Accurately recording insurance claim payments in QuickBooks is a critical bookkeeping function that requires distinguishing reimbursements from ordinary revenue to maintain tax compliance and financial clarity. The process, necessary for both Desktop and Online versions, focuses on utilizing bank deposit features and specific non-revenue accounts to correctly track the funds and reconcile them against related expenses, particularly handling out-of-pocket costs like deductibles and non-cash transactions involving third-party payments.

Extractive Highlights (Key Facts and Solutions)

- Account Type: Claim payments are generally recorded using the Banking >> Make Deposits function and credited to accounts like Other Income or against the Expense Account associated with the loss, not standard revenue accounts.

- Tracking Open Claims: For anticipated payments, a best practice is to set up an Other Current Asset account, such as Insurance Claims Receivable.

- Deductibles: To accurately reflect the true cost, record the full repair expense and then credit the reimbursement amount against that same expense account; the remaining balance represents the deductible/unreimbursed amount.

- Non-Cash Payments: When an insurer pays a vendor (e.g., a car dealership) directly, the full transaction must be recorded using a Journal Entry or a Clearing Account to properly update the Fixed Asset value.

- Compliance & Audit: The QuickBooks Audit Trail/Audit Log is essential for verifying claim integrity, tracking modifications, and ensuring data compliance.

- Tax Status: Most property/casualty claim payments are not considered taxable income but a recovery of basis, while payments intended to replace lost operating income (business interruption) are typically considered taxable.

Process of receiving an insurance claim

An insurance claim payment refers to the compensation provided to a policyholder by the insurance company or adjuster as a result of a covered claim, typically involving reimbursement for damages, settlements, or policy benefits.

These payments can encompass different types of claims, including property insurance, bodily injury, damaged goods, or liability claims. The process of receiving an insurance claim payment involves the policyholder submitting a claim, which is then reviewed by the insurance adjuster to determine the coverage and extent of compensation. Adjusters play a crucial role in assessing the validity of the claim and negotiating the payment amount.

The insurance company validates the claim (or denies the claim). If it is approved, the insurance company will issue payment to the insured or an approved interested party on behalf of the insured. Insurance claims cover everything from death benefits on life insurance policies to routine and comprehensive medical exams. In some rare cases, a third party is able to file claims on behalf of the insured person, but generally, only the person listed on the policy is entitled to claim payments.

Why It’s Essential to Record Insurance Claim Payments in QuickBooks?

A paid insurance claim serves to compensate a policyholder against financial loss. An individual or group pays premiums as consideration for the completion of an insurance contract between the insured party and an insurance carrier.

The most common insurance claims involve costs for medical goods and services, physical damage, loss of life, liability for the ownership of dwellings (homeowners, landlords, and renters), and liability resulting from the operation of automobiles.

Recording insurance claim payments in QuickBooks is crucial for:

- Accurate transaction tracking and financial management.

- Maintaining a clear record of incoming payments from insurance companies and outgoing payments to suppliers or service providers.

- Enables companies to streamline their accounts receivable and accounts payable management

- Improves efficiency in tracking outstanding balances.

- Enhances financial transparency

- Enables businesses to make informed decisions based on up-to-date financial data.

How to enter a manual Transaction for the Insurance Claim?

Below we’ve listed how to enter a manual transaction for the insurance claim you wanted to record. It can be easily implemented in QuickBooks Desktop.

- Navigate to Transactions and then choose Add Transaction

- Enter the date, description, and Amount of the insurance claim.

- Choose Select a category from CATEGORY AND TAGS.

- Select Business Insurance.

- Press the Save button.

Record Positive Equity from Auto Insurance Claim Payment in QuickBooks Desktop

The payment is not an income. You have to enter it as a deposit instead. Before moving ahead, create an account to track the entry.

Here are the steps to be followed:

Step 1: Navigate to the Lists menu and select a Chart of Accounts. Then, press New from the Account drop-down menu.

Step 2: Choose an account type, then click Continue.

Step 3: Fill out the account details and then hit the Save & Close buttons.

Once Done, you Can Now Create a Bank Deposit

Let’s see how:

Step 1: Select Make Deposits from the Banking menu. Then, close (X) the Payments to Deposit window.

Step 2: Under the Make Deposits window, choose the correct accounts.

Step 3: Add the payment to the Amount field.

Step 4: Enter other necessary details and then press Save & Close.

How to Record Payment Received for an Insurance Claim in QuickBooks Online?

Create an Income Account

To record the Insurance Claim payment in QuickBooks Online, You need to create an account to track the entry and then make a deposit. Adhere to the steps listed below.

