Recording interest income accurately is vital for maintaining precise financial records and ensuring tax compliance, as this income stems from non-core activities like bank accounts or investments. This guide provides step-by-step instructions for classifying and tracking these earnings efficiently within both QuickBooks Desktop and QuickBooks Online environments. The essential practice involves setting up interest earnings under an “Other Income” account, differentiating it from primary business revenue.

Whether utilizing the “Make Deposits” feature in Desktop or handling transactions during bank reconciliation in Online, proper categorization ensures accurate measurement of interest income, which is foundational for sound financial decision-making and minimizing discrepancies during annual tax reporting.

Highlights (Key Facts & Solutions)

- Core Solution: Interest income should be recorded using the Bank Deposit feature in both QuickBooks Desktop and Online.

- Account Categorization: Interest income must be categorized under Other Income to distinguish non-operating earnings from core business revenue.

- QuickBooks Desktop Steps: The process involves navigating to Banking > Make Deposits, creating a new account categorized as Other Income, and entering the earned amount.

- QuickBooks Online (QBO) Logic: For linked bank accounts, QBO suggests the correct “Interest Earned” category during the reconciliation process, often making the manual Bank Deposit step unnecessary.

- Alternative Recording: In QuickBooks Desktop, interest income can also be recorded directly through the Reconciliation page to avoid duplication.

- Best Practices for Accuracy: Frequent account reconciliation and tracking the bank’s actual interest rates are recommended to ensure the amounts recorded in QuickBooks match external statements, aiding accurate tax preparation.

- Interest Income Types: The content details three types: Bank Interest Income, Investment Interest Income, and other miscellaneous interest sources.

What is interest income in accounting?

In Accounting, interest income is usually taxable income that refers to the money earned by an individual or business from lending funds. This can be through depositing money in a bank account, purchasing certificates of deposit, or earning interest on loans provided by the business.

In QuickBooks Desktop or Online, you can easily record interest income using the Bank Deposit feature. This helps track interest earned from savings accounts, investments, or loans your business has made.

There are two ways to record interest income in QuickBooks:

- Through the Reconciliation page: This allows you to directly record interest during the reconciliation process.

- Creating a new interest account: This method lets you set up a specific account dedicated to tracking interest income.

Both options ensure that your interest earnings are accurately reflected in your financial records.

What Are the Different Types of Interest Income?

Interest income typically falls into three main categories: Bank Interest Income, Investment Interest Income, and Other Income. Here’s a brief explanation of each:

1. Bank Interest Income

This refers to the interest earned on deposits held in savings accounts at banks or other financial institutions. It’s the income you receive as interest on your money that is stored in these accounts over time.

2. Investment Interest Income

This is the income generated from various investment activities, such as dividends, interest from stocks, bonds, certificates of deposit or other securities. It requires accurate tracking and calculation, often managed through financial software.

3. Other Income

This category includes interest from various other sources like mutual funds, bonds, or other interest-bearing assets. It’s essentially any interest income that doesn’t fall into the first two categories.

How to Record Interest Income in QuickBooks Desktop?

To record interest income in QuickBooks Desktop, use the Make Deposits feature.

Go to Banking > Make Deposits, create a new interest account, enter details, select the bank account, and save.

Follow the mentioned steps below to record interest income:

Step 1: Navigate to Make Deposit

- First, go to Banking, then choose the Make Deposits option.

Sep 2: Create a New Interest Account

- Now, choose the New option to make a new interest account.

Step 3: Select the Add New Option

- Under the From Account menu, choose Add New from the drop-down section.

Step 4: Click the Other Account Types Option

- Click on the Income radio button below the Categorize money your business earns or spends option.

- Next, click on the Other Account Types radio button.

- Then, choose the Other Income option below the drop-down menu and tap on the Continue button.

Sep 5: Enter the Name of the Bank

- Now, enter the Bank’s name on the Add New Account page, fill out the relevant information, and choose the Save & Close button.

Step 6: Choose the Bank Account

- In the Make Deposit page, choose the Bank account below the Deposit to drop-down menu.

Step 7: Enter the Received Amount

- Choose the newly formed account type below the FROM ACCOUNT drop-down menu.

Step 8: Enter the Received Amount

- Then, enter the received amount below the AMOUNT section and fill out the necessary information in the required fields.

Step 9: Save the Changes

- Once you’re satisfied, choose the Save and New option.

