QuickBooks Desktop Pro/Premier payroll adjustments after system migration require a structured review of payroll configuration, payroll items, employee attributes, tax parameters, and year-to-date (YTD) records to restore accurate payroll calculation, correct tax reporting, and stable direct-deposit processing.

Payroll discrepancies originate from inaccurate payroll item mapping, inconsistent direct-deposit settings, corrupted data transfer, and misaligned payroll preferences. The adjustment workflow includes the review of payroll setup, examination of employee payroll data, validation of payroll items, execution of payroll calculation tests, correction of YTD values, and the creation of a verified backup.

This article addresses the search intent of handling QuickBooks Desktop Pro/Premier payroll adjustments after system migration. The following sections present a structured review of payroll setup, employee payroll data, payroll item mapping, payroll calculations, and YTD values to ensure complete post-migration accuracy.

Why QuickBooks Desktop Pro/Premier Payroll Adjustments Are Required After Migration?

Payroll adjustments in QuickBooks Desktop Pro/Premier are required after migration because the data transfer process can alter or misalign core payroll components. Adjustments ensure that all migrated data matches the original records and supports accurate payroll processing. Key reasons include:

- Migration shifts payroll configuration, payroll items, employee records, and tax settings.

- Misaligned payroll data affects tax calculations, wage reporting, and compliance accuracy.

- Incorrect year-to-date (YTD) balances create discrepancies in annual forms and tax filings.

- Direct-deposit settings may not transfer correctly, which disrupts payment distribution.

- Validating all migrated data prevents errors from carrying forward into future payroll cycles.

Steps to Handle Payroll Adjustments in QuickBooks Desktop Pro/Premier After Migration

QuickBooks Desktop Pro/Premier requires structured payroll verification after migration to confirm accurate data transfer and proper payroll calculation. The following steps address discrepancies in payroll configuration, payroll items, employee records, tax settings, and year-to-date (YTD) balances to restore accurate payroll processing and maintain compliance across subsequent payroll cycles.

Step 1: Review and Confirm Payroll Setup

Verify the integrity of all payroll configuration data after system migration.

- Go to Employee > Payroll Setup.

- “Review the company’s payroll settings using the configuration panel:

- Verify that federal, state, and local tax configurations are accurately migrated.

- Ensure that compensation settings match pre-migration records.

- Confirm that all employee benefit configurations are intact and assigned correctly.

- Review payroll schedules to ensure correct frequency and employee assignment.

- Validate the setup of all employee benefits and deductions.

Step 2: Review Employee Payroll Data

Verify the accuracy of all employee payroll data following the system migration.

Use the following steps to review employee payroll records:

- Navigate to Reports > Employees & Payroll.

- Select the report type to review employee payroll information:

- Payroll Summary – To view a summary of payroll data for a specific period, including taxes, earnings and deductions.

- Payroll Detail Review – To view a detailed look at all payroll transactions, including employee names, dates, and amounts.

- Payroll Detail – To view the details of individual paychecks, including earnings, deductions, and taxes for each employee.

- Use the following filters to customize payroll reports and identify potential data errors:

- Date Range

- Employee Name

- Payroll item

- Other criteria ( such as: class, department, etc.)

Customized payroll reports assist in identifying data anomalies such as omitted deductions or inaccurate tax entries following migration.

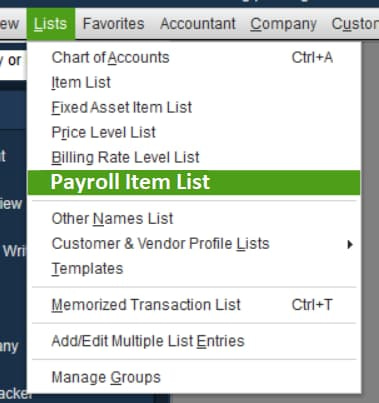

Step 3: Check Payroll Item List

Ensure all payroll items are correctly set up post-migration for accurate processing of deductions, benefits, and earnings.

