Highlights (Key Facts & Solutions)

- Version Determines Method: Renewal method depends on the payroll version: Enhanced Payroll is self-service online; Assisted Payroll requires contacting Intuit Support due to tax liability requirements.

- Administrator Access: Renewal must be initiated while logged in as the Administrator of the QuickBooks company file.

- Common Error PS038 Fix: This error, caused by paychecks stuck as “Online to Send,” is fixed by locating, correcting, or voiding the stuck paychecks within the Employee Center.

- Common Error PS036 Fix: This verification failure is typically resolved by removing the existing payroll service key and then manually re-entering and verifying the correct key in the Manage Service Key section.

- Mandatory Verification: After renewal, users must verify the subscription status is “Active” in the Payroll Center and manually ensure the latest payroll tax tables have been downloaded to maintain compliance.

- Software Currency: To prevent failures like Error 30114, users must ensure both the QuickBooks Desktop application and the tax tables are fully updated before attempting the renewal process.

Overview

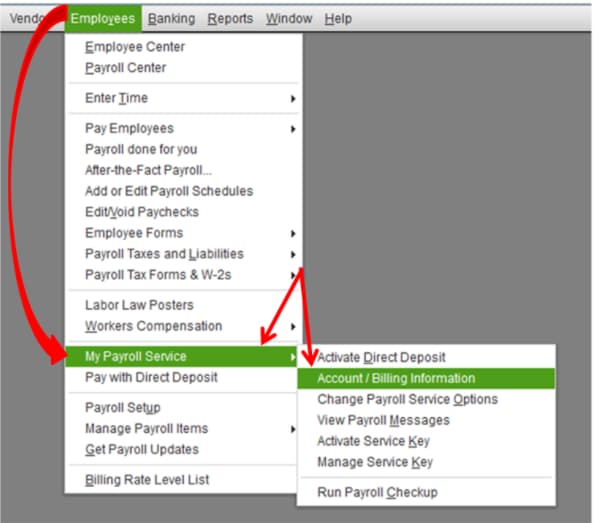

To renew your QuickBooks Desktop Pro or Premier Payroll Subscription, first log in as an administrator. Then, under the “Employee” menu, go to “My Payroll Services” and select “Account/Billing Information”.

Before renewing your payroll subscription services, check the status (active or inactive) and version (Assisted or enhanced) of the payroll services. The method of reactivation will vary depending on the subscription’s status.

If your payroll subscription is inactive or cancelled, you can renew it by following the necessary payment-related steps. However, if your subscription is active, you just need to reactivate the payroll subscription.

How to Check Payroll Subscription Status & Version of QuickBooks Desktop Pro and Premiere

Before you start with renewing your payroll subscription, it is important to check whether the subscription status is active or inactive and which version it is using (assisted or enhanced).

In case you have an active subscription, then you might need just to reactivate your QuickBooks Desktop Pro or Premier Payroll Subscription.

Steps to Check the Payroll Subscription Status

- Step: Open Your Company File

- Step: Sign In as the Primary or Payroll Admin

- Step: Go to the top menu and select Employees.

- Step: From the drop-down, choose My Payroll Service.

- Step: Select Account/Billing Info (sometimes labeled as Account/Billing Information)

- Step: Log In to Your Intuit Account

- Step: View Subscription Status

- Here, you can view your payroll subscription status, whether it is Active or Inactive.

Step to Check the Payroll Subscription Version

- Step: Open your QuickBooks Desktop company file.

- Step: Sign in as the Primary Admin or Payroll Admin.

- Step: Go to Employees, then select Payroll Center.

- Step: Within the Payroll Center, look for the Subscription Statuses tab.

- Step: The information on this tab will show you which payroll service (assisted or enhanced) you’re using.

Renewing of QuickBooks Desktop Pro or Premier Payroll Subscription

There are two methods to renew your QuickBooks Desktop Pro or Premier, depending on whether you are using enhanced payroll or assisted payroll.

Renew QuickBooks Desktop Pro or Premier Payroll Subscription (Enhanced)

Follow these steps to renew your QuickBooks Desktop Pro or Premier Payroll subscription (Enhanced or Basic):

- Step: Open QuickBooks Desktop

- Launch your QuickBooks Desktop company file

- Step: Access Payroll Service Account/Billing Information

- Go to the Employees menu.

- Select My Payroll Service.

- Click on Account/Billing Information.

- Step : Sign In to Your Intuit Account

- Sign in with your Intuit account credentials. Enter your user ID and password.

