Hey, I’m Smith, and I could really use some help figuring out how to clean up duplicate transactions in QuickBooks Online. I recently connected my business bank account to QBO, and after syncing, I noticed that a bunch of transactions appear to be duplicated. In some cases, the same transaction shows up twice — once from a manual upload I did last week and again from the automatic bank feed.

Now I’m stuck with a messy transaction list that’s throwing off my reports, bank balance, and even my profit and loss statement. I tried to delete a few manually, but I’m nervous about accidentally removing the wrong ones, especially if they’ve already been categorized or reconciled. I also tried undoing a few matches, but that didn’t completely fix the problem. I just want a clean ledger before I move forward with monthly reports and invoicing.

Is there a safe way to identify and remove these duplicate entries in bulk? And is there a best practice to avoid this kind of issue in the future when syncing or importing bank data? I’d really appreciate if can get help from someone who’s cleaned up this kind of mess before I’m worried I might make it worse if I just start deleting things at random.

Hi Smith,

You’re not the only one facing this kind of frustration. Many QuickBooks Online users encounter duplicate transactions, especially after importing a bank statement manually and later connecting the same account via bank feed.

You’ve already taken steps that most users do:

- Manually uploaded your business bank transactions using a CSV file

- Connected your bank account to QuickBooks Online for automatic syncing

- Noticed the same transactions showing up twice in your transaction list

- Tried deleting or undoing matches, but now you’re unsure what’s safe and what might affect reports

Now your financial reports, bank balance, and profit & loss statement are all off, and you’re stuck with a messy ledger.

Using QuickBooks Desktop Enterprise Payroll can lead to critical issues, especially in the Basic or Standard versions. In Payroll Basic, manual paycheck entries paired with synced bank data cause duplicate transactions. In Payroll Standard, direct deposits can sync into QuickBooks alongside recorded paychecks, which leads to the same problem.

Let’s explore why duplicate transactions occur, how to fix them safely, and ways to prevent them, especially in payroll.

Why Do Duplicate Transactions Appear in QuickBooks Online?

Duplicate transactions in QuickBooks Online often occur due to overlap between manual uploads and automatic bank feeds.

These duplicates can distort your bank balance, inflate your income or expenses, and complicate profit and loss reports. They also impact reconciliation and payroll processing, particularly if linked to paycheck clearing or direct deposits.

Common causes include:

1. Manual CSV Upload + Bank Feed Sync

You manually upload a bank statement (CSV) and later connect the same bank account. QuickBooks pulls in the same transactions again from the bank feed, resulting in duplicates.

2. Reconnecting a Disconnected Bank Account

If a bank connection was temporarily lost and then reconnected, QuickBooks import historical transactions again, some of which already exist from earlier manual entries.

3. Overlapping Import Date Ranges

Manually uploading CSVs with date ranges that overlap with already-synced data can result in QuickBooks recording the same transactions twice.

4. Incorrect Matching or Manual Entry

If you record a transaction manually (like a payment or deposit) and the same item later syncs from your bank, QuickBooks may not always match them automatically, leaving both entries in place.

Steps to Identify and Remove Duplicate Transactions in Bulk in QuickBooks Online

QuickBooks Online does not offer a one-click “deduplicate” tool, but you can safely remove duplicate entries in bulk using a combination of filtering, batch selection, and the Exclude feature.

Follow these steps:

Step 1: Go to the Banking Center

- Go to Banking > Select your bank account

- Click the For Review tab

This shows all transactions that have been imported but not yet added to your books.

Step 2: Filter for Likely Duplicates

- Click the Filter icon (top-right of the list)

- Use the following filters:

- Date range (e.g., when you did the manual import and bank sync)

- Transaction type (e.g., deposits or expenses)

- Amount (if you know which amounts are repeating)

Tip: Sort the list by Amount or Date to spot duplicate patterns faster.

Step 3: Identify the Duplicates by Source

QuickBooks often labels imported transactions differently:

- Manual upload: May include a tag like “Uploaded from file”

- Bank feed: Usually shows the bank’s name under the transaction

Tip: Keep the bank feed version for easier reconciliation and accurate audits. Disregard the manual version if it hasn’t been categorised.

