Highlights (Key Facts & Solutions)

- Classification: Security deposits are legally a Liability, not Income, upon receipt because they are funds owed to the tenant; they are only recognized as income if legally forfeited or applied to rent.

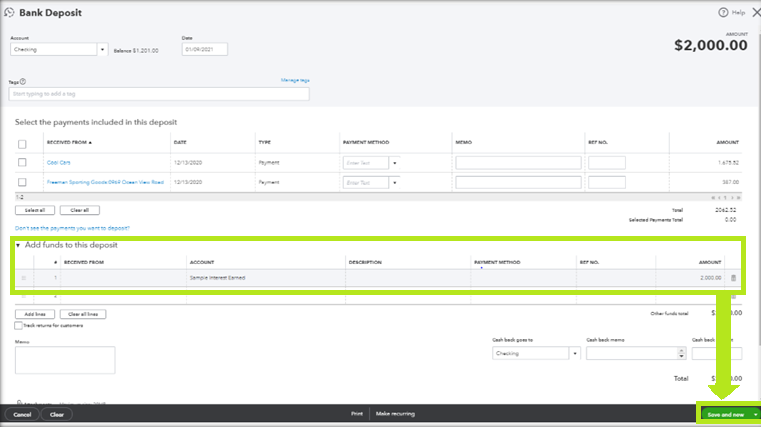

- Recording Process (QBD): To record the initial deposit correctly, use the Make Deposits feature in QuickBooks Desktop to increase the Bank Account and credit the Security Deposit Liability Account.

- Commingling Funds: It is a legal and accounting requirement to keep deposits in a separate, segregated bank account to prevent accidental use for operating expenses and simplify reconciliation.

- Forfeiture Handling: When a deposit is forfeited (e.g., for breaking a lease), a Journal Entry must be created to Debit the Liability Account and Credit an Income Account to recognize the revenue earned.

- Damage Claim: If the deposit is used for repairs, the full repair cost must be expensed, and the retained deposit must be separately reclassified as income to correctly offset the expense and avoid distorting net income.

- Compliance Tracking: Financial records must be managed with an awareness of local laws regarding Return Timelines (days allowed to return the deposit), Interest Accrual requirements, and maximum Cap Limits on the deposit amount.

- Common Errors: Avoid the three most critical mistakes: misclassifying the deposit as Income, commingling the funds with operating cash, and failing to link the deposit to the correct Customer/Tenant profile.

Overview

Recording a Security Deposit in QuickBooks helps businesses track liability and handle tenant or customer transactions more precisely.

Security deposits refer to money given to a lender, landlord, or seller of a house as a guarantee or security against potential damage, non-compliance with the terms of the lease, non-payment, or loan default.

Security deposits are mostly present in rental agreements for real estate and equipment, serving to safeguard the receiving party from potential losses.

What is a security deposit in QuickBooks?

A security deposit in QuickBooks is treated as an asset for a tenant. To record it, simply create an “Other Asset” account named “Security Deposits” and assign it to the payment. This helps you track the deposit as part of your assets in QuickBooks.

Why should you keep the Security Deposits transaction separate from personal transactions?

- Tax and Legal Requirements: By keeping security deposits in separate accounts, we prevent money from being mixed, which is crucial for ensuring tax compliance. This focus on meeting legal obligations can provide customers with a sense of security.

- Ease of Tracking: By keeping security deposits in a separate account makes it easier to track them, including when and from whom they were received.

- Tracking Interest to Capital: By keeping security deposits in a different account can help track interest earnings.

- Channeling and bifurcating funds: By keeping security deposits in a different account avoids unintentionally using them for unrelated costs.

- Better Financial Management: By keeping security deposits in different accounts, businesses can make better judgments and have a better understanding of their financial situation by classifying security deposits as customer deposits.

Are security deposits considered income or liabilities?

The security deposits are considered as a “liability” and not as an “income” from the business point of view. They are recorded under the “liability side” of the balance sheet.

You generally don’t include security deposits on your income side if you are required to return them to the tenant at the end of your lease. You might have to keep a certain part of the security deposit for a part of it in case of:

- The tenant breaks the lease by vacating the property early. [ Consider the amount as “income” in that year]

- The tenant damaged the property [ Consider the amount as “expenses” if your practice is to deduct the cost of repairs ]

- If the security is used as a tenant’s last month’s rent. [ Consider the amount as “income” in that year]

To the extent that the security deposit reimburses these expenses, do not consider that amount in income if your practice is not to deduct the cost of repairs as expenses.

How to record a Security deposit in QuickBooks Desktop?

Part 1: Create the liability account

Step 1: Navigate to the Chart of accounts

- Click on the Setting option on the gear icon.

- Now, choose the Chart of Accounts option from the drop-down menu.

Step 2: Create the account

- Click on the + New.