- Step: Review Subscription Status

- On the Intuit account page, check your payroll subscription status.

- If your subscription is expired or due for renewal, you’ll see a Resubscribe or Reactivate button.

- Step: Update Payment Information

- Click Resubscribe or Reactivate.

- Review your subscription details.

- Select your preferred Payment Method and enter updated payment details if necessary.

- Step: Complete Renewal

- Click Place Order or Submit to finalize your renewal.

- Step: Verify Renewal

- After renewal, return to Employees > My Payroll Service > Account/Billing Information to confirm your subscription status is now active.

Renew QuickBooks Pro & Premier Payroll Subscription – Stay Compliant Today

Renew QuickBooks Desktop Pro or Premier Payroll Subscription (Assisted)

To renew your QuickBooks Desktop Payroll Assisted subscription (used with Pro or Premier), you must contact Intuit’s official support team directly. Unlike Enhanced or Basic payroll, there is no self-service online renewal for Assisted Payroll.

Here’s the process:

- Step: Prepare Your Account Information

- Have your company’s QuickBooks account details and payroll service information, including your company ID, contact information, and any recent billing statements.

- Steps: Contact Intuit Payroll Assisted Support

- Call Intuit’s official support team for Payroll Assisted. You can find the most current support number in your QuickBooks Desktop application or on Intuit’s official website.

- In QuickBooks Desktop, go to the Help menu

- Select QuickBooks Desktop Help.

- Click Contact Us and describe your request as “Renew Payroll Assisted Subscription” to get the correct contact options.

- Step: Work with the Support Representative

- The support agent will verify your account and guide you through the renewal process.

- You may be asked to confirm or update your billing information and payment method.

- The representative will process your renewal and provide confirmation.

- Step: Wait for Confirmation

- The renewal may take up to 24 hours to be reflected in your account.

- Once renewed, your Payroll Assisted subscription status will update to “Active.”

- You can verify this in the Payroll Center under the Employees menu.

QuickBooks Pro/Premier Payroll Renewal Errors (PS038, PS036, 30114)

When renewing your payroll subscription in QuickBooks Pro or Premier, you might run into errors like PS038, PS036, or 30114. These usually happen due to outdated payroll data, incorrect service keys, or connectivity issues with Intuit’s servers.

Here’s what these common errors mean and how to resolve them:

Common Payroll Renewal Errors & How to Fix Them

1. Error PS038 – “You have a paycheck stuck as ‘Online to Send'”

- Cause: A paycheck is stuck in the system and hasn’t been sent or updated correctly.

- Solution:

- Go to the Employee Center, locate stuck paychecks, and try sending or voiding them.

- Update your payroll and QuickBooks to the latest version.

- If the issue persists, reach out to QuickBooks support for paycheck data repair.

2. Error PS036 – “Cannot verify your payroll subscription”

- Cause: This often appears when your payroll service key is incorrect or your subscription info is outdated.

- Solution:

- Go to Employees > My Payroll Service > Manage Service Key.

- Remove and re-enter your valid service key.

- Also, check your QuickBooks license and update your billing info in your Intuit account.

3. Error 30114 – “Subscription verification failed”

- Cause: Typically caused by a failed attempt to validate your payroll subscription during renewal.

- Solution:

- Update QuickBooks and run the Payroll Subscription Validation:

- Go to Employees > My Payroll Service > Account/Billing Info and sign in.

- Verify your subscription details and refresh your service.

- If needed, restart QuickBooks and reattempt renewal.

- Update QuickBooks and run the Payroll Subscription Validation:

Bottom Line

Renewing your QuickBooks Pro or Premier Payroll subscription involves checking your subscription status and version, then following the appropriate renewal steps—self-service for Enhanced payroll or contacting Intuit support for Assisted payroll.

Renew QuickBooks Pro & Premier Payroll Subscription – Stay Compliant Today

Frequently Asked Questions

1. What are the key distinctions between Enhanced Payroll and Assisted Payroll that affect the renewal process?

The core distinction lies in who manages the tax compliance and the subsequent method of renewal:

- Enhanced Payroll (Self-Service):

- The client is responsible for filing their own federal and state tax forms (e.g., 941, W-2s) and making tax payments.

- Renewal is typically a self-service process completed online through the QuickBooks Desktop application or the Intuit account portal.

- Assisted Payroll (Full Service):

- Intuit assumes responsibility for depositing and filing the client’s payroll taxes and forms, including a tax penalty guarantee.