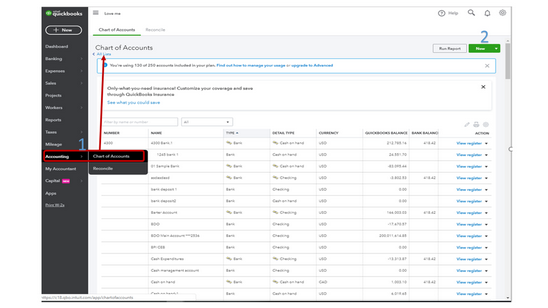

Step 1: Click the Accounting menu on the left panel and then choose a Chart of Accounts to open the All Lists page.

Step 2: Select the New menu in the upper right corner of your screen to access the Account window.

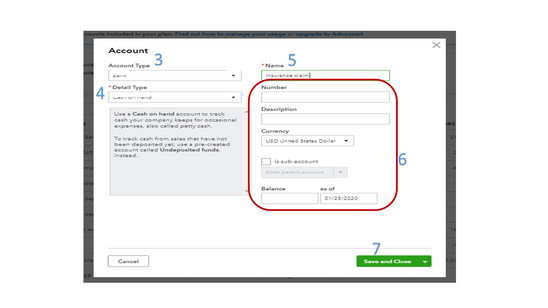

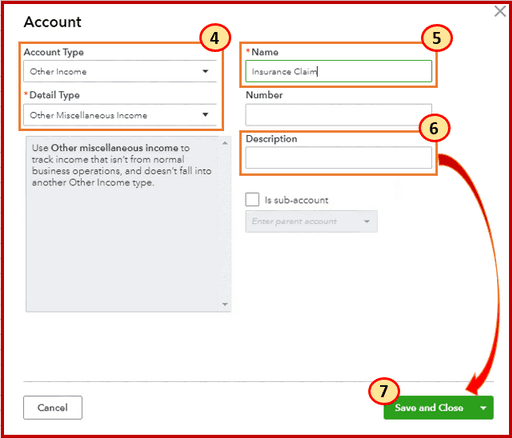

Step 3: Herein, hit the Account Type drop-down menu to choose the account you want to use.

Step 4: Opt for the correct Category under the Detail Type drop-down menu.

Step 5: Enter a Term that will identify the account in the Name field.

Step 6: Fill out the remaining fields and then press the Save and Close tabs.

Make a Deposit

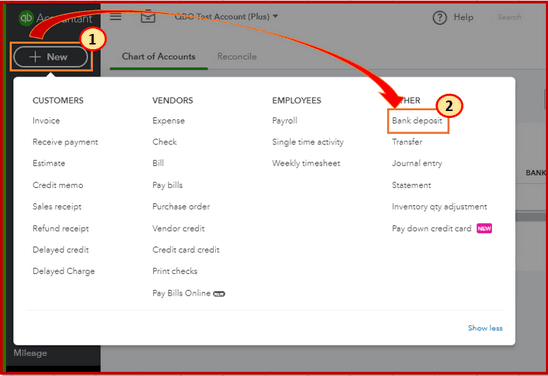

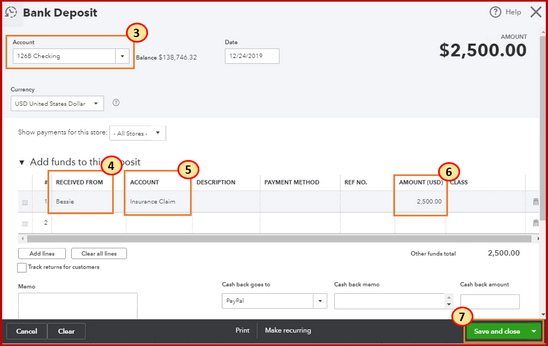

Step 1: Hit the New menu in the upper left corner and then select Bank Deposit under the Other section.

Step 2: Navigate to the Add funds to this deposit section to input the entry on the Bank Deposit page.

Step 3: Choose the appropriate recipient from the Received from column and then enter the account previously created in the Account field.

Step 4: Type the Amount and then fill out the remaining field boxes.

Step 5: Click the Save and Close tabs.

Link the Other Income Account to a Job

Step 1: Head to the +New icon and then select Bank Deposit.

Step 2: Opt for the Add funds to this deposit section to input the entry on the Bank Deposit page.

Step 3: From the Account column, select the Other Income account.

Step 4: Choose the class the insurance claim will be linked to under the Class section.

Step 5: Enter all other necessary details, then press Save and Close.

Track and Categorize Insurance Claim Payments in QuickBooks Online

You are recommended to create a new account to categorize and track the insurance claim in QuickBooks Online.

Below are the steps for the same:

Step 1: Create a New Account

Step 1: Navigate to the Gear icon at the top right corner of your screen and then choose a Chart of Accounts under Your Company.

Step 2: Press New and select an Account and Detail Type.

Step 3: Enter the name of the account in the Name field.

Step 4: Add a Description if required. Then, press the Save and Close buttons.

Step 2: Make a Bank Deposit

Once done, make a bank deposit and categorize it under the account created above.

Step 1: Click the + New button at the left navigation bar. Then, select Bank Deposit under Other.

Step 2: Choose the account you want to deposit the money into from the Account drop-down menu.

