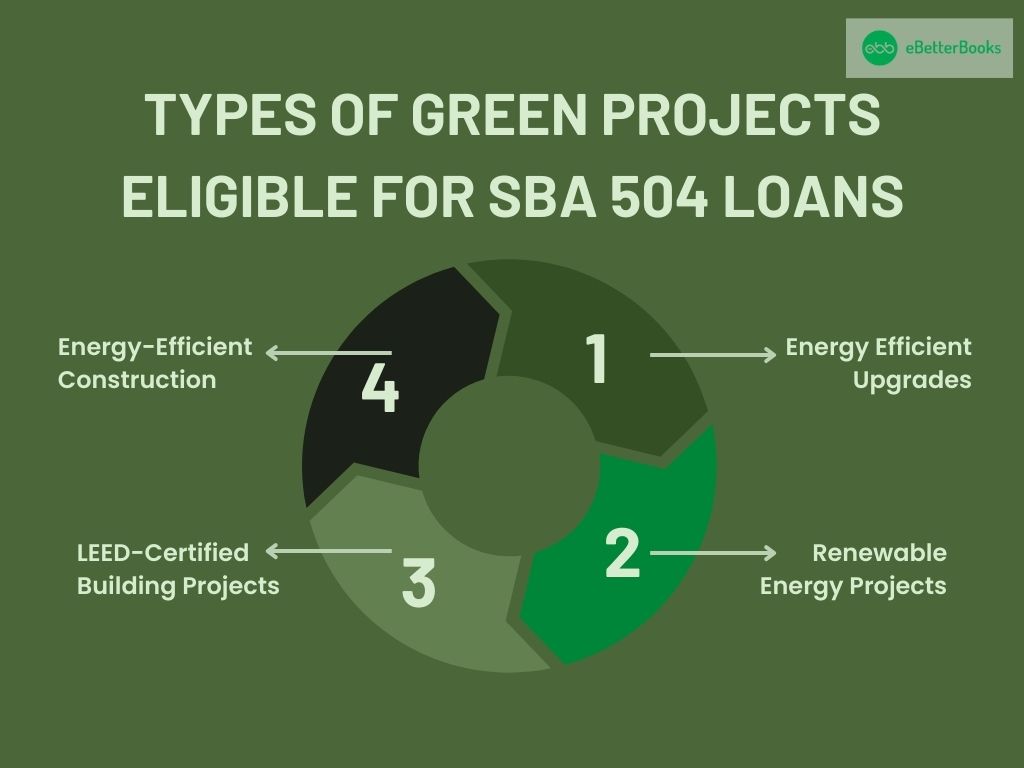

Types of Green Projects Eligible for SBA 504 Loans

Here are the eligible green project types for the SBA 504 Green Loan Program, explained in a similar detailed manner:

Energy Efficiency Upgrades

These projects include carrying out an enhancement that helps to cut down the energy use of a building by at least 10% in a bid to enable businesses to reduce their energy bills and expenses as well as having a better face the social responsibility of conserving the environment.

Common types of upgrades include:

- HVAC Systems: Installing efficient lighting and high-efficiency heating, ventilation, and air conditioning (HVAC) reduces energy consumption. These systems mostly contain smart controls and programmable thermostats to manage temperature schematically, making them efficient, convenient, and economical.

- Insulation: Making walls, roofs, and floors more thermally efficient allows comfortable indoor environmental conditions during the cold season and summer as well. This minimizes the load effectively used by HVAC systems, resulting in reduced energy consumption.

- Lighting: One of the most effective measures to reduce electrical usage is to replace old bulbs with new, improved ones, such as LED bulbs or smart bulbs. LED lights take less energy to glow, have a longer lifespan than most types of bulbs, and can be used with other control mechanisms for energy efficiency.

Renewable Energy Projects

These projects are particular on the technique of producing energy through natural sources instead of fuel. Renewable energy can either be adopted for use in business operations or to supplement conventional sources of energy.