- Go to Lists > Payroll Item List.

- Click Edit payroll item.

- Select Pay types or Deductions & contributions to view your list of items and the employees assigned to them.

- Confirm that salary, wage, tax, and deduction items match original configurations.

Step 4: Test Payroll Calculation

Test payroll accuracy post-migration by running a Payroll Checkup or creating a non-live paycheck.

Steps to Run a Payroll Checkup

Change the system date to the final day of the target year, then perform the following steps to run a payroll checkup.

- Back up your company file.

- Go to Employees > My Payroll Service.

- Click on Run Payroll Checkup.

- Choose Data Review and fix any errors found.

- In the Review Your Payroll Data window, select No for wage base adjustments.

- Click Continue >Finish.

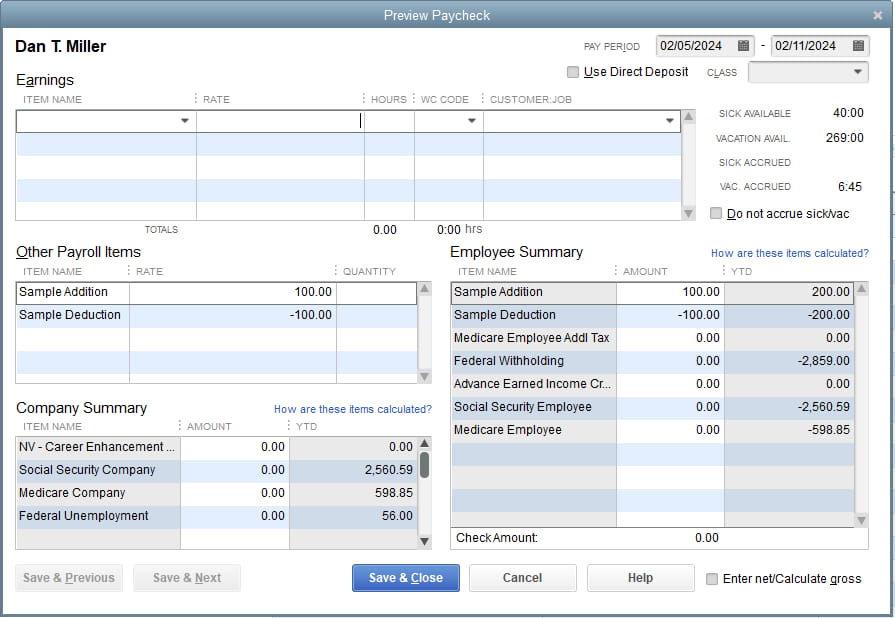

Step to Create Dummy Paycheck

Use the following steps to create a test paycheck:

- Go to Employees > Pay Employees > Unscheduled Payroll.

- Update the date and select the employee’s name.

- Click the Open Paycheck Detail button.

- Remove all items listed in the Earnings section.

- In the Other Payroll Items section, eliminate any addition or deduction items.

- Add the dummy addition and deduction items that you’ve just created.

- Enter a sample amount (for example: 100) and ensure that the Check Amount is zero.

Step 5: Update Year-To-Date (YTD) Balances

Update Year-To-Date (YTD) payroll balances if the migration occurs during the fiscal year. Inaccurate YTD balances impact W-2 generation, tax reporting, and year-end employee records.

- Go to the Employees > Payroll Centre.

- Click on Pay Employees tab > Other Activities > Set Up YTD Amounts

- Follow the instructions in the wizard and enter the YTD amounts for employees.