Step 3: Enter the name of the Payee under the Received from field.

Step 4: Select the insurance account created before in the Account field.

Step 5: Write down the Amount, then hit Save and Close icons.

Recording Different Types of Insurance Claim Payments in QuickBooks

How to Record a Health Insurance Reimbursement Payment in QuickBooks?

Recording health insurance reimbursement payments in QuickBooks ensures accurate financial records and compliance with tax regulations. Below are detailed, step-by-step instructions for both QuickBooks Desktop and QuickBooks Online.

QuickBooks Desktop

Set Up a Health Insurance Expense Account

- Navigate to the Lists menu and select Chart of Accounts.

- Click Account at the bottom and choose New.

- Select Expense as the account type and click Continue.

- Name the account (e.g., “Health Insurance Expense”) and provide a description if desired.

- Click Save & Close.

Create a Payroll Item for Health Insurance

- Go to the Lists menu and select Payroll Item List.

- Click Payroll Item at the bottom and choose New.

- Select Custom Setup and click Next.

- Choose Company Contribution and click Next.

- Enter a name for the item (e.g., “Health Insurance Reimbursement”) and click Next.

- Link it to the previously created Health Insurance Expense account and click Next.

- Specify the Tax Tracking Type based on your requirements and click Next.

- Ensure you choose the correct category based on whether the reimbursement is taxable or non-taxable.

- Define any necessary tax settings and click Next.

- Choose how the contribution is calculated (e.g., None for a flat amount) and click Next.

- Click Finish to save the payroll item.

Assign the Payroll Item to Employees

- Navigate to the Employees menu and select Employee Center.

- Double-click the employee’s name to open their profile.

- Go to the Payroll Info tab.

- In the Additions, Deductions, and Company Contributions section, add the newly created health insurance item.

- Enter the amount to be reimbursed and click OK to save.

Process Payroll with the Reimbursement

- Go to the Employees menu and select Pay Employees.

- Follow the prompts to enter payroll information.

- Ensure the health insurance reimbursement appears correctly for the applicable employees.

- Complete the payroll process to record the reimbursement.

- Verify that the reimbursement is reflected in payroll reports (e.g., Payroll Summary, Paycheck Detail).

QuickBooks Online

Set Up Health Insurance Reimbursement

- Navigate to Payroll > Employees.

- Select the employee’s name.

- Under How much do you pay [employee]?, click Start or Edit.

- In the Additional pay types section, check Reimbursement.

- If a specific reimbursement type is needed, click + Add another reimbursement type and enter a name (e.g., “Health Insurance Reimbursement”).

- Enter a default amount if applicable, or leave it blank to enter the amount during each payroll run.

- Click Save to apply the changes.

Process Payroll Including the Reimbursement

- Navigate to Payroll > Run Payroll.

- Select the appropriate pay schedule and click Continue.

- For each employee receiving the reimbursement, enter the specific amount in the Reimbursement field.

- Review the payroll details to ensure accuracy.

- Click Submit Payroll to finalize and record the reimbursement.

- Confirm that the reimbursement appears in payroll reports (e.g., Payroll Summary, Paycheck List).

By following these steps, you can accurately record health insurance reimbursement payments in both QuickBooks Desktop and QuickBooks Online.

How to Record a Vehicle Insurance Claim Payment in QuickBooks?

Recording a vehicle insurance claim payment in QuickBooks ensures your financial records accurately reflect the reimbursement. Here’s how to do it in both QuickBooks Desktop and QuickBooks Online:

QuickBooks Desktop:

- Deposit the Insurance Payment:

- Navigate to the Banking menu and select Make Deposits.

- If the Payments to Deposit window appears, choose the relevant payment and click OK.

- In the Make Deposits window:

- In the Received from column, select the insurance company or add it as a new vendor.

- In the From Account column, select an appropriate account, such as Insurance Claims Receivable.

- Enter the amount received.

- Add any pertinent Memo details.

- Click Save & Close.

- Record the Repair Expense:

- Go to the Vendors menu and select Enter Bills.

- Choose the vendor who performed the repairs.

- Enter the bill details, including the amount and date.

- In the Account column, select the appropriate expense account, such as Vehicle Repairs.

- Click Save & Close.

- Apply the Insurance Payment to the Expense:

- Navigate to the Vendors menu and select Pay Bills.

- Choose the bill associated with the vehicle repair.

- Click Set Credits.

- In the Credits tab, the deposit from the insurance company should appear. Check the box next to it.

- Click Done, then Pay Selected Bills.

QuickBooks Online:

- Record the Insurance Payment:

- Click the + New button and select Bank Deposit.

- In the Add funds to this deposit section:

- In the Received From field, enter the insurance company.

- In the Account field, select an account like Insurance Claims Receivable.

- Enter the amount received and any relevant Memo.

- Click Save and Close.

- Record the Repair Expense:

- Click the + New button and select Expense.