Eligible renewable projects include:

- Solar Panels: Businesses can produce electricity from the sun by installing solar photovoltaic (PV) systems. Depending on their size and the mere availability of light, solar installations may cut or even completely eradicate a company’s electricity bills. Solar energy systems can also be eligible for federal, state, or local incentives, including tax credits and rebates.

- Wind Turbines: Where there is a reliable wind speed, firms can devise energy through the use of wind turbines. Wind energy can be used as a main or secondary energy source; this way, companies can essentially become free from dependence on energy imports and decrease CO2 emissions.

- Geothermal Systems: Geothermal energy power systems can produce heat or electricity by exploiting heat generated within the earth. These systems provide efficiency and reliability for businesses situated in regions with direct access to geothermal resources.

LEED-Certified Building Projects

The international recognition of green buildings is provided by the certification known as LEED (Leadership in Energy and Environmental Design). Buildings seeking to be LEED certified require specific standards for aspects like energy and atmosphere, water efficiency, indoor environmental quality, and innovation and design.

- Achieving LEED Certification: To qualify, a business must incorporate green building practices in its buildings, including energy-efficient HVAC, recycled-content construction materials, daylighting, and water efficiency. LEED-certified buildings normally have lower operating costs than conventional buildings and provide better working conditions to the occupants.

- Benefits: LEED Certification not only reduces projects’ environmental effects but also gives any company a better image when it adopts its measures. Green fixed assets, including the costs associated with both new construction and green retrofit projects targeted at meeting the requirements for LEED certification, are eligible for the SBA 504 Green Loans.

Energy-Efficient Construction

It includes designing or building structures, whether or not they are part of a renovation project, that incorporate energy-efficient designs and materials on a scale more effective than required by code. The concern is designing building forms that need little energy to heat, cool, or illuminate but are comfortable and effective.

- Building Materials: Using low-conductive materials like insulated concrete, Low-E windows, and cool roof surfaces inhibits energy transfer to enhance a construction’s thermal performance suitably. These materials help to bring down energy costs and enhance control within enclosed spaces.

- Advanced Building Techniques: Methods, such as positioning a room facing the sun to allow for natural lighting heating by the sun and insulation that prevents heat loss, are employed to increase general energy efficiency. They are very effective in reducing the energy use of a building throughout its life cycle, which benefits the project.

Eligibility Requirements for SBA 504 Green Loans

The guidelines for eligibility to the SBA 504 Green Loan Program are based on both general factors of the business and several specific factors related to green projects.

General Business Eligibility Criteria

Here are the details:

- For-Profit Business: The applicant has to be a profit-oriented enterprise based on the laws of the United States of America. This loan program is not for non-profit organizations.

- Size Standards: The business must meet the SBA’s size standards, which include a tangible net worth of less than $15 million and an average net income of less than $5 million for the past two financial years.

- Business Type: It generally covers virtually all forms of operations, with the exception of over-the-counter speculation, lending, betting, and other unlawful activities.

- Ability to Repay: The business needs to show that it has the fixed charges coverage level to repay the loan from the cash flow generated from operations.

- Occupancy Requirement: SBA 504 loan permits that, for an existing structure, the business must use not less than 51% of the premises. For the new constructions, the business has to take

- No Prior Default on Government Loans: Companies are not allowed to owe any money to the federal government, or they cannot have any past loan arrears.

Green Project-Specific Requirements

To qualify as a “green project,” the loan must meet at least one of the following criteria related to energy savings or environmental impact:

- Energy Efficiency Upgrades: The project must show a minimum of a 10% enhancement in the ratio of energy utilization. Energy conservation can be achieved through upgrades to systems like heating, ventilation, air conditioning, lights, and insulation, among others.

- Renewable Energy Projects: The project involves installing Renewable Energy Systems, such as Solar Panels or Wind Power, that must be capable of producing at least 15% of the building’s energy requirements. These installations assist firms in limiting the use of conventional energy sources in the conduct of their economic activities.

- LEED-Certified or Equivalent Sustainable Building: The construction or renovation project must include a plan to pursue LEED certification or equivalent levels of green building certification. The building’s designation should conform to standards on energy use, use of environmentally friendly building materials, and environmental conservation.