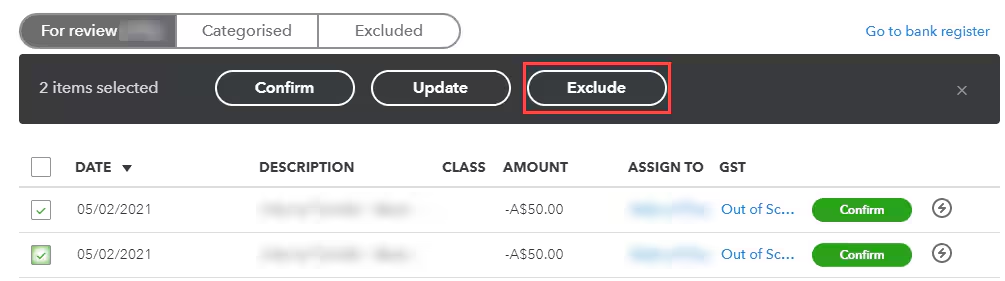

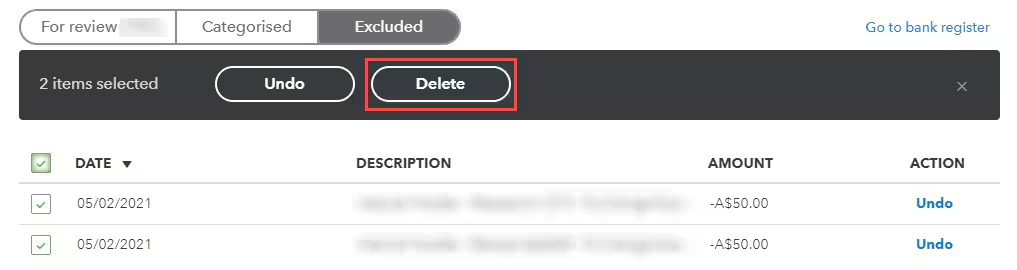

Step 4: Select anOnce duplicates are excluded:

d Exclude Duplicates in Bulk

- Select all the duplicate transactions using the checkboxes

- Click Batch actions > Exclude Selected

Excluded transactions are hidden from your books but remain accessible under the Excluded tab in case you need to revisit them.

Note: Do not use the Delete option unless you are certain the transactions have not been categorised or reconciled.

Step 5: Reconcile to Validate

Once duplicates are excluded:

- Go to Accounting > Reconcile

- Select the affected bank account

- Ensure your cleared balance matches your actual bank statement

This final step confirms your books reflect accurate, duplicate-free data.

Step 6 (Optional): Use a Spreadsheet to Compare Bulk Data

If the volume of duplicates is large:

- Export the For Review list to Excel

- Compare it to your manual CSV upload

- Highlight duplicates and return to QBO to confidently exclude them in batches

Best Practices to Prevent Duplicate Transactions in the Future

- Choose either manual upload or bank feed, not both, for the same date range

- If you manually upload a CSV, turn off bank sync temporarily

- Always review import dates and filters before uploading

- Use bank rules to automate classification and reduce manual errors

- For payroll users, maintain a buffer in your payroll bank account to absorb timing delays or feed sync lags

Frequently Asked Questions

Can I delete a duplicate transaction if it’s already categorised?

No, first, undo the categorisation, then exclude or remove it. Deleting without reversing the match can disrupt your records.

How do I know if a transaction is from a manual upload or a bank feed?

Look at the “Source” column or transaction details. Manual uploads often have “Uploaded from file” labels, while bank feeds will show your bank’s name.

Can I bulk delete all duplicates at once?

Use Batch Exclude in the For Review tab to remove multiple entries that match your criteria (date, amount, description).

Should I use both manual upload and bank feed?

Only if necessary, and never for the same account/date range without checking for duplicates.

Will this affect my payroll if I use Desktop Enterprise?

Yes, especially in Payroll Basic or Standard. Duplicate deposits or paychecks can affect cash flow tracking and compliance. Always reconcile your payroll bank or clearing account.

Disclaimer: The information outlined above for “How to Clean Up Duplicate Transactions in QuickBooks Online?” is applicable to all supported versions, including QuickBooks Desktop Pro, Premier, Accountant, and Enterprise. It is designed to work with operating systems such as Windows 7, 10, and 11, as well as macOS.