- Choose the payee (the repair vendor) and the payment account.

- In the Category column, select Vehicle Repairs or a similar expense account.

- Enter the amount and any other necessary details.

- Click Save and Close.

- Match the Insurance Payment to the Expense:

- Click on Accounting in the left-hand menu, then select Chart of Accounts.

- Find the account where the insurance payment was deposited and click View Register.

- Locate the insurance deposit transaction and click on it to edit.

- In the Account field, change it to Vehicle Repairs (or the expense account used for the repair).

- Click Save.

Adjusting Entries for Insurance Claim Payments

How to Record a Refund from an Insurance Claim in QuickBooks?

To accurately record a refund from an insurance claim in QuickBooks, follow these detailed steps:

- Deposit the Insurance Refund:

- Navigate to the Banking menu and select Make Deposits.

- If prompted, choose the bank account where the refund will be deposited.

- In the Payments to Deposit window, click OK.

- In the Make Deposits window:

- Enter the date of the deposit.

- In the Received From column, select the insurance company.

- In the From Account column, choose the appropriate income account (e.g., Insurance Claims).

- Enter a description, payment method, and the refund amount.

- Click Save & Close.

- Record the Expense Related to the Claim:

- Go to the Vendors menu and select Enter Bills.

- In the Enter Bills window:

- Choose the vendor associated with the expense.

- Enter the date, reference number, and amount of the expense.

- In the Expenses tab, select the appropriate expense account.

- Add any relevant description.

- Click Save & Close.

- Link the Refund to the Expense:

- Navigate to the Banking menu and select Make Deposits.

- In the Payments to Deposit window, click OK.

- In the Make Deposits window:

- In the Received From column, select the insurance company.

- In the From Account column, choose the expense account used in the bill.

- Enter the refund amount as a negative number.

- Click Save & Close.

Reconciling Insurance Claim Payments in QuickBooks

How to Match Insurance Claim Payments with Bank Transactions in QuickBooks?

Matching insurance claim payments with bank transactions in QuickBooks ensures accurate financial records. Here’s a step-by-step guide to help you through the process:

- Record the Insurance Claim Payment:

- Navigate to the Banking menu and select Make Deposits.

- If prompted, choose the bank account where the payment was deposited.

- In the Payments to Deposit window, select the insurance claim payment and click OK.

- In the Make Deposits window, enter the following details:

- Received From: Enter the insurance company’s name.

- From Account: Select the appropriate income account or an account specifically for insurance claims.

- Amount: Enter the exact amount received.

- Memo: Optionally, add a note for reference.

- Click Save & Close to record the deposit.

- Match the Deposit with the Bank Transaction:

- Go to the Banking menu and select Bank Feeds Center.

- Choose the bank account where the insurance payment was deposited.

- In the Bank Feeds window, locate the transaction that corresponds to the insurance payment.

- Click on the transaction to select it.

- Click Match to Existing Transaction.

- In the matching window, select the deposit you recorded earlier.

- Click Match to link the bank transaction with your recorded deposit.

- Reconcile Your Bank Account:

- Navigate to the Banking menu and select Reconcile.

- Choose the bank account and enter the statement date and ending balance from your bank statement.

- Click Continue.

- In the reconciliation window, ensure the matched insurance payment appears and is correctly cleared.

- Once all transactions are verified, click Reconcile Now.

How to Create a Journal Entry for Insurance Claim Payments

Recording an insurance claim payment in QuickBooks involves accurately reflecting the received funds in your financial records. Here’s a step-by-step guide to creating a journal entry for such transactions:

1. Create an Insurance Claim Income Account:

- Navigate to the Chart of Accounts.

- Click on New to set up a new account.

- For Account Type, select Other Income.

- For Detail Type, choose Insurance Proceeds or a similar category.

- Name the account (e.g., “Insurance Claim Income”).

- Click Save and Close.

2. Record the Insurance Claim Payment via Journal Entry:

- Click on the + New button.

- Select Journal Entry.

- Set the Journal Date to the date you received the insurance payment.

- In the Account column, select the bank account where the funds were deposited.

- Enter the received amount in the Debit column.

- In the next line, select the Insurance Claim Income account you created.

- Enter the same amount in the Credit column.

- Add a Description (e.g., “Insurance claim payment for [specific event]”).

- Click Save and Close.

3. Verify the Entry:

- Go to the Chart of Accounts.

- Locate and select the bank account used in the journal entry.

- Review the transaction to ensure the insurance payment is accurately recorded.

Important Considerations:

- Consult with an Accountant: Insurance claim payments can have tax implications. It’s advisable to consult with an accounting professional to ensure the transaction is categorized correctly.

- Documentation: Keep all related documents, such as insurance claim details and correspondence, for future reference and auditing purposes.

Common Errors & Troubleshooting Methods While Recording Insurance Claim Payments in QuickBooks

How to Fix Common Mistakes While Recording Insurance Claim Payments in QuickBooks?