By following these simple steps, you can effectively track and record the interest you earned from income in QuickBooks Desktop.

How to Record Interest Income in QuickBooks Online (QBO)?

To record interest income in QuickBooks Online, create an interest account under Chart of Accounts as “Other Income.” Then, use the Bank Deposit feature: select + New > Bank Deposit, choose the customer, and enter the details. Save to complete the process.

Following the step-by-step information below:

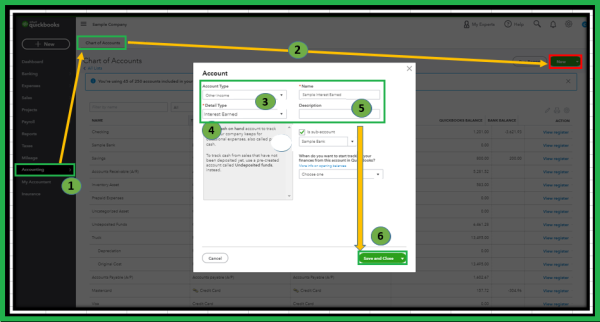

Step 1: Navigate to the Chart of Accounts

- First, go to Transactions, then choose the Chart of Accounts option.

Step 2: Create a New Interest Account

- In the Chart of Accounts, click the New button to create a new account.

Step 3: Choose the Other Income Option

- After clicking New, you’ll be prompted to choose the Account Type.

- From the drop-down list, select Other Income. This option is ideal for income sources that are not part of your core business activities, such as interest income or other non-operating income.

- In the Detailed Type drop-down, choose option “Interest Earned“.

Note: The “Interest earned” option in QuickBooks Online (QBO) is available only when bank accounts are not connected to online banking. Since both your checking and savings accounts are already linked, the option no longer appears during reconciliation.

Step 4: Save the Changes

- Below the name column, enter any applicable name, then choose Save and Close.

- After this, create a bank deposit to post the amount.

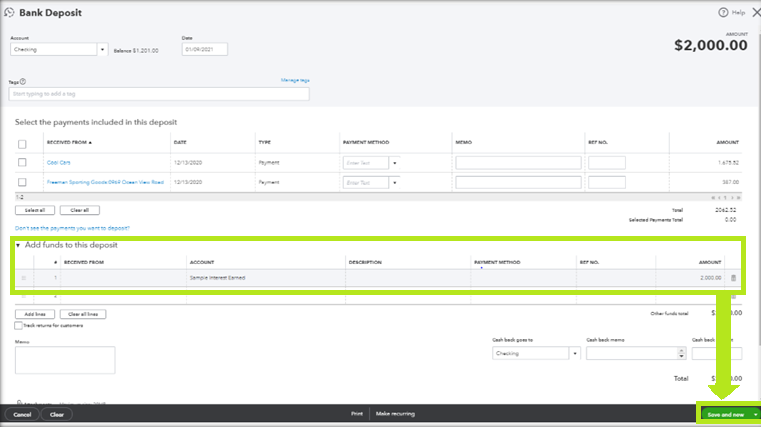

Once done, Follow the steps mentioned below to create and record a bank deposit:

Step 5: Navigate to +New Option

- First, choose the “+ New” option.

Step 6: Navigate to Bank Deposit

- Then select “Bank Deposit”.

Step 7: Choose the Customer Name

- Now, below the “Add funds to this Deposit“, choose the name of the customer who has paid the interest.

- Then choose the “Other income” account that you’ve created.

Step 8: Save the Changes

- After that, enter a description, payment method, and amount, then choose the Save and New button.

Note: From the Dashboard, you can see that the Deposit was previously recorded in the bank account.

Note: These above steps also work for tracking the interest earned for your Savings account. You can follow these steps:

Best Practices for Recording Interest Income in QuickBooks

The manage interest income in QuickBooks effectively, reconcile accounts frequently, track interest rates, and adjust categorization rules. This ensures accurate reporting, optimal income recognition, and efficient financial management.

Consider the following points below to manage interest income in QuickBooks:

1. Reconcile Your Accounts Frequently

Account reconciliation is the process of comparing monthly statements with the recorded accounts and then reconciling any difference that may exist.

This process:

- Aids in making efficient adjustments for interest amounts and changes in rates.

- Improves measurement of interest rates to increase income earnings.

- This will facilitate accurate accounting of interest income, which is necessary for sound financial decision-making.

When done often, it is easier to update the accounts and deal with any changes that occur in the economy.