- Now, choose the Account Type from the drop-down menu from the Account window.

- Select the account type.

- Choose the account receivable as detail type under the Detail type drop-down menu.

- Enter the account name.

- Add the description.

Step 3: Save the transaction

- Click on Save once you have mentioned all the details.

Part 2: Record the Security Deposit as a Check

Step 1: Navigate to Write Checks

- Click on the Banking menu on the screen.

- Now, choose the Write Checks option.

Step 2: Select the Bank account

- Click on Bank account.[ The bank account from which the money will be taken. ]

- Put the Ending balance. [ The balance of the given bank account as of the date of writing the checks.]

Step 3: Select the Payee’s details

- Now, choose Pay to the Order. [ It will have the name of the payee or whoever the check is issued for.]

- Mention the number assigned to the check number in the No. field.

- Now, check the amount in number. [The “Pay to the order” field will automatically display the dollar amount in words.]

- The payee address will automatically pop up in the Address field.

- The Memo field can be left blank. [ Otherwise, it is used as an unofficial note for additional details like the account information, the period, and the payment.]

Step 4: Selecting payment option

- You get the option to Pay Late or Pay Online. [ Put a checkmark on the option which suits you best.]

- In the Expenses or Item tab, put the shipping charges, liability (in cases of payments for liabilities/loans), and other expenses not associated with any item in QuickBooks.

Step 5: Save the transaction

- Click on the drop-down menu from the Item tab to select the appropriate item.

- Click on Save once you have mentioned all the details.

How to Record a Security Deposit in QuickBooks Online?

Part 1: Create the liability account

Step 1: Navigate to the Chart of accounts

- Click on the Setting option on the gear icon.

- Now, choose the Chart of Accounts option from the drop-down menu.

Step 2: Create the account

- Click on the + New.

- Now, choose the Account Type from the drop-down menu from the Account window.

- Select the account type.

- Choose the account receivable as detail type under the Detail type drop-down menu.

- Enter the account name.

- Add the description.

Step 3: Save the transaction

- Click on Save once you have mentioned all the details.

Part 2: Record the Security Deposit

Step 1: Navigate to the Security deposit option.

- Click on the + New button on the screen.

- Choose the Sales receipt.

- Put the customer’s name.

- Under the Product/service field, click on the Security Deposit [ if it doesn’t exist, kindly follow Step 2: Create the account, in order to create the item ]

Step 2: Mention the security amount

- Enter the security deposit amount.

Step 3: Save the transaction

- Click on Save once you have mentioned all the details.

Part 3: Record a Refund of a Security Deposit

Step 1: Locate the Security deposit option.

- Click on the + New button on the screen.

- Choose the refund receipt.

- Put the customer’s name.

- Under the Product/service field, click on the Security Deposit.

Step 2: Mention the security refund amount

- Enter the amount that needs to be refunded.

Step 3: Save the transaction

- Click on Save once you have mentioned all the details.

Avoiding Common Errors in Managing Security Deposits with QuickBooks

Accurately recording and managing security deposits in QuickBooks is essential for clean financial records. Businesses often make mistakes like misclassifying deposits, mixing funds, or skipping customer links. Understanding proper handling, forfeiture, reconciliation, automation, and multi-currency management ensures precise accounting and smooth audits.

Common Mistakes to Avoid When Recording Security Deposits in QuickBooks

Many businesses make 3 key mistakes when recording security deposits in QuickBooks. First, they record deposits as income instead of liabilities, which can cause inaccurate balance sheets. Second, they mix deposit funds with operating cash, making it harder to track and reconcile. Third, they skip linking the deposit to the correct customer or vendor profile, which leads to missing records during refunds. By fixing these 3 errors, you ensure clean financial data, accurate tax reporting, and faster audit preparation. Always use a dedicated liability account, keep funds in a separate bank account, and document each transaction properly.

How to Handle Forfeited Security Deposits in QuickBooks

When a security deposit is forfeited, follow 3 clear steps in QuickBooks. First, reclassify the deposit from liability to income to reflect it as business revenue. Second, create a journal entry that credits the liability account and debits the appropriate income account. Third, update customer records to note the reason for forfeiture, such as early lease termination, unpaid rent, or damages. This process ensures accurate financial statements, compliance with tax laws, and a clear audit trail. Always store supporting documents like lease agreements, invoices, and damage reports to justify the forfeiture in case of disputes or inspections.

Reconciling Security Deposit Accounts in QuickBooks for Month-End and Year-End Reports

To reconcile security deposit accounts, follow 3 critical steps. First, match all deposit transactions in QuickBooks with bank statements to ensure no missing or duplicate entries. Second, verify that each deposit is linked to the correct customer or vendor account for accurate tracking. Third, review the liability balance and confirm it matches your separate security deposit bank account. This reconciliation process helps prevent accounting errors, supports accurate financial reports, and simplifies tax preparation. Perform this check monthly for smooth year-end closing and maintain a detailed reconciliation report for audits or internal reviews.