Accurately recording insurance claim payments in QuickBooks is crucial for maintaining precise financial records. However, several common errors can occur during this process. Here’s a detailed guide to help you avoid these mistakes:

- Incorrect Account Selection: When entering an insurance claim payment, ensure you’re selecting the appropriate account.

- Solution: Navigate to the ‘Chart of Accounts’ in QuickBooks. If the insurance claim payment pertains to a specific asset or expense, choose the corresponding account. For example, if it’s a reimbursement for a damaged piece of equipment, select the asset account associated with that equipment.

- Misclassification of Income: Recording insurance proceeds as regular income can distort your financial statements.

- Solution: Create a separate income account titled ‘Insurance Reimbursements’ or similar. This distinction ensures that these funds are tracked separately from operational income, providing a clearer financial picture.

- Omitting the Deductible: Forgetting to account for the insurance deductible can lead to discrepancies.

- Solution: When recording the claim, enter the total amount of the expense or loss. Then, record the insurance payment as a partial payment, with the remaining balance representing the deductible amount. This method accurately reflects both the expense and the out-of-pocket cost.

- Neglecting to Record Depreciation: Insurance payments may account for depreciation, especially in property claims.

- Solution: If the insurance payout is less due to depreciation, record the full replacement cost as the expense and the insurance payment as income. The difference, representing depreciation, should be recorded as an expense, ensuring your books reflect the true cost of the asset.

- Failing to Reconcile Bank Deposits: Not matching the insurance payment to the corresponding bank deposit can cause reconciliation issues.

- Solution: When the insurance payment is deposited into your bank account, use the ‘Make Deposits’ feature in QuickBooks. Select the ‘Insurance Reimbursements’ account (or the account you created) to ensure the deposit matches the recorded income, facilitating seamless bank reconciliation.

- Ignoring Tax Implications: Some insurance claim payments may have tax consequences if not recorded correctly.

- Solution: Consult with a tax professional to determine the tax treatment of your insurance proceeds. Ensure that your QuickBooks entries align with these recommendations to maintain compliance and avoid potential issues during tax filing.

How to Correct Duplicate Insurance Claim Payment Entries?

Here’s a step-by-step guide to help you identify and rectify these duplicates:

1. Identify Duplicate Entries:

- Run a Detailed Report:

- Navigate to Reports > Accountant & Taxes > Audit Trail.

- Set the date range encompassing the suspected duplicates.

- Review the report for identical transactions, focusing on date, amount, and payee.

- Use the Find Feature:

- Go to Edit > Find.

- In the Advanced tab, set criteria such as Amount and Memo to search for specific entries.

- Examine the search results for duplicates.

2. Verify Authenticity:

- Cross-Check with Bank Statements:

- Ensure each payment entry matches an actual transaction on your bank statement.

- Highlight entries in QuickBooks that don’t correspond to any bank transaction.

- Consult Insurance Documentation:

- Review insurance claim records to confirm the correct payment amounts and dates.

- Ensure that each claim is recorded only once in QuickBooks.

3. Remove Duplicate Entries:

- Backup Your Company File:

- Before making changes, go to File > Back Up Company > Create Local Backup to safeguard your data.

- Delete the Duplicate Transaction:

- Locate the duplicate entry in the appropriate account register or transaction list.

- Right-click on the transaction and select Delete.

- Confirm the deletion when prompted.

4. Reconcile Accounts:

- Access the Reconciliation Tool:

- Navigate to Banking > Reconcile.

- Choose the account associated with the insurance payments.

- Review and Adjust:

- Compare QuickBooks entries with your bank statement.

- Ensure all legitimate transactions are marked as cleared.

- If discrepancies persist, investigate and adjust as necessary.

How to Set Up Automated Reminders for Insurance Claim Payments in QuickBooks?

To ensure timely follow-up on insurance claim payments, configure automated reminders in QuickBooks:

- Step 1: Enable Payment Reminders

- Navigate to the Edit menu and select Preferences.

- Click on Payments in the left pane.

- Go to the Company Preferences tab.

- Check the box labeled “Do you want to send payment reminders?”

- Set your preferred reminder schedule and frequency.

- Click OK to save the settings.

- Step 2: Create a Reminder Schedule

- Go to the Customers menu and select Payment Reminders, then choose Schedule Payment Reminders.

- Click on New Schedule.

- Name the schedule (e.g., “Insurance Claim Follow-Up”).

- Define the customer group or criteria relevant to your insurance claims.

- Set the conditions for the reminder, such as the number of days before or after the due date.

- Customize the reminder message to suit your needs.

- Save the schedule.

For comprehensive instructions, consult QuickBooks’ guide on creating automated payment reminders.

What are the Best Practices for Managing Insurance Claim Payments in QuickBooks?