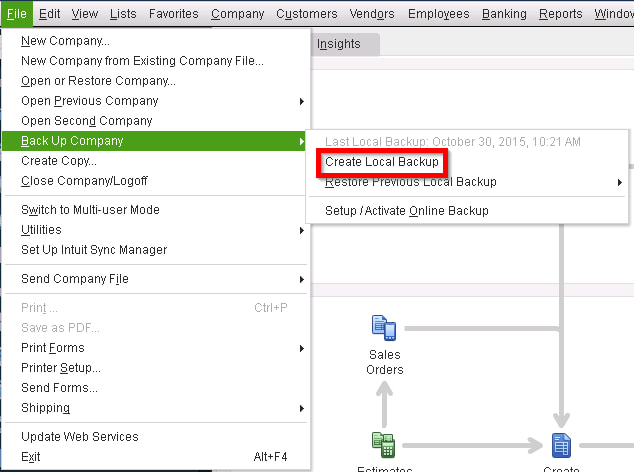

Step 6: Back Up After Adjustments

After verifying and adjusting, create a new full backup of your file.

- Click on File > Back Up Company > Create Local Backup in the top menu.

- Select Local backup > Next.

- Click OK in Backup Options.

- Click Next on the Create Backup screen.

- Click Save on the Save Backup Copy screen.

- Click OK on the QuickBooks Desktop Information pop-up.

Post-Migration QuickBooks Desktop Pro/Premier Payroll Prevention Measures

The following post-migration best practices help to maintain data integrity and consistent payroll performance. These measures include verifying payroll configuration, reviewing employee records, validating payroll items, monitoring year-to-date (YTD) balances, installing tax table updates, and creating regular backups to ensure accurate payroll processing.

- Run a Verify Data Check: Ensure your company file is free from corruption and the payroll data is accurate.

- Re-train Staff: Familiarize your payroll team with the new system and teach them to spot discrepancies early.

- Download Latest Payroll and Tax Updates: Keep payroll calculations compliant by obtaining the latest updates from QuickBooks.

- Perform Regular Backups: Back up your company file during the first few payroll runs to safeguard data in case of errors.

- Conduct Regular Audits: Periodically review payroll data, especially in the early months after migration, to catch errors early.

- Monitor Payroll Item Mapping: Validate that earning types, deductions, and contribution items remain correctly assigned after migration.

- Review Employee Records: Reconfirm employee tax settings, benefit assignments, and pay rates to ensure alignment with payroll configuration.

- Check Direct-Deposit Configuration: Verify funding accounts, employee banking details, and transmission settings to maintain uninterrupted processing.

Conclusion!

Accurate payroll processing in QuickBooks Desktop Pro/Premier after system migration depends on a structured review of payroll configuration, payroll items, employee records, tax parameters, and year-to-date (YTD) balances. The adjustment steps restore correct payroll calculation, precise tax reporting, and stable direct-deposit operation. Regular verification, timely updates, and routine backups maintain the integrity of payroll data across subsequent payroll cycles.

Frequently Asked Questions

How do I Verify if my Payroll Data has Been Migrated Correctly?

To verify your payroll data after migration, run reports like Payroll Summary and Payroll Detail to identify discrepancies such as missing deductions or incorrect tax withholdings. Conduct a Payroll Checkup or create a dummy paycheck to test calculations.

What Should I Do if I Encounter Payroll Errors After Migration?

If you find payroll errors, check and correct your payroll item mappings, employee records, and tax settings. Running a payroll checkup or generating a dummy paycheck can help identify issues.

Can Migration Affect my Tax Calculations in QuickBooks Payroll?

Migration can affect tax calculations if payroll item mappings are incorrect or updates are missing. Review your tax setup and run payroll tests to ensure accuracy, and download the latest payroll and tax table updates.

How does incorrect year-to-date (YTD) data affect payroll after migration?

Incorrect YTD data affects payroll summaries, annual tax forms, employee wage records, and downstream payroll calculations.

Why is it important to validate direct-deposit settings after migration?

Validation is important because migrated direct-deposit settings may shift or disconnect, which affects payment distribution and transmission accuracy.

How do I confirm payroll calculation accuracy after migration?

Payroll calculation accuracy is confirmed by running a Payroll Checkup or creating a test paycheck to verify earnings, deductions, and tax outputs.

Disclaimer: The information outlined above for “Handle QuickBooks Desktop Pro/Premier Payroll Adjustments After System Migration” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.