Setting Up Automation for Security Deposit Tracking in QuickBooks

Automation in QuickBooks can streamline security deposit management in 3 major ways. First, set up recurring transactions for deposits from long-term tenants or clients to save manual entry time. Second, use automated reminders to track refund dates, ensuring timely returns and avoiding penalties. Third, integrate QuickBooks with payment gateways to automatically record deposits as liabilities. This approach reduces human errors, speeds up data entry, and ensures consistent compliance. Always review automated settings monthly to confirm accuracy, and keep backup records in case of technical issues or system updates that could impact tracking.

Handling Multi-Currency Security Deposits in QuickBooks

Managing multi-currency security deposits requires 3 key actions. First, enable the multi-currency feature in QuickBooks to record deposits in the customer’s currency. Second, set up a dedicated liability account for each currency to avoid conversion confusion. Third, use QuickBooks’ real-time exchange rate updates to track gains or losses when converting deposits. This ensures accurate financial statements, proper tax reporting, and easier reconciliation. Always review currency rates before refunds, as fluctuations can impact the final amount. Maintain detailed records of original deposit amounts, conversion rates, and payment dates for transparency and audit readiness.

Security deposit management varies widely across regions, with legal limits, storage requirements, and refund deadlines differing significantly. Proper handling, including dedicated accounts and staff training, ensures compliance and transparency. Integrating QuickBooks with property software further streamlines processes, while deposit data aids in accurate financial planning.

Understanding Legal Implications of Security Deposit Management QuickBooks in Different States/Countries

Security deposit laws vary in 3 critical ways across states and countries. First, some regions cap the maximum deposit amount a landlord can collect, often between one to three months’ rent. Second, many laws require deposits to be stored in interest-bearing accounts, with interest paid back to tenants annually. Third, strict timelines exist for returning deposits, usually 14–60 days after a lease ends. In QuickBooks, tracking these legal requirements ensures compliance, prevents penalties, and builds trust with clients. Always check local regulations before recording, holding, or refunding a deposit, and document compliance for legal protection.

Best Practices for Maintaining Separate Bank Accounts for Security Deposits

Maintaining separate bank accounts for security deposits offers 3 major advantages. First, it prevents accidental use of deposit funds for operational expenses, protecting you from legal disputes. Second, it simplifies reconciliation, as the account balance should always match your QuickBooks liability records. Third, it enhances transparency during audits, making it easy to prove funds are untouched. Open a dedicated account solely for deposits, link it in QuickBooks, and record every transaction with clear descriptions. Review the account monthly to confirm accuracy, and avoid mixing even small operational payments with deposit funds.

How to Educate Staff on Proper Security Deposit Recording in QuickBooks

Training staff on security deposit recording requires 3 focused steps. First, create a simple step-by-step guide with screenshots showing how to record, refund, and reclassify deposits in QuickBooks. Second, conduct regular workshops or online sessions to update them on policy changes, tax rules, or QuickBooks features. Third, assign one staff member as the deposit compliance lead to review entries and correct mistakes promptly. This approach ensures consistent accuracy, reduces errors, and speeds up month-end reconciliation. Always provide real case examples during training to make the process relatable and easy to follow.

Integrating QuickBooks with Property Management Software for Security Deposits

Integration between QuickBooks and property management software offers 3 key benefits. First, it syncs tenant data and deposit transactions automatically, eliminating manual entry errors. Second, it enables real-time tracking of deposits, refunds, and forfeitures across multiple properties. Third, it consolidates financial and rental data for faster reporting and tax preparation. Choose software that supports QuickBooks integration, set clear mapping for liability accounts, and test the sync before going live. Regularly monitor data flow to ensure accuracy, and keep backup records in case of sync issues or software updates.

Using Security Deposit Data for Financial Forecasting and Planning

Security deposit data can improve financial forecasting in 3 ways. First, tracking total deposits helps estimate future refund obligations and plan cash flow accordingly. Second, analyzing forfeiture trends can highlight recurring issues, such as high tenant turnover or property damages. Third, monitoring deposit growth over time can indicate business expansion or contraction. In QuickBooks, use custom reports to pull deposit-related figures and integrate them into your budgeting process. Regularly review this data quarterly to adjust forecasts, allocate resources wisely, and strengthen overall financial planning.

Conclusion!

By properly recording the security deposit in QuickBooks, businesses can manage transparent and well-organized financial records. This procedure makes sure that all accounting standards are followed properly without any dispute.

Frequently Asked Question!

1. Why must a security deposit be classified as a “Liability” instead of “Income” when received by a landlord or business?

A security deposit is classified as a Liability because it represents funds that the business is legally obligated to return to the tenant or customer at a future date.