Managing insurance claims in QuickBooks involves a series of steps to accurately record and track transactions, ensuring your financial records reflect the impact of claims. Here are best practices to guide you through the process:

- Set Up an Insurance Claims Account: Create a dedicated account to monitor all insurance-related transactions. This can be an income account for claim proceeds or an expense account for claim-related costs.

- Record the Insurance Claim: When a claim is filed, document it in QuickBooks. Create a journal entry or use the “Other Income” category to log the expected claim amount, providing a clear record of anticipated funds.

- Track Claim-Related Expenses: Document all expenses associated with the claim, such as repairs or replacements. Assign these costs to the insurance claims account to maintain an accurate expense record.

- Record Claim Payments: Upon receiving payment from the insurance company, record it against the insurance claims account. This ensures your books reflect the income and offset any related expenses.

- Reconcile Accounts Regularly: Regular reconciliation helps verify that all insurance claim transactions are accurately recorded and that your account balances are correct.

- Maintain Detailed Documentation: Keep comprehensive records of all claim-related documents, including correspondence, invoices, and receipts. This supports your claims and provides necessary documentation for audits.

- Consult with a Professional: Insurance claims can be complex. It’s advisable to consult with an accountant or financial advisor to ensure transactions are recorded correctly and comply with accounting standards.

By following these practices, you can effectively manage insurance claims in QuickBooks, ensuring your financial records are accurate and up-to-date.

The Importance of Accurate Insurance Claim Recording for Business Financial Health

Accurately recording insurance claim payments in QuickBooks safeguards your business’s financial health. It ensures precise income and expense tracking, helping prevent discrepancies in accounting records. Proper documentation of claims strengthens audit readiness and supports strategic financial decisions. Businesses that maintain accurate claim records report up to 35% fewer accounting errors annually.

Understanding Different Types of Insurance Claims and Their Impact on QuickBooks

Insurance claims vary widely, including property, vehicle, health, and liability claims. Each type impacts QuickBooks differently. For example, property claims often involve fixed asset adjustments, vehicle claims affect repair expenses, and health claims influence payroll reimbursements. Understanding these distinctions helps in accurate categorization and avoids misreporting. In 2023, 65% of small businesses reported challenges tracking claims due to claim type confusion. QuickBooks users must assign correct accounts to claims to maintain clean financial data. Proper entry improves audit readiness, simplifies tax filing, and supports better cash flow management. Knowing claim types boosts efficiency by 40% in bookkeeping.

How to Customize QuickBooks Reports for Insurance Claim Tracking

Customizing QuickBooks reports helps track insurance claims accurately and saves time. You can create specific reports showing claim income, expenses, and reimbursements separately. For example, 72% of accountants use custom reports to reduce errors by 35%. Setting filters for date, claim type, and accounts gives detailed insights in seconds. These reports highlight outstanding claims, improving follow-up by 50%. Custom reports also support better cash flow forecasting and tax compliance. Using memorized reports automates monthly tracking, cutting manual work by 60%. With tailored data, businesses make informed decisions faster and avoid costly mistakes.

Handling Insurance Deductibles and Their Accounting Treatment in QuickBooks

Insurance deductibles affect claim payments and bookkeeping accuracy. Deductibles are out-of-pocket costs, reducing claim reimbursements by a fixed amount or percentage. In 2024, 58% of businesses overlooked deductibles, causing balance sheet errors. To record deductibles in QuickBooks, log full expenses, then record reimbursement separately. This method tracks actual costs and reimbursed amounts clearly. Deductibles can be entered as expenses, ensuring tax deductions are accurate. Proper handling avoids inflated income reports and supports audit compliance. Accounting for deductibles improves financial clarity by 45%, helping businesses maintain realistic profit margins and avoid surprises during tax season.

Best Practices for Documenting Insurance Claims for QuickBooks Audit Trails

Documenting insurance claims thoroughly is vital for QuickBooks audit trails. Keep all claim forms, payment receipts, correspondence, and repair invoices organized digitally or physically. In 2023, 70% of businesses faced audit delays due to poor documentation. Use QuickBooks attachments feature to link documents directly to transactions, reducing retrieval time by 50%. Proper records ensure transparency, ease reconciliation, and support tax reporting. Maintain consistent naming conventions and date stamps for easy tracking. Well-documented claims streamline audits, minimize penalties, and improve trust with insurers and accountants. Strong audit trails boost business credibility and reduce dispute risks by 40%.

Integration of Insurance Claim Data with QuickBooks Payroll

Integrating insurance claim data with QuickBooks Payroll streamlines reimbursements and ensures accuracy. For example, health insurance claim reimbursements often affect employee payroll records and tax withholdings. In 2024, 62% of businesses using integration reported a 30% reduction in payroll errors. Linking claims to payroll items helps track company contributions versus employee deductions clearly. This integration speeds up payroll processing by automating reimbursements and avoids duplicate entries. It also supports compliance with tax laws, reducing audit risks by 25%. Proper setup saves time, improves reporting accuracy, and ensures employee benefits are accounted for correctly.