2. Keep Track of Interest Rates

It is also important to constantly check the interest rates in order to control it and report income statements from interests properly.

QuickBooks allows businesses to:

- Allocate, recognize, and report income correctly.

- Ensure to adapt to rate changes within a short time to avoid differences.

- Prepare reasonable accounting figures that give the true picture of analyzed revenues.

Such adjustments secure financial credibility with respect to interest rates and prevent possible inaccurate entries in the accounts.

3. Analysis and Adjust Your Categorization Rules

This shows that it is helpful to periodically review and update the rules for categorization in order to improve the efficiency of interest income management.

This approach:

- Brings out the alignment of the financial categorization with the current standard and instruments.

- Enhances accuracy in financial reporting by presenting clear and understandable information on incomes.

- Raises the adequacy of financial control, allowing the right decisions concerning investments and projects to be made.

By continuing to make consistent categorization and adjustments, the existing economic likelihoods for business increase the reliability of the existing economic records and the existing financial management.

Recording interest income in QuickBooks is crucial for correct bookkeeping and financial management. This process involves categorizing income connected to investment activities or interest earned from bank accounts.

The Bottom Line

Adopting these best practices in QuickBooks leads to thorough management of interest income, which achieves developmental financial control. Recording interest income in QuickBooks is crucial for correct bookkeeping and financial management. This process involves categorizing income connected to investment activities or interest earned from bank accounts.

FAQs

Why should I categorize interest income as “Other Income” instead of a regular “Income” account in QuickBooks?

You should categorize interest income as an Other Income account because it represents money earned from non-core business activities, like savings accounts or investments. Regular Income accounts track revenue from your primary business operations (e.g., sales of goods or services). Correct categorization is essential for accurate financial reporting, as it ensures your Gross Profit (a key performance indicator) is not inflated by non-operating earnings.

When I reconcile my bank account, QuickBooks Desktop already shows the interest earned. Do I still need to use the “Make Deposits” feature?

No, you should not use the Make Deposits feature if you are recording the interest directly during the reconciliation process. If the interest appears on your bank statement and you select it as a clearing transaction in the reconciliation screen, QuickBooks automatically creates the necessary journal entry. Recording it separately via Make Deposits would result in the income being counted twice, causing your bank balance to be overstated.

What should I do if my bank is linked to QuickBooks Online and the “Interest Earned” detailed type is missing?

This is normal and actually simplifies the process. If your bank is linked, QuickBooks Online is designed to suggest the correct category automatically when reviewing transactions on the Banking tab. When you see the interest deposit, you should select Categorize and choose the pre-existing Interest Earned (or Other Income) account. The manual deposit steps outlined in the article are only necessary when bank feeds are not connected.

The article mentions tracking interest rates. How exactly does a small business effectively track and use this information in QuickBooks?

The main reason to track rates is for verification and planning. You can create a monthly reminder to check your current rate against the total interest earned in QuickBooks. Most importantly, you should use the bank’s year-end Form 1099-INT to reconcile the total interest income reported to the IRS with the total recorded in your QuickBooks Other Income account. Any discrepancy must be investigated and corrected before tax filing.

If I lend money and charge interest to a customer, how should I record that in QuickBooks?

When lending money and charging interest to a customer, you should typically record the interest using an Invoice. First, set up the loan principal as an Other Current Asset. The interest charged should be recorded as a service line item on the invoice, categorized to your Other Income or a specific Loan Interest Income account. This ensures the income is tied to the customer’s record and tracks what they owe you.

I received dividends and bank interest. Should I put them both into the same “Other Income” account?

While both are non-operating income, best practice is to separate them. Create a sub-account under Other Income for Interest Earned (for bank interest) and a separate sub-account for Dividend Income (for investment income). This level of detail enhances the transparency and accuracy of your financial reports, which is crucial for decision-makers and tax preparers who need to know the specific source of non-operating funds.

The article recommends reviewing categorization rules. What is the biggest mistake I could make when setting up a rule for interest income?

The biggest mistake is creating a rule that automatically categorizes all bank deposits into the Interest Earned account based only on the description. This could incorrectly include refunds, customer payments, or transfers, leading to significant reporting errors and overstating your interest income. Your categorization rule should be highly specific, using unique bank transaction codes or very precise vendor names to avoid misclassification.

Disclaimer: The information outlined above for “How to Record Interest Income in QuickBooks Desktop/Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.