- Environmental Impact Reduction: Operations that would be directly relevant to reducing the business’s impact on the environment, such as waste management and pollution control, can also be allowed. Instead, focus is put on improving an organization’s sustainability, and the target is quantified.

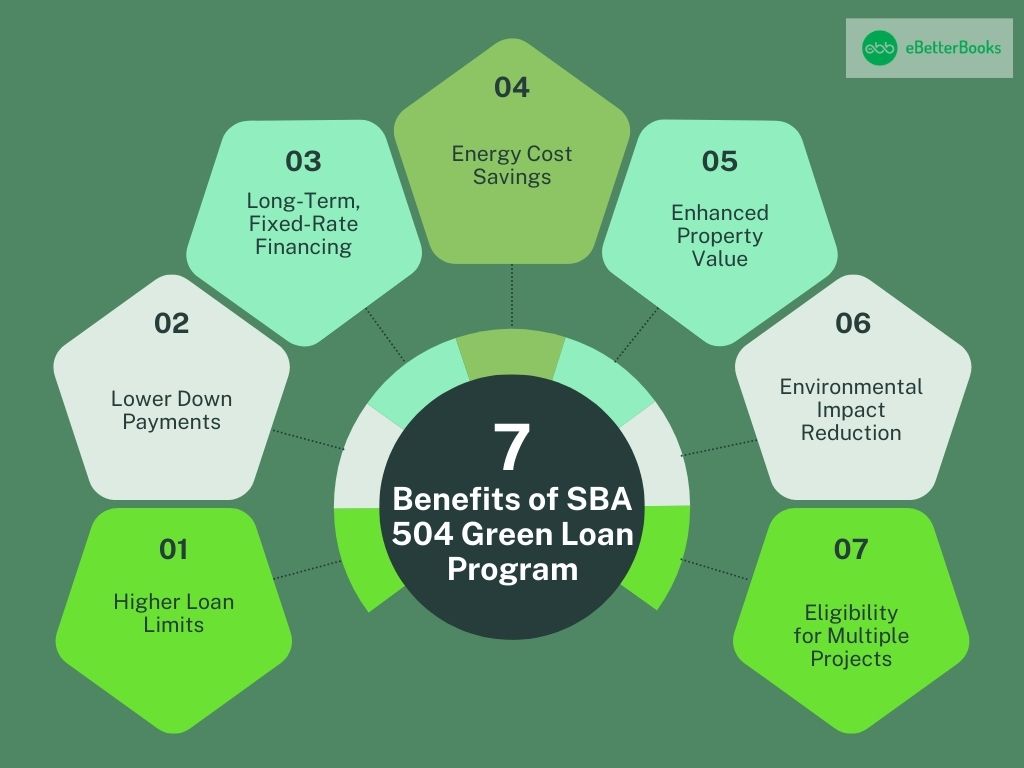

Benefits of Using SBA 504 Loans for Green Projects

The benefits of using SBA 504 loans for green projects include:

- Higher Loan Limits: It raised the cap on SBA-backed loans of green projects to $5.5 million per project, allowing businesses to undertake bigger energy or renewable energy projects.

- Lower Down Payment: These sustainable finance facilities demand only a 10 % borrower contribution, thus allowing businesses to set aside operating capital to spend on sustainability.

- Long-Term, Fixed-Rate Financing: The SBA 504 loan provides fixed interest rates and may be made for 10, 20, or 25 years.

- Energy Cost Savings: Access to capital for energy-efficient improvements and renewable sources of power can diminish energy costs and amount to remarkable savings in the long term.

- Waived Job Creation Requirement: Green loans do not require businesses to create a specific number of jobs in relation to the loan amount, making it easier for smaller businesses to qualify.

- Environmental Impact Reduction: Environmentally sustainable investment involves financing projects that can positively change a particular organization, enabling it to decrease its carbon footprint.

- Enhanced Property Value: To add value to the property, the efficiency of the facilities should be improved with an energy-efficient feature or renewable energy installation.