- Renewal must be completed by contacting Intuit’s official Assisted Payroll Support team; there is no self-service online renewal due to the fiduciary nature of the tax service.

2. If my Enhanced Payroll subscription has expired, do I lose access to historical payroll data?

No, you generally do not immediately lose historical data stored in the company file, but the payroll functionality is severely restricted:

- Access Restriction: Upon expiration, the system ceases all online services. You cannot create new paychecks, update tax tables, process direct deposits, or e-file forms.

- Historical Data: Past paychecks, employee records, and payroll history remain within your QuickBooks company file. You can usually view this data, but you cannot make any updates or utilize active payroll features.

- Best Practice: Renew promptly and ensure the QuickBooks application is up to date to maintain access to critical online services and tax compliance features.

3. I received Error PS038 during renewal. How is a “stuck” paycheck preventing my subscription verification?

Error PS038 indicates a data integrity failure where a paycheck transaction is improperly marked as “Online to Send” but has not been successfully transmitted or resolved, preventing the renewal and tax table update sync.

The required steps to resolve this data inconsistency include:

- Identify Stuck Paychecks: Use the Find feature (Edit > Find > Advanced) to locate all paychecks marked with the status “Online to Send.”

- Clear the Status: Open the oldest stuck paycheck, click Paycheck Detail, make a minor, reversible change (like adding and removing a zero-value earnings item), and then Save & Close to force the paycheck to be re-saved and the status cleared.

- Send Data: Go to Employees > Send Payroll Data and attempt to send the data again.

- Troubleshoot: If the error persists, update the QuickBooks application, verify the payroll service key, and then attempt renewal.

4. What is the correct way to update my payroll service key if I receive Error PS036 during renewal?

Error PS036, “Cannot verify your payroll subscription,” frequently means the service key (subscription identifier) in your company file does not match the key on file with Intuit’s servers, or that the file Paysub.ini is corrupt.

The correct steps to manage and update the service key are:

- Navigate to Employees menu.

- Select My Payroll Service.

- Choose Manage Service Key.

- Remove the existing, invalid key (Select the key, click Remove).

- Select Add and manually re-enter the correct payroll service key associated with your Intuit account.

- Click Finish or Update/Verify to force synchronization with Intuit’s server.

- Alternative Fix: If the issue continues, search for and rename the hidden file

Paysub.ini(e.g., toPaysub.old), which forces QuickBooks to create a new, clean subscription file upon next sign-in.

5. Why do I need to contact a support agent for Assisted Payroll renewal, and what information should I have ready?

Assisted Payroll renewal is a mandatory agent-assisted process because Intuit accepts the full tax liability and guarantee for tax filings and payments. The agent must verify sensitive account and banking information for compliance before renewal can be processed.

Information to prepare before calling the Assisted Payroll Support team includes:

- The company’s QuickBooks License Number and Company ID.

- The Payroll Service Key (if known).

- The current primary billing method and associated contact information.

- Confirmation that you are logged in as the Primary Admin of the QuickBooks file.

6. If my renewal attempt fails with Error 30114, what is the primary cause and the necessary first step for resolution?

Error 30114, “Subscription verification failed,” is a general failure often caused by deep system issues that prevent QuickBooks from securely validating the subscription. The most common underlying causes are:

- Corrupt Registry/System Files: A damaged QuickBooks-related registry entry or system file.

- System Contamination: Virus infection or malware corrupting linked payroll files.

- Incomplete Installation: Improper or partial installation of the QuickBooks software or its components.

The necessary first step is often to address the root software environment:

- Run System Tools: Utilize the QuickBooks Tool Hub (Program Problems > Quick Fix my Program) to automatically fix common installation and data issues.

- Check Windows Integrity: Run a full system malware scan and ensure all Windows and device drivers are updated.

- If needed: Perform a clean install of QuickBooks Desktop to eliminate corrupted program files.

7. After successfully renewing my Enhanced Payroll, what two verification steps are mandatory to ensure tax compliance and full functionality?

Verification is mandatory to prevent compliance failures on the next payroll run. The two critical post-renewal steps are:

- Verify Subscription Status:

- Go to Employees > My Payroll Service > Account/Billing Information.

- Sign in and confirm the subscription status explicitly shows as “Active” with the correct new expiration date.

- Verify Tax Table Updates:

- Go to Employees > Get Payroll Updates.

- Confirm the system displays a message that the most recent tax table version has been successfully downloaded and installed. You must manually run this update if the download failed during renewal.