- Definition: Liability is an obligation to transfer assets (cash) or services in the future as a result of a past transaction.

- Revenue Recognition: The deposit is not considered “earned” or income until the obligation to return it is extinguished. This occurs only if the tenant forfeits the deposit (e.g., breaks the lease) or if it is applied to the last month’s rent.

- Balance Sheet Impact: Recording it as a liability ensures the Balance Sheet accurately reflects the company’s financial obligations to external parties.

2. What is the fundamental transaction in QuickBooks Desktop to record the receipt of a security deposit?

In QuickBooks Desktop, receiving a security deposit must be recorded using the Make Deposits feature to correctly increase both the bank asset account and the deposit liability account.

The necessary entry is:

- Debit: The business’s Bank Account (Asset account) for the amount received. This increases cash.

- Credit: The dedicated Security Deposit Liability Account (Other Current Liability) for the amount received. This creates the obligation to repay.

Using this process ensures the transaction shows up on the bank statement for reconciliation.

3. Why is it a legal and accounting best practice to keep security deposits in a separate, segregated bank account?

Maintaining separate bank accounts for security deposits is crucial to prevent the commingling of funds, which is often required by state and local laws and ensures accounting transparency.

- Legal Compliance: Many jurisdictions mandate that security deposits be held in a dedicated, often interest-bearing, custodial account. Commingling funds can lead to legal penalties and civil litigation.

- Asset Protection: Segregation protects the funds from being accidentally used for operational expenses or seized by business creditors, as the money legally belongs to the tenant until earned.

- Reconciliation: It simplifies the monthly reconciliation process, as the balance in the segregated bank account should precisely match the total balance of the Security Deposit Liability Account in QuickBooks.

4. How should a business accurately record a forfeited security deposit in QuickBooks?

A forfeited security deposit, where the tenant fails to comply with the lease and the business retains the funds, requires a specific two-step reclassification process to move the funds from liability to revenue.

- Step 1: Reclassify Funds: Create a Journal Entry (JE) or use a similar adjustment function.

- Debit: The Security Deposit Liability Account for the amount forfeited. This reduces the obligation to zero.

- Credit: A dedicated Income Account (e.g., “Forfeited Deposit Income” or “Rental Income”) for the same amount. This recognizes the revenue.

- Step 2: Justification: Ensure supporting documentation (lease agreement, damage report, or termination notice) is retained to justify the revenue recognition for auditing and tax purposes.

5. When a deposit is kept to cover property damage, how should the transaction be handled to avoid distorting net income?

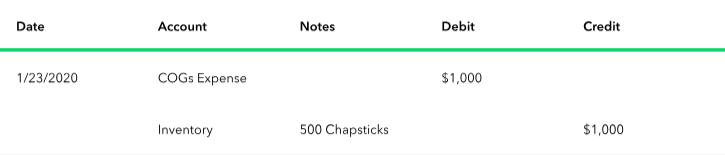

If a portion of the deposit is kept to pay for property repairs, the transaction should reflect that the retained deposit is income that offsets the expense of the repair, maintaining accounting integrity.

- Repair Expense: The full cost of the repair must be recorded as an Expense (Debit Expense, Credit Cash) when the repair is paid.

- Deposit Reclassification: The portion of the deposit kept must be reclassified from Liability to Income (Debit Liability, Credit Income) as described above.

- Net Effect: The income recognized from the forfeited deposit effectively reduces the company’s net operating expense, avoiding the distortion that would occur if the deposit was simply used to pay the repair bill directly.

6. What are the three most common errors businesses make when managing security deposits in QuickBooks?

Mismanagement of security deposits often stems from a lack of adherence to fundamental accounting and legal principles.

The three most critical mistakes are:

- Misclassification: Recording deposits as Income upon receipt instead of as a Liability, leading to overstated income and premature tax payments.

- Commingling: Failing to keep deposits in a separate bank account, which violates state laws and complicates reconciliation.

- Missing Customer Link: Not linking the deposit to the correct Customer/Tenant Profile, making it impossible to track and refund the correct amount when the lease ends.

7. Beyond the amount, what three legal deadlines or requirements should businesses track alongside the security deposit liability in QuickBooks?

Tracking the amount is insufficient; businesses must manage three compliance factors tied to the deposit that vary significantly by state or country.

- Return Timeline: The mandatory number of days (e.g., 14, 30, or 60 days) the business has to return the deposit after the tenant vacates. Failure to meet this can result in triple-damage penalties.

- Interest Accrual: Whether the deposit must be held in an interest-bearing account and if that interest must be paid annually or compounded until the lease end.

- Cap Limits: The maximum amount (often 1 or 2 months’ rent) that the landlord is legally permitted to collect as a security deposit.

Disclaimer: The information outlined above for “How to Record a Security Deposit in QuickBooks Desktop or Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.