- Eligibility for Multiple Projects: Companies can do more than one green project, which raises their total funding potential for further initiatives when active sustainability projects already exist.

Steps of SBA 504 Green Loan Application Process

The application process for SBA 504 Green Loans involves several key steps:

Step 1: Determine the Eligibility: Make sure your business and project are eligible for the SBA 504 Green Loan, which covers energy efficiency upgrades, environmentally friendly energy systems, or environmentally friendly construction. Such a business must operate for profit and meet the SBA size standards.

Step 2: Find a Certified Development Company (CDC): Partner with the CDC, a non-profit organization designated by the SBA to implement the 504 Loan Program. The CDC will assist the client in preparing the documentary proofs to support the request.

Step 3: Prepare Financial Documentation: Financial documents needed for an SBA loan application, including business financial statements, tax returns, personal financial statements, and a detailed plan of the project, including energy savings or renewable aspects, shall also be assembled.

Step 4: Submit the Loan Application: Once you have filled out your whole loan application package as required by the SBA, CDC will forward the application to the SBA for approval. This pack refers to any documents that may be necessary for the project, such as the proposal, the documents regarding the finances, and others.

Step 5: SBA Review and Approval: The SBA will then analyze the application to ensure it conforms to the requirements of the 504 Green Loan Program. Upon approval, the SBA will authorize the loan.

Step 6: Finalize the Loan Structure: With your CDC, your participating bank, and your SBA, determine your loan terms and structure, the funding in terms of your contribution, and the SBA-backed CDC loan to be offered by the participating bank.

Step 7: Complete the Loan and Begin the Project: Once the loan is closed, you can use the financial resources to start on your energy-efficient project or renewable energy generation.

For further details, you can check the official SBA site.

Working with CDCs for Green Loans

Cooperation with a Certified Development Company is the procedure that must be completed according to the SBA 504 Green Loan.

Here’s how they work:

- Role of a CDC: A Certified Development Company is an SBA partner that provides funding for the U.S. Green Loan Program. CDCs assist firms in the loan procurement process, sourcing for papers, evaluating the project’s SBA conformity, and submitting the loan bundle to the SBA for consideration.

- Assistance in Application: CDCs are directly involved with reviewing and certifying businesses’ compliance with the SBA 504 Green Loan eligibility criteria. They help Applicants understand issues related to planning, financial reporting, and general conduct that complies with the program requirements.

- Connecting with Lenders: CDCs work in conjunction with other third-party financiers, commonly banks, which offer finance between 30% and 50% of the overall project cost. The CDC itself can bear upto 40% of the costs through an SBA-guaranteed debenture, and a borrower contributes 10% in the form of a down payment.

- Project Compliance and Monitoring: After the green loan is approved, the CDC follows up on the project to correct any wrongdoings regarding how the funds should be used. They can also continue offering their services to help the project succeed and meet any possible environmental or energy efficiency objectives.

Impact of Energy Efficiency on SBA 504 applications

- Increased Loan Amounts:

Energy-efficient projects qualify for larger loan amounts under the SBA 504 Green Loan Program. Businesses that demonstrate a commitment to sustainability can get more substantial funding to support their growth and expansion plans.

- Enhanced Loan Approval Rates:

Comprehensive energy audits provide detailed documentation of potential energy savings and efficiency improvements, enhancing the persuasiveness of loan applications. This approach aligns with the SBA’s focus on sustainability, increasing the chances of approval.

- Long-Term Cost Savings:

Adopting energy-efficient measures can significantly reduce operating costs for businesses. Upgrading to energy-efficient lighting and HVAC systems, improving insulation, and installing renewable energy can cut energy consumption by 10% to 30%, enhancing profitability.

- Improved Marketability and Brand Image:

Investing in energy-efficient and sustainable projects enhances a company’s reputation, attracting eco-conscious customers and partners and providing a competitive advantage.

Documenting The Impact

It is important to submit evidence of energy saving or achievement of environmental goals.

Here are some important documents that will help you:

Energy Efficiency Documentation: Each business that plans to make energy efficiency improvements needs to submit supporting documents showing current energy efficiency levels, which should be at least 10% lower than before.