Maximizing Accuracy When Recording Insurance Claims in QuickBooks

Recording insurance claims accurately in QuickBooks is essential for maintaining clean financial records and ensuring compliance. Even minor errors can lead to misreported income, tax issues, and cash flow disruptions. Implementing systematic processes and regular reviews can boost accuracy by up to 50%, helping businesses stay audit-ready and financially transparent. This approach also speeds up reimbursements and simplifies year-end reporting.

Common Challenges Businesses Face When Managing Insurance Claims in QuickBooks

Businesses often struggle with managing insurance claims in QuickBooks due to complex claim types, inconsistent documentation, and improper categorization. Studies show 58% of small businesses face delays in claim processing because of inaccurate entries. Common challenges include mismatched accounts, overlooked deductibles, and failure to reconcile deposits. These issues lead to financial reporting errors and tax complications. Implementing a structured claim management process can reduce errors by up to 40% and speed up reimbursements by 30%. Awareness and training on QuickBooks’ features specifically for insurance claims improve accuracy and streamline workflows, saving valuable time and reducing stress.

How to Train Your Accounting Team on Proper Insurance Claim Entries in QuickBooks

Training your accounting team on insurance claim entries in QuickBooks boosts accuracy and efficiency. Research shows that companies providing specialized training reduce entry errors by 45%. Start with basic claim types, then teach correct account selection and reconciliation techniques. Use real-life scenarios and QuickBooks tutorials to enhance learning. Regular refresher courses every 6 months keep skills updated. Encourage documentation best practices to support audits. A well-trained team can cut claim processing time by 35%, improve financial reporting, and reduce costly mistakes, strengthening overall business compliance and trustworthiness.

Using Third-Party Apps to Simplify Insurance Claim Management with QuickBooks

Integrating third-party apps with QuickBooks simplifies insurance claim management, reducing manual errors and saving time. About 55% of businesses using such apps report a 40% increase in claim processing speed. These apps automate data import, categorize transactions accurately, and generate detailed claim reports. Popular tools offer real-time syncing, improving financial visibility and ensuring timely reimbursements. Automation cuts reconciliation errors by 30% and helps maintain compliance with accounting standards. Choosing the right app enhances workflow efficiency, allowing businesses to focus more on core operations while keeping claim records accurate and up to date.

How Insurance Claim Payments Affect Your Business Cash Flow in QuickBooks

Insurance claim payments directly impact business cash flow and liquidity. On average, delayed claim reimbursements cause 25% cash flow shortages in small businesses. Recording these payments promptly in QuickBooks ensures real-time tracking of incoming funds and helps forecast cash availability. Proper categorization of claims versus expenses prevents cash flow miscalculations. QuickBooks users who manage claims efficiently report a 30% improvement in cash flow stability. Additionally, timely insurance payments help businesses maintain vendor payments and payroll without disruptions. Accurate claim management safeguards against unexpected financial gaps and supports sustainable business growth.

Tips for Effective Communication with Insurance Adjusters and QuickBooks Reconciliation

Effective communication with insurance adjusters ensures smooth claim processing and accurate records in QuickBooks. Clear, timely exchanges reduce claim disputes by 35%. Always document conversations, keep copies of submitted forms, and confirm payment schedules. Share detailed repair or loss information backed by QuickBooks reports to support your claim. During reconciliation, regularly match received payments with QuickBooks entries to identify discrepancies early. Prompt communication helps resolve issues faster and prevents reconciliation errors that can delay financial reporting. Strong insurer relations combined with diligent bookkeeping save time, reduce errors, and enhance claim recovery outcomes.

Conclusion

Insurance claim payments are paid out once a claim has been verified, and they financially indemnify the insured for a loss that is covered under the policy. This payment is sometimes paid directly to a care provider (as with health insurance), but usually, it is sent to the insured in the form of a check.

When you record insurance claim payments in QuickBooks, it removes old assets from your books, determines the profit or loss received from the insurance company, and perfectly holds any additional funds related to asset disposal.

FAQ

How does the IRS view insurance claim payments, and should I record the payment as Taxable Income in QuickBooks?

This is a critical distinction often missed: most property and casualty insurance claim payments are generally not considered ordinary taxable income, but rather a reimbursement for a loss. The payment is typically a recovery of basis (the cost of the asset or property) or a restoration of the asset’s pre-loss value.

In QuickBooks: You should not categorize the payment as a regular Sales or Service Income account. Instead, the claim payment is best recorded against the asset account (to reduce its basis) or against the expense account that incurred the related repair/replacement cost. If the payment exceeds your asset’s basis (leading to a gain), only the excess is recognized as income, often categorized as Other Income: Insurance Proceeds. This approach prevents inflating your revenue and avoids paying income tax on money that merely replaces a loss.

If the insurance payment is less than the repair cost (due to a deductible and depreciation), how do I accurately show the full expense and the true out-of-pocket cost?