This may include:

- Energy Audit Reports: A professional energy audit can assess the current energy consumption and estimate the energy savings that can be expected from the proposed upgrade. This is understandable when determining the initial energy consumption and the resultant projection of the expected savings.

- Utility Bills Comparison: Companies may be asked to attach their past utility charges and estimated future charges after taking energy-saving measures.

- Technical Specifications: Specified information regarding the equipment or systems to be installed, namely high-efficiency HVAC, LED lighting, and the extent of energy savings, should also be provided.

- Renewable Energy Project Documentation: Auxiliary requirements for renewable energy installations include evidence of how the applicant intends to ensure the system will produce usable energy of not less than 15% of the property’s energy requirement.

This can be demonstrated by:

- System Design and Specifications: For renewable energy systems, the specifics of the work to be accomplished should include a clear and comprehensive description of the system details (solar panel arrays, wind turbine power capacities, etc.).

- Energy Generation Estimates: Quantitative estimations specifying the energy the system is expected to generate relative to the energy demand of the property.

- Environmental Impact Documentation: For projects carried out to mitigate the effects of climate change, for instance, LEED-certified projects, the following points should be highlighted:

- Certification Goals: Contemplated goals providing the designation of LEED and information on compliance with all the requirements for sustainability, water and energy usage, and material usage.

- Impact Assessments: Project outcomes related to the company’s environmental footprint, such as a decrease in greenhouse gas emissions, decrease in waste output, or efficient use of resources.

Unique Terms for Projects for Better Achievement

Here’s a list of unique terms for projects that achieve significant energy reductions:

- Energy Star Certification: Awards structures that comply with particularly high energy efficiency as defined by the EPA.

- Net-Zero Energy Building (NZEB): Such buildings should rely on efficient and renewable energy systems so that the total energy consumption is equal to the energy produced annually.

- High-Performance Building: All have been created with higher performance standards than the standard energy, water, and environmental quality standards.

- Deep Energy Retrofit: Efficient upgrades that reduce a building’s energy demand by greater than 50%.

- LEED Platinum Certification: The highest accreditation in LEED, which is the acronym for Leadership in Energy and Environmental Design.

- Zero-Carbon Building: Seeks zero or negative carbon effect by emphasizing both efficiency and renewable energy.

- Passive House Standard: Major emphasis on minimizing heating/cooling energy demand through either high levels of insulation on walls and roof and/or great air tightness.

Conclusion

The SBA 504 Green Loan Program is what any business requires today, especially when it comes to practicing energy efficiency in their operations. Thus, from the point of view of financial performance and the preservation of the environment, the program offers additional forms of financing for projects, for example, the installation of equipment for the use of renewable energy sources, modernization of energy, and others for receiving additional sources of financing for implementation of such projects.

Supported by the CDC, it promotes tangible energy conservation and favorable environmental outcomes, which would help businesses lessen their spending on expenses, thus helping to create a better environment for their cities and the entire world. For further information, please check the official website of the SBA 504 Green Loan Program.

FAQs!

What is the maximum SBA 504 green loan amount?

An SBA 504 Green Loan usually has an SBA maximum of $5.5 million per project. However, there is no longer an aggregate cap controlling the total sums businesses can borrow, so they can get several loans for various projects.

What are green loans used for?

Green loans are applied to projects that improve the environment, energy efficiency, renewable power like solar and wind, LEED-certified building projects, and more involving decreased carbon footprint or environmentally friendly projects.

What are the disadvantages of green loans?

The disadvantages of green loans are that they can be costlier initial funding for some environmentally friendly projects, they have narrow criteria for sustainable characteristics, and they require more paperwork to support claims about energy and environmental savings.

Who benefits from green finance?

Green finance without limitations brings gains to a commercial enterprise, an investor, and society collectively. Companies obtain cheap financing to finance projects with reasonable paybacks; investors have the opportunity to finance sustainable initiatives; and the general population benefits from decreased emissions saved resources, and an eventual shift toward a more sustainable economy.