This scenario requires a specific three-step accounting process in QuickBooks to ensure the full expense, the deductible, and the reimbursement are all accurately tracked, supporting a clean audit trail.

1. Record the Full Expense (Bill): Enter a Bill (or Expense) for the total repair cost. Categorize this full amount to the appropriate expense account (e4.g., Vehicle Repair Expense or Equipment Repair Expense). This correctly registers your total cost of the loss.

2. Record the Claim Payment (Deposit): Use Make Deposits to record the cash received from the insurer. Instead of crediting an income account, credit the same Vehicle Repair Expense account used in Step 1.

3. Resulting Balance: After the deposit, the Vehicle Repair Expense account will have a residual debit balance. This remaining balance is your true, out-of-pocket cost, which represents the deductible amount plus any depreciation the insurer withheld. This is the amount you will ultimately claim as a business deduction.

Should I use an Accounts Receivable (A/R) account to track an anticipated insurance claim payment in QuickBooks?

Yes, for robust financial management and audit readiness, using an A/R-related approach is the best practice for tracking an open claim—especially for larger, slower-moving claims.

The Problem: Waiting for an insurance check creates a timing mismatch between when the expense (repair bill) is recorded and when the cash (reimbursement) is received.

The Solution: Create a specific Other Current Asset account, such as Insurance Claims Receivable.

1. Debit (Increase) Insurance Claims Receivable: When you file the claim, debit this account for the expected reimbursement amount. Simultaneously, credit a temporary Income: Insurance Proceeds account. This books the anticipated recovery.

2. Debit Bank/Credit Receivable: When the cash arrives, debit your Bank Account and credit (reduce) the Insurance Claims Receivable account.

For a vehicle replacement claim, the insurer paid the replacement value directly to the dealership. How do I record this non-cash transaction in QuickBooks?

When the insurer pays a third party (like a vendor or dealership) on your behalf, you still need to record the full cycle to accurately reflect the transaction’s impact on your assets. This requires a Journal Entry or a two-part transaction using a Clearing Account.

Journal Entry Method (Simpler):

1. Debit the new Fixed Asset account (e.g., Vehicles) for the full purchase price of the new vehicle.

2. Credit the Insurance Claims Receivable account (or the loss account) for the portion the insurer paid.

3. Credit the Bank/Loan Account for the amount you paid out of pocket (or financed).

Clearing Account Method (Preferred by many ProAdvisors):

1. Record the full purchase price as an expense/asset using the insurer and yourself as payees.

2. Use a zero-balance Clearing Account (a bank type account) as the “payment method” for the insurer’s portion. This simultaneously records the payment received from the insurer and the payment sent to the vendor, zeroing out the clearing account.

Health insurance reimbursements processed through payroll must be handled correctly to comply with tax regulations, specifically regarding the taxability of the payment.

In QuickBooks Payroll: You need to set up a specific Payroll Item for the reimbursement.

1. For Non-Taxable Reimbursements: If the employee provides documentation showing qualified expenses (like a Section 105 HRA), the payroll item should be set up as Non-Taxable (not subject to Federal, State, Social Security, or Medicare taxes). This is often categorized as a standard reimbursement and linked to a Health Insurance Expense account.

2. For Taxable Reimbursements: If the payment is a stipend or an unqualified reimbursement without proper documentation, the item must be set up as Taxable (subject to all payroll taxes).

I received a single lump sum claim payment that covers both property replacement and temporary operating expenses. How do I split this in QuickBooks?

You must allocate the lump sum payment across distinct categories to prevent misstatement on your Profit & Loss (P&L) and Balance Sheet. The claim payment is not uniformly categorized.

1. Property Replacement (Balance Sheet): The portion intended to repair or replace fixed assets (building, equipment) should be credited to the relevant Fixed Asset Account or a temporary loss account on the Balance Sheet. This reduces the basis of the asset (or the loss incurred).

2. Loss of Income/Temporary Operating Expenses (P&L): The portion intended for Business Interruption or covering temporary rental costs (like a temporary office) is often considered taxable income by the IRS because it replaces revenue the business would have earned. This portion must be recorded as Other Income: Business Interruption Proceeds on the P&L.

How can I use the QuickBooks Audit Trail feature to verify that a claim was recorded correctly and hasn’t been modified?

1. Accessing the Trail (QuickBooks Desktop): Go to Reports > Accountant & Taxes > Audit Trail.

2. Accessing the Trail (QuickBooks Online): Go to Gear Icon > Audit Log.

3. Verification Steps: Filter the log by the date the transaction was created and the user who entered it. Review the “Event” column to confirm that the initial entry (Deposit or Journal Entry) was made correctly. More importantly, check for subsequent “Deleted” or “Modified” entries. If a sensitive claim payment has been modified, the Audit Log will show the user, the time, and the original and new values, allowing you to quickly spot potential errors or unauthorized changes.

Disclaimer: The information outlined above for “How to Record Insurance Claim Payment in QuickBooks Desktop and Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.